In the darkest moment when Bitcoin spot ETFs experienced four consecutive weeks of net outflows totaling $3.7 billion, Polymarket dropped a bombshell: the CFTC officially issued an "Amended Order of Designation," allowing the world's largest on-chain prediction market to legally provide services to U.S. users through registered futures commission merchants (FCMs). This is not just a simple "unblocking," but the first real connection of TradFi's faucet to Web3's pipeline after the crypto industry endured a regulatory winter from 2022 to 2024.

1. When "On-Chain Casinos" Become Financial Tools: The Significance of Compliance Breakthrough

For the past three years, Polymarket has been labeled as a "gray area casino." But this time, the CFTC redefined it as a "regulated event contracts market" with a 27-page amended order. This means:

U.S. users no longer need a VPN + self-custody wallet + USDC to place bets

Traditional brokers like Fidelity, Robinhood, and Interactive Brokers can legally access Polymarket's liquidity pool

Institutions can openly include "prediction market positions" in compliance reports to hedge against macro event risks

In summary: The prediction market has completed its transformation from a DeFi toy to a TradFi compliant tool.

2. Real Incremental Liquidity: Not "U.S. Retail Investors Returning," but "Wall Street Money Can Legally Enter for the First Time"

Many people interpret this unblocking as "allowing U.S. retail investors to use Polymarket again," which is a serious underestimation. The real impact lies in the opening of institutional channels. Imagine:

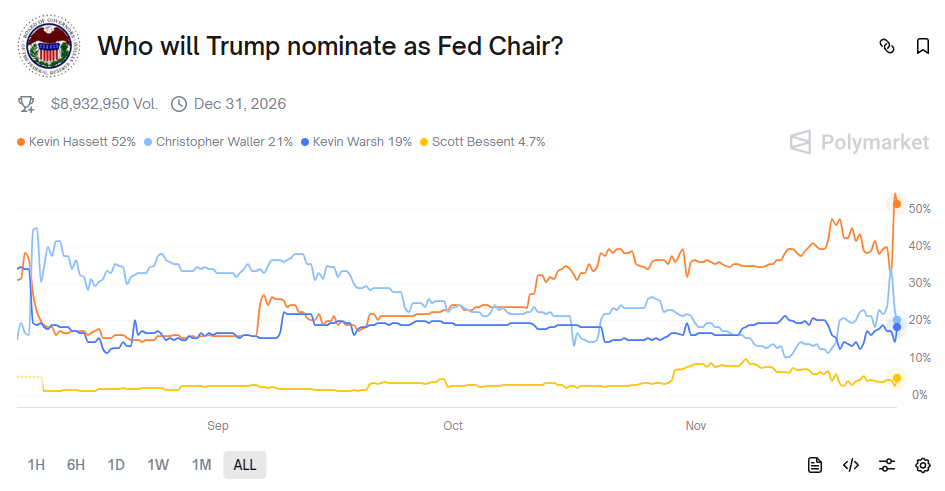

Hedge funds can hedge interest rate risks through Polymarket's "December Rate Cut Probability" contract before Federal Reserve meetings

Asset management companies can use the "Trump 2026 Midterm Elections Republican Hold Senate" contract to hedge political risk exposure

Corporate treasury departments can even use the "2026 Q1 CPI > 3%" contract to hedge inflation bonds

These are not retail plays, but genuine risk management needs. Compared to CME's macro futures, Polymarket offers hedging tools for "low probability, high impact events" that are completely absent in traditional finance. Wall Street has never lacked money; it lacks compliant entry points. Now the entry point is open.

(Chart: Prediction voting on "Who will Trump appoint as the next Federal Reserve Chair?" on Polymarket)

Risk Warning:

It must be emphasized again that Polymarket belongs to "binary options gambling." Its contract outcomes are "all or nothing," and there is a risk of price discrepancies during liquidity exhaustion. This is not a stable investment; it is essentially closer to high-risk hedging or gambling.

