Author: Will A-Wang

Almost every narrative design and activity ends with a vision described by Bankless: we can build a Web3 on-chain digital bank through stablecoin payment + on-chain finance, providing almost all the services that traditional banks can offer, achieving financial inclusion and financial equality.

The starting point of this grand vision is not only crypto-native applications like Crypto Consumer Apps, DeFi, and public chains, but also stablecoin payment companies, Fintech, and more. It can be said that the revolution of new digital banks has arrived.

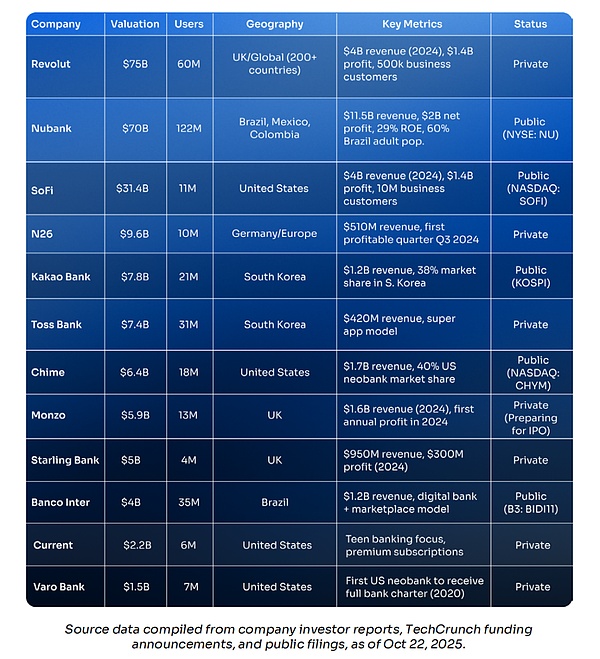

Traditional digital banks and Fintech are thriving, with Nubank reaching a market value of $72 billion, serving 122 million users in Latin America; Revolut valued at $75 billion, with over 60 million global customers; Chime reaching a market value of $11.6 billion upon its IPO in 2025, with 18 million accounts in the U.S. These "digital-native" banks prove that better, faster, and cheaper banking services can expand to hundreds of millions of users, generating billions in revenue—without needing a single physical branch.

Crypto-native Web3 on-chain banks have already emerged. Crypto users have long been engaging in self-custody, peer-to-peer trading, and earning yields with stablecoins, and the market is awakening. However, for these digitally native ordinary people, crypto is still too complex and dangerous. What they need is a bridge: a new type of Web3 bank—a familiar banking interface that runs on blockchain tracks, stablecoin accounts, and DeFi infrastructure.

Therefore, we compiled the article "MOIC Digital Onchain Neobanks & the LATAM Gold Rush," looking at how Web3 on-chain banks built on blockchain and stablecoin infrastructure will meet user needs in the future, serving those who are underserved by traditional financial services.

We will focus on the Latin American region. Here, crypto has taken root, proving that new types of banks can reign supreme and are native to stablecoins. Latin America has structural conditions such as currency crises, remittance dependence, and financial exclusion, making Web3 new banks not just "useful," but "essential." The region processes hundreds of billions of dollars in crypto transactions annually, with 50-90% being stablecoin payments rather than speculation. Argentina's 178% inflation rate has made people desperate for dollar-denominated accounts; $160 billion in remittances flows through this land, yet is drained by exploitative fees; 122 million people still lack bank accounts, yet everyone has a smartphone.

https://www.moicdigital.com/neobanks-latam-report

1. Traditional Digital Banks

1.1 What is a Digital Bank (Neobank)?

A digital bank is a "digital-native" financial institution that operates solely through mobile apps and websites, without any physical branches. Traditional banks move offline operations online, while digital banks are born in the cloud, designed from the ground up for smartphones. They typically partner with licensed banks to achieve regulatory compliance and deposit insurance, while directly serving customers with better experiences, lower fees, and faster speeds.

The five defining characteristics of digital banks are:

Zero branches: All operations are completed on mobile, account opening takes 5 minutes, no need to visit branches, no business hours, 24/7 online customer service.

Zero paper: No piles of forms or notarized materials, automated KYC: take a photo of your ID, scan your face, and finish in 10 minutes.

Ultra-low fees: Free checking accounts, no monthly fees, no minimum balance requirements.

Mobile-first: The app is not an "additional channel" like traditional banks, but the entire product itself.

User-centered: Traditional banks prioritize institutional processes, while digital banks prioritize user needs—spending categorization, savings goals, investment opportunities, and cashback rewards are all built-in features, not additional plugins.

Digital Bank ≠ "Bank + App"

The difference lies in the underlying architecture. Traditional banks overlay a digital interface on core systems from decades ago; digital banks have rewritten their infrastructure with API-first modern technology from day one, resulting in better products, faster feature iterations, and lower operational costs.

This infrastructure allows Nubank to serve a customer at an average monthly cost of only $1, while traditional banks in Brazil require $15-20; it enables Revolut to open in new countries within weeks, while traditional banks take years; it allows 80-90% of new customers for digital banks to grow through word-of-mouth, while traditional banks need to spend hundreds of dollars to acquire a single user.

1.2 Current State of the Digital Banking Market

Digital banks have rapidly become the most valuable sector in fintech. While traditional banks have spent decades building branches and legacy systems, digital-native challengers have already acquired hundreds of millions of customers, with market values approaching those of century-old institutions. We let the numbers speak:

Revolut: 60 million customers, valued at $75 billion

Nubank: 122 million users, valued at $70 billion

Chime: $11.6 billion upon IPO

They are no longer "startups," but financial giants: with annual transaction volumes in the hundreds of billions and revenues in the tens of billions, many are already profitable. The global landscape is as follows:

A Young Market, Rapid Speed

This territory has not existed since ancient times; the entire sector is just over a decade old, yet its total market value rivals that of century-old institutions. Fifteen years ago, most players did not even exist: Revolut was founded in 2015; N26, Chime, and Nubank were all born in 2013.

From 2023 to 2024, multiple companies are expected to become profitable, proving that the model can scale; public listings will come even later: Nubank went public in December 2021, SoFi listed the same year, and Chime is expected to go public in 2025—the story is just beginning.

Superstars Emerging from Latin America

Here comes the key point: the digital bank with the most global customers is headquartered in Latin America. Nubank has 122 million users in Brazil, Mexico, and Colombia, surpassing the combined total of Revolut and Chime. In just over a decade, it has covered 60% of Brazil's adult population from scratch; with annual revenues of $11.5 billion and a return on equity of 29%, it has made traditional banks envious.

Even Warren Buffett has placed a bet: in 2021, Berkshire Hathaway invested $500 million in its Pre-IPO round—legendary investors rarely touch technology and fintech, but this time he made a rare move.

Imagine this: if Latin America can cultivate a $70 billion digital bank in a market with high inflation and financial exclusion using fiat accounts, then when Web3 on-chain digital banks bring stablecoin infrastructure + DeFi yields + blockchain tracks to the same group of people, how great will the opportunity be?

This is the gap we aim to seize.

1.3 Unit Economics and Revenue Models

To understand the opportunity for Web3 on-chain digital banks, we first need to grasp how traditional digital banks make money and why their unit economics outperform legacy banks.

