Written by: Frank, PANews

The market crash on October 11 not only broke through the price defenses of crypto assets but also ignited a "hundred billion migration" in the stablecoin sector.

Data shows that since October, the total market capitalization of stablecoins has shrunk from $308.7 billion to $302.8 billion, with nearly $6 billion leaving the market. In this tide of retreat, the compliant stablecoin USDC was hit hardest, with its supply on the Solana chain plummeting. Meanwhile, the previously popular "stablecoin newcomer" USDe also saw a significant drop in issuance due to leveraged liquidation.

However, this is not merely a case of capital fleeing; it is a brutal competition. When we clear the fog of data, we find that this is a shift from "speculation" back to "rationality," with funds flowing from high-leverage on-chain gaming to safer havens with stronger compliance, smoother fiat channels, and real-world asset (RWA) yields.

The "Spiral Double Kill" of the Solana Ecosystem and USDC

In this wave of shrinking market capitalization, USDC became the biggest "bleeding point." Data shows that of the nearly $6 billion that flowed out, USDC accounted for half, with its total market capitalization dropping from $76.3 billion to $73.5 billion, a decrease of $2.8 billion.

The decline of USDC is primarily due to a 18.24% drop in USDC issuance on the Solana chain over the past month. On October 11, the total amount of USDC issued on the Solana chain was about $12.8 billion, which fell to $8.7 billion by November 23, a reduction of 4.1 billion tokens.

During the same period, the Total Value Locked (TVL) on the Solana chain also dropped from $12.9 billion to $8.79 billion, with a decline similar to that of USDC's supply. Leading DeFi protocols on Solana also experienced significant drops in TVL during this phase. From this perspective, after the market crash on October 11, a large amount of capital on the Solana chain chose to redeem stablecoins directly to avoid market risks.

For example, according to on-chain analyst Yu Jin's monitoring, in the past week, the Pump.fun project transferred 405 million USDC to Kraken. During the same period, 466 million USDC moved from Kraken to Circle, likely indicating a withdrawal. These funds were raised by Pump.fun through the sale of PUMP to institutional private placements in June. However, Pump.fun's co-founder Sapijiju responded, stating, "This is completely false information; Pump.fun has never cashed out," and indicated that this was merely a step in fund management.

Not only Solana, but Hyperliquid, known for high-leverage derivatives trading, also faced a decline in liquidity, with its stablecoin issuance dropping from $6 billion to $4.4 billion, a decrease of 25%. This comprehensive contraction directly impacted the performance of issuer Circle in the U.S. stock market. Due to poor revenue expectations and a sharp reduction in USDC supply, Circle's stock price fell from a high of $240 to below its issuance price at $71.3, and the once highly anticipated "compliant stablecoin unicorn" myth seems to be facing its first crisis post-IPO.

The USDe Crisis and the Sui Stablecoin Data Mix-Up

If the decline of USDC is a cyclical deleveraging, then the crisis of USDe exposes the structural fragility of algorithmic stablecoins in a bear market.

