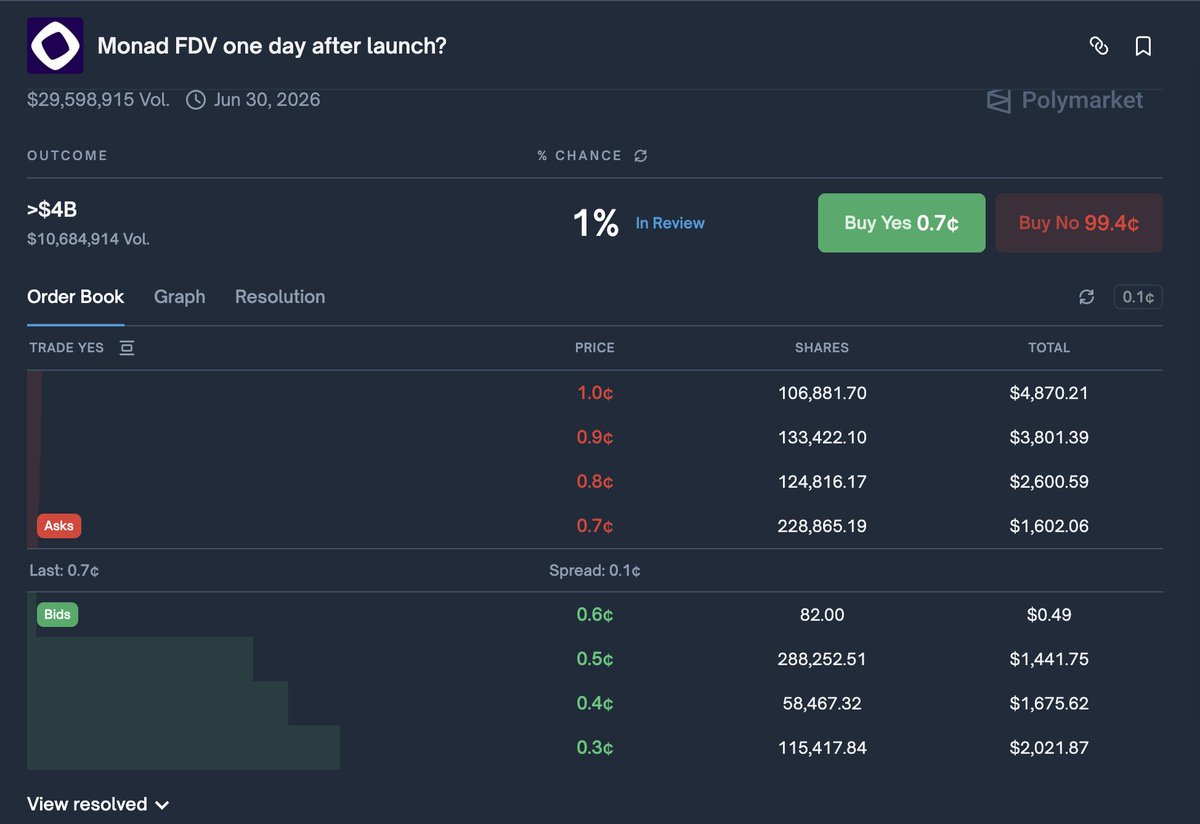

"Monad FDV > $4B? The Most Exciting Polymarket Battle of the Year"

The Polymarket is currently experiencing the most intense battle over the rules regarding whether Monad's FDV will exceed $4B one day after its listing.

The core of the controversy stems from this statement:

“The resolution source for this market is the most liquid price source available.”

The question is:

Does “most liquid” refer to depth or trading volume?

Should the final price be taken as Close, Open, High, or Aggregator?

This directly determines:

