The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

Time flies, and this year has already come to its last month. Financial reports from major institutions and foreign trade settlements will all accumulate to this fruitful month of December. There are still many friends who have rigid views on Bitcoin, and many analysts share the same thoughts as Lao Cui. The recent decline of ETH and BTC is more about human liquidation rather than fundamental issues; this line of thinking has been consistent in Lao Cui's perspective. Observing some signals on the chain, we have once again returned to the top three in BTC mining this year, with investment costs recoverable in just three months. Under this trend, some still doubt the bubble issue of BTC and even question the market capitalization of the coin circle. It can only be said that everyone's thinking is not the same, and their understanding varies slightly. Lao Cui has never doubted whether a bull market will come again. In Lao Cui's mind, it is bound to happen.

Most users attacking the coin circle revolve around the issue of decentralization, which is also the viewpoint of many analysts who are bearish on the coin circle. Next is the issue of tariff trade, and the core issue is the anchor asset. Lao Cui has explained these issues multiple times before, but every time new users or fans join Lao Cui, they will discuss them again. I will unify and explain them once more, and then I will pin this article and no longer answer such questions. The issue of decentralization is not something that can be achieved at this stage. The change in Ethereum's mechanism is also due to the concentration of computing power, which leads to a struggle for pricing power. The previous computing power could threaten the issue of centralization. Currently, Bitcoin's solution has changed to hard forks, but ultimately cannot escape the result of computing power being tied to electricity. With the introduction of the US stablecoin bill, the coin circle has long lost the gimmick of decentralization. Trump's rise to power has deeply bound the relationship between the US and the coin circle.

This round of the bull market has formed precisely because the theory of decentralization has been lost. The endorsement from the US is to better manipulate coin prices. Everyone should stop discussing the theory of decentralization; it is currently not valid. Secondly, regarding tariffs, many people are primarily bearish on the coin circle. However, Lao Cui thinks the opposite: in the short term, the tariff trade war will lead to a downturn in the coin circle. But in the long run, it is beneficial for the coin circle because the scenarios that the coin circle can fully utilize are settlements. If the dollar is not recognized, then world trade cannot use gold as a settlement method; the burden is too great, and ultimately, some funds will flow into the coin circle. The settlement method of the coin circle is the most discreet. In other words, the multi-level opposition in the world will instead increase the application scenarios of the coin circle; world peace is not beneficial to the coin circle. The current development pattern of the coin circle is also like this: under the chaotic world economic system, the coin circle is in a bull market state. Do not link the coin circle with traditional finance; these are two different theories.

The final issue is still the anchor asset. The dollar anchors the credit of the US, but in essence, it anchors the strength of the country. The reserve of gold remains a world consensus. From Lao Cui's perspective, the price increase of gold is not caused by inflation; the purchasing power of gold has not changed much in Lao Cui's eyes, still adhering to the concept of equivalent exchange. Its value has not changed. Lao Cui believes that the increase in gold prices is merely due to currency devaluation. Therefore, regarding the anchor assets of the coin circle, it is currently the US Treasury bonds and the endorsement of the dollar. The most important value is the establishment of channels, which can bring assets from anywhere to where you want to take them; this is value. As long as this demand continues to increase, Bitcoin will continue to appreciate. Everyone can think about how many people in this world want to seek a way to survive? These people could all become users of the coin circle, and the value of Bitcoin will naturally rise.

