Bitcoin quickly fell from its historical high of $125,000 in October 2025, dropping below $90,000 in just a month. The more than 25% deep retracement has led investors to question: Is the familiar four-year cycle theory still valid?

From the halving in April 2024 to the new high of $120,000 in October 2025, Bitcoin has followed a path of nearly 18 months. If we only look at this trajectory, it seems to still be operating according to the cycle theory. Halving leads to a bottom, followed by a peak within a year, and then a correction.

However, what truly confuses the market is not whether there has been an increase, but rather it hasn't increased like it usually does. There hasn't been a series of explosive rises like in 2017, nor the widespread frenzy seen in 2021.

Even more perplexing is that Bitcoin fell below $90,000 less than a month after reaching a new high, with a retracement exceeding 25%. This is not the typical "bubble tail" that should appear in a cycle; it feels more like the market was extinguished before it even heated up.

1. Three Market Indicators of Cycle Dysfunction

This round of Bitcoin's market movement feels "off." According to historical patterns, 12 to 18 months after a halving, the market should experience a major upward wave and emotional climax. This was somewhat the case, as Bitcoin surged to a new high of $125,000 in October 2025.

But the real issue is that this round of market activity lacks that final frenzy and the widespread emotional engagement.

1. Slow, Weak, and Short Price Increases

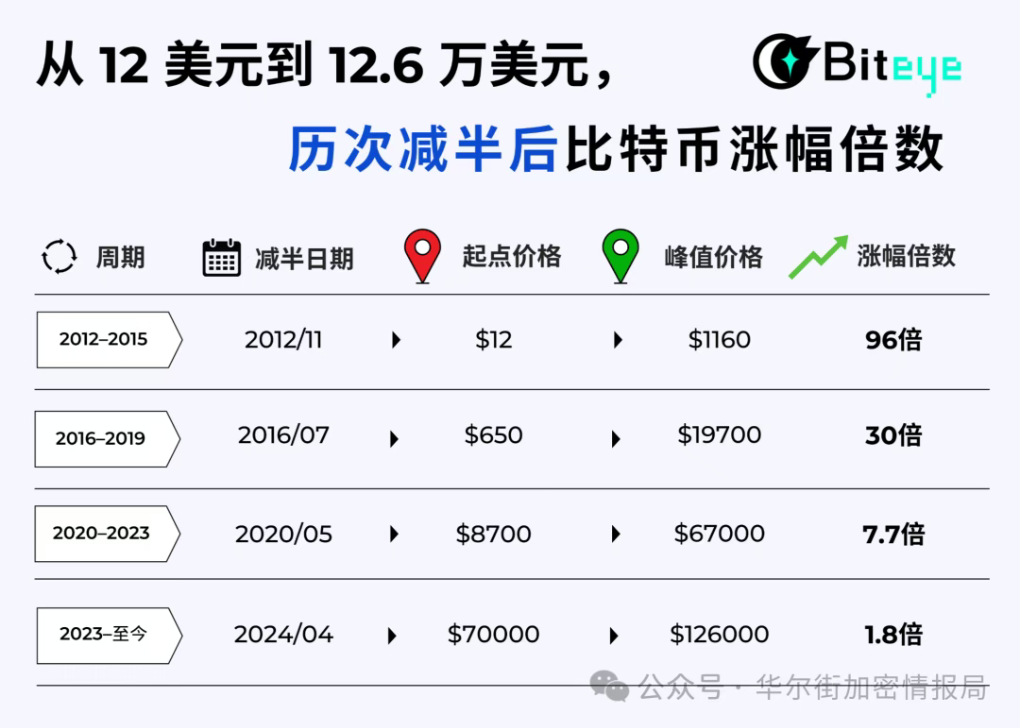

● Compared to the tenfold or even hundredfold increases in previous cycles, this round saw Bitcoin rise only 7 to 8 times from its low at the end of 2022 to its high;

● From the halving point, the increase is less than 2 times, which has never happened in history.

2. Missing Emotion: Altcoins Aren't Rising, Retail Investors Aren't Coming

● In past bull market peaks, on-chain funds were active, altcoins surged, and retail investors rushed in. However, in this round, Bitcoin's market cap dominance remains close to 59%.