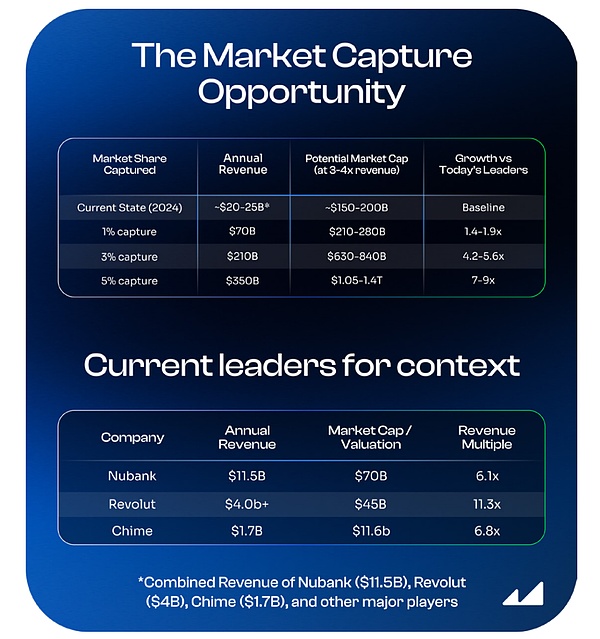

Traditional Banking: A $7 Trillion Annual Revenue Baseline

First, let's look at the scale. According to McKinsey's "2024 Global Banking Annual Review," the global banking industry generates approximately $7 trillion in annual revenue. Even the largest digital banks account for less than 1% of this. The opportunity does not lie in overnight replacing traditional banks, but in capturing even just 3-5% of the pie over the next decade.

Let's do some simple calculations:

If digital banks capture 5% of global banking revenue → $350 billion/year;

Based on current valuation multiples (most at 3-4 times revenue, with high-growth companies like Revolut commanding even higher premiums);

The total market value of the industry could reach $1-1.4 trillion;

This would be 5-6 times the total of today's leading digital banks, and Web3 on-chain digital banks are expected to capture a significant share of this.

1.4 Four Core Revenue Sources for Digital Banks

A. Interchange Fees from Credit Cards

Every time a customer swipes a card, the merchant pays a 1-3% transaction fee. Card networks (Visa/Mastercard) take a portion, and the remainder goes to the digital bank. This is the largest source of revenue (Chime derives about 70-90% of its revenue from this).

B. Credit Products

Credit cards, personal loans, BNPL, etc., generate interest income. Traditional banks rely on lending for 50-60% of their revenue; digital banks first attract deposits and issue cards, then enter lending once trust and data are established.

Nubank's credit balance in Q3 2024 is approximately $21 billion, with a return on equity as high as 30%, far exceeding the traditional bank average of 15-18%, because it targets underserved populations and strictly controls risk.

C. Premium Subscriptions

Monthly fees of $10-45 unlock benefits like airport lounge access, better exchange rates, and crypto trading. Revolut Premium, Nubank Ultravioleta, etc., rely on this for high-margin, predictable recurring revenue.

D. Forex and Crypto Trading Spreads

Fees are charged on currency exchange and crypto trading. Revolut supports over 80 cryptocurrencies, with strong revenue growth in its wealth/crypto segment in 2024; in Latin America, customers continuously convert volatile local currencies into dollars or stablecoins, yielding particularly rich spreads.

Traditional digital banks have already proven with superior unit economics that a purely digital banking model can expand to hundreds of millions of users and generate billions in revenue.

So, what would happen if "crypto-native" were written into the DNA from day one?

2. The Era of Web3 On-Chain Digital Banks Has Arrived

Digital banks are the ultimate destination for cryptocurrencies. This perspective can push the on-chain world into the mainstream. Every tokenization of real-world assets (RWA), every token, every decentralized finance (DeFi) product, every investment vault, and every Layer 1 or Layer 2 public chain—all on-chain entities require distribution channels. A new wave of digital banks is connecting all the dots.

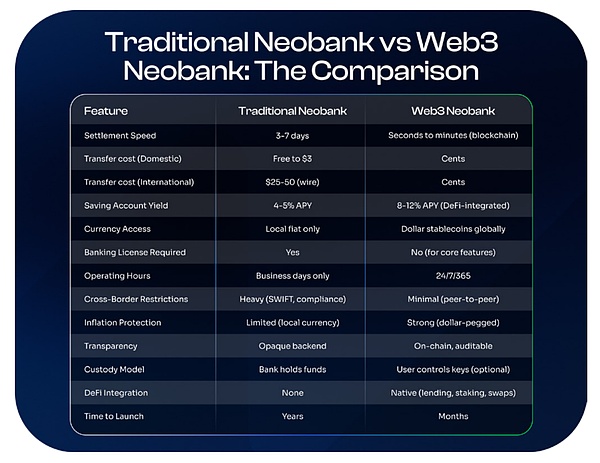

Digital banks have disrupted traditional banking through "digitization"; Web3 on-chain digital banks will once again disrupt digital banking using blockchain and stablecoins.

This is not as simple as adding a "crypto trading" label to existing banking apps. Web3 on-chain digital banks are fundamentally built on a blockchain-native architecture, completely restructured.

2.1 What Makes Web3 On-Chain Digital Banks Different? — UR: A Real Sample

UR, supported by Mantle's multi-billion dollar treasury, is set to launch in June 2025 as a Web3 on-chain digital bank. Users can open Swiss IBAN accounts, supporting USD, CHF, EUR, CNY, JPY, SGD, and HKD, with 1:1 deposit backing, and can spend globally using a Mastercard debit card. All accounts are provided by a Swiss licensed financial institution, but the core system integrates tokenized deposits + NFT identities.

The key lies in the underlying structure: UR deeply integrates Mantle Network (Ethereum L2) and its native products—mETH (liquid staking token) and MI4 (tokenized currency fund). Thus, UR can provide traditional banking services (IBAN, debit cards, fiat currency) while simultaneously allowing users to earn on-chain yields and access DeFi opportunities.

This is the core difference: traditional digital banks have a single-layer banking architecture; Web3 on-chain digital banks separate the layers, connecting the settlement layer to global blockchains, the liquidity layer to tokenized capital pools and DeFi protocols, while retaining a familiar banking interface for the user.

Users do not need to understand Mantle or mETH; they only see: "USD deposit annualized XYZ%", "EUR to USD instant exchange." The blockchain infrastructure exists invisibly, yet supports superior economics.

The debit card is a distribution channel; the account is the infrastructure. We believe that successful digital banks should "put accounts first": creating regulated, named multi-currency accounts that connect to the traditional financial system, allowing on-chain USD to be used for payroll, bill payments, and accumulating credit history over time. We firmly believe this is the path to building a successful digital bank that blurs the lines between fiat and cryptocurrencies.

— Neo Liat Beng, COO of UR

Now, let's break down the four core differentiators that make this architecture powerful:

A. Blockchain Financial Infrastructure

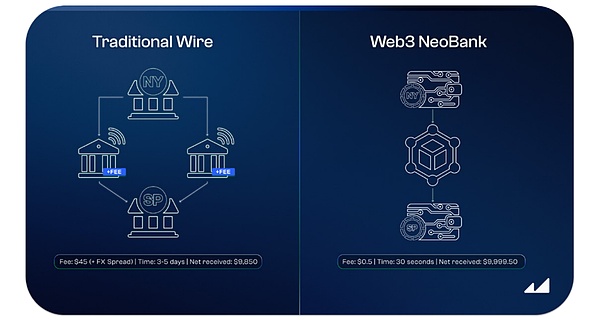

Traditional digital banks still operate on outdated financial tracks. When you transfer money using Revolut or Nubank, the funds must go through systems like ACH (U.S.), SEPA (Europe), taking 3-7 business days for settlement; wire transfers are even slower, costing $25-50 per transaction; SWIFT cross-border transfers are even more exaggerated, starting at 5 days, with intermediary banks taking their cuts.

