Original Source: BONK

Key Points

· Bonk was launched at the end of 2022, during a low period for Solana following the FTX collapse. The project distributed 50% of its total supply of 100 trillion tokens, making it one of the largest airdrops in Solana's history (approximately 50 trillion BONK distributed to about 297,000 wallets).

· Initially a Meme token, Bonk quickly gained widespread use within the Solana ecosystem, now integrated into over 400 applications across DeFi, NFTs, gaming, and payment sectors. Nearly 1 million wallet addresses hold BONK, reflecting strong community acceptance.

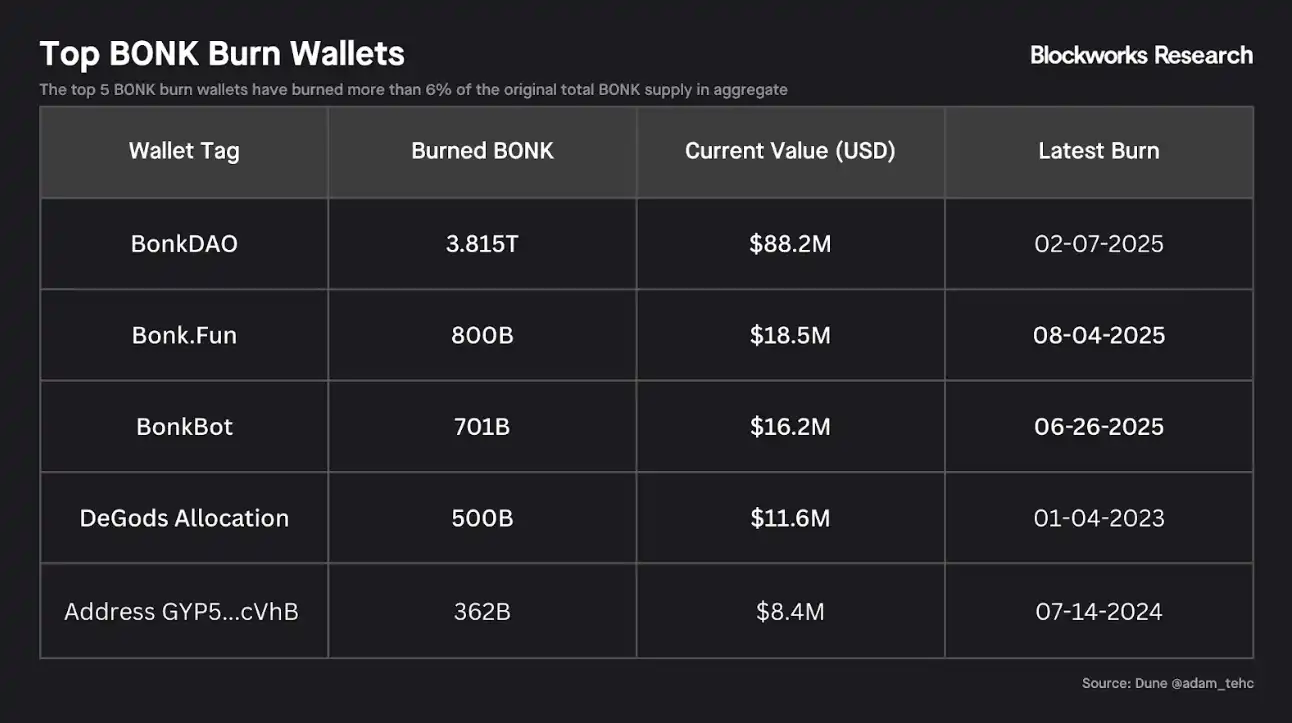

· The difference between BONK and traditional short-lived Meme coins lies in its establishment of a fee-driven burn mechanism and DAO-led burn events. Applications like BonkBot and Bonk.fun contributed significantly to the burn volume, while initiatives like Bonk Rewards' staking and large events like BURNmas further reduced circulating supply. As a result, the total supply of BONK has decreased from 100 trillion to about 88 trillion.

· BONK has transformed from a grassroots Meme coin into a financial asset. The Osprey Bonk Trust, the upcoming Bonk ETF, and the rebranding of Safety Shot into Bonk Treasury Company indicate an increasing number of pathways for traditional investors to gain exposure. These tools introduce new risks related to liquidity, regulatory scrutiny, and market perception while reducing circulating supply.

The Origin and Issuance of BONK

The concept of Bonk emerged at the end of 2022 when the Solana ecosystem was in a downturn due to the FTX collapse. The price of Solana plummeted from around $36 before the crisis to below $10, with its DeFi activity and TVL (Total Value Locked) also sharply declining. The broader crypto market was in a deep bear market, with Bitcoin and Ethereum both hitting multi-year lows. Meanwhile, Meme coins like DOGE and SHIB, which had surged in 2021, gradually lost popularity by the end of 2022, leading to increasing skepticism about the long-term value of most altcoins, especially Meme coins.

Against this backdrop, the idea of Bonk was born, aiming to serve as a community-driven Solana Meme coin to rally community strength and boost the morale of Solana.

