Ethereum #Bitcoin #Ethereum Real-time Analysis #Bitcoin Real-time Analysis

Hello everyone, I am Lao Lv. Yesterday's article should be a feel-good piece; looking back, it’s all about slapping thighs. Overall, it’s still the same old story. We highlighted the up-and-down washing trend on the first trading day of this week and repeated it yesterday. Looking back, isn’t there some similarity? Yesterday, we provided a small cycle support for Bitcoin at $86,200. The original plan was not to go long, mainly considering that the price hadn’t broken $88,300, and the upward space was insufficient. After 1 AM, Bitcoin washed around $86,200-$88,300! A typical roller coaster trend. This is why I always say, never open positions in the middle for both long and short. Bitcoin is oscillating around the large range of $84,800-$88,300, and with the current trend, it’s a pity to abandon it, yet tasteless to hold. Therefore, next, we wait for a breakout in one direction, and the four-hour Bollinger Bands have clearly indicated that the price will choose a direction in the next couple of days. As of now, Bitcoin is struggling to break above $88,300, and the upward space cannot open up. We have been discussing this position almost every day, so there’s no need to doubt whether it’s hindsight. Surely someone will ask, will the price stabilize here and then surge? If I could answer you 100%, then the person at the top of the Forbes list should be me, not anyone else. What I can tell you is that through technical analysis, we have concluded that this is a strong resistance level. Then you set a reasonable stop-loss and go for it. In fact, many friends are not inherently distrustful; they just forget the original intention of trading. This is not a gamble!

Given that many paid friends missed the market due to late payment, even if it’s just five dollars, I don’t want anyone to waste their money. So today we will layout in advance. This layout will be effective today and tomorrow. We will make a forecast and expectation for the price trend in advance. If the price moves as expected, we will layout according to the strategy. This layout includes: detailed entry price, stop-loss price, reduction position, and profit-taking position, etc., while also making a detailed expectation and analysis of Bitcoin's head and shoulders pattern, and an expectation and analysis of Ethereum's "M" type double top.

Bitcoin is currently forming an irregular head and shoulders downward pattern. Today or tomorrow, we will focus on the neck line position, which is the effective breakout at $86,000. For this downward pattern not to break, the price cannot break above the right shoulder, which is the strong resistance at $88,300. Therefore, the operation is divided into two factions: conservative and aggressive. The aggressive faction continues to hold the stop-loss at $88,500 and continues to short. However, with the current price, the stop-loss position is too large, and the risk-reward ratio is too big. Unless the price can surge to around $87,800 today, we can use a small loss of $700 to look for a breakout. In our operations, we not only look at support and resistance but also focus more on the risk-reward ratio. If it doesn’t reach at least 1:2, there’s no need to take the trade. On the other hand, the conservative approach waits for the price to break the neck line support and then short near the neck line on a pullback. Personally, I prefer this approach, but everyone has different personalities and groups. I will lay out all feasible ideas and let personal character decide how to operate specifically. I will illustrate the specific ideas in the Bitcoin chart. Currently, Bitcoin has upper pressure at $88,300 and lower support has moved up to $86,000. The space is very compressed, so we are just waiting for a big one-way move. Remember, in these two days, set your stop-loss properly.

Here we need to note that the conservative breakout approach needs to meet one condition: there must be a large number of bearish candles on the hourly K-line below $86,000. I will specifically show this in the chart for your reference.