Web3 on-chain digital banks settle directly using blockchain. Sending USDC to the other side of the globe takes seconds to minutes, with fees under $1 (efficient chains like Solana and Plasma can even be below $0.1). There are no weekends, no holidays, no intermediary banks, and no delays.

Real case: Sending $10,000 from New York to São Paulo

Traditional wire transfer: $45 fee, 3-5 days to arrive, intermediary bank + exchange rate difference, net received $9,850

Web3 on-chain digital bank (USDC): $0.5 fee, 30 seconds to arrive, net received $9,999.50

This is not theoretical; millions of users are already using stablecoins for cross-border remittances because it is both cheap and fast.

B. Stablecoin Accounts

Traditional digital banks only offer local currency accounts (Brazilian Real, Mexican Peso, Argentine Peso). To hold USD assets, one must either open a U.S. bank account or be exploited by high exchange rates at local banks.

Web3 on-chain digital banks directly provide stablecoin accounts (USDC, USDT), allowing anyone, anywhere, to easily hold dollar-denominated assets with one click. No need for a U.S. bank, no need for local residency, no need for credit history—just download the app to deposit USD on-chain.

In Latin America, this is a matter of survival: when local currencies depreciate by over 50% annually (as in Argentina and Venezuela), holding USD is not speculation; it is "a matter of life and death."

C. DeFi Integration

The interest rates on savings accounts offered by traditional digital banks are tied to central bank policies. In the U.S., high-yield savings accounts have an annual percentage yield (APY) of 4-5%, aligned with Federal Reserve rates; in Brazil, Nubank offers rates approximately equal to 100% of the CDI (Brazilian interbank benchmark rate), currently nominally at 10-11% APY.

However, Brazilian users face a trap: with inflation rates of 4-6%, the Real continues to suffer from political and exchange rate fluctuations (expected to depreciate over 15% against the dollar in 2024), what seems like a 10% return in Real may actually result in negative returns when converted to USD—interest may be earned, but purchasing power is lost.

Web3 on-chain digital banks directly integrate DeFi protocols, allowing users to earn on USD stablecoins while hedging against inflation and depreciation. Sources of yield include:

Over-collateralized lending: lending USDC/USDT to borrowers with collateralization rates ≥150%

Liquidity provision: providing liquidity for stablecoin trading pairs on DEXs

On-chain treasury: professional asset managers running delta-neutral strategies on-chain

Staking rewards: earning validator node rewards by holding liquid staking tokens

Yield tokenization: platforms like Pendle allow trading and leveraging future yields

Comparison: Chase's ordinary savings account offers 0.01% APY, while Nubank offers 10% APY but with a 15% depreciation in currency value. For Brazilian users, earning 12% APY on USD stablecoins through Ethena is far superior to earning 10% in Real that depreciates annually.

Although these yields come with smart contract risks and are not covered by FDIC insurance; DeFi protocols may be vulnerable to attacks, Ethena's delta-neutral strategy relies on the normal functioning of the derivatives market, and Pendle's high yields require a deep understanding of the fixed income market. However, context dictates choice. In the following countries:

Triple-digit inflation (Argentina 178%)

Strict foreign exchange controls (Venezuela)

Turbulent banking systems (Lebanon, Turkey, Nigeria)

Political instability leading to capital flight

The risks of DeFi often feel "safer" than local banks. Those who have experienced government account freezes (Argentina 2001, Brazil 1990) or a 90% overnight depreciation of their local currency may find "smart contract risk" relatively manageable.

For hundreds of millions globally, this is a choice that requires no hesitation.

D. Permissionless

Traditional digital banks must first obtain a banking license, pass regulatory approvals, partner with licensed banks to provide FDIC insurance, and sign card agreements with Visa/Mastercard, then comply with dozens of local financial regulations—before even making their first business deal, they spend years and millions of dollars on legal and compliance.

The core products of Web3 on-chain digital banks (stablecoin accounts, DeFi yields, peer-to-peer transfers) can be launched directly without permission:

Allow users to hold USDC

Integrate Aave for earning

Enable on-chain transfers

None of these require a banking license. From development to deployment, it can be completed in weeks to months. Although Web3 on-chain digital banks still need licenses and partners to perform the following tasks: debit/credit cards (issued by Visa/Mastercard); fiat deposits and withdrawals; KYC/AML compliance (requiring licensed providers). However, the core product of stablecoins + DeFi can be launched immediately, with cards and fiat channels added later. The barriers to entry have drastically lowered, and the time to market has significantly shortened.

As a result, by 2025, Web3 on-chain digital banks are expected to see explosive growth:

Infrastructure is mature → Demand has been validated → Regulatory frameworks are in place (GENIUS Act)

Builders can now move forward at full speed.

2.2 Why "Now" is the Key Moment

A. Shift in the Crypto Market Landscape

In recent years, the crypto community has often shouted, "Use blockchain to serve the unbanked," but that was merely a beautiful vision—wallets were hard to use, gas fees skyrocketed, regulations were hostile, and the experience was poor, making it impossible to land.

By 2025, the situation has completely changed:

Stablecoins have matured: market capitalization exceeds $200 billion, stability has been validated, and regulatory frameworks are in place

Networks are fast and cheap: Solana, Base, Plasma, Mantle with thousands of TPS, fees below 1 cent

Experience has qualitatively improved: account abstraction, social recovery, embedded wallets—using crypto wallets is as simple as using Venmo

Regulations are clear: the U.S. "GENIUS Act" and the EU "MiCA" have been enacted

Infrastructure is plug-and-play: Circle/Tether API, Fireblocks custody, Plaid-style account opening, no need to reinvent the wheel

All the puzzle pieces are in place, and the market is truly ready.

B. Regulation: The Window of Opportunity is Now

For many years, the biggest roadblock for Web3 on-chain digital banks has not been technology, but regulation. Stablecoins have long been in a "gray area," banks have refused to cooperate, VCs have been hesitant, and entrepreneurs have had to operate offshore.

On July 18, 2025, everything changed. U.S. President Trump signed the "Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act," marking the first comprehensive federal regulatory framework for stablecoins in the United States.

The biggest "existential risk" for institutional funds has been removed—banks can confidently partner with stablecoins, and digital banks can boldly integrate USDC/USDT.

The floodgates have opened. The first compliant players include: Circle (USDC) | Tether (USDT) | PayPal (PYUSD) | Paxos (USDP)

The U.S. is not an isolated case. The European Union's "Markets in Crypto-Assets Regulation" (MiCA), effective in 2024, also provides clear guidance, allowing compliant stablecoins like EURC and EURT to circulate freely across 27 member states.

Thus, the two largest economies in the world have reached a regulatory consensus on stablecoins.

C. Explosion of Stablecoin Market Capitalization

The clarity in regulation has directly ignited the market: the global stablecoin market capitalization is projected to reach $150 billion in 2024 and exceed $250 billion in 2025.

According to adjusted data from Visa, in 2024, the annual trading volume of stablecoins will surpass $5 trillion, approaching Visa's $14 trillion. People are using it for real economic activities: remittances; savings; daily payments; cross-border trade.

It is no longer "crypto enthusiasts' self-indulgence," but a new settlement layer for global commerce. This is the true "practical scenario."

The Window is Open

2025-2026 is the golden entry period for Web3 on-chain digital banks:

Clear regulations

Stablecoins at $250 billion and continuing to grow

Mature infrastructure

Influx of institutional capital

Verified user demand

Pioneers who act now can achieve crypto integration in traditional digital banks and gain a first-mover advantage before large tech companies enter the space. The starting gun has fired—Latin America is a gold mine.

