Written by: Yangz, Techub News

After experiencing two consecutive "Black Friday" crashes, Bitcoin has nearly erased the gains of the past six months, plunging the market into a bone-chilling winter. However, the forces of recovery seem to be surging from all directions: from the continued warming of interest rate cut expectations in December to the successive approvals of various altcoin ETFs, this warm current has now spread to the state-level "Strategic Bitcoin Reserve" (SBR) in the United States.

Early this morning, Lee Bratcher, president of the Texas Blockchain Association, announced that the state has officially launched its Bitcoin reserve program and has completed its first purchase of a $5 million BlackRock Bitcoin spot ETF (IBIT). At this moment, the cold market sentiment seems to have heard the crisp echo of ice cracking.

Texas Breaks the Ice: $5 Million "Leads" State Strategic Bitcoin Reserves

While the market is still embroiled in debates over short-term fluctuations, Texas has cast its vote with real money. From the announcement by the state's lieutenant governor at the end of January this year to prioritize "Bitcoin reserves" as a legislative focus for 2025, to state legislator Charles Schwertner submitting SB 21 in February, followed by a series of legislative reviews and procedural advancements, the bill was finally signed into effect by the governor on June 20 and completed its first allocation last week. This long journey of about 10 months, while not as swift as the market had hoped, ultimately concluded with a tangible transaction.

Lee Bratcher revealed that this purchase occurred on November 20, marking both the first allocation of funds for the reserve and the first case of a state government in the U.S. allocating Bitcoin. Additionally, according to the latest 13F filing submitted by the Texas Treasury Trust Company, the company holds approximately $667 million in SPY (S&P 500 ETF) and $34 million in Janus Henderson funds. If, as Bratcher stated, the $5 million purchase of IBIT (as part of a $10 million Bitcoin allocation) becomes the third-largest holding in this portfolio.

Notably, Bratcher specifically pointed out that Texas's ultimate goal is to achieve self-custody of Bitcoin. Currently, the allocation through the BlackRock ETF is merely a transitional solution before the bidding process is completed. This also suggests that in the future, Texas may likely bypass intermediaries and hold Bitcoin directly.

Perhaps as Bratcher said, Texas is "buying the dip." In a time of low market sentiment and price corrections, this move serves as a strategic "low-position layout" and injects a dose of confidence from the official level into the entire crypto market. It conveys a clear message: at least in the eyes of some decision-makers, the long-term value of Bitcoin has already surpassed the risks of volatility.

The Reality: The Lone Star Leading and the Silent States

Since U.S. Senator Cynthia Lummis first proposed the concept of a "Strategic Bitcoin Reserve" last year, multiple state legislatures in the U.S. have followed suit, sparking a wave of proposals for state-level Bitcoin reserve bills. In March of this year, after Trump signed an executive order calling for the establishment of a national Bitcoin reserve, the competition further heated up.

