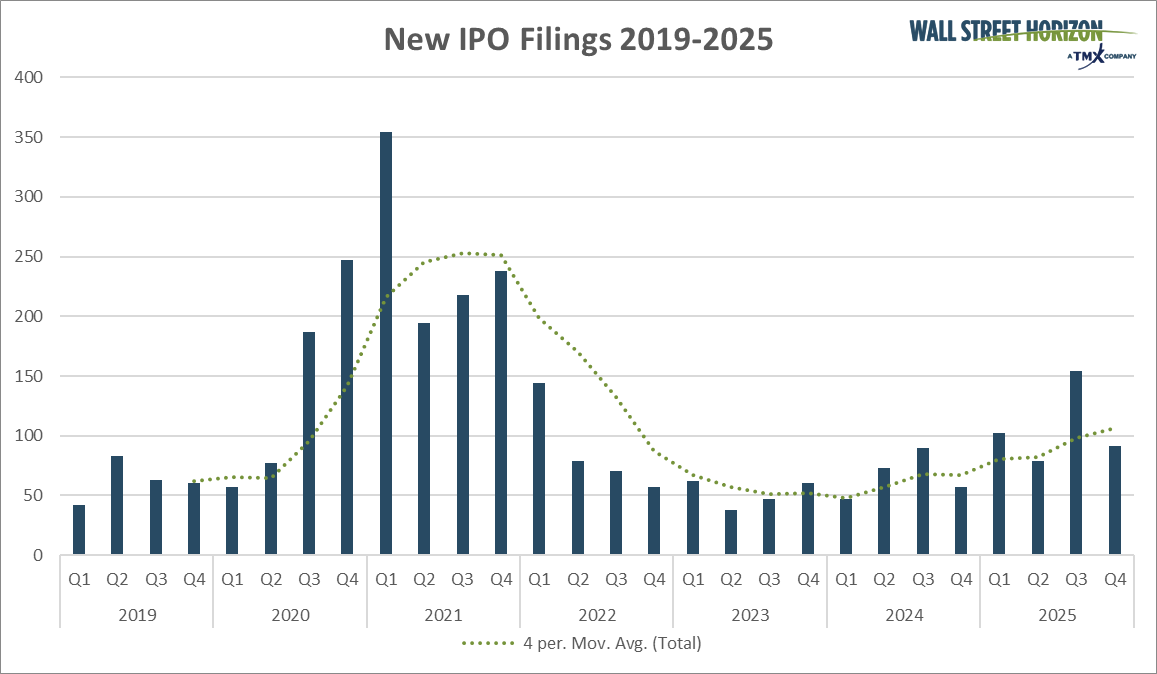

I just saw the data on new IPOs (Initial Public Offerings) in the United States from 2019 to 2025. From a cyclical perspective, it is clear that the bear market (high interest rate) period is lower than the bull market (low interest rate) period. Currently, the IPO data for 2025 is still much lower compared to 2020 and 2021, and 2025 resembles the early stage of 2019, which is the early stage of economic recovery.

From this perspective, 2026 is very promising. As long as the Federal Reserve can enter a true easing phase, the recovery of IPOs itself is a signal that the market believes the risk of recession is decreasing. The more IPOs there are, the easier it is for technology stock valuations to rise, and the funding situation for cryptocurrencies will also be more relaxed.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。