2.3 New Narrative Ignited by Plasma

The concept of digital banking is not new; projects have emerged over the years but have remained lukewarm. Until 2025, after a series of regulatory victories, a landmark event completely ignited the market—on September 25, the Plasma blockchain and its flagship digital banking product, Plasma One, officially launched.

This is seen as the "iPhone moment" for Web3 on-chain digital banks: the convergence of infrastructure, regulation, capital, and user experience makes the vision of scaling finally feasible.

Funding Path: From Seed to $396 Million

Seed Round $3.5 Million (2024): Led by Bitfinex, used to build USDT infrastructure on Bitcoin and expand stablecoin reach.

Series A $20 Million (February 2025): Led by Framework Ventures, used to launch Plasma's own blockchain.

Token Public Offering $373 Million (oversubscribed 7 times): Market funds voted to purchase on-chain tokens.

Plasma is strategically supported by Tether, serving as the core liquidity provider. On-chain USDT transfer fees are waived, directly subsidized by the Plasma network. The most widely used stablecoin globally (with a market cap exceeding $180 billion) can flow on-chain at zero cost, representing a new generation of banking infrastructure. When the world's largest stablecoin issuer personally supports Web3 on-chain digital banking infrastructure, it is no longer an experiment but an official announcement of the future.

For Latin America, the impact is enormous. Stablecoins have become mainstream in the region's crypto trading (accounting for 50-90% of trading volume in major markets). Now, these transactions not only settle in seconds with zero fees but also come with substantial yields.

The project launched on September 25, 2025, and the data speaks for itself:

On the first day:

$2 billion USDT liquidity injected all at once

Stablecoin deposits yielding 10%+ annually (Plasma One)

USDT transfers with 0 fees

Early users receive 4% cashback on debit card purchases

20 days later (October 15):

Total Value Locked (TVL) surpassed $5 billion, 2.5 times the first day

Leading DeFi protocols such as Aave, Pendle, Balancer, Fluid, Veda, Neutrl, and Euler have all been deployed

This is a real-time demonstration of product-market fit.

A. The Narrative Spreads

The launch of Plasma not only ignited its own project but also brought the entire "Web3 on-chain digital banking" sector into the spotlight. Projects that had been quietly building for months or even years suddenly found themselves labeled as "the next Plasma," becoming the hottest targets in the crypto market. Announcements followed in quick succession:

RedotPay: Announced a $47 million Series A the day after Plasma's launch, with a valuation exceeding $1 billion, backed by Coinbase Ventures, Galaxy Digital, and Vertex Ventures, perfectly timed.

Tria: Completed a $12 million pre-seed and strategic round in October.

Twitter KOLs, VC analysts, and fintech media began to intensively output themes around "Web3 on-chain digital banks" almost simultaneously. Once a niche sector, it instantly became the hottest narrative of Q4 2025.

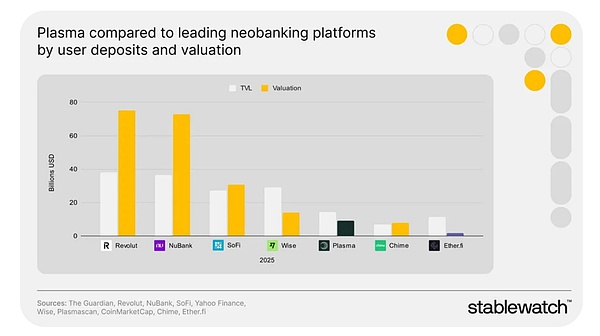

B. Valuation Gap

Despite the arrival of the trend, the valuations of Web3 on-chain digital banks remain far below those of traditional players. Stablewatch's latest report compares Plasma, EtherFi, and traditional digital banks based on TVL and market capitalization:

Traditional Digital Banks

Nubank: Valuation $70 billion, users 122 million

Revolut: Valuation $75 billion, users 60 million

SoFi: Valuation $31.4 billion, users 18 million

Web3 On-Chain Digital Banks

Plasma: Valuation approximately $3-4 billion (Plasma token XPL represents both the L1 blockchain and Plasma One digital bank, with valuation including infrastructure premium)

EtherFi: Valuation approximately $600-1 billion

If Web3 on-chain digital banks can capture just 5-10% of the market share from their Web2 counterparts, the upside potential based on current valuations is 10-30 times.

C. Open Ecosystem: Everyone Has a Seat

Plasma CEO Lucid recently articulated the network's vision, stating that although Plasma has created Plasma One, it welcomes more projects to enter and establish their own dominance—"the track is big enough to accommodate many winners." The narrative of digital banking extends far beyond Plasma.

While Plasma One is our flagship digital bank, Plasma is actively welcoming more teams to build digital banks on the platform.

"We do not view other digital banks as competitors. The world is too vast and diverse for a single product to win the entire market. Look at how Revolut, Monzo, and Starling have each captured large user bases in the UK, and how Nubank, Tonik, and Kuda have thrived in their respective regions with distinctly different models. The proliferation of financial services is a global issue that cannot be solved by a single application.

Our goal is to transition the world from traditional financial systems to superior financial tracks. This means we need to create a strong product with unique features while also empowering others to expand horizontally in different regions and use cases. Freelancers in Kenya, small businesses in Turkey, and retail users in Indonesia have vastly different needs.

Plasma provides developers with top-notch payment infrastructure, ample liquidity, user resource channels, and a permissionless system—where users can freely switch between various digital banks built on Plasma (including Plasma One). We also offer support in finance, operations, and funding to help these digital banks grow faster."

Looking back at Web2: Nubank dominated Latin America, Revolut swept Europe, and Chime ruled the U.S. Different regions, different user habits, and different regulatory environments ultimately lead to a win-win scenario. Web3 on-chain digital banks will replicate this path: multiple players will emerge, each dominating vertical fields or geographic territories.

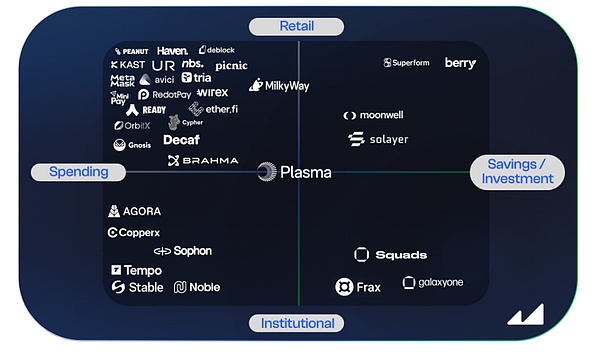

2.4 The Explosive Growth of the Web3 On-Chain Digital Banking Ecosystem

Following Lucid's open philosophy, we have outlined the main players in the Web3 on-chain digital banking space. The entire chain has recorded over 70 projects, and due to overlapping functionalities, we present them in a "spectrum" rather than rigid classifications (the diagram only lists 34 for readability; the retail consumption/card sector is the most crowded).

Spectrum Quadrants:

Retail (Top): Aimed at the general public, not institutions

Institutional (Bottom): B2B digital banking solutions

Payment Consumption (Left): Focused on everyday spending, such as crypto cards or payment infrastructure

Savings/Investment (Right): Emphasizing capital appreciation and DeFi yields

Now, let's take a closer look at four representative projects and how they stand out in the sector: EtherFi, Plasma, UR, and a special mention of Neobankless—whose alpha version has already attracted over 5,000 Brazilian users.

