Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

For MegaETH, which was once endorsed by Vitalik Buterin and boasted "100k TPS" and "sub-millisecond latency," the pre-deposit launch last night was undoubtedly a clumsy stress test.

In just a few hours, the community experienced the full suite of "drama" including website crashes, instant depletion of limits, unexpected multi-signature executions, and repeated fluctuations in limits. This turmoil, woven from technical failures and human errors, ultimately concluded with a forced lock of $500 million in deposit limits.

A "Circuit Breaker" from the Start: The Logical Flaw Behind the Error Pop-up

The story begins on the evening of November 25. According to the original plan, the USDm pre-deposit channel was supposed to open at 10 PM Beijing time, with an initial limit of $250 million. However, the surge in traffic was more intense and chaotic than anticipated.

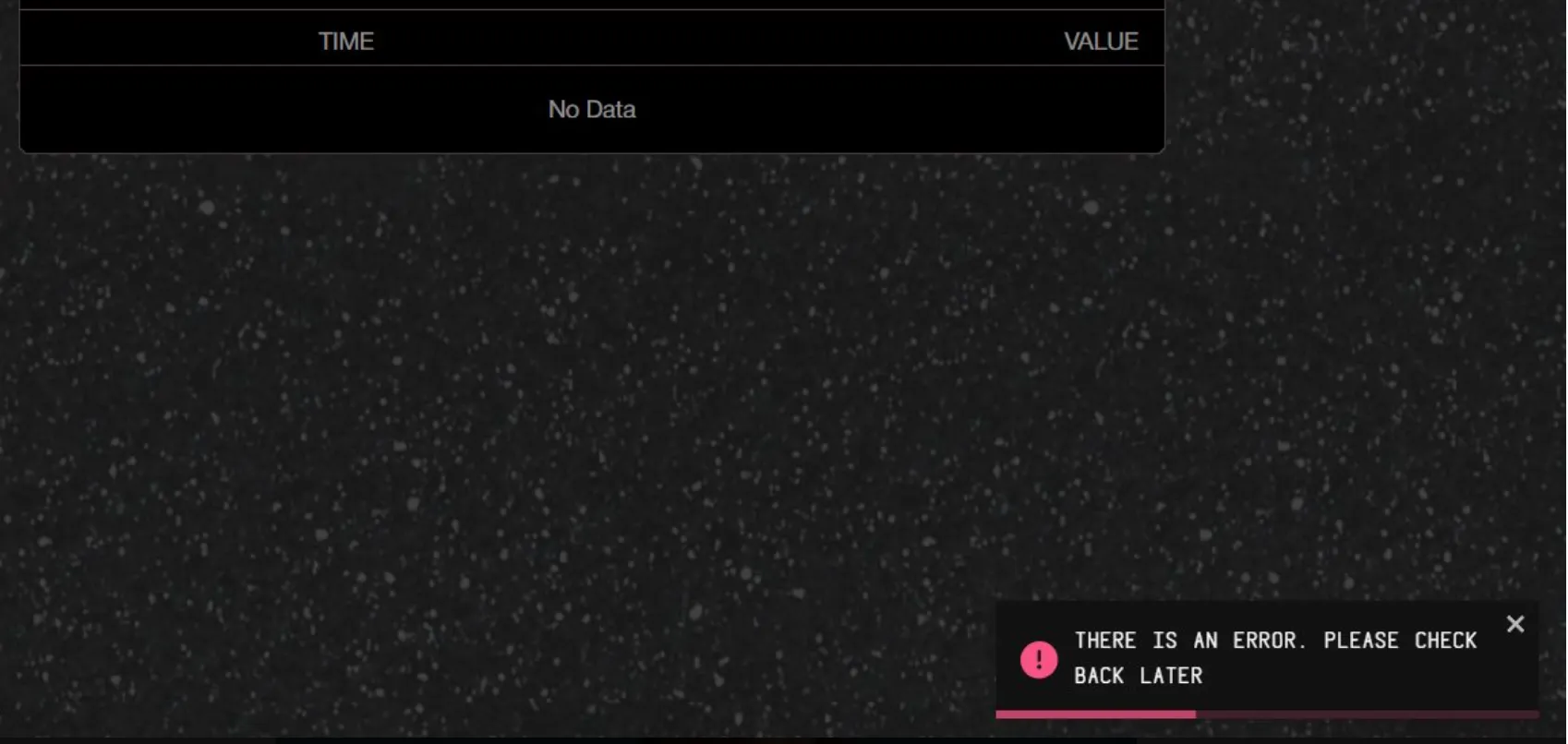

At the moment of launch, users waiting in front of their screens did not experience the smooth operation they had expected. Most faced a black background screen with only the word "Data," accompanied by a cold pink error message at the bottom: "THERE IS AN ERROR. PLEASE CHECK BACK LATER." There was no explanation, no queue indication, only the frustrating unknown.

Afterwards, the MegaETH team admitted in a review that this was not simply a case of traffic overload, but a typical "backend double accident."