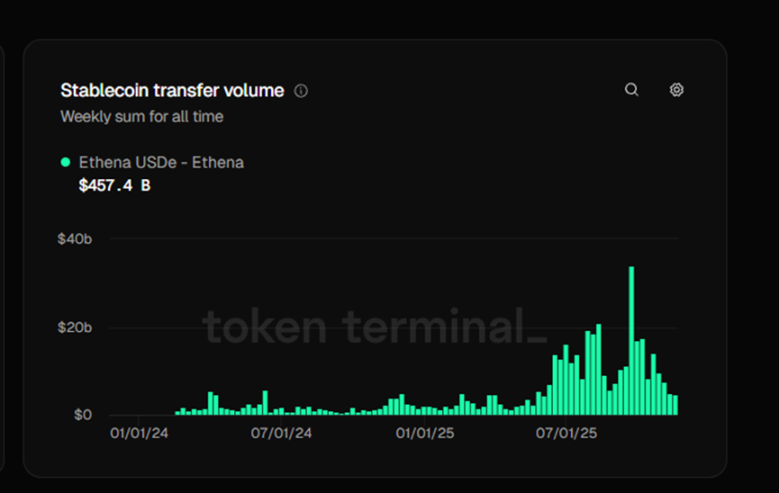

Since October 10, USDe's supply has halved from $14.6 billion to $7.38 billion, and its price on Binance briefly decoupled to $0.65 due to a lack of short-term liquidity. The main reason for the decoupling was that liquidity providers collectively withdrew from centralized exchanges during the panic, leading to an extremely thin order book. Meanwhile, although USDe's official redemption mechanism was functioning normally, the "off-exchange settlement" behind it had a delay of several hours. This delay prevented arbitrageurs from quickly capitalizing on the price drop within minutes, exacerbating the decoupling.

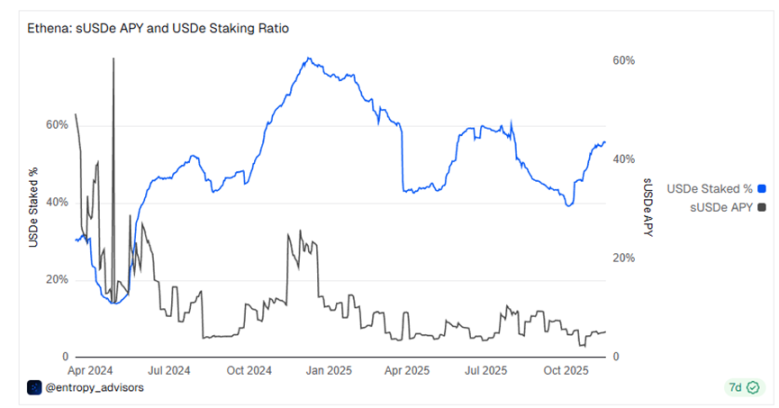

The sharp drop in issuance was actually due to the market crash causing perpetual contract funding rates to plummet, even turning negative, which undermined the economic basis for the "circular loan" leverage strategies widely deployed on lending platforms like Aave and Morpho. With yields below borrowing costs, traders were forced to massively deleverage and close positions, leading to a shrinkage in USDe supply. Subsequently, OKX CEO Star posted on X platform stating, "USDe should not be viewed as a stablecoin pegged 1:1 to the dollar; it is a tokenized hedge fund."

Even though Ethena set a record of $151 million in fee capture in Q3 this year, it still could not withstand the loss of market confidence due to sharply declining yields. Currently, while USDe's yield has rebounded to over 5%, its overall supply and trading volume remain on a downward trend.

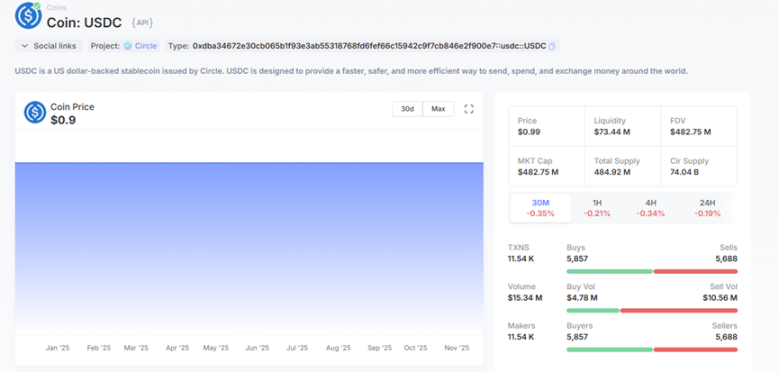

In a time of extreme market anxiety and a desire to find the next growth point, a data mix-up regarding the Sui public chain became an interlude. On November 24, Artemis data showed that the stablecoin supply on the Sui chain had increased by $2.4 billion. Social media speculated that this might indicate some institutions or smart money actively positioning in certain assets on the Sui chain. Even the Sui official account participated in the interaction, responding with "stablesmaxxing."