Bonk officially launched on December 25, 2022, branding itself as "the people's Dogecoin on Solana." The issuance process did not involve private placements or VC funding; instead, 50% of the total supply of 100 trillion tokens was airdropped to active users in the Solana ecosystem, covering nearly 300,000 wallet addresses. This airdrop was one of the largest in Solana's history, targeting the core community to maximize grassroots user participation.

The clear goal of this airdrop was to reward the active Solana community and cover multiple groups within the ecosystem. Notably, core Solana developers also received a small amount of BONK airdrop as a token of appreciation. The widespread distribution quickly made BONK one of the most widely held tokens on Solana.

Most of the token supply immediately entered circulation after issuance, with only 21% of early contributor allocations subject to a linear unlocking mechanism, starting from the end of December 2022. The remaining small locked amounts will gradually unlock over the coming months until January 2026. Another significant portion of project-related tokens, 16%, was allocated to BonkDAO.

BonkDAO was initially managed by a committee of 11 community members and core contributors, controlling the DAO treasury's multi-signature account. The DAO committed to gradually achieving decentralization and will open community voting in July 2024, allowing proposals to burn BONK collected by BonkBot and ultimately integrating with Solana's governance platform Realms for community governance voting. Many of BonkDAO's proposals revolve around marketing incentives and various token burns (such as Burnmas, BonkBot burns, and November burns).

The launch of Bonk coincided with a surge in speculative interest, and the token was quickly tradable on Solana DEX, with several centralized exchanges rapidly listing BONK, including Coinbase, Binance, OKX, Huobi, MEXC, Bybit, Gate.io, all completing listings in the first week of January 2023. This exchange support helped BONK achieve a market cap of hundreds of millions within weeks.

However, the initial excitement from the airdrop and launch gradually faded by mid-year, until the end of 2023, when Solana experienced a broader Meme coin craze, with new tokens like WIF gaining attention. Yet, BONK maintained its status as Solana's flagship Meme coin and rebounded significantly during this period. By the end of 2023, BONK had firmly established its core position within the Solana ecosystem, with price movements often synchronized with SOL, but exhibiting higher volatility.

Integration and Applications

From the beginning, Bonk's strategy has been to deeply embed itself in the Solana ecosystem, with two main objectives:

1. To gain and maintain community attention

2. To create diverse application scenarios that reduce the circulation of BONK through fees or burn mechanisms

Here are the main integrations and applications of BONK:

Decentralized Exchanges and Liquidity Pools (January 2023): DEXs on Solana quickly adopted Bonk, with Orca and Raydium being the first to launch BONK liquidity pools and offer incentive rewards. Additionally, a Bonk-branded DEX—BonkSwap—also emerged in early 2023.

