Original Author: Auditless Research

Original Translation: Deep Tide TechFlow

Content Coins may be the only way to excite creators about Rollup. But be aware, the house always wins.

Crypto Twitter's reaction to the launch of $JESSE was not friendly:

(This tweet is actually one of the more rational and down-to-earth criticisms I've seen.)

Others pointed out some issues:

- Timing: The launch coincided with David Phelps' article, where he complained that Base was too focused on creator tokens;

- Extraction issue: Some believe that $JESSE extracted a large amount of transaction fees from sales;

- Buyout issue: Due to $JESSE using the Zora x Doppler bond curve auction mechanism, it unexpectedly attracted buyers.

But I do not agree with these concerns.

The timing issue is indeed a bit unfortunate, but I suspect Jesse had already planned the launch time and chose his birthday as this special milestone.

The extraction issue also does not hold water. During his birthday live stream, he was able to reinvest the fees into other creators on Base. He also claimed he did not intend to sell these tokens.

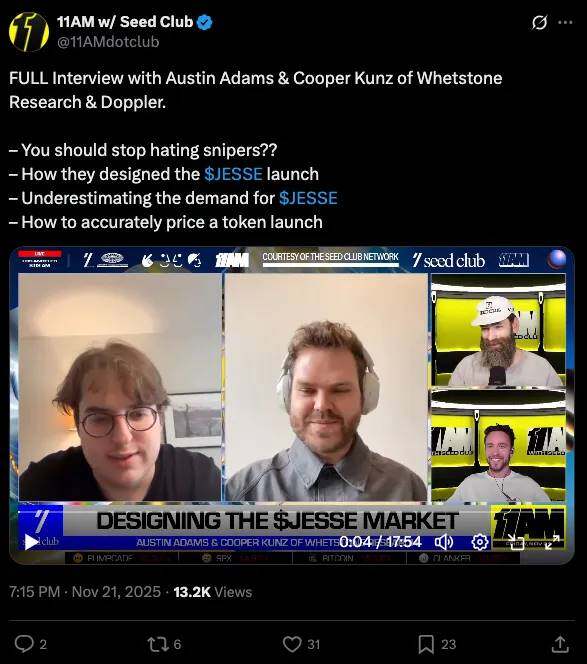

Ultimately, Doppler and 11AM had a pretty good discussion about the buyout issue:

We will delve deeper into the pros and cons of different auction mechanisms in next week's content, but Austin's research on auction mechanisms far exceeds those complaining about buyouts on X (formerly Twitter).

If it’s not malicious, then why would Jesse do this?

The Real Reason for Promoting Creator Tokens

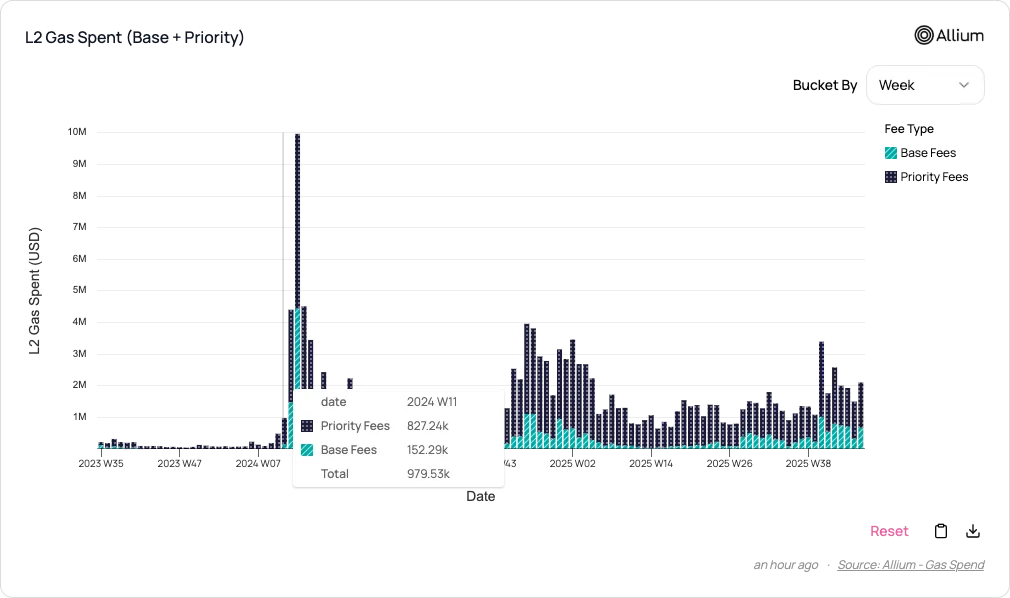

Most of the revenue for Rollup comes from transaction fees.

So far, Base has earned more revenue from meme token trading than any other activity. The issuance of new tokens and the resulting speculative trading volume are significant factors driving transaction fees.