3. The Revaluation Window for On-Chain Infrastructure: A Second Spring for Polygon, UMA, and Chainlink

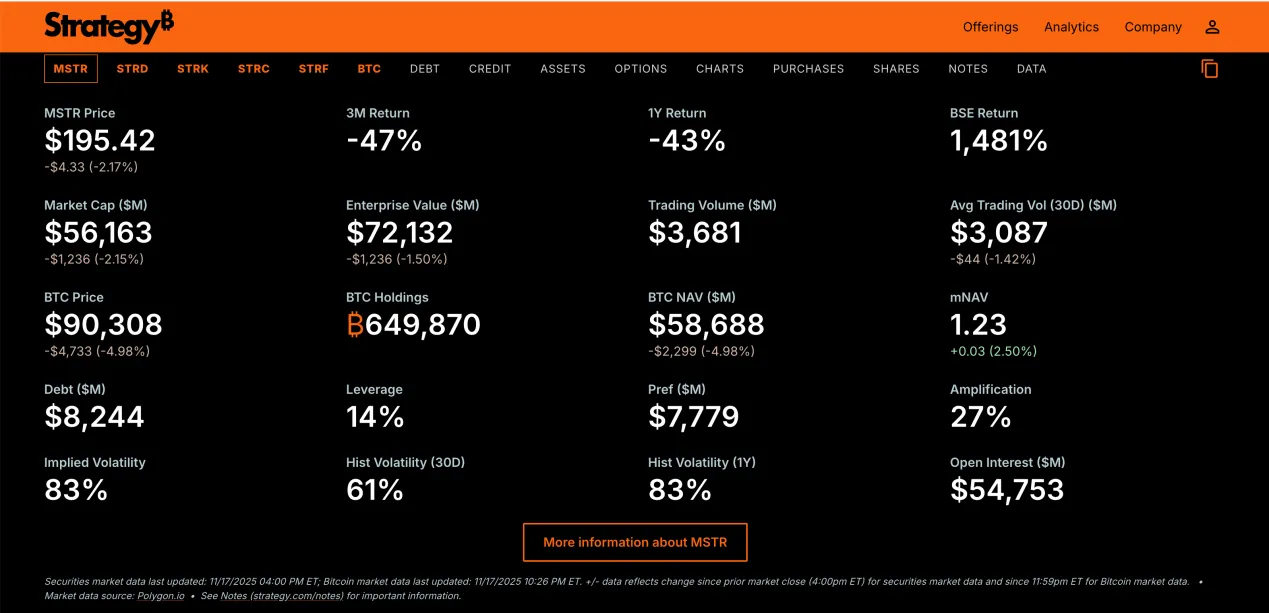

Currently, 98% of Polymarket's trading volume runs on Polygon PoS + USDC, with dispute resolution completed by UMA's optimistic oracle and price feeds relying on Chainlink. This is not a coincidence, but a compromise between regulatory and technical realities:

Polygon's gas fees are low enough (<$0.01) to support high-frequency small bets

USDC is the only compliant stablecoin accepted by the CFTC

UMA's "optimistic + dispute resolution" mechanism perfectly meets the CFTC's requirement to "prevent market manipulation"

The surge in trading volume will geometrically amplify the value capture of underlying public chains and oracles. The three "forgotten old infrastructure coins"—POL, UMA, and LINK—are about to experience a significant revaluation.