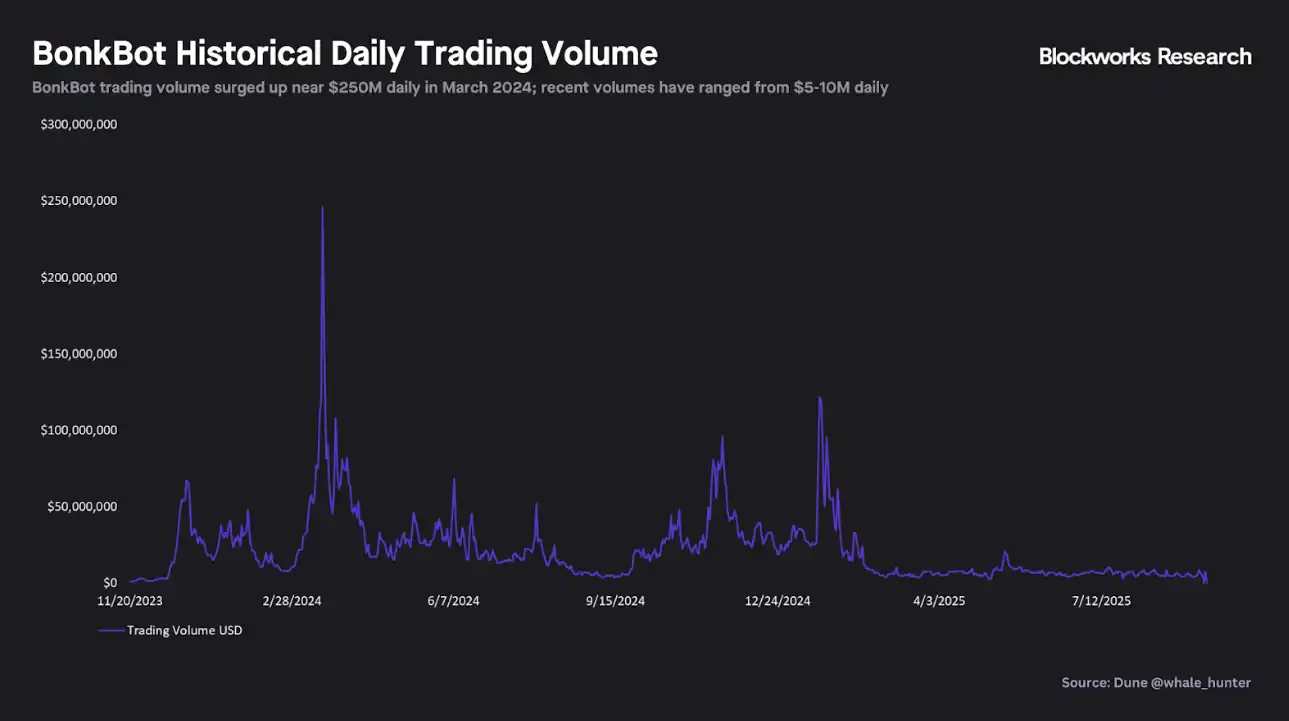

Trading Bot - BonkBot (Mid-2023): One of the most influential applications in the Bonk ecosystem is BonkBot, a Telegram trading bot mentioned in our previous trading bot industry report. BonkBot allows users to trade any Solana token through a chat interface, charging a 1% fee on trading volume, with 10% of that used to buy back and burn BONK. During the Solana Meme coin craze in early 2024, BonkBot became the leading trading bot for several months. Although growth in the trading bot sector stagnated afterward, its core users continued to contribute stable fee income, supporting BONK's burn.

Token Issuance Platform – Bonk.fun (Q2 2025): After Raydium launched its modular issuance platform LaunchLab, Graphite Protocol partnered with BONK to launch Bonk.fun, a Bonk-themed issuance platform built on the LaunchLab product. Similar to Pump.fun, Bonk.fun allows anyone to issue new SPL tokens without permission and is highly inclined towards Meme coin activities.

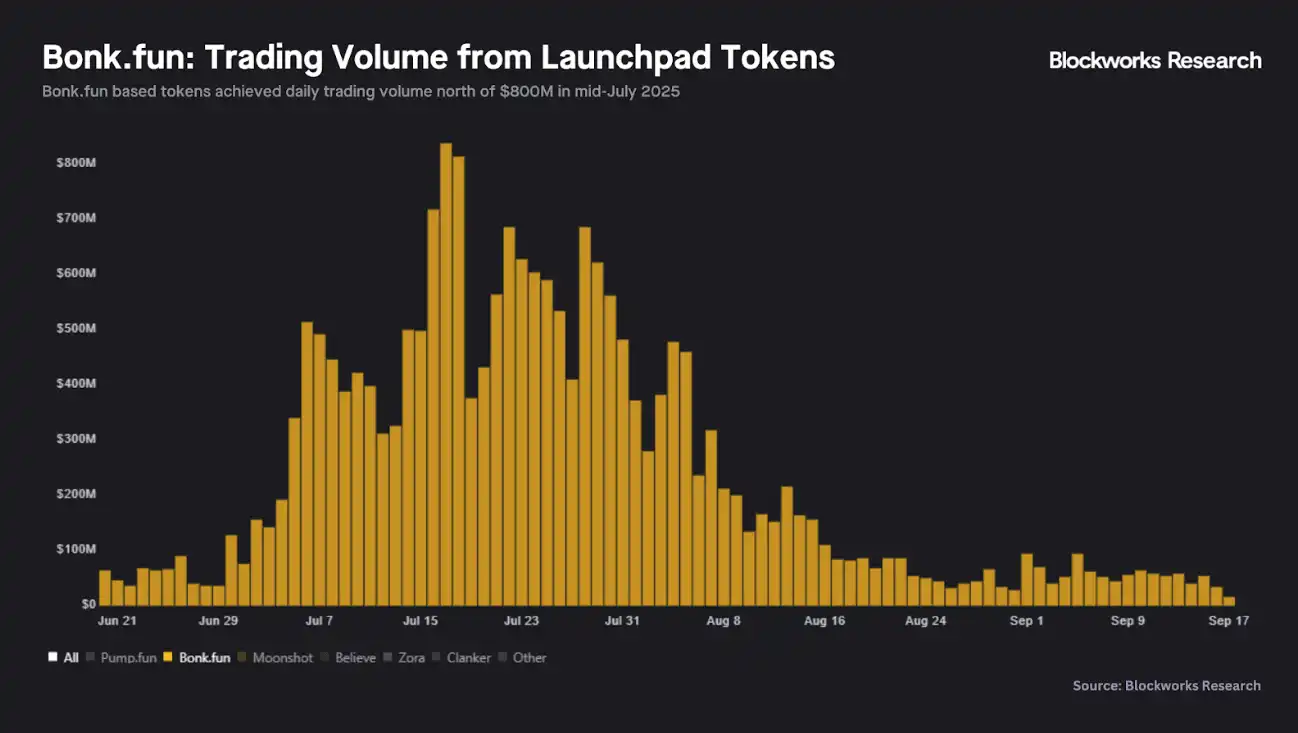

Bonk.fun quickly sparked a frenzy after its launch, with daily trading volume surpassing $400 million within weeks. The excitement then receded over the following months until early July, when Bonk.fun suddenly surpassed Pump.fun, accounting for over 60% of trading volume on Solana's issuance platforms at its peak.

Like BonkBot, Bonk.fun uses a portion of the platform's generated fees to buy back and burn BONK. We will explore the impact of these major burn drivers in more detail in subsequent sections.

Game – Bonk Arena (June 2025): Bonk entered the GameFi space with Bonk Arena, a "kill-to-earn" arcade shooting game developed by Bravo Ready. Bonk Arena launched in June 2025 as a web/browser game, requiring players to pay 10,000 BONK (approximately $0.15 at launch) to enter the deathmatch, where defeating opponents allows them to win their BONK stakes. Of the BONK used in the game, 50% is allocated for token burns, BONK staking rewards, and charitable donations. Bonk Arena can be accessed directly through the Phantom wallet and plans to launch on Solana's Saga phone and PSG1 gaming handheld.