First was a fatal configuration error—SaleUUID mismatch. The parameters written into the pre-deposit contract did not match those of the Sonar system responsible for KYC verification, causing all deposit requests to be directly rejected on-chain. Correcting this parameter was not as simple as changing a line of code, as the contract was controlled by Safe multi-signature (4/6). This meant that in a race against time, the team had to urgently coordinate with 4 signers for on-chain interaction, directly extending the downtime.

To make matters worse, the third-party service provider Echo (Sonar) also encountered issues. Due to a rate limit configuration that was set too low, the influx of real user traffic was misjudged and intercepted by the system. According to official sources, it took a full 23 minutes from the discovery of the problem to the deployment of a fix.

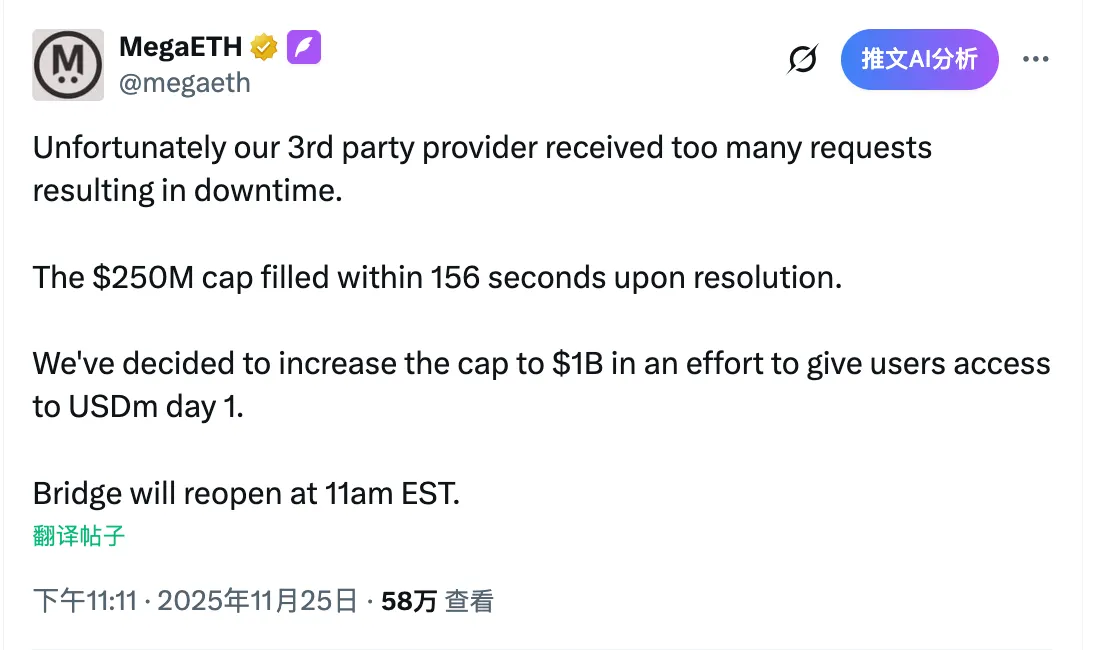

When the two major obstacles of UUID correction and rate limit removal were finally cleared, the system resumed automated operation. The long-suppressed FOMO sentiment was instantly released, and in just 156 seconds, the initial limit of $250 million was snapped up.

Multi-signature "Slip": An Unexpected Incident 34 Minutes Early

If the initial congestion was still a "routine operation" for Web3, then the subsequent expansion episode was entirely a case of human "black humor."