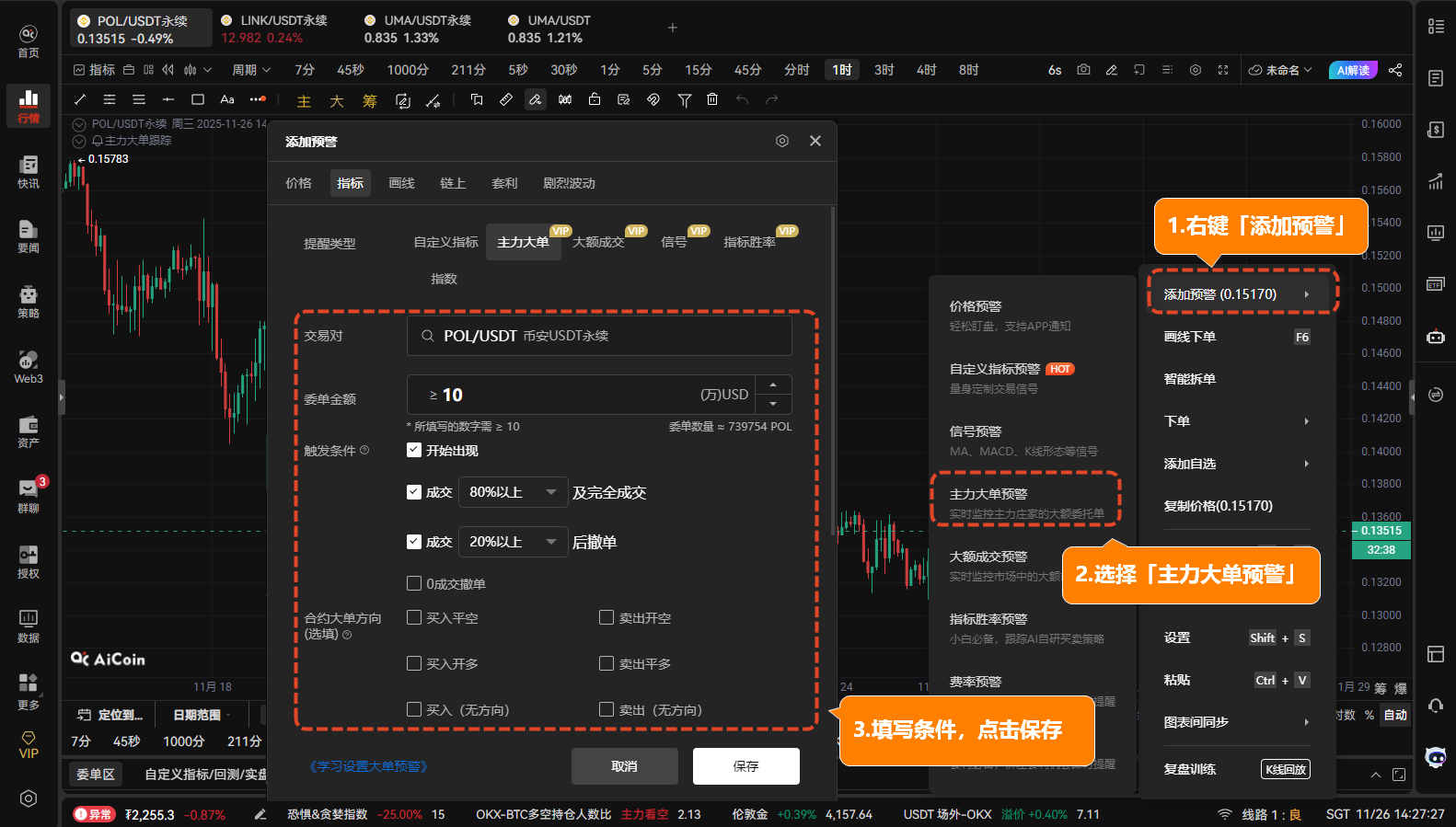

4. Practical Strategies: Use AiCoin to Turn Ambiguous Good News into Precise Signals

As the good news lands, the main funds have already positioned themselves. To avoid being "lured in and dumped" by the market, ordinary people must convert emotions into actionable funding signals.

1. Capture Real Buying Pressure of Underlying Assets (POL / UMA / LINK)

Set up "Large Order Buy Alerts (≥500,000 USDT)" for these three tokens on AiCoin

If there are consecutive large buy orders, this is often solid evidence of main funds accumulating. You can use AiCoin pop-ups to make short-term rebounds immediately

2. Monitor "Smart Money" On-Chain Migration

Open "Large Transfers" real-time monitoring on AiCoin, focusing on the flow from USDC → Polygon

Pay special attention to these three types of anomalies:

→ Large amounts of USDC withdrawn from CEX to new wallets

→ Flowing into Polymarket's official contracts or popular market pools

→ Common whale hot wallet clusters (AiCoin has built-in tags)