Fitness Application – Moonwalk (2024–2025): Moonwalk is one of the first "real-world incentive (RWA-Fitness)" applications in the BONK ecosystem, gamifying fitness activities to allow users to earn on-chain rewards through walking, running, and other daily activities. Moonwalk's long-term goal is to expand the user base for Web3 fitness and convert the average user's daily exercise into on-chain behavioral data, bringing more authentic user demand and healthy growth metrics to the entire BONK ecosystem. Through Moonwalk, Bonk moves beyond social or trading applications and enters the realm of "real-world use cases," further broadening BONK's appeal beyond Web3.

Digital Art – Exchange Art: Exchange Art is one of the largest digital art and NFT trading platforms on Solana. In 2025, BONK collaborated with Solana to launch the Crycol Gallery (New York) in the real world, bringing all gallery works to Exchange Art, achieving a closed loop of "online + offline" art display. Exchange Art supports artists in accepting BONK as a currency for purchases and integrates BONK-related art themes in some events, making BONK a part of Solana's NFT culture.

Charity – Buddies for PAWS: Buddies for PAWS is BONK's global animal charity program, supporting multiple animal protection organizations through a "community donation + BONK official 1:1 matching" approach. This program reinforces BONK's narrative of "from the community, back to the community," expanding BONK's international influence and conveying positive brand values to the traditional world. Although donations do not directly lead to burns, they indirectly enhance BONK's social acceptance and long-term value stickiness through the elevation of BONK culture and media dissemination.

Cross-Chain Bridges: As Bonk grew, it began to expand to other chains. Cross-chain bridges like Wormhole enable BONK to circulate on chains such as Ethereum, BNB Chain, and Base. By 2025, BONK was available on 13 blockchains through cross-chain bridges or wrapped tokens, significantly enhancing accessibility. However, Solana remains the core chain for BONK activities.

Multi-Chain Deployment: Bonk is also exploring the launch of DeFi products on different blockchain platforms. Recent plans include launching BONAD on Monad, a Meme coin issuance platform similar to Bonk.fun. In the future, the redeployment or expansion of Bonk products to more blockchain ecosystems may further drive the buyback and burn pressure on BONK.

This extensive integration demonstrates Bonk's vision of not merely positioning itself as a Meme coin. By embedding the token into various application scenarios, Bonk aims to create organic demand that transcends pure retail speculation.

Supply-Side Evidence: "Deflationary Dogecoin"

Almost all Meme coins gradually disappear after their initial hype fades, but the Bonk community has chosen to build a sustainable ecosystem. By 2024, a new narrative began to form: "BONK is not just a Meme coin," with its core being fee revenue and token burn mechanisms.

Fee Generation and Distribution

As mentioned, BonkBot and Bonk.fun are the most influential applications driving the use of application fees for BONK buybacks and burns.

BonkBot charges a fixed 1% fee on each transaction:

- 10% of which is used for market buybacks and burns of BONK

- Another 10% is transferred to the BonkDAO multi-signature wallet

Thus, 20% of all BonkBot fees directly benefit BONK holders—half through permanent burns and the other half through DAO accumulation (these funds are ultimately used for burns through governance proposals).