A. Plasma

Infrastructure-level advantages + top-tier backing, with the most critical factor being the close ties with Tether. Deep liquidity, a complete ecosystem surrounding the entire chain, combined with Plasma One's high yield, makes it a leader in "stablecoin-native" projects. USDT transfers incur 0 fees, and the initial liquidity injection of $2 billion clearly establishes its competitive moat.

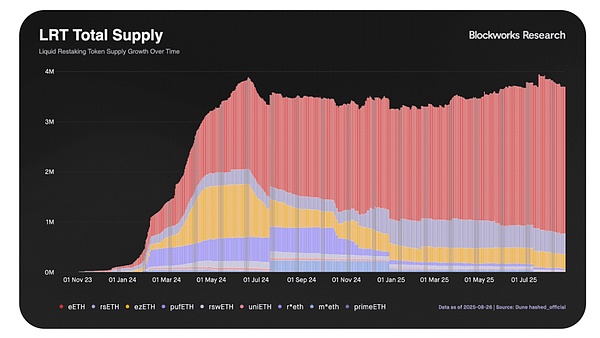

B. EtherFi

Extremely DeFi-native. During the peak of the "re-staking" narrative, it rapidly attracted capital through liquid re-staking, resulting in a surge in TVL. The team expanded its business into digital banking while retaining its DeFi genes. Targeting both retail and institutional clients, it offers the highest market yields (including token incentives of 11-15% APY), making it highly attractive to crypto-native users.

If you are new to DeFi, you might think EtherFi was born as a large Web3 on-chain digital bank. This is not the case—it initially started as a "liquid re-staking" protocol and completely dominated that narrative from 2023 to 2024.

When the re-staking craze subsided, EtherFi was the only major LRT protocol that retained a significant amount of TVL. The charts from Blockworks Research make this clear:

Why did it stand firm while others collapsed? EtherFi leveraged its strengths: it seamlessly transitioned the billions of TVL and infrastructure accumulated during the re-staking era into the Web3 on-chain digital banking sector, creating a moat that new entrants cannot replicate. The key difference: retaining users with "real value."

Deep liquidity. As the largest LRT, eETH has actual liquidity across various DeFi protocols—tradeable, usable as collateral, and capable of generating yield. Smaller protocols cannot achieve this.

Rapid delivery of new value. EtherFi did not sit idle collecting eETH management fees; instead, it continuously launched new products, giving users "reasons to stay."

EtherFi's product trio creates a closed loop for earning on consumption, allowing users to deposit qualified assets like eETH into a collateral vault and directly use the EtherFi card for everyday expenses (paying bills, buying groceries, subscribing, etc.); the collateralized assets continue to earn yields, enabling spending without selling tokens, while benefiting from price appreciation, with cashback on consumption within 3%, and repayments can be made directly using stablecoins or other crypto assets:

① Stake. Deposit ETH, BTC, or USD to earn yields, with eETH alone locking over $6 billion, forming the foundation of the project.

② Liquid. An automated strategy vault that distributes ETH, BTC, and USD across multiple protocols to earn higher yields, significantly increasing TVL stickiness.

③ Cash—this allows EtherFi to enter the "digital banking" sector. A non-custodial, DeFi-native credit card:

In just a few months since its launch, the data is already impressive: cumulative spending exceeds $77 million; cashback distributed exceeds $3.6 million; transaction count exceeds 930,000; card issuance exceeds 32,000; and this is just the beginning.

C. UR

A Swiss-compliant multi-currency account + Mastercard debit card, directly connected to traditional clearing networks like SWIFT, SEPA, and SIC. Backed by the Mantle blockchain and leveraging resources from the global top exchange Bybit, it precisely addresses the pain points of enterprises and high-net-worth individuals who "want both traditional banking functions and Web3 infrastructure."

D. Neobankless

Neobankless directly targets the Brazilian market, packaging Web3 yields into a Web2 experience, something that international players have yet to achieve. The pain point: high volatility of the real and high inflation, making Brazilians reluctant to hold their local currency; however, using services like Nomad and Wise to buy dollars incurs high fees, which can be painful even if the experience is friendly.

Solution:

Downplaying the underlying Solana, users "do not see" the chain: PIX instant transfers convert reais to USDC in seconds.

DeFi yields are abstracted as "high-yield dollar savings," and users do not need to know what blockchain is.

Differentiation:

While others only offer debit cards, Neobankless directly provides credit cards.

Users' funds continue to earn dollar yields while spending against their credit limits.

Credit limits = total value of collateralized assets in the account, allowing for flexible coexistence of savings and overdrafts, something traditional banks cannot replicate.

Supports installment payments—a necessity in emerging markets like Brazil.

Large purchases can be paid in installments while still being priced in dollars, avoiding depreciation of the local currency.

In short: entering with reais, earning in dollars, spending with credit cards + installment options, Neobankless has made "stablecoin-native" a truly usable digital bank for locals.

Market validation:

The limited beta version has attracted over 2,000 users, with a cumulative transaction volume exceeding 1.5 million reais, and over 3,000 people on the waiting list.

Zero budget, 100% organic growth. Visa credit cards are about to be issued, directly competing with Brazil's two major dollar channels, Wise (valued at $10 billion) and Nomad (valued at $363 million).

III. Crypto Gold Rush in Latin America: An Untapped Gold Mine

Before everything begins, let’s quote a post from Harj Taggar, managing partner at Y Combinator, from a few weeks ago:

"If you are building a Web3 on-chain digital bank and ignoring Latin America, you are missing the biggest opportunity in the entire sector."

Now, let’s dig deeper into this "Latin American Alpha."

3.1 Current State of Crypto Usage in Latin America

Latin America is not "crypto curious," but "crypto native." The region has processed more crypto transaction volume than all of Europe, with stablecoins occupying an absolute mainstream position—not for speculation, but as savings accounts, remittance channels, and inflation hedging tools.

According to Chainalysis' "2025 Latin America Crypto Adoption Report," from July 2022 to June 2025, the total crypto transaction volume in Latin America reached $1.5 trillion, with a year-on-year growth of 42.5%. For reference, this figure is larger than the entire GDP of developed countries like Sweden, Norway, and Austria.

From the perspective of "value reception," Brazil leads with $318.8 billion, accounting for nearly one-third of Latin America's total activity, followed by Argentina, Mexico, Venezuela, and Colombia.

A. Stablecoins Reign, Not Speculation

Key insight: The core of Latin America's crypto activity is not betting on Bitcoin's rise, but using stablecoins as tools for savings and payments in dollars. In major Latin American markets, 50-90% of crypto transactions involve stablecoins. When Argentinians or Venezuelans "buy coins," they are not betting on Bitcoin doubling; they are scrambling for USDT to hedge against their local currency collapse.

Hard data:

Argentina: 50% of crypto purchases are stablecoins.

National crypto adoption rate is nearly 20%, the highest in Latin America. With an annual inflation rate of 178%, the peso is expected to depreciate by 51.6% against the dollar in 2024; ordinary people without U.S. bank accounts can only rely on USDT/USDC to preserve their purchasing power.

Bitso Exchange: 46% of purchases are stablecoins.

Bitso covers Mexico, Brazil, Argentina, and Colombia, with platform data showing that 46% of buying funds flow directly into USDT/USDC rather than BTC/ETH.

Brazil: Over 90% of crypto flows are stablecoins.

Chainalysis points out that Brazilian users have a strong preference for saving and transferring using stablecoins. The country's digital infrastructure is mature (PIX processes 420 billion transactions annually), and users have no barriers to "digital money," simply wanting to convert "reais" into "dollars."