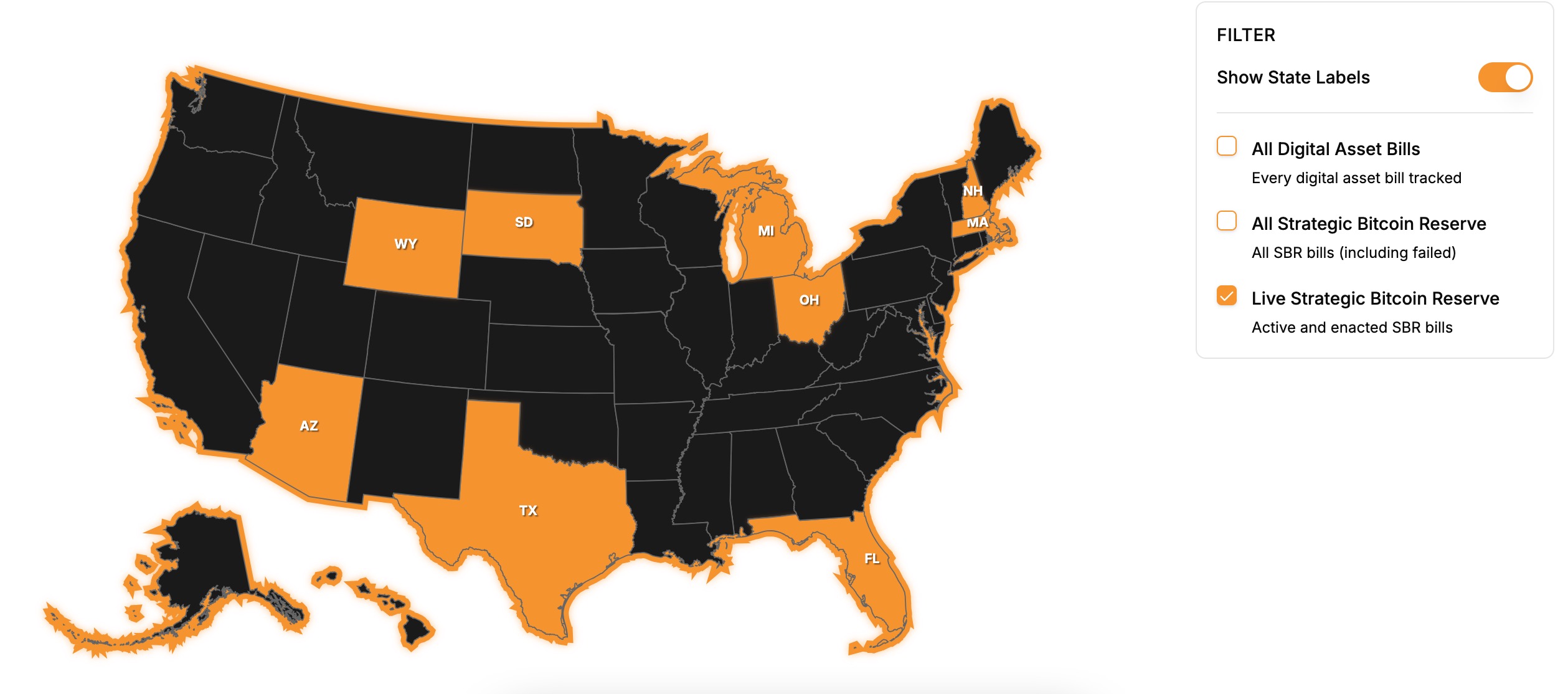

However, the legislative process has not been smooth sailing. Most states have stalled after proposals, with some bills even being withdrawn or directly rejected, leaving very few that have entered substantive stages. According to Bitcoin Laws, as of now, only three states in the U.S. have officially passed state-level strategic Bitcoin reserve bills, namely Arizona, New Hampshire, and Texas. Besides these three states, only Florida, South Dakota, Wyoming, Michigan, Ohio, and Massachusetts are still advancing SBR bills.

Indeed, as shown in the image above, while the macro landscape of state strategic Bitcoin reserves across the U.S. remains "dim," Texas's $5 million allocation shines like a match struck in a cautious silence. Although it is dazzling, it has yet to illuminate the entire room.

The light of this match clearly illuminates two distinctly different paths: on one side is Texas's resolute journey from legislation to execution, while on the other side is the vague outline of the vast majority of states still waiting and watching. Rather than being a "lead," this is more of a "stress test." Once the first state officially writes Bitcoin into its official balance sheet, the question for other states is no longer whether to discuss it, but rather when and how to follow suit. Texas has turned its vision into reality; who will be the first to step up and become its follower?

Can SBR Ignite After the DAT Narrative Fizzles Out?

As the market cools and some companies choose to sell coins to stabilize, the once highly anticipated DAT craze has clearly reached a turning point. However, Texas's announcement early this morning is like a wave surging again on the beach where this craze has receded.

Unlike publicly traded companies that focus on short-term financial performance and marketing effects, state-level strategic Bitcoin reserves carry far-reaching strategic considerations: this is not only about the diversification of public assets but also a redefinition of financial sovereignty and a forward-looking layout for the future monetary landscape. Texas's $5 million allocation indicates that government actions are not as easily swayed by quarterly financial report fluctuations as corporate actions; the positioning of its "strategic reserve" seeks a long-term value storage that transcends economic cycles.

However, whether the SBR narrative can truly take over the baton from DAT still faces real-world scrutiny. Compared to the multi-million or even billion-dollar allocations during the DAT craze, Texas's $5 million allocation is like a "spark." Whether it can ignite a "prairie fire" across the U.S. depends not only on the price movements of Bitcoin itself but also on whether state governments can reach a consensus ideologically and truly "make their move." This path has just begun; it is destined not to sway dramatically with market sentiment like DAT, but precisely because of this, each step it takes will be more solid and profound.

Conclusion

In the crypto world, a $5 million allocation may seem insignificant, but when this "match" is struck by a state government, its significance transcends the amount itself.

Texas has demonstrated through action that from legislation to actual financial allocation, this path, which most states are still watching, now has its first "streetlight." Perhaps this beam of light is still weak, far from illuminating the entire room, but it has indeed ignited hope for everyone at the moment when market confidence is most fragile, allowing those in the cold market to clearly hear the sound of ice cracking. When the short-term fluctuations of the market intersect with the long-term strategies of the government, the momentum of recovery may quietly seep from trading charts into the deeper soil of the system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。