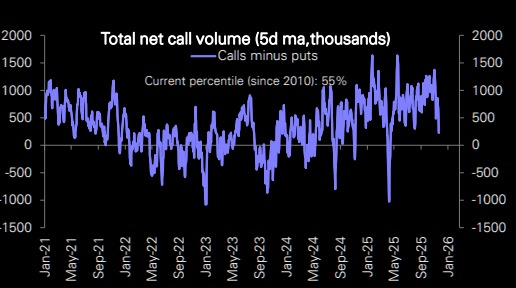

From the historical percentile of the 5-day average data of total net call option trading volume (Call minus Put), it is currently around 55%, which is a neutral to slightly optimistic position.

This indicates that there is no significant risk-averse sentiment in the market (large net buying of Puts), nor is there a large-scale chasing-up sentiment (large net buying of Calls), and the overall environment is one of normal risk appetite. Investors are not pessimistic about the direction.

Typically, in this range, the market's major direction will not experience short-term turning points due to sentiment in the options market; rather, it is more about waiting for macro data or changes in liquidity to drive the trend.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。