B. Why Choose Stablecoins? Because the Local Currency is Collapsing

The rise of stablecoins is a rational response to economic realities:

Inflation nightmares:

Argentina: 178% (2024)

Venezuela: Hyperinflation (over 1000%)

Currency devaluation:

Argentine peso: depreciated 51.6% against the dollar within 12 months.

Brazilian real: expected to depreciate over 15% against the dollar in 2024.

Venezuelan bolívar: nearly worthless.

When your salary shrinks by 15-50% each year, holding dollars is no longer optional; it becomes a necessity for survival.

3.2 How Digital Banks Fit the Latin American Market

If you were to design a market most suitable for the disruption of digital banking, you would draw it as Latin America:

A large unbanked population eager for financial services.

Real-time devaluation of the local currency, with purchasing power evaporating instantly.

Banking oligopolies reaping high rents.

Mature mobile infrastructure, where any smartphone can serve as a banking outlet.

Traditional digital banks have validated this argument with Nubank; Web3 on-chain digital banks take it a step further—embedding stablecoin settlements, DeFi yields, and instant cross-border transactions to achieve a disruptive advantage.

Latin America will be a region where cryptocurrency-driven digital banks thrive. We have already seen institutions like Lemon, Nubank, and Bitso leading the way. Now, on-chain infrastructure makes launching digital banks easier than ever, and I expect dozens of strong participants to emerge in the next five years—they will drive financial inclusion in the last mile and transform the traditional financial industry.

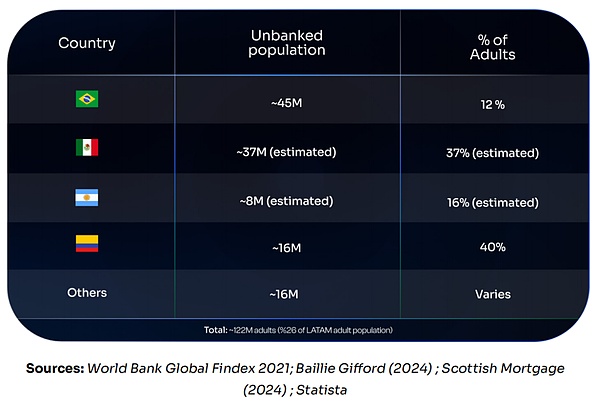

A. Unbanked Crisis: 122 Million Excluded

Latin America has 122 million people (26% of the region's total population) without bank accounts. This is not a niche group; its size is almost equivalent to the entire population of Mexico. It is not that they do not need banking services, but traditional banks are unwilling to serve them or set the barriers too high.

Why are so many people unbanked?

Minimum balance requirements keep low-income individuals out.

Documentation barriers (proof of address, employer letters, tax ID).

Geographic exclusion (rural areas, slums, and informal settlements lack banking outlets).

Distrust of institutions—historical memories of banking crises, account freezes, and currency confiscation.

Web3 on-chain digital banks instantly solve all these issues: zero minimum balance, zero offline branches, zero proof of employment—just a smartphone and a photo ID, with KYC completed in 10 minutes. Download the app, deposit through local payment channels (or directly deposit stablecoins), and you can open a dollar-denominated account, enjoy yields, and receive a debit card.

Nubank has captured 60% of adults in Brazil with its "accessible banking"; Web3 on-chain digital banks can replicate this miracle by making "dollar banking" equally accessible and low-cost, sweeping across all of Latin America.

B. Inflation Nightmare: Watching Money Turn to Paper

Argentina's inflation rate of 178% in 2024 means that if you receive a salary of 100,000 pesos in January, by December, the same amount of money can buy less than 40% of what it could at the beginning of the year. Your salary either remains flat or grows at a rate that cannot keep up with inflation. Rent is rising, weekly grocery expenses are increasing, and various bills continue to climb.

Worse still is the long-term nature of this inflation: over the past decade, Argentina's average annual inflation rate has reached 66.9%. This is not a one-year crisis but a continuous erosion of purchasing power. In 2018, Venezuela experienced hyperinflation exceeding 65,000%, rendering its currency virtually worthless.

Even "stable" countries have not been spared: Brazil's average annual inflation rate of 5.9% over the past decade means that 100 reais will lose about 45% of its value over ten years. In contrast, the average annual inflation rate in the U.S. during the same period was 2.5%.

When the local currency depreciates so rapidly, the only rational action is to immediately convert it into dollars.

C. Banking Oligopoly

The banking system in Latin America is dominated by oligopolies that extract monopoly rents as if they were "farming customers." In Brazil, for example, just five banks (Itaú, Bradesco, Banco do Brasil, Santander, Caixa) control 92% of the credit market, charging as follows:

Overdraft fees: annualized 300-400%

Credit card interest: annualized 400%+

Basic checking accounts also incur account management fees

Domestic wire transfers incur additional transfer fees

Digital banks have broken this pattern. Nubank introduced free checking accounts, zero fees, and transparent pricing, and now 60% of Brazilian adults have Nubank accounts.

Web3 on-chain digital banks can bring the same revolution to all of Latin America:

USDT transfers incur zero fees

No minimum balance, no account management fees

Savings yield of over 10% annually

Exchange spreads lower than bank spot rates

Cross-border transfers arrive in seconds, costing less than $1, while bank wire transfers cost $25-50

Oligopolies survive solely on regulatory moats and inertia; Web3 on-chain digital banks bypass both.

D. Mature Mobile Infrastructure

This is the advantage of infrastructure: smartphone penetration in Latin America has reached 80%, with 88% of users conducting financial transactions via mobile. This means:

No need to establish physical branches

No need to teach users what mobile banking is

Channels are plug-and-play, reaching users instantly

A young population that is digitally native

Brazil's PIX processes 42 billion transactions annually—instant, free, peer-to-peer—has accustomed over 100 million Brazilians to digital money flows. If Web3 on-chain digital banks can make the user experience as seamless as PIX, combined with the advantages of Web3 yields and stablecoins, Brazilians will trust stablecoins flowing in the same way they trust reais.

This "mobile-first" financial behavior is not unique to Latin America. a16z points out that mobile usage in developing countries is highly correlated with on-chain activity—the infrastructure is already in place, just waiting to be ignited.

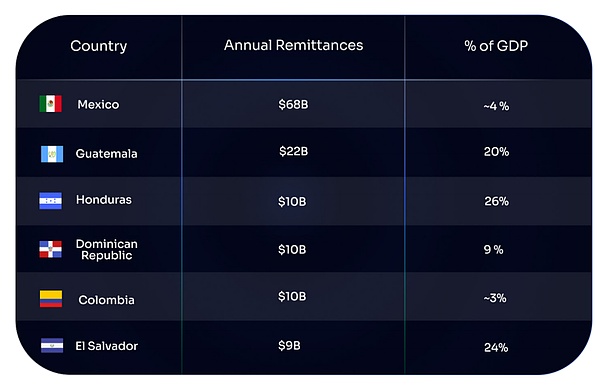

E. Remittance Dependency

Latin America receives over $160 billion in remittances annually, almost entirely from workers in the U.S. For many countries, this money accounts for between 4% and 26% of GDP: 26% in Haiti, 17% in Honduras, 15% in El Salvador, 14% in Guatemala, 11% in Nicaragua, and even 4% in Mexico.

However, traditional channels remain exploitative: the average fee is 6.35%, with banks charging up to 12.66%. If someone sends $500 from the U.S. to Mexico each month, they are charged $32-63 per transaction, resulting in annual fees of $380-760, equivalent to a local minimum wage.

Web3 on-chain digital banks can reduce the cost of the same remittance to under $1 using stablecoin channels: the remitter in the U.S. buys USDT → sends it to the recipient's Web3 account in Mexico in seconds → the recipient can directly use a debit card for spending or easily convert it to pesos for withdrawal.