Source: Allium

It is likely that Base is spending more than ever on core team, funding, activities, proprietary applications (like Base App), and support for founders. However, these expenditures have not significantly increased Base's contribution to Coinbase's financial statements as a Rollup.

Creator tokens and content tokens are a very clever solution to this problem:

- Their issuance even surpasses that of meme tokens (token issuance is the main battleground for Rollup);

- They can stimulate trading and speculative activity;

- They are built by converting attention into on-chain fees, and anything that can go viral can almost be tied to a content token;

- Compared to meme tokens, they do not even require any underlying economic activity, community support, or commitment.

Although users view soaring gas fees as negative, from the perspective of Rollup, creating excessive demand for block space is actually a sign of success.

No other form of creator monetization can achieve the same effect:

- Payments: Any form of payment (like donations) has insufficient transaction volume, especially the portion paid to creators.

- Rewards: Base does utilize a reward mechanism to support the Base App ecosystem, but these rewards have minimal impact on revenue.

- Advertising: On-chain advertising is almost non-existent, thus cannot contribute to sorter fees.

Are Creator Tokens Really Good?

We have understood why creator tokens are a focus area for Base, but are they really the best mechanism for users and creators?

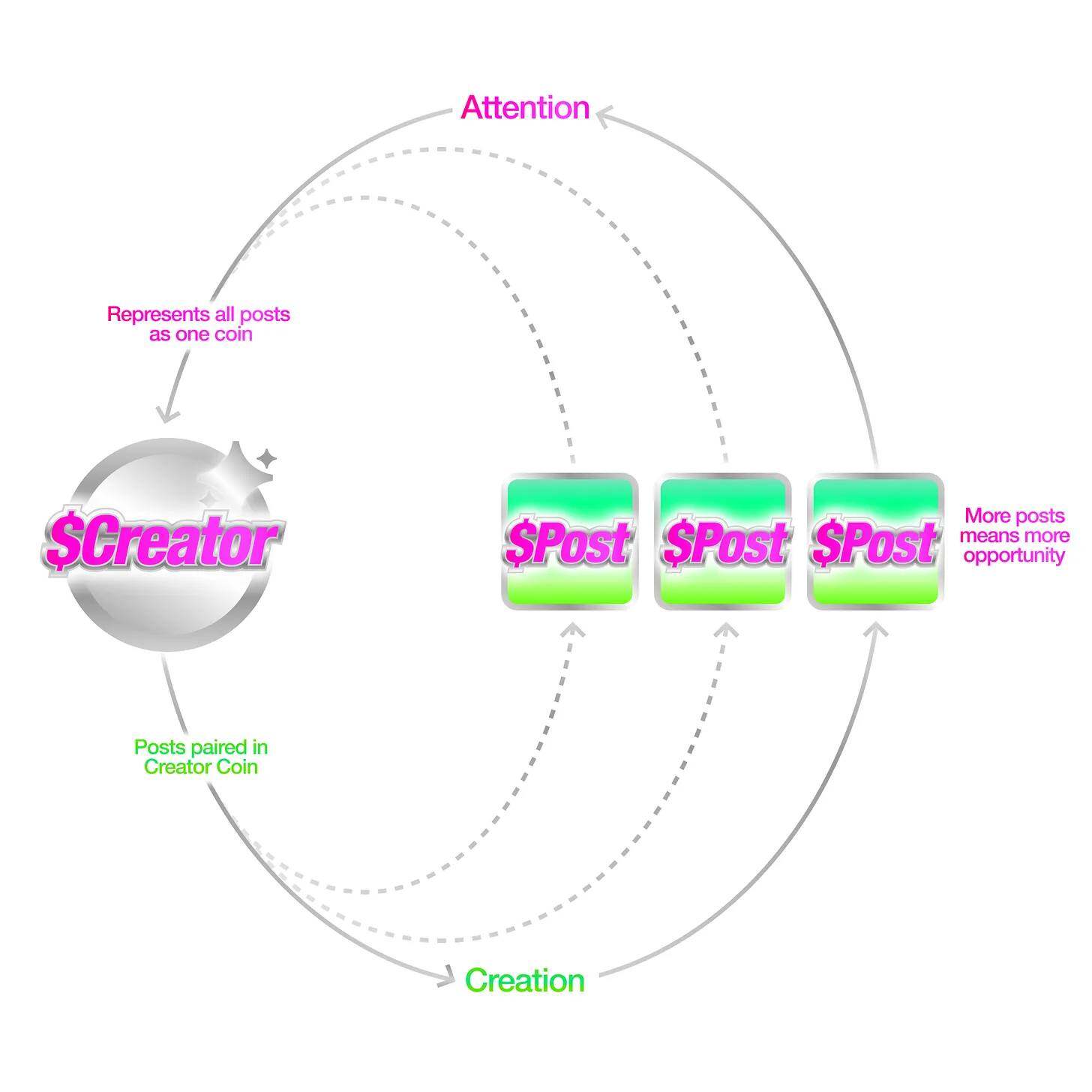

Source: Zora Docs

The logic of the flywheel effect of creator tokens is simple:

- If you publish content, a content token (Content Coin) will be generated, and you will own 1% of its supply.

