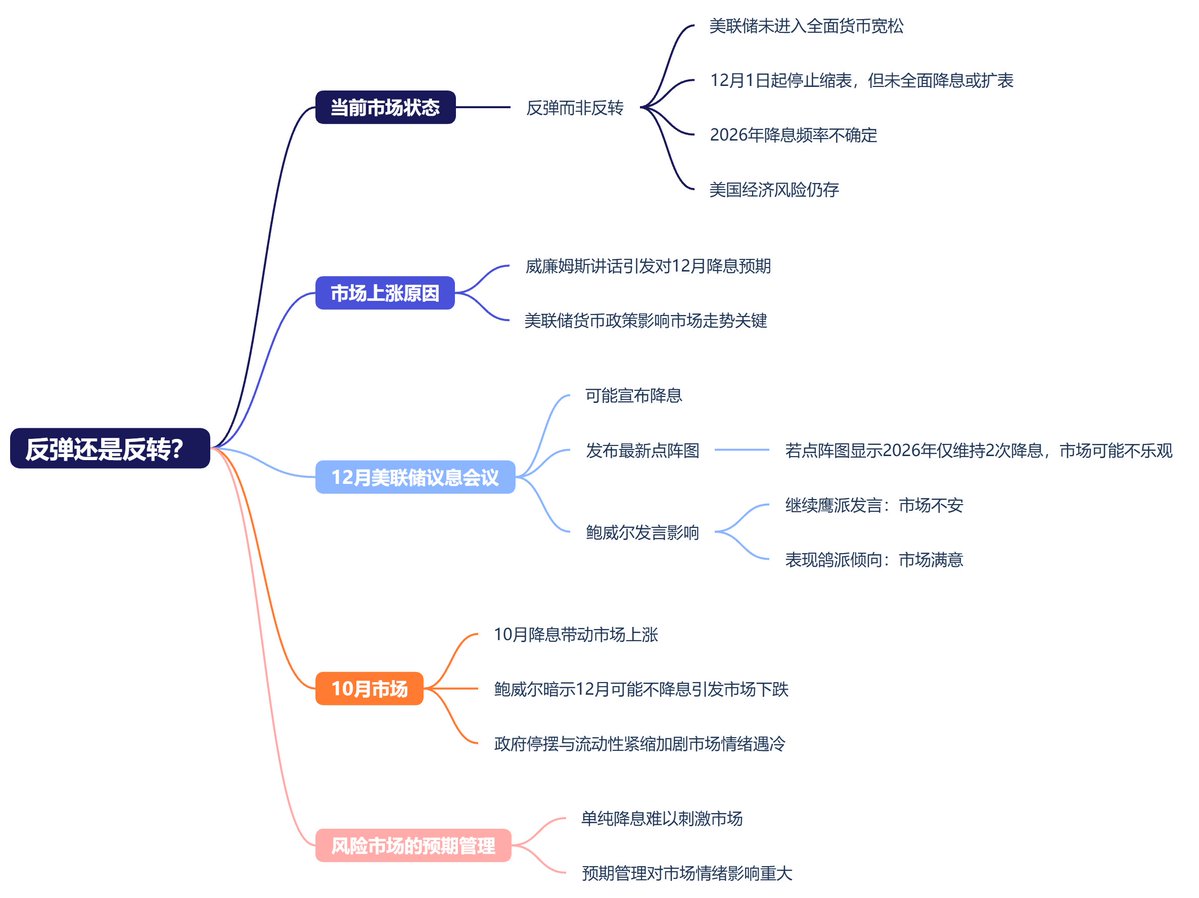

Is the current environment a reversal or a rebound? If it's a reversal, does that mean everything will go smoothly? If it's a rebound, where is the next danger point?

(1) Monetary Policy

To conclude: In my personal view, we are still in a rebound, not a reversal. (Of course, I may not be right.)

The most important factor for a reversal is that the Federal Reserve fully enters a monetary easing policy. From the current conditions, although the tapering will stop starting December 1, we have not yet entered a comprehensive rate-cutting phase, let alone expanding the balance sheet.

The frequency of rate cuts in 2026 is still hard to determine, and if we are not in a fully easing environment, it means that the risks to the U.S. economy still exist. As long as this possibility remains, I personally believe it is not a reversal.