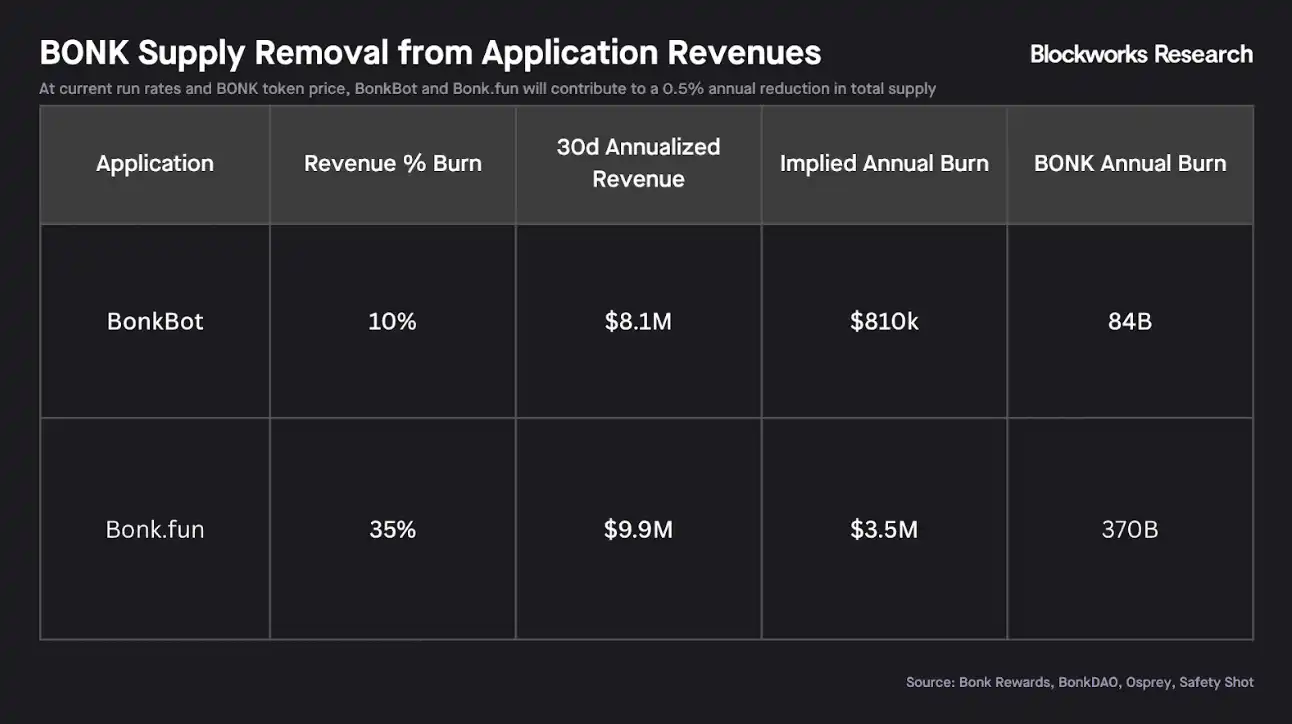

To date, BonkBot has generated over $87M in trading fees, with approximately $8.7M used for BONK burns and another $8.7M accumulated in the DAO. While 2024 is a highlight year for BonkBot, recent trading volumes and fees have significantly declined. The past 30 days' fees were about $667k, implying an annualized BONK burn of approximately $810k (if the 10% allocated to the DAO is also used for burns, the total could reach $1.6M).

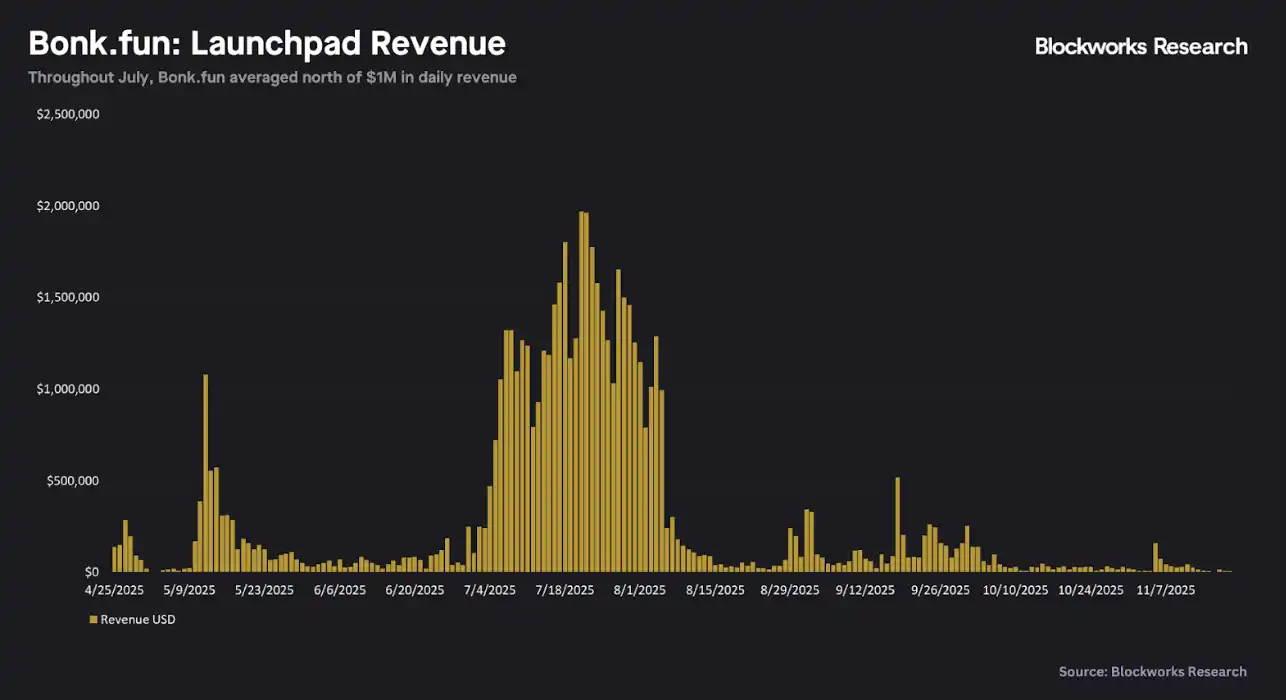

In addition to BonkBot, Bonk.fun became a significant driver of BONK burns in mid-2025. The platform charges a 1% fee on Bonding Curve-based trading volume. As of August 11, Bonk.fun allocated 50% of trading fees for market buybacks and burns of BONK; this ratio was later adjusted to 35%, but Safety Shot committed to reinvesting 90% of its 10% revenue share into purchasing BONK, resulting in an actual buyback and burn ratio of 44%.

As shown in the chart, Bonk.fun experienced a surge in trading volume in July, surpassing Pump.fun in market share, generating over $37M in revenue in July, with 50% allocated for BONK burns. However, since July, Bonk.fun's activity and revenue have declined by over 90%. The past 30 days' revenue was approximately $812k, indicating an annualized BONK burn of about $3.5M at the 35% burn ratio (considering Safety Shot's reinvestment, the actual burn pressure may be even higher).