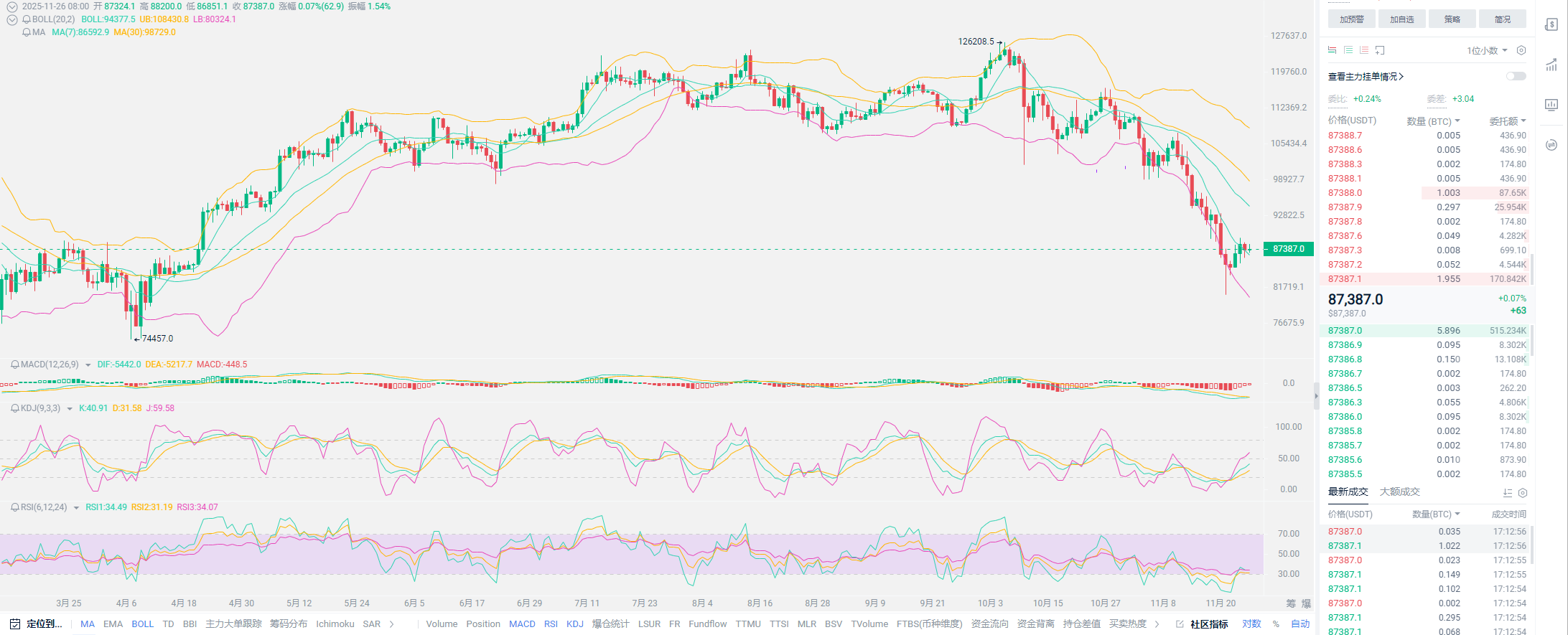

On the trend level, there is no need for everyone to get too entangled, especially for spot users. Lao Cui has almost always discussed the market in advance. At the end of October, I reviewed with everyone that there would be a new low in November. At that time, many friends asked Lao Cui if they could add positions in November. Of course, they could; this answer remains the same for Lao Cui at this stage. The market trend has not exceeded expectations; it is just that the low points are hard to predict. When the bearish market arrived, it was instead everyone who hesitated, which should not be the concern of a trader. As long as you start to doubt the trend, it is a kind of internal consumption for yourself. Those who should bottom out can confidently do so; the market will definitely recover this year. From a long-term perspective, the current prediction for interest rate cuts is that there may be a 150 basis point cut next year, a theory that Lao Cui agrees with. If a 150 basis point cut really occurs, combined with the US's weak dollar strategy, the coin circle may see new bull market highs. Bitcoin has a chance to reach the 150,000 mark next year; this year's prediction of the 130,000 to 150,000 range has not yet been achieved.

For Lao Cui, the overall trend is merely a question of when the bull market will arrive, not whether it will end. Either there will be a complete rebound in December, or there will be a full-on assault next year, but it will not exceed next year. However, after 2026, everyone needs to be cautious. The primary reason is the strategy of the US. After 2026, Trump will have only two years left in office. How the next president will treat the coin circle will determine the trend of the coin circle. Currently, it is impossible to analyze trends for 3-5 years. Analysts who claim to have such analyses can be directly blocked. If you cannot see such distant trends, based on the current trend, it can be confirmed that the market near the interest rate cut in December will definitely be higher than now. Therefore, for everyone, it is sufficient to expand profits according to the current trend. After recent fluctuations, there may still be one more dip; it is very likely that we will directly welcome the speculation before the interest rate cut, so everyone must have the ability to assess the situation and try to reduce the holding of short positions. After this decline, exit as soon as possible.