However, after an investigation by PANews, it was found that this might just be a mix-up. A careful comparison of multiple data panels revealed that USDC is indeed the most issued stablecoin on Sui, with a current issuance market value of about $480 million. Other stablecoins on Sui have issuance amounts in the tens of millions of dollars. According to Defillama data, the current total stablecoin supply in the Sui ecosystem is about $653 million. If there were a single-day inflow or issuance of $2.5 billion, it would mean that the stablecoin supply on Sui would increase by about four times.

On-chain information also shows that USDC's issuance on Sui is $482 million, with the largest holding address being Binance with about 148 million tokens. Subsequently, Artemis updated this data, showing that the stablecoin supply on Sui had increased by $117 million in the past week.

A New Direction for Hedging: Embracing Yields

After capital withdrew from high-risk areas, it did not completely disappear but flowed into safer, more functional assets.

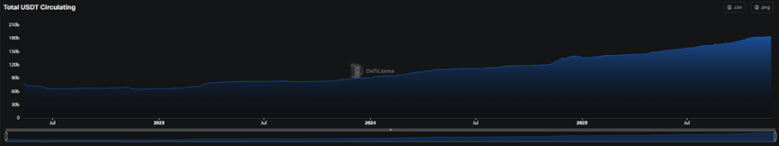

During the market downturn, USDT once again proved its dominance as the "king" of stablecoins, with its total market capitalization not only unaffected but repeatedly reaching new highs of $184.7 billion.

In contrast to the decline of USDC, other compliant stablecoins showed significant growth. After the market crash on October 11, the issuance of PYUSD achieved a counter-trend increase, rising from $2.5 billion to $3.6 billion, an increase of nearly 50%. In the segmentation of public chains, the growth of PYUSD mainly came from the Ethereum mainnet, which increased by 57% in the past month.

Data released by Token Terminal on November 9 showed that PYUSD became one of the fastest-growing tokenized assets with a market capitalization of over $1 billion. Compared to other stablecoins, PYUSD's core advantage may lie in its convenient fiat exchange channels and relatively stable yields. PYUSD had previously maintained an APY of over 10% on the Solana chain through yield subsidies. Additionally, the compliance of PYUSD is also one of the key considerations for many institutional investors.

Furthermore, the yield-bearing stablecoin USYC, also issued by Circle, saw a 45% increase in issuance over the past month, with a total issuance increase of about $500 million. This indicates that during market turmoil, institutional investors are no longer satisfied with holding zero-yield cash and are unwilling to take on the high risks of DeFi, but prefer stable returns anchored to U.S. Treasury bonds and other RWAs.

Data from RWA.xyz also shows that the issuance of RWA assets has not been affected by the market downturn and continues to grow steadily, increasing from $33 billion on October 11 to $36 billion, a rise of 10%.

A turbulent market has become a litmus test for the stablecoin market. It not only allows the market to distinguish which stablecoins are primarily used for high-leverage trading and which are used as wealth management targets for large institutions but also reflects that the crypto market has officially bid farewell to the "wild era" that relied solely on on-chain leverage to drive scale.

In contrast, the counter-trend breakout of PYUSD and the steady growth of RWA assets prove that capital has begun to vote with its feet. In times of turmoil, more convenient fiat channels, more transparent compliance endorsements, and real yields based on U.S. Treasury bonds are the core competitive advantages for retaining capital.

The outflow of $6 billion may have given us a moment to reflect; the second half of the stablecoin war will no longer be a competition of printing speed but a contest of scenarios, trust, and the quality of underlying assets. For issuers, how to evolve from being "fuel" for on-chain speculation to a "bridge" in financial and trade processes will be the only ticket to the next bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。