● This indicates that most funds are still concentrated in mainstream coins, with altcoins lagging behind and lacking explosive rotation.

3. ETF Dominance Changes Market Rhythm

● After the launch of ETFs, institutions began to buy continuously, becoming the main force in the market. Institutions are more rational and better at controlling volatility, which has led to a decrease in market emotional fluctuations and a smoother trading rhythm.

● In the past week, institutional funds have withdrawn on a large scale; for example, the U.S. Bitcoin ETF saw a single-day net outflow of up to $523 million, with a monthly total exceeding $2 billion.

2. Underlying Logic: Which Cycle Patterns Remain Valid

Despite the chaotic surface phenomena, a deeper analysis reveals that the four-year cycle theory has not been completely lost. Fundamental factors such as supply and demand changes triggered by halving are still at play, albeit in a more subdued manner than before.

1. Long-term Supply Logic of Halving

● Bitcoin halves approximately every four years, meaning that new supply continues to decrease. This mechanism remains a key logic supporting price increases in the long run. In April 2024, Bitcoin completed its fourth halving, reducing the block reward from 6.25 BTC to 3.125 BTC.

● Although nearly 94% of Bitcoin's total supply has been reached, the marginal changes brought by each halving are diminishing, but the market's expectation of scarcity has not disappeared.

2. On-chain Indicators' Cyclicality

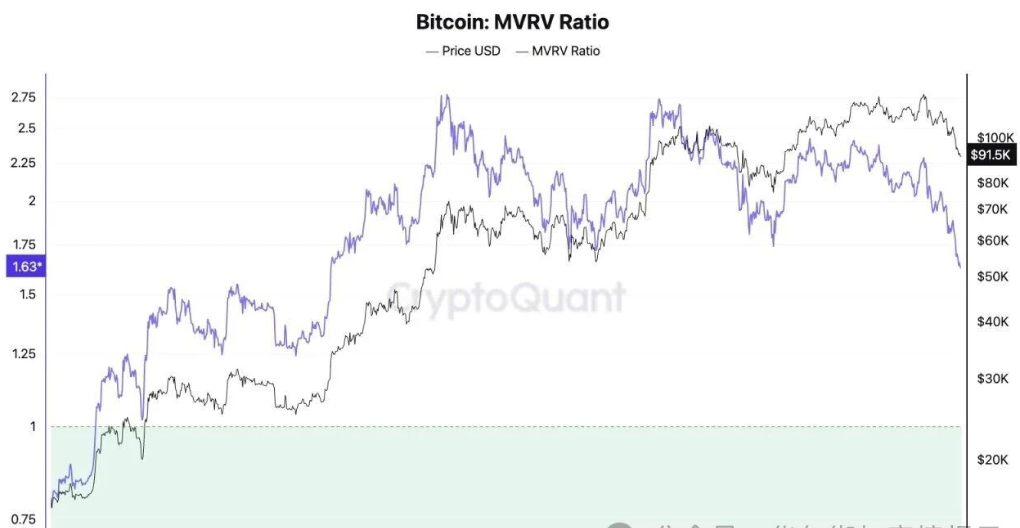

The behavior patterns of Bitcoin investors exhibit a cyclical "hoarding-sell-off" loop, which is still reflected in on-chain data.

● MVRV is the ratio of market value to realized value. When the MVRV value rises, it indicates that Bitcoin is overvalued. At the end of 2023, MVRV fell to 0.8, rose to 2.8 during the bullish phase in 2024, and fell below 2 during the correction in early 2025.