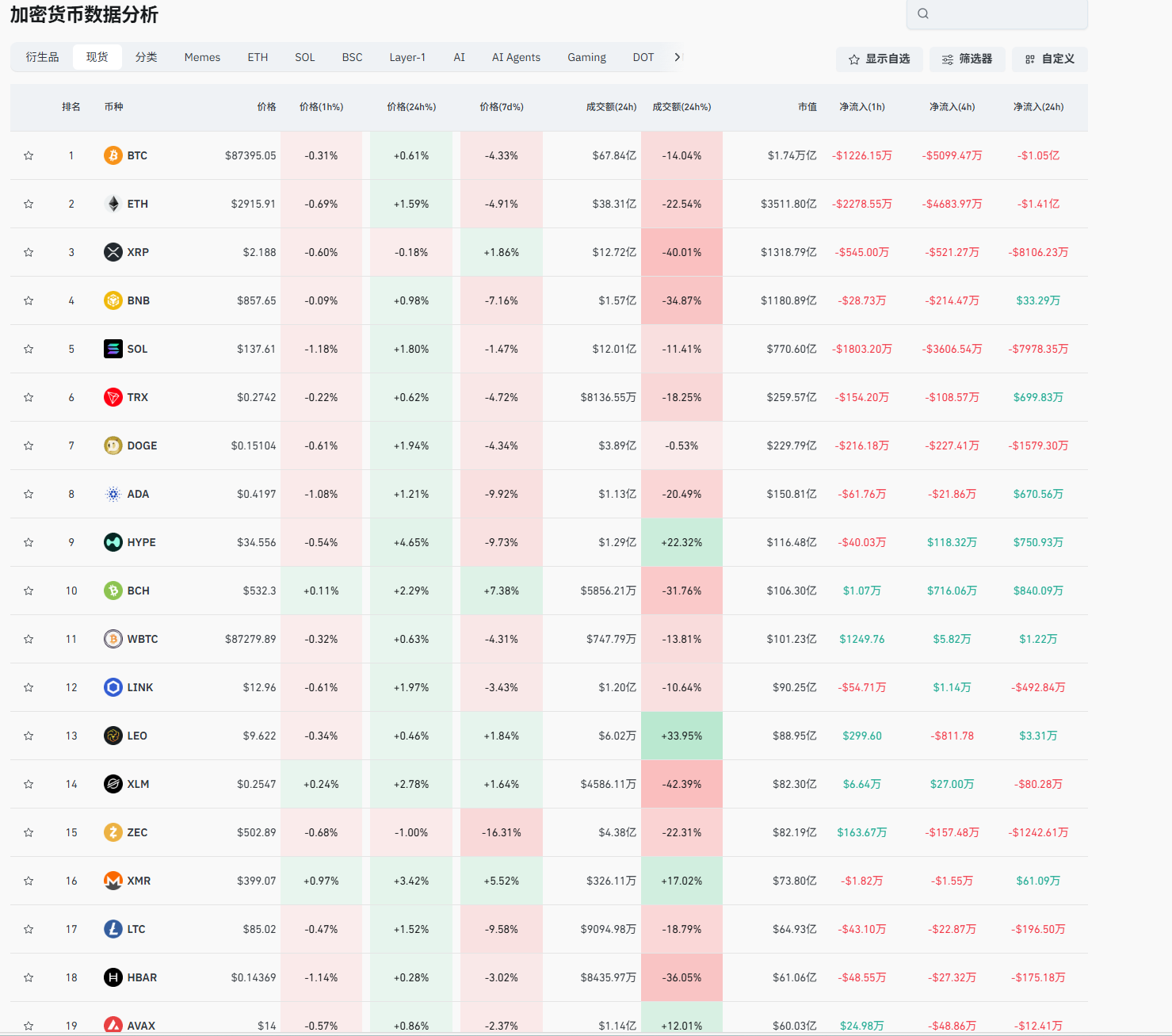

Lao Cui summarizes: The current spot buying is particularly strong, almost forming an inflow phenomenon for nearly half a month. Many large purchases are private transactions; only when they accumulate to wallet addresses will there be data on the chain. Everyone should not blindly trust superficial data. Here, Lao Cui will also provide an outlook for the market in December. As long as the end of balance sheet reduction and the arrival of interest rate cuts are confirmed, the market will reverse, especially if the situation of continuous interest rate cuts occurs in January; this rebound may last until the beginning of the year. This does not include altcoins; altcoins will not have another bull market. Even if there is, it can only be a short-term rebound and will not reach historical new highs. Therefore, spot users should focus on bottoming out at this stage. Even if Bitcoin does not reach new highs this year, the continuous interest rate cuts after 2026 will inevitably lead to new highs in the market. Short-term corrections are untenable; a rebound is already on the way. For users wanting to enter contracts, the best time is to wait for the establishment of the market in early December. Those currently trapped in short positions should find an opportunity; there will still be one more dip, and exit as soon as possible. If you have specific questions, just ask Lao Cui. Free consultation.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。