Other applications in the Bonk ecosystem are relatively niche but generally follow the same model: allocating part of the fees for buybacks and burns of BONK. These applications include BonkSwap, Bonk Arena, Bonk Validator, and other Bonk-related applications or integrations.

The key conclusions are:

· The burn pressure on Bonk primarily comes from the success of BonkBot and Bonk.fun

· Various small applications have a negligible impact on the overall burn rate

Nevertheless, the core team and community of Bonk continue to launch new Bonk-related applications, games, and integrations, creating potential sources for future reductions in BONK supply.

Autonomous Burns and Locking Mechanisms

In addition to the main Bonk-related applications, another significant source of burns comes from DAO voting, events, and community/cultural decisions.

· Bonk DAO Burns: The DAO regularly proposes to burn tokens accumulated through revenue sharing in the treasury. For example, the burn of approximately 278 billion BONK in April 2024 was decided by a committee vote, while the burn of about 840 billion BONK in July 2024 was determined by community voting (any holder can temporarily stake BONK to participate in voting).

· Event Burns (such as BURNmas): BURNmas is an incentive-based marketing campaign where the DAO commits to burning different amounts of BONK based on tweets and other social interactions. From November 15 to December 24, 2024, the DAO and community burned tokens daily, aiming for 1 trillion BONK, ultimately burning 1.69 trillion BONK.

· DeGods Allocation Burn: The entire DeGods airdrop allocation (500 billion BONK) was burned in January 2023. As a Solana NFT project, DeGods was initially included in the BONK airdrop, but after announcing its migration to Ethereum, the community and Bonk team unanimously decided to burn that allocation.

In addition to the burn mechanisms, Bonk launched the Bonk Rewards locking (staking) mechanism in mid-2024 to encourage long-term holding. Users can choose a locking period from 1 month to 1 year, with longer periods yielding higher reward multiples. In return, locked users receive a share of the Bonk Rewards pool, funded by the Bonk ecosystem's revenue, with rewards primarily in USDC, supplemented by a small amount of BONK, distributed regularly.

Currently, approximately 35 trillion BONK is locked, accounting for about 4% of the total supply.

Demand-Side Drivers: Access to Traditional Financial Products

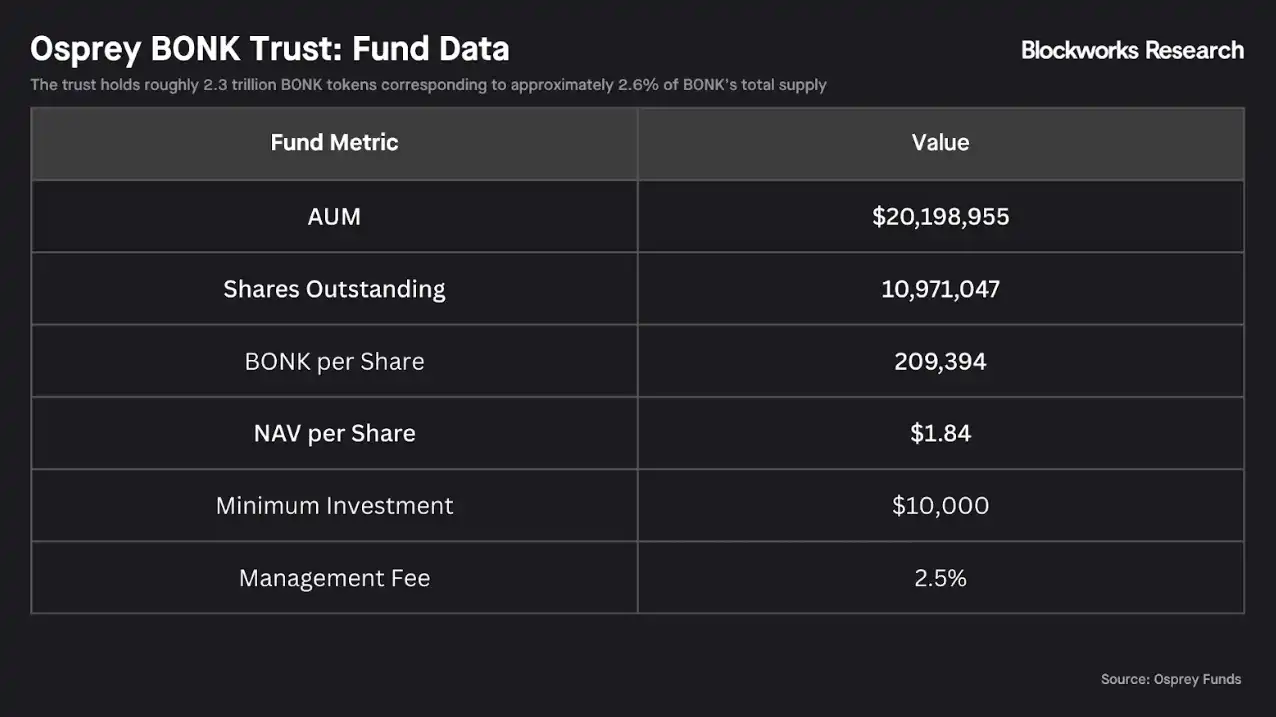

Osprey Bonk Trust was launched by Osprey Funds in October 2024 as a Delaware Grantor Trust, designed to provide passive exposure to BONK for U.S. accredited investors without directly holding tokens. The trust is issued in the form of a 506(c) private placement, with a minimum investment of $10,000, charging a 2.5% annual management fee, and adopting a closed-end structure (no direct redemption of shares allowed).