3. Guard Against "Good News Exhaustion" Harvesting (Lock with Technical Indicators)

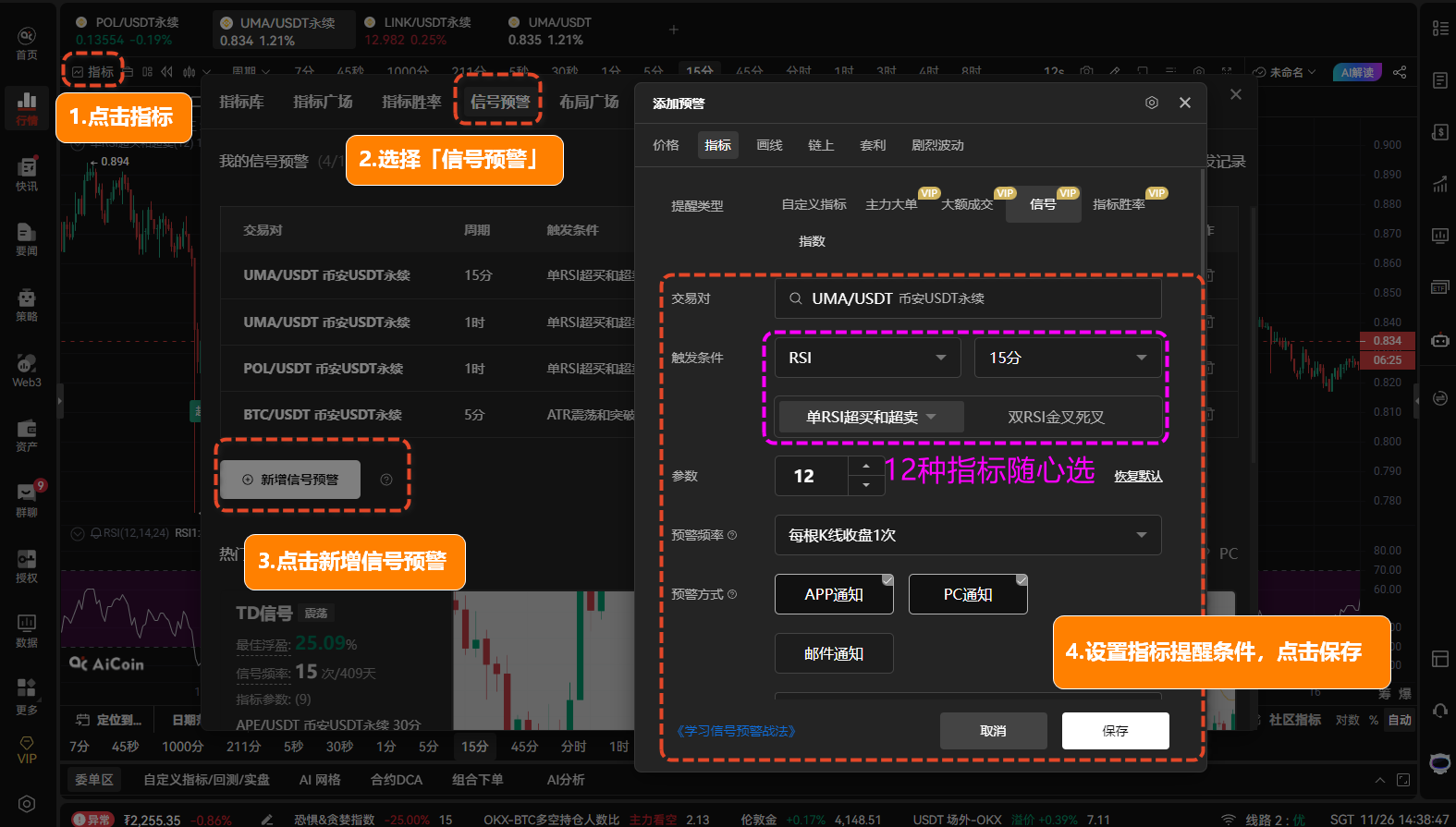

Open "Signal Alerts" on AiCoin and enable Boll / KDJ / RSI indicators for overbought and oversold alerts. If: the price rises but main positions decrease, and high-frequency indicators signal overbought, even if the narrative is good, decisively take profits.

Conclusion

Polymarket's approval by the CFTC to return to the U.S. is a long-awaited story for the crypto industry:

Regulation is not the enemy, but a necessary condition for scaling.

When Wall Street can legally buy on-chain event contracts through Fidelity accounts, ETF outflows, DeFi sluggishness, and L2 narrative vacuums will all become a thing of the past. The real battle has just begun.

Make sure to turn on alerts; don’t regret it after the bullets have flown by.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。