Selected News

XION briefly surged past $0.99, rising over 170% in 24 hours

Affected by Upbit's launch of the KRW trading pair, PLUME briefly rose over 54%

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content into English:

[KALSHI]

Today's discussion around KALSHI highlights its growing importance in the prediction market space. Key topics include: collaboration with NEAR Protocol for native deposits and withdrawals; significant market trading volume compared to competitors; facing legal challenges in Nevada regarding sports event contracts; speculation about potential incentives similar to those offered by Polymarket; additionally, the platform is gaining attention for its strategic partnerships and market innovations.

[POLYMARKET]

Polymarket is receiving widespread attention today due to its recent approval from the CFTC to operate fully as an exchange in the U.S., marking an important milestone for the platform. This approval allows Polymarket to offer intermediary trading through brokers, which is expected to bring substantial liquidity and user participation. Furthermore, discussions emphasize: rapid growth in website traffic; its potential to surpass major competitors like Coinbase in the near future; the platform's expansion into the U.S. market is seen as a pivotal moment for prediction markets, positioning Polymarket as a leader in the field.

[MEGAETH]

Today's discussion around MEGAETH mainly focuses on its pre-deposit activity, which encountered significant technical issues, including website crashes and mismanagement of the increased cap. The initially set cap of $250 million was filled within minutes after a delayed launch due to the website crash. Attempts to raise the cap to $1 billion were mishandled, leading to confusion and criticism within the community. Despite these issues, MEGAETH's innovative approach to fundraising through USDm's treasury-backed reserves rather than charging a premium to sorters is highlighted as a disruptive move in L2 economics. Community reactions are mixed: some express frustration over the technical failures, while others remain optimistic about MEGAETH's potential.

[NESA]

NESA is gaining attention for its innovative AI approach, which shards data and models to ensure privacy and security, providing cryptographic proof for outputs. This method eliminates the need for blind trust in companies, aligning with the principle of "don't trust, verify."

Featured Articles

Just this month, there have been at least three serious real-world robbery cases in the crypto industry. For criminals, it is clearly faster and easier to force someone to reveal their cryptocurrency wallet password than to rob their entire cash or bank card passwords at home. Worse, the lifestyle of crypto individuals is inherently "high exposure": flaunting wealth on Twitter, appearing at conferences, being named in articles, using insecure Wi-Fi, or even just attending an industry event… all of these leave clues in the dark, indicating which "crypto asset millionaire" is worth targeting.

Marketing in the crypto industry is undergoing a profound transformation: trend lifecycles are getting shorter, competition is becoming more intense, and traditional strategies are gradually failing. For entrepreneurs, growth leaders, and marketing teams, understanding these changes is not just a matter of survival but also key to seizing opportunities. This article systematically outlines the seven core trends in crypto marketing for 2026 based on a talk by Hype Partners' Chief Marketing Officer Emily Lai, covering recruitment, performance marketing, content creation, channel diversification, event experiences, incentive mechanisms, and AI-driven operations. It also shares industry predictions and a framework for staying ahead.

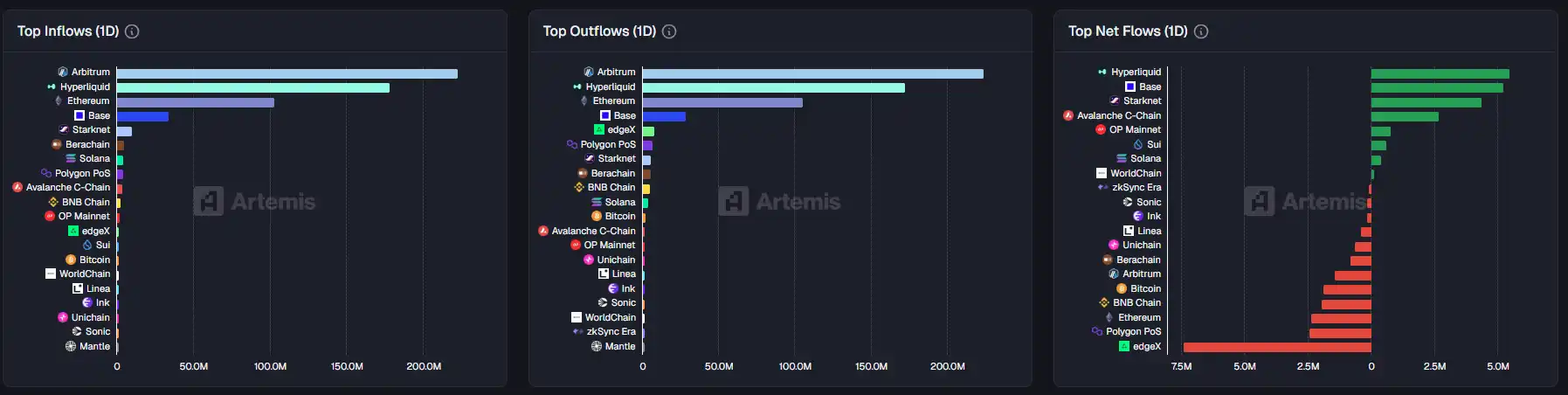

On-chain Data

On-chain capital flow situation for the week of November 26

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。