With an annual remittance total of $163 billion and an average fee rate of 6%, traditional institutions extract $9.8 billion in fees each year. If we can capture just 5% of the market share, it could generate over $8 billion in annual transaction volume, with customer acquisition and operational costs far lower than Western Union or MoneyGram, presenting a crushing economic model advantage.

F. Nubank: The Viability of the Latin American Model Validated by a $70 Billion Valuation

The previously mentioned "large unbanked population, inflation crisis, banking oligopoly, and mature mobile infrastructure" may sound theoretical, but can it really work? Just look at Nubank. Founded in São Paulo in 2013, Nubank started from zero and has now become the digital bank with the most customers globally, valued at $70 billion, entirely supported by Latin American users.

Growth trajectory: 0 → 122 million users

Total customers: 122 million (more than the sum of Revolut and Chime)

107.3 million in Brazil, covering 60% of the adult population

Over 10 million in Mexico

2.5 million in Colombia

Financial performance:

2024 revenue: $11.5 billion

Net profit: $2 billion

Return on equity (ROE): 29%—unmatched by most traditional banks globally

Efficiency ratio: 29.9%, earning $1 for every $0.3 spent

In comparison, the widely recognized best-managed JPMorgan has an ROE of only 17%. Nubank achieving a 29% ROE in emerging markets is truly phenomenal.

3.3 Latin America Gold Rush Playbook

Understanding the opportunity is one thing; executing it is another.

The vast majority of Web3 projects rush into Latin America with a "global uniform" strategy, English-first content, and zero understanding of local payment habits and user behavior, only to complain about stagnation in adoption. To win in Latin America, the pace must be fast, money must be spent wisely, and localization must be deep. The following playbook provides direct answers.

A. Brazil-First Landing Strategy

The reason for choosing Brazil is not because it is simple, but because the risk-reward ratio is the most favorable.

Why choose Brazil?

Largest market: 215 million population, Nubank has validated 107 million digital banking users, with the lowest education costs.

Best infrastructure: PIX processes 42 billion instant transfers annually, and users are already accustomed to "instant" digital payments.

Clearest regulation: The Central Bank of Brazil (BCB) is building a complete regulatory framework for crypto, set to be implemented in 2025-2026, allowing for early positioning.

Largest crypto transaction volume: annual transaction volume of $318.8 billion, accounting for 31% of Latin America's total.

Brazil strategy: On the first day of launch, it is essential to integrate with PIX—this is a non-negotiable hard condition; collaborate with local exchanges like Mercado Bitcoin (detailed later); provide BRL to USDC conversion with transparent fee rates; and build products in Portuguese from day one, rather than retrofitting later.

Nubank has validated this approach: they focused solely on Brazil for years before expanding to Mexico and Colombia. It is this focus that allowed them to capture 60% of Brazil's adult population. First, penetrate one market thoroughly, then discuss regional expansion.

B. Leverage CEX Partnerships for Distribution

Most Web3 builders overlook a key insight: in Latin America, the entry point for cryptocurrencies is almost monopolized by centralized exchanges, with a significant gap.

Chainalysis data shows that 64% of on-chain activity in Latin America occurs on CEX, second only to the Middle East and North Africa (66%), far exceeding North America (49%) and Europe (53%). Why do CEX dominate?

Fiat entry: Users must convert local currencies (BRL, MXN, ARS) into crypto assets

Brand trust: Mercado Bitcoin and Ripio were established as early as 2013, and SatoshiTango launched in 2014, building a strong user reputation over the years

Local customer service: Portuguese/Spanish support, dispute mediation, and full compliance licenses

Payment channels: PIX, SPEI, bank transfers, and cash deposits are all integrated for a one-stop experience

Leading regional platforms:

Mercado Bitcoin: the largest in Brazil, with the highest brand recognition

Bitso: 8 million users, the leader in Mexico, with previous data showing that 46% of users purchase stablecoins

Ripio: covers all of Latin America, strong in cross-border business

Wenia: launched by Colombia's largest bank, Bancolombia, deeply rooted in the local market

SatoshiTango: has been deeply engaged in the Argentine market for ten years.

Instead of competing head-on with these exchanges, it’s better to collaborate directly: we can offer a white-label digital banking solution, embedding our stablecoin accounts as an "off-platform wallet" option for the platform, while providing yields significantly higher than those of exchange savings accounts, and setting up referral rewards for users who transfer funds to our bank. A specific approach can refer to the Bitso model: users can earn only 3% annually by keeping USDT on Bitso, while we can offer 10% through DeFi integration; Bitso can package our services as a "high-yield investment area" to promote to its 8 million users and share the revenue. The result is that the exchange retains customer relationships while we instantly gain massive distribution channels, benefiting both parties.

Example: Bitso directs 8 million users to your "premium savings" product, they earn commissions, and you gain large-scale distribution, with users only needing to click "one-click transfer to high-yield wallet."

C. User Acquisition Playbook: Targeting Niche Markets

Latin America is a "scale game"—without reaching millions of users, the banking model cannot operate; relying on organic growth in a red ocean market is simply insufficient. The fatal mistake made by the vast majority of projects is trying to "appeal to everyone" from day one.

The reality is: to establish a foothold in Brazil and across Latin America, you must first identify a niche community—a specific group that you can deploy all your firepower on, quickly turning it into an "atomic network," and then expand outward.

Who could be your niche?

Frequent travelers needing dollar accounts and international cards?

Gamers who have already purchased game skins with crypto?

Small vendors looking to save on card processing fees?

Young professionals tired of traditional banking bureaucracy?

Crypto traders needing smooth fiat entry and exit?

Why must you start with a niche?

Concentrated marketing budget: Instead of spreading thin, penetrate one circle deeply.

Rapid word-of-mouth: Close-knit communities recommend each other, leading to exponential referrals.

Validate PMF: First, clarify which features are truly needed before spending heavily.

Brand labeling: "The bank used by a certain community" is far more penetrating than "a bank for everyone."

A successful example of a Web3 on-chain digital bank that found its niche market is Kast—since its inception, it has fully bet on the Solana ecosystem, and while it targets a global audience, it is particularly strong in Brazil. Similarly, the previously mentioned EtherFi also chose to focus on DeFi-native users, especially within the EVM ecosystem; Haven has entered the privacy space, utilizing ZK technology and blockchain to create self-custodied privacy crypto cards. These Web3 examples demonstrate effective paths to precisely lock in an initial niche market.

These Web3 cases illustrate effective paths to lock in an initial niche market. The niche is your foundation; only by truly occupying this community can you fully deploy your customer acquisition playbook. In the next section, we will see that the reason for the effectiveness of old users bringing in new ones is that old users are deeply embedded in the community; KOLs are effective because you can accurately identify the opinion leaders in that circle; giveaways are effective because you reward the "insiders" who are most likely to become super users. Without a niche, you are just noise; with a niche, you are the only important choice. Once you identify and capture this niche, you enter the scaling phase:

Proven "Latin American Market Promotion Strategies":

I. Member-Get-Member Program

In Latin America, the viral mechanism is the king of growth. 80-90% of Nubank's users flow in naturally through word-of-mouth and referral rewards. The approach is simple yet effective: the referrer earns 10 USDC, and the referred user earns 5 USDC upon completing their first transaction (example). The sharing link must jump directly to WhatsApp—over 90% of private and group chats in the region happen there, so don’t make users click more than necessary.