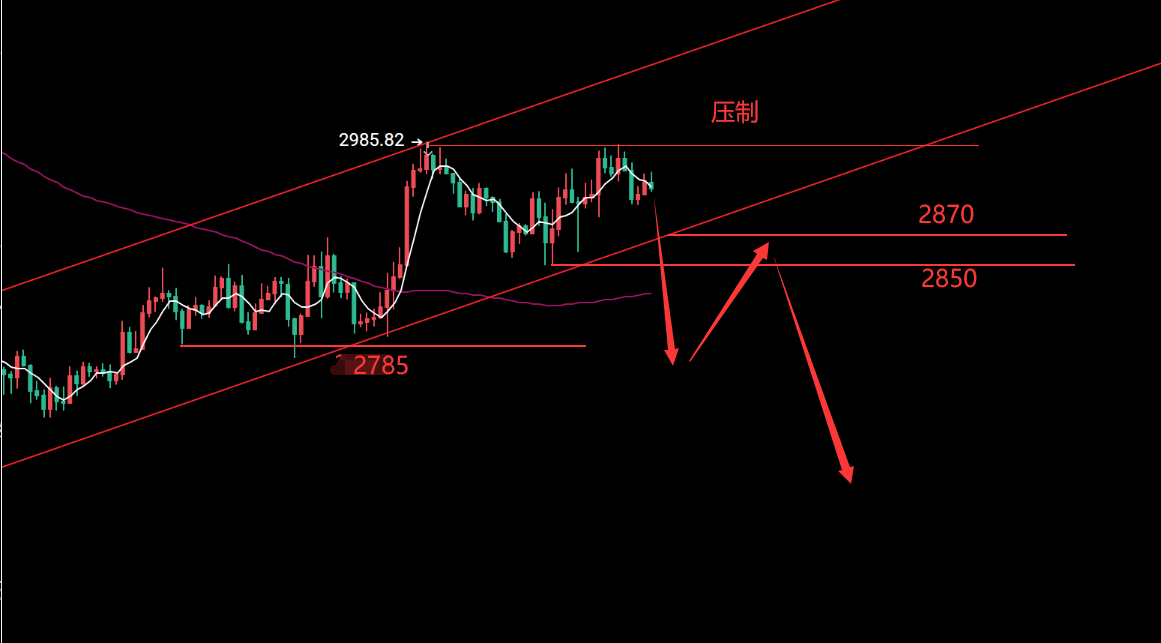

For Ethereum, yesterday we provided a large cycle support level at $2,830, and suggested going long near $2,840 with a very small stop-loss at not breaking $2,820, basically at the limit position. The small target for the long position is not greedy, just looking for an increase of $80-$100. Last night, it rose from $2,855 to $2,956, then dropped back to $2,870, and continued to surge to $2,980. Currently, it is still experiencing small bearish fluctuations. If you don’t set the entry, stop-loss, and take-profit positions well, it’s basically all in vain. If you prefer to hold positions, then you can consider that I didn’t say anything. Looking at the trend, whether it can break out significantly is unclear; it depends on Bitcoin's performance. If Bitcoin stabilizes above $88,300 on the four-hour level, Ethereum still has space, at least up to $3,200. Conversely, if Bitcoin doesn’t break, $2,980 will definitely continue to exert pressure. The current Ethereum pattern is definitely stronger than Bitcoin, so the shorting path is a bit difficult. The entire structure has initially formed an M-type double top pattern, with the left bottom at $2,785 and the double top at $2,980. If this structure can play out today or tomorrow, we will also arrange two different operational ideas: conservative and aggressive. Ethereum stop-loss at $2,990, short at any price. The current support level has come to around $2,850, which is also the conservative approach we are talking about. A large number of bearish candles are falling below $2,850 on the hourly line. If it sees the $2,760-$2,780 position, we can short on a pullback testing the $2,850-$2,870 range. This belongs to the conservative operation after a breakout. Of course, different methods have different stop-losses. We will focus on discussing the conservative ideas for Bitcoin and Ethereum.

If Ethereum's price breaks below $2,850 and sees around $2,760-$2,780, we will short after a rebound in the $2,850-$2,870 range. Stop-loss at $2,910, target at $2,770, reduce position and move stop-loss to $2,850, clear at $2,680.

If Bitcoin's price breaks below $86,000 and sees the range of $85,200-$84,800, we will short after a rebound in the $86,800-$87,000 range. Stop-loss at $87,800, target at $85,200, reduce position and move stop-loss to $86,800, clear at $84,000.

Today: Written by Lao Lv on November 26, 2025, at 2:30 PM. Note that all strategies are effective once and cannot be reused! Check the text version and specific entry prices in the lower right corner of the chart or video.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。