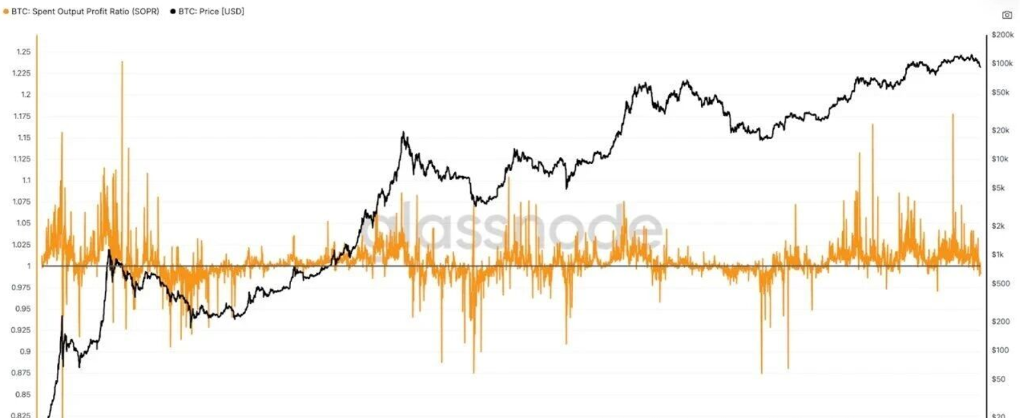

● SOPR can be simply understood as the price at which an asset is sold divided by the price at which it was bought. In cyclical terms, SOPR=1 is seen as the dividing line between bull and bear markets.

● In this cycle, SOPR remained below 1 during the 2022 bear market, and after 2023, it rose above 1, entering a profit-taking cycle. During the bull market phase from 2024 to 2025, this indicator was mostly above 1, consistent with cyclical patterns.

3. Diminishing Returns Seem Inevitable

From another perspective, the peak increase of each cycle compared to the previous cycle is gradually decreasing, which is actually a normal evolution of the cycle theory.

● From 2013 to 2017, the peak rose about 20 times, from 2017 to 2021, the increase shrank to about 3.5 times, while this round saw an increase from $69,000 to $125,000, with a rise of about 80%.

● This marginal decrease is also a result of the market's expansion and the diminishing marginal push from new funds, which does not indicate a failure of the cycle logic.

3. Three Driving Forces Behind Cycle "Deformation"

If the cycle still exists, why is this round of market activity so difficult to interpret? The reason lies in the previously singular halving rhythm, which is now disrupted by multiple forces.

1. Structural Impact of ETFs and Institutional Funds

Since the launch of Bitcoin spot ETFs in 2024, the market structure has undergone significant changes.

● ETFs represent "slow money," continuously accumulating during rises and also seeing some buying during dips. However, it is important to note that institutional funds have recently withdrawn on a large scale.

● ETFs not only bring in a large amount of incremental funds but also enhance price stability, with these positions having an average cost of about $89,000, forming effective support. This has made the rhythm of the Bitcoin market slower and steadier.

2. Fragmented Narratives and Accelerated Hotspot Rotation

● In the previous bull market (2020–2021), DeFi and NFTs created a clear value narrative, while the current market resembles a collection of fragmented hotspots.

● From the dominance of Bitcoin ETFs and the craze for inscriptions at the end of 2023 to the rise of Solana and meme narratives in 2024, followed by Crypto AI and AI Agents becoming hot topics, and in 2025, InfoFi, Binance Alpha, prediction markets, and x402 taking turns in the spotlight.

● The rapid rotation of narratives and weak continuity of hotspots lead to frequent fund switching, making it difficult to form medium- to long-term allocations.

3. Reflexivity Reinforcement

● In addition to ETFs, funds, and narratives, we also face another phenomenon: the cycle itself is "self-influencing," which is reflexivity. Because everyone knows the halving logic, they end up preemptively positioning and cashing out, leading to an early exhaustion of the market.

● At the same time, ETF holders, institutional market makers, miners, etc., are also making strategic adjustments based on the cycle. Whenever prices approach theoretical peaks, there may be a large amount of profit-taking that preemptively drives the market down, artificially advancing the cycle rhythm.

4. How Market Experts View the Future of the Cycle

In the face of market uncertainty, different KOLs have provided various judgments, and through these perspectives, we may better understand the current market sentiment.

Bearish View: The Cycle is Dead.

● @BTCdayu believes the four-year cycle no longer exists, as Bitcoin has shifted from being halving-driven to institution-driven, with retail investors' weight gradually diluted.

● Bitwise CEO @HHorsley also tweeted that the traditional "four-year cycle" model is no longer applicable, as the structure of the crypto market has undergone profound changes. He believes the market actually entered a bear phase six months ago and is now in its final stage.

Bullish View: The Cycle is Still Valid.