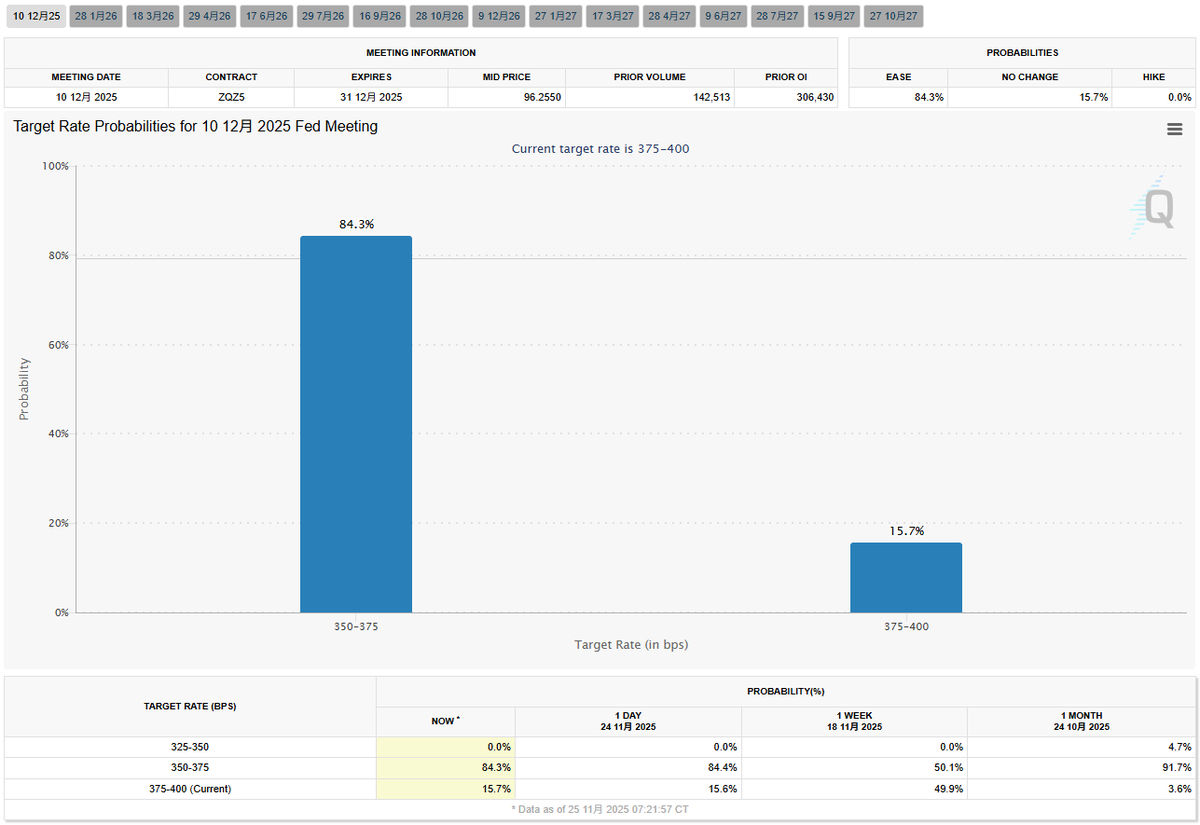

Especially considering the rise that started last Friday night, it is clear that Williams' speech led the market to re-evaluate expectations for a rate cut by the Federal Reserve in December, which alleviated the decline. This also shows that the Federal Reserve's monetary policy is one of the most important factors influencing market trends.

Many people are now looking forward to the Federal Reserve announcing a rate cut in December, which would indeed benefit risk markets. However, it is important to note that the latest dot plot will also be released in December, and whether Powell will continue to maintain a hawkish stance during his speech.

In October, the expectation of a rate cut drove the market up, but after Powell stated that there might not be a rate cut in December, the market began to decline. When combined with the liquidity tightening due to the government shutdown, it significantly cooled market sentiment.

Therefore, a simple rate cut cannot excite the market; managing expectations is very important for risk markets. So even if the Federal Reserve announces a rate cut at the December meeting, if the dot plot for 2026 still indicates only two cuts, the market is unlikely to be optimistic.

Moreover, Powell's statements are even more important. If the dot plot is a long-term forecast, Powell's statements have a short-term impact on the market.

If Powell continues to maintain a hawkish stance, such as stating that there will not be further rate cuts in January 2026, the market will still be uneasy. Conversely, if Powell shows that he does not oppose further rate cuts and makes clear dovish statements, the market will be more satisfied.

Image: Goldman Sachs' forecast for the interest rate path from 2025 to 2026 (whether the pace of rate cuts is fast enough determines whether it is a reversal)

From Goldman Sachs' forecast for the interest rate path from 2025 to 2026, it can be seen that even if the baseline expectation (60%) believes there will be consecutive rate cuts in the future, the pace is still relatively slow and has not entered the rapid, sustained, and clear easing cycle that the market needs. As long as the rate cut path is not fast enough or certain enough, I believe the current market situation cannot be defined as a true reversal, but only as a rebound under policy games.

Therefore, from an overall macro perspective, until we enter a complete rapid rate-cutting channel, it may not be considered a reversal, and the market's trend could be swayed at any time by the Federal Reserve's rate-cutting pace.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。