Author: Zhang Feng

Artificial Intelligence (AI) is undoubtedly the hottest technology trend globally, reshaping various industries at an unprecedented pace. However, behind the booming noise lies a harsh reality: the vast majority of AI businesses, especially startups, have not found a stable and sustainable path to profitability. They are caught in the dilemma of "getting applause but not the box office," where technological prosperity coexists with commercial losses.

1. Why "losing money to gain attention"?

The profitability dilemma of AI businesses does not stem from a failure of the technology itself, but rather from its centralized development model, which leads to structural contradictions. Specifically, it can be summarized into three main reasons:

Extreme centralization: sky-high costs and oligopolistic monopoly. The current mainstream AI, especially large models, is a typical "heavy asset" industry. Its training and inference processes require massive amounts of computing power (GPU), storage, and electricity. This has led to polarization: on one end are tech giants with substantial capital (such as Google, Microsoft, OpenAI), capable of bearing investments of hundreds of millions or even billions of dollars; on the other end are numerous startups that have to "tribute" most of their funding to cloud service providers to obtain computing power, severely squeezing their profit margins. This model has created a "computing power oligopoly," stifling innovative vitality. For example, even OpenAI heavily relied on Microsoft's massive investments and Azure cloud resources in its early development to support the research and operation of ChatGPT. For the vast majority of players, high fixed costs make it difficult to achieve scalable profitability.

Data dilemma: quality barriers and privacy risks. The fuel of AI is data. Centralized AI companies face two major challenges in obtaining high-quality, large-scale training data. First, the cost of data acquisition is high. Whether through paid collection, data labeling, or utilizing user data, it involves significant financial and time investments. Second, there are enormous risks related to data privacy and compliance. With the tightening of global data regulations (such as GDPR, CCPA), collecting and using data without explicit user authorization can lead to legal lawsuits and hefty fines at any time. For instance, several well-known tech companies have faced astronomical fines due to data usage issues. This creates a paradox: without data, AI cannot develop, but acquiring and using data is fraught with difficulties.

Value distribution imbalance: contributors and creators excluded from profits. In the current AI ecosystem, value distribution is extremely unfair. The training of AI models relies on countless user-generated behavioral data, content produced by creators (text, images, code, etc.), and open-source code contributed by global developers. However, these core contributors can hardly receive any returns from the enormous commercial value created by AI models. This is not only an ethical issue but also an unsustainable business model. It dampens the enthusiasm of data contributors and content creators, which, in the long run, will erode the foundation for the continuous optimization and innovation of AI models. A typical case is that many artists and writers have accused AI companies of using their works for training and profit without any compensation, leading to widespread controversy and legal disputes.

2. New Profit Paradigm

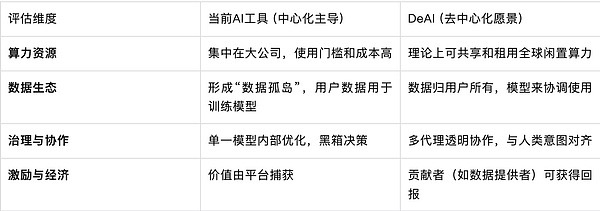

DeAI (Decentralized AI) is not a single technology but a new paradigm that integrates blockchain, cryptography, and distributed computing. It aims to reconstruct the production relationships of AI through decentralization, specifically addressing the three major pain points mentioned above and opening up possibilities for profitability.

DeAI disperses computing power demand globally through a "crowdsourcing" model (personal computers, data centers, etc.). This is akin to "Airbnb for GPU," forming a global, competitive computing power market that can significantly reduce computing costs. Participants earn token incentives by contributing computing power, achieving optimized resource allocation.

DeAI employs technologies like "federated learning" and "homomorphic encryption" to achieve "data immobility, model mobility." It does not require original data to be centralized; instead, it distributes models to various data sources for local training, only aggregating encrypted parameter updates. This fundamentally protects data privacy while legally and compliantly utilizing decentralized data value. Data owners can autonomously decide whether to provide data and profit from it.

DeAI constructs a transparent and fair value distribution system through "token economics" and "smart contracts." Data contributors, computing power providers, model developers, and even model users can automatically receive corresponding token rewards based on their contributions through smart contracts. This transforms AI from a "black box" controlled by giants into an open economy co-built, co-governed, and co-shared by the community.

3. Three-Layer Architecture for Transformation

Migrating traditional centralized AI businesses to the DeAI paradigm requires systematic reconstruction at the technical, business, and governance levels.

(1) Technical Reconstruction from Centralized to Distributed

Computing Layer relies on decentralized physical infrastructure networks (DePIN) projects, such as Akash Network and Render Network, to build a flexible, low-cost distributed computing pool, replacing traditional centralized cloud services.

Data Layer adopts federated learning as the core training framework, combined with cryptographic technologies like homomorphic encryption and secure multi-party computation to ensure data privacy and security. Establishing blockchain-based data markets, such as Ocean Protocol, allows data to be traded under the premise of rights confirmation and security.

Model Layer deploys trained AI models in the form of "AI smart contracts" on the blockchain, making them transparent, verifiable, and callable without permission. Each use of the model and the generated revenue can be accurately recorded and distributed.

(2) Business Reconstruction from Selling Services to Ecosystem Co-Building

From SaaS to DaaS (Data as a Service) and MaaS (Model as a Service), companies are no longer just selling API call counts but acting as builders of the ecosystem, incentivizing community participation in network construction through the issuance of functional or governance tokens. Revenue sources expand from a single service fee to token appreciation, transaction fee dividends, and more, driven by ecosystem value growth.