As of November 21, 2025, the trust holds approximately $20.2M in assets, corresponding to 10.97 million shares, each backed by about 209,000 BONK.

The trust currently holds about 23 trillion BONK, accounting for approximately 2.6% of the total supply, which is a significant portion that is locked away and removed from the market for the long term. Osprey has indicated that once the time and asset requirements for OTCQX listing are met, it plans to list the trust, providing public market investors with a trading method similar to Grayscale GBTC's stock code. However, before the official listing, liquidity is only achieved through periodic private placements, and due to the lack of a redemption mechanism, there are the following risks:

No redemption, shares can only be traded on the secondary market

After listing, there may be premium or discount trading, a risk that has historical precedents in similar closed-end funds (like GBTC)

Alongside the trust, Osprey is collaborating with REX Shares to apply for a Bonk ETF, which will directly hold BONK and provide daily subscription/redemption in the primary market. Multiple Rex-Osprey Meme coin ETFs, including BONK, TRUMP, and DOGE, are expected to start trading on September 12 after passing the SEC's 75-day review window.

Additionally, Tuttle Capital is advancing a 2x leveraged Bonk ETF and other leveraged crypto ETFs, but SEC approval remains uncertain. If approved, these ETFs will provide compliant, exchange-listed investment channels for BONK, potentially bringing marginal capital inflows. Notably, when news of the 2x Bonk ETF emerged in July 2025, the price of BONK rose by about 10% in a single day, indicating that the market expects more convenient access methods to enhance demand. Ultimately, the actual impact of these products will need to be observed once trading goes live and capital inflow is monitored.

In August 2025, Florida-based health beverage company Safety Shot restructured to become the first publicly listed BONK Digital Asset Treasury Company (DATCO), with BONK as its core treasury asset. The company committed to purchasing up to $115M of BONK (approximately 4-5% of total supply), with the initial $25M acquisition completed in collaboration with BonkDAO, and receiving a 10% revenue share from Bonk.fun. The company subsequently rebranded to Bonk, Inc. (NASDAQ: BNKK) to strengthen its association with the BONK ecosystem.

Bonk, Inc. raised funds through convertible preferred stock and ATM offerings to purchase and hold BONK, committing to reinvest 90% of Bonk.fun's revenue into BONK. Although BNKK nominally continues to operate its beverage business to maintain its listing status, its core strategy is to provide traditional investors with a stock-like exposure to BONK. This initiative triggered significant volatility—on the day of the announcement, the stock price fell nearly 50%, but before the Bonk ETF launch, it provided BONK with a public equity market investment channel and drove indiscriminate buying of BONK until the $115M acquisition commitment was fulfilled.

The demand-side story for BONK is financialization: an initially grassroots Meme coin that is now entering the traditional financial system through investment trusts, potential ETFs, publicly listed companies, and derivatives markets. If these products succeed, they could inject substantial capital into BONK, but they also introduce new risks, such as capital flow, premium/discount trading, and regulatory approvals, complicating a market that was originally purely retail-driven.

Token Economics: Supply and Demand Accounting

The total supply of BONK has decreased from the initial 1 trillion to approximately 880 trillion, primarily due to various burn mechanisms.