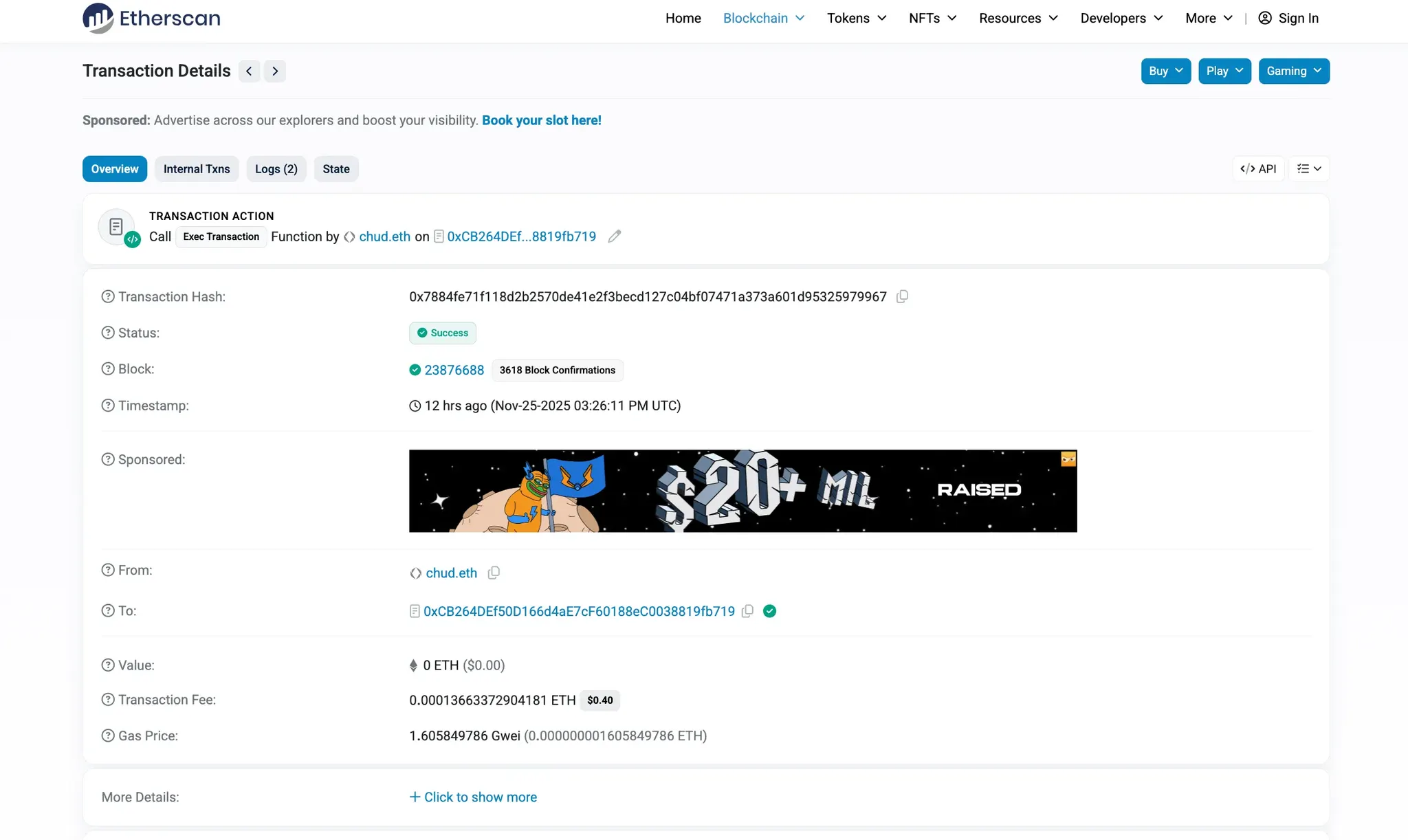

After the first round of limits was exhausted, in response to the community's heightened enthusiasm, the MegaETH team decided to temporarily adjust their strategy, planning to raise the limit significantly to $1 billion to ensure more users could access USDm on the mainnet's first day. To execute this increase, the project initiated a multi-signature transaction involving the Safe address (0xCB…719).

However, dramatically, on-chain data showed that the 4th signer (@chud_eth) accidentally executed the transaction 34 minutes before the scheduled launch time. This was not just a simple "slip," as it directly led to the deposit channel being opened prematurely without any warning.

Funds surged in like a flood, completely disrupting the official rhythm. In a panic, the team attempted to "mend the fence": initially wanting to control the limit at $400 million as a test, but it was too late; ultimately, they had to forcibly lock the hard cap at $500 million. Even so, this additional limit was filled in an instant.

Such dramatic fluctuations quickly triggered a strong crisis of trust within the community. Disappointment and ridicule intertwined, with some stating that this chaotic experience "felt like wandering through a poorly managed casino," and developers sharply pointed out that for an infrastructure project with a vision of expansion, such basic engineering negligence was deeply concerning.

Faced with overwhelming skepticism, the MegaETH team quickly released a long review. While admitting mistakes, they repeatedly emphasized the core bottom line: all contract codes have been audited and are secure, with no risk to funds. To soothe emotions, the official also promised that users who successfully participated in the pre-deposit would receive priority in future reward activities.

Settling Down: KYC Issues Force Abandonment of the $1 Billion Plan

After a night of turmoil, in the early hours of November 26, the MegaETH team finally clarified this farce: officially abandoning the original $1 billion expansion plan and locking the total pre-deposit amount at $500 million.

The reason for hitting the brakes was not merely to quell public opinion, but more due to technical helplessness. According to official disclosures, there are still unresolved bugs in the KYC verification process, preventing some compliant users from participating normally. Clearly, forcing open the $1 billion floodgates before clearing these roadblocks was irrational.

Regarding the most pressing "stay or leave" issue for existing users, the team also provided a pragmatic solution. The official admitted that this experience was "unacceptable," especially for those early users who entered based on the "hard cap of $250 million" expectation, as the unexpected doubling of limits objectively diluted their shares and rights. To rectify this "expectation breach," the team promised to launch a withdrawal page in the coming days, returning the choice to the users.

Although the execution process has been criticized by many as a "makeshift operation," the hard data does not lie—against the backdrop of last month's MEGA token sale exceeding $1.39 billion, this $500 million "instant depletion" once again confirmed the market's high expectations for MegaETH.

However, this incident also served as a wake-up call for all Web3 projects born with a silver spoon: While the endorsements of Vitalik Buterin and Joe Lubin can determine how high your ceiling is, the most fundamental engineering execution capability ultimately decides how far you can fly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。