● @Wolfy_XBT argues that the halving rhythm has never failed, stating that this bull market ended on October 6, and the current market has entered the early stages of a bear market. The four-year cycle logic still holds, and macro narratives and short-term emotions are merely noise.

Middle Ground: The Cycle has Deformed.

● @0xSunNFT suggests that both the four-year halving cycle and smaller local markets still exist. Every round of market activity has its quiet periods, and the key is to understand the rhythm of the cycle.

● @lanhubiji aligns closely with this article's viewpoint, asserting that the cycle has not disappeared but has "deformed." The oversupply of memes and the dysfunction of altcoins have fragmented the market, necessitating new methods for cycle judgment.

● In a dialogue between Raoul Pal and Chris Burniske, both expressed differing views. Chris Burniske believes this cycle may have ended, while Raoul Pal thinks the cycle is still ongoing.

● Chris Burniske pointed out: "In the simplest framework, if you follow the four-year cycle framework, then Bitcoin is currently forming a top. If you believe in this four-year framework, right? Then you would expect a bottom to appear in about 12 months."

5. How to Survive in a Changing Market

For ordinary retail investors, the most realistic approach may not be to predict cycles, but rather to develop their own market perception, such as learning to use data to assist in judgment and avoiding the traps brought by emotional fluctuations.

1. Stop Using a Simple "Halving Timeline" to Judge Bull and Bear Markets

There are now more factors influencing the market: ETF fund flows, macro liquidity, leverage structures, institutional positions, the strength of altcoin narratives, miner selling pressure, U.S. Treasury rates, U.S. stock cycles, etc. The cycle has become a "multivariable system."

2. Pay Attention to On-chain Data and Institutional Fund Flows

Learn to read on-chain indicators like MVRV and SOPR to understand which phase of the cycle the market is in. At the same time, closely monitor ETF fund flows; sustained net inflows or outflows are direct indicators of institutional short-term sentiment.

3. Adopt a Barbell Strategy to Balance Risk and Reward

For most newcomers to the crypto market, they should allocate at least 50% of their positions to Bitcoin, and then use the remaining 50% to explore other assets. If your entry point is very good, you can take your money out early even if the asset hasn't reached a new high, which is actually your advantage.

4. Manage Emotions and Avoid FOMO

Anyone using leverage has been hurt, especially those who leveraged based on Binance prices, who have certainly suffered significant losses. More importantly, the buying interest in long-tail assets had already paused, and catastrophic events have exacerbated this pause.

6. Where is the Bitcoin Cycle Headed?

● The changes in market structure may be permanent. With the launch of Bitcoin ETFs and increased institutional participation, the market has undergone fundamental changes.

These changes include increased institutional adoption and investment, greater integration with traditional financial markets, and improved regulatory transparency from major economies. These factors contribute to a more mature and potentially less volatile market environment.

● The impact of macro factors is becoming increasingly significant. The cryptocurrency market experienced another round of intense volatility over the past week, with prices swinging dramatically as traders reacted to changes in macroeconomic indicators, particularly regarding expectations for U.S. interest rate hikes.

When the hawkish minutes from the Federal Reserve meeting were released, reducing expectations for a rate cut in December, it triggered a sell-off in the cryptocurrency market. Conversely, when a Federal Reserve official made unexpected dovish comments, market sentiment shifted almost immediately.

● The cycle may be extended rather than invalidated. Well-known cryptocurrency analyst Michaël van de Poppe stated that the current market cycle for Bitcoin and altcoins is far from peaking, and it will last longer and reach higher price levels, suggesting that the traditional four-year cycle has become a thing of the past.

This viewpoint challenges long-standing cycle predictions based on halving events, implying that market dynamics are evolving due to institutional adoption, regulatory progress, and macroeconomic factors.

Analyst Benjamin Cowen previously warned: “Please note that previous death crosses marked local lows in the market. Of course, when the cycle ends, the death cross rebound fails. If the cycle has not ended, the timing of Bitcoin's rebound will begin next week.”

The market structure has changed, participants have changed, and the way emotions spread has also changed. The old method of fixating on a timeline to bet on bull and bear markets may be becoming outdated, requiring a broader understanding of the context. The cycle has not disappeared; it has simply become more complex, necessitating a more sophisticated perspective to recognize its existence.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。