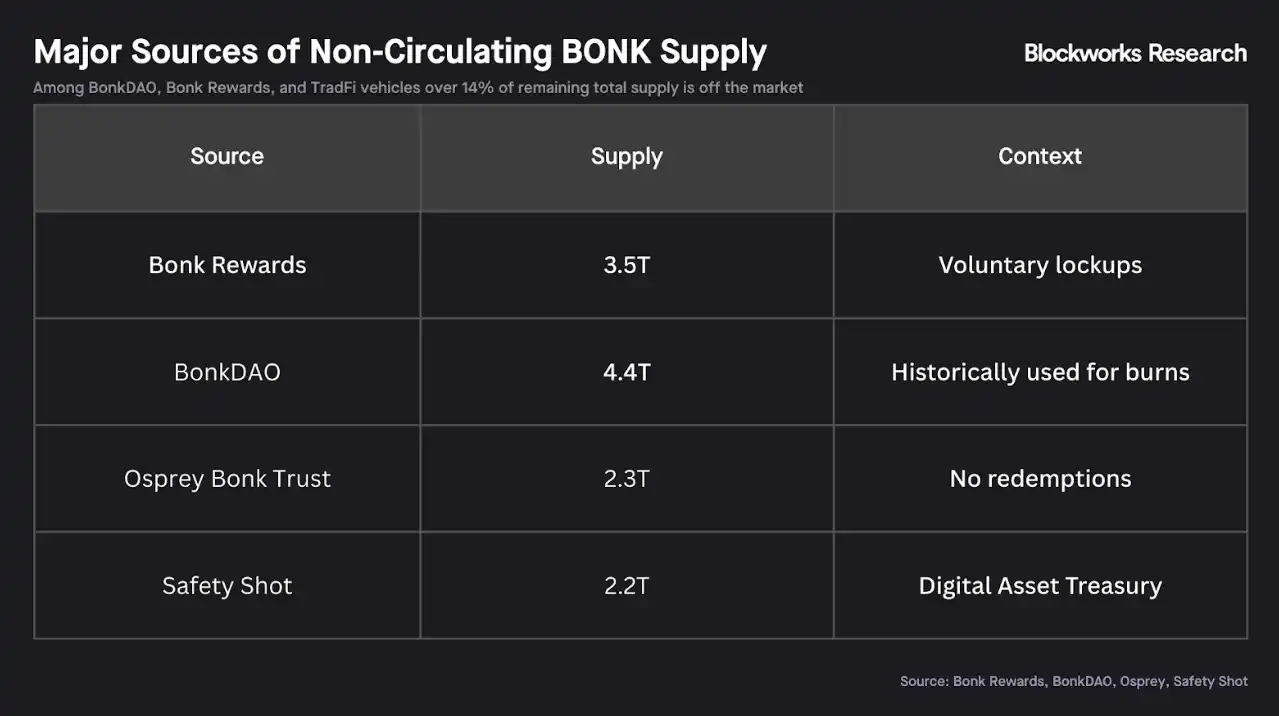

Of this 880 trillion, several non-circulating sources have already been identified:

· Bonk Rewards Locking

· BonkDAO Holdings

· Osprey Bonk Trust and Safety Shot Holdings

These collectively account for over 14% of the remaining total supply, effectively removed from the market.

Additionally, the original Bonk Contributors allocation still has about 200 trillion tokens awaiting unlocking, which is expected to be fully unlocked in the coming months.

We can also demonstrate the impact of BonkBot and Bonk.fun's revenue run rates on token supply reduction. Based on previously calculated 30-day annualized revenues, BonkBot and Bonk.fun are expected to burn approximately 84 billion and 370 billion BONK annually, respectively, totaling about 0.5% of the total supply.

Essentially, Bonk's narrative revolves around limited supply and continuous burns. Positive catalysts include:

· New locking tools that further reduce circulating supply

· Increased revenue from Bonk-related applications, driving accelerated burns

Conversely, if the Osprey Bonk Trust begins to offer redemption mechanisms after the Bonk ETF launches or if the market share of applications like BonkBot and Bonk.fun continues to decline, we expect BONK prices to face downward pressure.

Risk Factors

Operational Risks

The value of BONK is increasingly tied to the performance of applications like BonkBot and Bonk.fun, as they directly influence the burn volume. The ability of the Bonk team and community to continuously capture new narratives, launch applications that generate fees and drive burns, and maintain relevance in the crypto market has become a key driver of success.

This model is highly cyclical: it is constructive when product popularity rises, but it can also experience reflexive declines when the hype fades. We have observed this phenomenon with BonkBot and Bonk.fun—BONK surged when these applications dominated, but faced declines when market share was reclaimed by competitors.

Ecological Competition Risks

The Meme coin ecosystem on Solana is not monopolistic. If a more topical Meme coin (like TRUMP earlier this year) emerges, users may shift from BONK to other tokens. Similarly, Bonk products face competitive pressure within the Solana ecosystem:

· In 2024, BonkBot was the leader in the trading bot market but was subsequently marginalized

· Bonk.fun briefly held the majority of the Solana Launchpad market share in July 2025, but Pump.fun quickly regained dominance

If Bonk products continue to lose market share, the narrative of driving fees into burns will become ineffective. Bonk must maintain cultural relevance while adapting to the increasingly competitive DeFi and trading application ecosystem on Solana.

Reputation and Ethical Risks

Bonk is inherently associated with speculative fervor. If a significant fraud or exit event occurs under the Bonk brand, it could impact the entire ecosystem. For example:

- If a malicious token issued on Bonk.fun exits, users may blame the platform or Bonk

- If a celebrity promotes BONK and the price subsequently crashes, the media may label it as "pump and dump"

The team attempts to position Bonk as community-friendly, but there have been negative cases in the history of Meme coins, such as lawsuits arising from celebrity tokens and criticism of "celebrity coins" on Crypto Twitter. Additionally, after Safety Shot announced its BONK treasury strategy, the stock price fell nearly 50%, which may indicate that the market perceives this move as "not serious." If this narrative spreads (with media mocking the Bonk treasury as absurd), it could hinder further adoption, such as Bonk ETF products, and even trigger regulatory scrutiny of Meme coin treasuries.

Conclusion

BONK has evolved from a festive airdrop to one of the most influential native assets on Solana, reflecting the power of community, experimental spirit, and broad integration. Its fee-driven burn + cultural stickiness model gives it a longer lifespan than most Meme coins, while the acceptance of traditional financial tools marks a new chapter of legitimacy.

However, BONK's future depends on the community's ability to continue innovating, defending its cultural moat, and maintaining effective burn mechanisms amid competition and narrative changes. If successful, BONK will become a typical case of how Meme coins can transform into enduring ecological assets.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。