Therefore, building a decentralized task platform to publish tasks such as data labeling, model fine-tuning, and specific application development in the form of "bounties," which can be undertaken by global community members for rewards, significantly reduces operational costs and stimulates innovative vitality.

(3) Governance Reconstruction from Corporate Structure to DAO

Based on community governance, participants (contributors, users) holding governance tokens have the right to vote on key decisions, such as the direction of model parameter adjustments, the use of treasury funds, and the priority of new feature development. This achieves true "users as owners."

Based on openness and transparency, all code, models (partially open-sourced), transaction records, and governance decisions are put on-chain, ensuring the process is public and transparent, establishing a trustless collaborative relationship, which itself is a powerful brand asset and trust endorsement.

Taking the transformation of traditional logistics data platforms to DeAI as an example, the dilemma of traditional logistics data platforms lies in the fact that, while they aggregate data from various sources such as maritime, land transport, and warehousing, participants are "unwilling to share" due to concerns about commercial confidentiality leaks, leading to data silos and limited platform value. The core of the transformation to DeAI is to release data value and incentivize fairly without exposing original data:

Technically, build a trusted computing network. The platform no longer centrally stores data but transforms into a blockchain-based coordination layer. By adopting federated learning and other technical models, AI models can "airdrop" to local servers of various enterprises (such as shipping companies and warehouses) for training, only aggregating encrypted parameter updates to jointly optimize the global prediction model (such as cargo ship arrival times, warehouse congestion risks), achieving "data immobility, value mobility."

Business-wise, promote data assetization and token incentives. The platform issues utility tokens, allowing logistics companies to "mine" points by contributing data (model parameters). Downstream customers (such as cargo owners) pay tokens to query high-precision "prediction results" (for example, the on-time rate of a certain route in the coming week) instead of purchasing raw data. Revenue is automatically distributed to data contributors through smart contracts.

Governance-wise, build an industry DAO, where key decisions (such as new feature development and fee adjustments) are jointly voted on by token holders (i.e., core participants), transforming the platform from being privately led to an industry community.

The platform evolves from a centralized entity attempting to extract data intermediary fees to a neural system co-built, co-governed, and co-shared by the entire logistics industry chain, significantly enhancing industry collaboration efficiency and risk resistance by solving trust issues.

4. Compliance and Security

Despite the broad prospects of DeAI, its development is still in the early stages and faces a series of challenges that cannot be ignored.

Compliance and legal uncertainty. In terms of data regulations, even if data does not move, models like federated learning still need to strictly comply with regulations such as GDPR regarding "purpose limitation," "data minimization," and user rights (such as the right to be forgotten) when handling personal data. Project parties must design compliant data authorization and exit mechanisms.

In terms of securities regulations, tokens issued by projects can easily be classified as securities by regulatory bodies in various countries (such as the U.S. SEC), facing strict regulatory scrutiny. How to avoid legal risks when designing token economic models is key to the survival of projects.

In terms of content liability, if a DeAI model deployed on the chain generates harmful, biased, or illegal content, who is responsible? Is it the model developer, the computing power provider, or the governance token holder? This presents new challenges for the existing legal system.

In terms of security and performance challenges, model security means that models deployed on public chains may face new types of attack vectors, such as exploiting vulnerabilities in smart contracts or maliciously poisoning data to disrupt federated learning systems.

Performance bottlenecks such as the transaction speed (TPS) and storage limitations of blockchain itself may not support high-frequency, low-latency large model inference requests. This requires effective combinations of Layer 2 scaling solutions and off-chain computing.

Collaboration efficiency means that while distributed collaboration is fair, decision-making and execution efficiency may be lower than centralized companies. How to strike a balance between efficiency and fairness is an ongoing exploration in DAO governance.

DeAI, as a revolution in production relationships, has the potential to break the monopoly of giants through distributed technology, token economics, and community governance, releasing idle computing power and data value globally, and building a more equitable, sustainable, and potentially more profitable new AI ecosystem.

5. Current Exploration Directions

The current development of AI tools is still a long way from achieving the ideal decentralized artificial intelligence. We are still in the early stages dominated by centralized services, but some explorations have already pointed to future directions.

Current explorations and future challenges. Although the ideal DeAI has not yet been realized, the industry is already making valuable attempts that help us see the future path and the obstacles that need to be overcome.

For example, the embryonic form of multi-agent system collaboration. Some projects are exploring the creation of environments where AI agents can collaborate and co-evolve. For instance, the AMMO project aims to create a "symbiotic network of humans and AI," with its designed multi-agent framework and RL Gyms simulation environment allowing AI agents to learn cooperation and competition in complex scenarios. This can be seen as an attempt to build the underlying interaction rules of the DeAI world.

Another example is preliminary incentive model attempts. In the vision of DeAI, users who contribute data and nodes that provide computing power should receive fair returns. Some projects are trying to redistribute value directly to contributors in the ecosystem through encrypted incentive systems. Of course, how this economic model can operate on a large scale, stably, and fairly remains a significant challenge.

Yet another example is moving towards more autonomous AI: Deep Research-type products demonstrate AI's strong autonomy in specific tasks (such as information retrieval and analysis). They can autonomously plan, execute multi-step operations, and iteratively optimize results, which is the foundation for AI agents to work independently in the future DeAI network.

For AI practitioners struggling in a red ocean, rather than getting caught up in the old paradigm, it is better to bravely embrace the new blue ocean of DeAI. This is not only a shift in technical routes but also a reshaping of business philosophy—from "extraction" to "incentivization," from "closed" to "open," and from "monopolizing profits" to "inclusive growth."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。