II. Micro + Macro KOL (Influencer) Strategy

Don’t just spend money on those "crypto bigwigs" with millions of followers. Combine the reach of "macro influencers" with the trust of "micro influencers": a local financial blogger in São Paulo with 50,000 followers often has a higher conversion rate than a general crypto trader with 500,000 followers. Cross-category collaborations—personal finance, entrepreneurship, technology, lifestyle—will always reach the mainstream audience better than relying solely on crypto-native creators.

III. Ambassador Program

Select a group of super users in each market and upgrade them to "brand ambassadors." Provide co-branded materials, exclusive benefits, and tiered commissions: for each new user they bring in who completes their first deposit, ambassadors earn 5-10 USDC plus a level upgrade. Let them become your "human broadcasting stations" locally.

IV. High-Impact Giveaways

Creativity determines virality. Example: Deflo gave away cars, international flights, iPhones, etc., in Brazil, causing the event to explode on TikTok and Twitter, garnering millions of exposures and downloads. People are willing to download the app, complete KYC, and invite friends for a chance to win a car. Set milestone prize pools: "10,000 users enter to win a BMW," "Refer 10 friends to enter to win 10,000 USDC." The prizes must be significant enough to go viral, but the actions to claim them must be tied to growth metrics—registration, KYC, first deposit, sharing—none can be missing.

V. Loyalty Points & Cashback

Cashback is the key to retention. All card spending instantly returns USDC, with transparent ratios, real-time deposits, and on-chain verifiability. As long as the rewards are higher than traditional cards and the experience is smooth, users will set your card as their default payment method. Additionally, layer on a points system: $1 spent = 1 point, which can upgrade to gold/platinum cards, unlocking higher yields, exclusive customer service, airport lounge access, and other privileges.

VI. Ad Retargeting

The vast majority of Web3 projects waste their budgets on cold traffic. The real ROI lies in retargeting:

Visitors who haven’t registered → Show social proof (user reviews, cumulative registration numbers, security audit badges)

Downloads without KYC → Promote a 60-second short video demonstrating the entire process of "taking a passport photo → passing"

KYC without deposit → Limited-time "20 USDC cashback for first deposit within 72 hours"

The reality is: users typically need to see you online 5-6 times before they finally convert. Cold traffic conversion rates are below 1%, while retargeted warm traffic can reach 5-10%, showing a huge difference. Therefore, it is essential to actively build a retargeting funnel, tracking every drop-off point and re-engaging users at each stage.

This is a Web2 play, but don’t forget: digital banks target both Web3 and Web2 users, and cannot rely solely on Web3 marketing strategies. The vast majority of potential users in Latin America are not crypto-native; they simply want better banking services. Meet them where they are.

VII. Narratives Beyond the Crypto Sphere

FTX's Super Bowl ad was not aimed at crypto veterans but at mainstream audiences across the U.S. In Latin America, you must use the same approach: collaborate with creators outside the crypto space—lifestyle vloggers, sports stars, personal finance educators—letting them share their real experiences of why they use your digital bank for dollar savings, remittances, or daily spending.

When planning campaigns, focus on "pain points" rather than "features": "Tired of your salary shrinking every month?" "Convert your savings to dollars and earn 10% effortlessly; stop holding depreciating pesos." Such slogans resonate far more than "We are a Web3 on-chain digital bank integrating DeFi." Mercado Bitcoin has mastered this approach.

Reality Check

The fact from the front lines is: the ultimate winner will not simply be the one with the flashiest ideas or the most funding, but the one who can combine creativity, capital, brand presence, and the best product experience. No matter how dazzling the marketing is, if the app crashes, KYC takes three days, or a card transaction fails once, users will immediately uninstall and leave.

Strong product + aggressive channels = the only formula for winning in digital banking.

3.4 Localization is Not Optional, But a Matter of Life and Death

This statement should be self-evident, yet countless projects treat it as background noise: if you don’t localize, you are not even in the race.

Language Aspect

Brazil must use authentic Brazilian Portuguese, not just a rough translation from Spanish;

Other Latin American countries use Spanish, but Mexican Spanish ≠ Argentine Spanish; hire local native creators to write copy, avoiding Google Translate;

Customer service must respond in the local language 24/7, not with English templates.

Cultural Aspect

Informal Economy: Millions rely on cash gigs for income; they are the target audience, so first understand how they receive and spend money;

Family-Centric: Remittances are not cold, on-chain transactions, but a means to support families; marketing language must reflect this responsibility;

Trust Barriers: Having experienced bank failures, currency collapses, and government account freezes, users approach any new financial tool with skepticism. You must gradually dismantle these walls with transparent mechanisms, security endorsements, and local partnerships;

Mobile is Everything: 88% of financial activities occur on mobile; the web is merely an accessory, so ensure the app experience is smooth before considering the website.

12-18 Month Window

Traditional digital banks (like Revolut, Nubank) are witnessing the rise of Web3 narratives; tech giants are testing stablecoin integrations, and local banks are cautiously exploring blockchain. The window for first-mover advantage is currently wide open, but it won’t stay that way forever. Projects executing fully in 2025-2026 will capture brand mindshare, user trust, and distribution partners before competition heats up; those who wait will find the market already divided.

Conclusion: The Gunshot Has Been Fired, and the Race Has Begun

The math is simple, and the opportunity is laid out on the table—so why hasn’t everyone rushed in?

Let’s recount the known facts:

The market has been validated. Traditional digital banks have a combined valuation of over $150 billion, serving hundreds of millions of users. Nubank alone has achieved a valuation of $70 billion with fiat accounts. The business model is established, unit economics are sound, and scale effects are in place.

The infrastructure is ready. The market capitalization of stablecoins has surpassed $250 billion; blockchain settlements are completed in seconds with transaction fees under $1; DeFi protocols are offering annualized returns of over 10% on dollar-denominated assets. Technologies that seemed experimental five years ago are now proven production tools.

Regulation has been implemented. The U.S. GENIUS Act, the EU MiCA, and the Brazilian Central Bank framework—clear rules are finally set for 2025. The "survival risk" that once made institutional capital hesitant has disappeared. Banks can collaborate, builders can launch, and investors can place significant bets.

Latin America is crypto-native. With a trillion-dollar crypto trading volume, stablecoins account for 50-90% of on-chain settlements; 122 million unbanked individuals hold smartphones; $163 billion in remittances are still subject to 6-8% fees; and 178% inflation has made "access to dollars" a necessity.

There is a huge valuation gap. The entire Web3 on-chain digital banking sector is valued at less than 7% of Nubank's valuation. Capturing just 5-10% of the traditional digital banking market represents a 10-30 times upside potential.

So, where does the gap come from? Because "seeing" does not equal "doing."

Everyone has read Chainalysis reports and knows that Latin America's crypto trading volume is unparalleled; everyone understands Argentina's soaring inflation and Brazil's millions of unbanked individuals; everyone has witnessed Plasma raising $373 million in 20 days, with TVL soaring to $5 billion. Yet, the vast majority of projects still treat Latin America as an "optional" market:

Launch the English version first, and worry about Portuguese and Spanish later;

Not integrating PIX or using local payment channels;

Only collaborating with global exchanges, ignoring local portals like Mercado Bitcoin and Bitso that hold user trust;

Spending advertising budgets on cold traffic without implementing referral programs;

Trying to appeal to everyone from the start, unwilling to penetrate a specific vertical niche first.

They lack a "battle manual" and are unwilling to execute the plan—this is the window left for a few teams. Opportunities do not belong to "everyone," but to those willing to take immediate action.

The question is no longer "Can Web3 on-chain digital banks dominate Latin America?" but rather "Who will be the first to execute effectively?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。