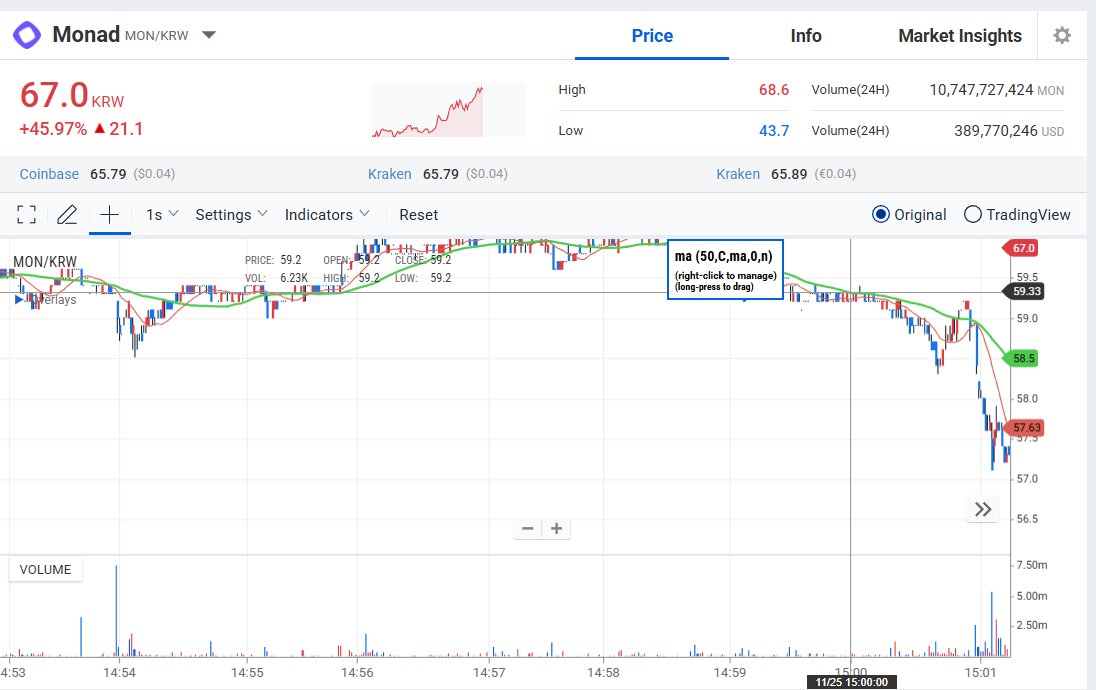

Coinbase final price < 0.04 → NO

Upbit final price > 0.04 → YES

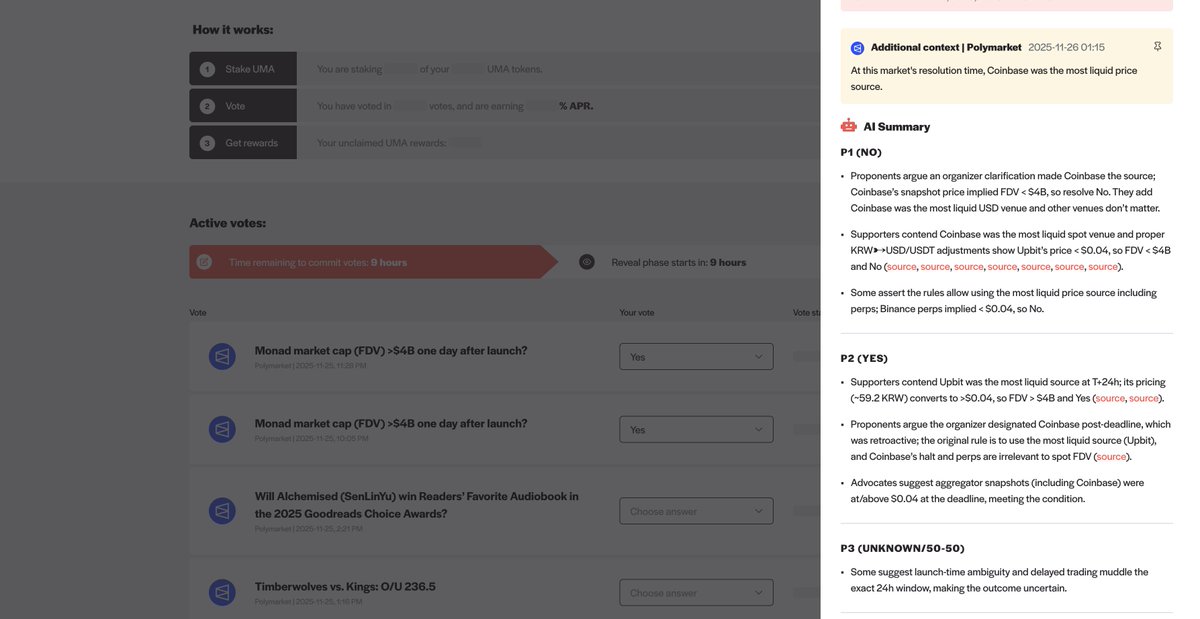

The market has now entered UMA arbitration. I took a look at the discussions in the UMA Discord, and they are very exciting.

NO side's viewpoint (< $4B):

- CMC's liquidity score: Coinbase > Upbit, so Coinbase should be chosen.

- Even according to Upbit, after converting to USDC, it is still < $4B.

- Polymarket added a small note after the market closed: “At this market's resolution time, Coinbase was the most liquid price source.”

YES side's viewpoint (> $4B):

- Upbit's daily trading volume accounts for over 50% of the entire network, almost double that of Coinbase, so Upbit should be chosen according to the rules.

- The rules are vague: it does not specify whether to take Close, Open, or Aggregator. If using Aggregator, both Coinbase and Upbit are > $4B.

- The rules state USD FDV, which is unrelated to USDC/USDT.

My viewpoint: a very clear Yes.

Upbit's trading volume is far greater than Coinbase, and Coinbase even briefly suspended trading of Monad/USD during the day.

According to the rules, the most liquid source → should take Upbit → FDV > $4B = YES.

The most dramatic part is:

In the UMA Discord and Polymarket comment section, almost all debaters support using Upbit → YES.

Yesterday, some supported NO, but now a large number of NO positions have been preemptively cashed out at 99+ prices, while countless users are frantically buying YES below 1 ——

They express their views with funds.

Even more outrageous is:

Those who bought NO above 99 are all “professional tail-end traders” on Polymarket.

They bet: official clarifications + Coinbase = NO.

But the reality is:

From the rules, from the facts, and from on-chain data, it should be YES.

Now, the real decision-makers are UMA stakers, and UMA's market cap is only $70M.

This means:

A protocol with a market cap of $70 million is to adjudicate a market with a trading volume that could exceed tens of millions.

If you were a UMA whale, what would you do?

The most likely scenario is:

UMA whales buy a bunch of YES <1 → vote YES in DVM → hundredfold returns.

Thus, the conflict becomes:

Rule faction vs tail-end whales → UMA whales vs Polymarket whales.

It's so exciting.

I firmly stand with YES, Rule is rule.

To those still buying NO at 99+ — good luck.

There are 1 day and 10 hours left for the result, detailed reading materials: 👇

- Detailed voting/debate details: https://vote.uma.xyz/

- Polymarket link regarding whether Monad's FDV exceeds $4B one day after launch: https://polymarket.com/event/monad-market-cap-fdv-one-day-after-launch/monad-market-cap-fdv-4b-one-day-after-launch-532?tid=1764167479596

- A well-summarized AI analysis: https://chatgpt.com/share/69268948-f418-8012-9436-6b6766e876ed

- UMA Discord discussion: https://discord.com/channels/718590743446290492/964000735073284127/threads/1442900257951187158

Polymarket #Monad

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。