- Each content token can only be purchased with your creator token (Creator Coin). If you issue a creator token, you will hold 50% of its supply (gradually unlocked).

- The demand for content tokens will naturally drive the demand for creator tokens. This mechanism incentivizes you to create quality content while benefiting from holding creator tokens and transaction fees.

To some extent, the behavior of content tokens is similar to Patreon membership subscriptions. If you spend $1,000 to purchase a content token, your opportunity cost is using that $1,000 for other market investments to earn returns. The forgone returns are essentially like paying a subscription fee to a creator. In return, the creator may reward you for holding these tokens. These rewards can be tiered like Patreon or distributed proportionally or randomly (similar to a lottery).

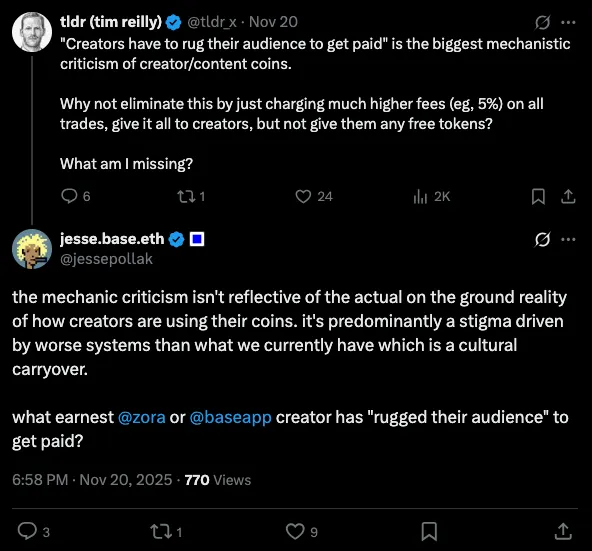

However, creators cannot directly receive subscription fees from this unless they sell their creator tokens. Therefore, even if your cost is paid in the form of a revenue subscription, not all costs will effectively transfer to the creator you support unless they "cash out" (i.e., "rug"). Jesse also pointed out this issue:

Additionally, content tokens (Content Coins) also have attributes similar to fan collectibles. As an artist's popularity increases, the rewards they can offer to "subscribers" also become more valuable. Therefore, content tokens carry a speculative component. Even if you do not care about supporting the artist or obtaining rewards, you might buy content tokens simply to speculate on their future potential reward value (whether material or immaterial). This is similar to buying a first edition CD from your favorite artist, which you might resell at a higher price in the future.

However, this characteristic of creator tokens also brings significant drawbacks: they have effectively become a financial instrument, and their market may attract institutional participants with more advanced tools than ordinary fans.

Just as true fans need vision, patience, and investment to identify, preserve, and invest in classic CDs or merchandise, the market for content tokens also requires true fans to support it. On the other hand, a savvy trader can profit from content tokens simply by exploiting buyouts or other speculative means.

When exiting "membership," you need to sell tokens to realize this, which incurs slippage. Ironically, the lower the liquidity of creator tokens, or the greater your contribution to the creator, the higher the slippage you face. Content tokens, to some extent, punish the most generous sponsors.

The House Always Wins

My core issue with the creator token model is that it attempts to combine sponsorship with curation to maximize trading volume, but it may bring out the worst of both.

- True sponsors have to deal with price volatility, antagonistic market participants, transaction taxes, and other issues.

- Curators lack clear guarantees for future rewards, as creator tokens do not explicitly bind the creator's equity or other value streams. Curators are essentially speculating on the potential demand for future unknown rewards.

- This model tends to front-load the creator's income, which may generate large transaction fees during the initial price discovery phase, but whether long-term trading volume is sustainable remains uncertain (the performance of $JESSE will become a point of observation). This mechanism does not truly achieve incentive alignment between creators and token holders.

The end result is that the revenue extracted by the underlying blockchain and trading venues (in this case, Uniswap) far exceeds that of a simple payment solution under a membership model.

You could argue that the curation market does provide an additional function, but the two (sponsorship and curation) cannot be clearly separated.

In contrast, we can study Craig Mod's model. He built his own membership system, focusing on keeping the setup as streamlined as possible, and has succeeded.

He can proudly say that no one has lost their hard-earned money by supporting him.

What attracts me to Craig's model is that its focus is on the creation itself (like books), rather than the content or the creator as an individual.

Personally, I believe that a interaction-centered creator economy is less effective than a model around real value exchange. Content should merely serve as a discovery mechanism and a way to publicly create, rather than being the core product. To some extent, it can provide a free foundational level for users to experience.

I also believe these issues can be resolved, and there is no doubt that the Zora and Base teams are working towards this.

At the very least, creator tokens represent a new attempt at monetization for creators. Even if it ultimately fails to become the optimal solution, it is still worth a try.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。