The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and refuse any market smoke screens!

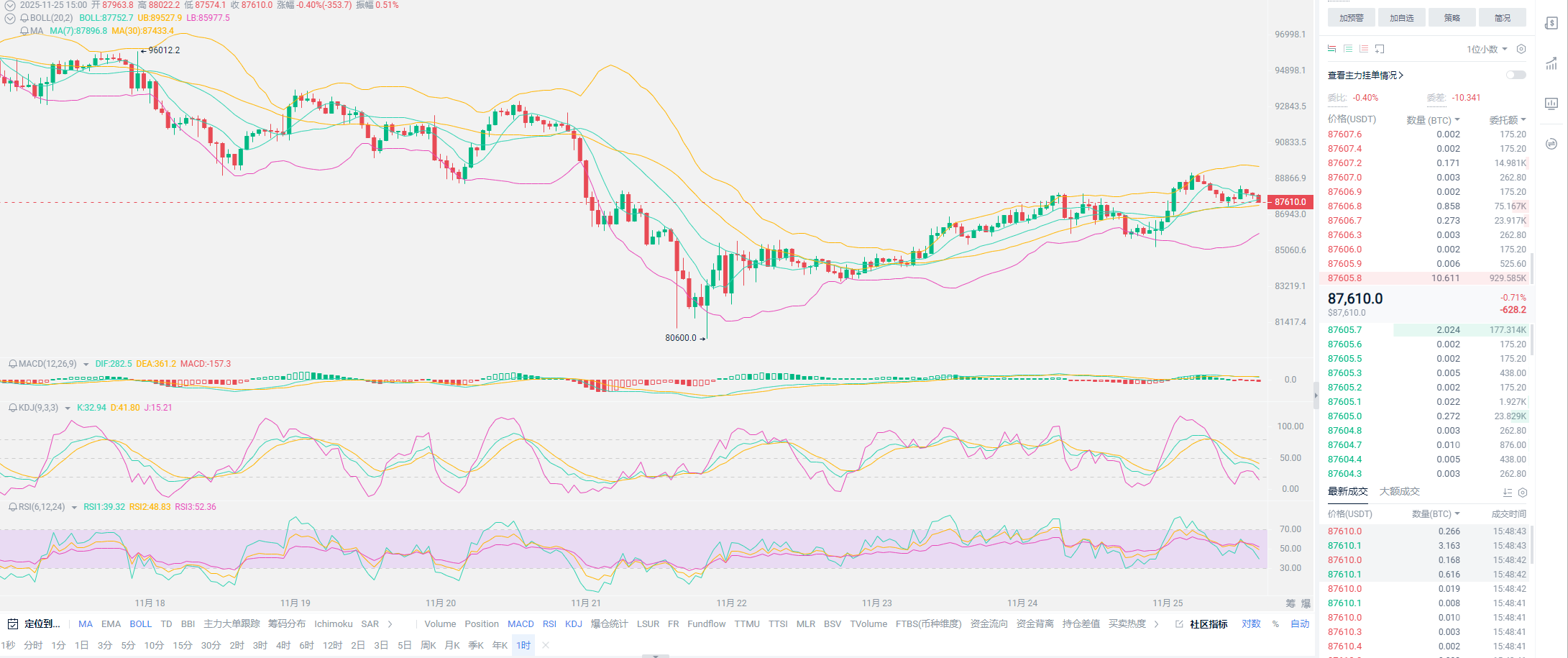

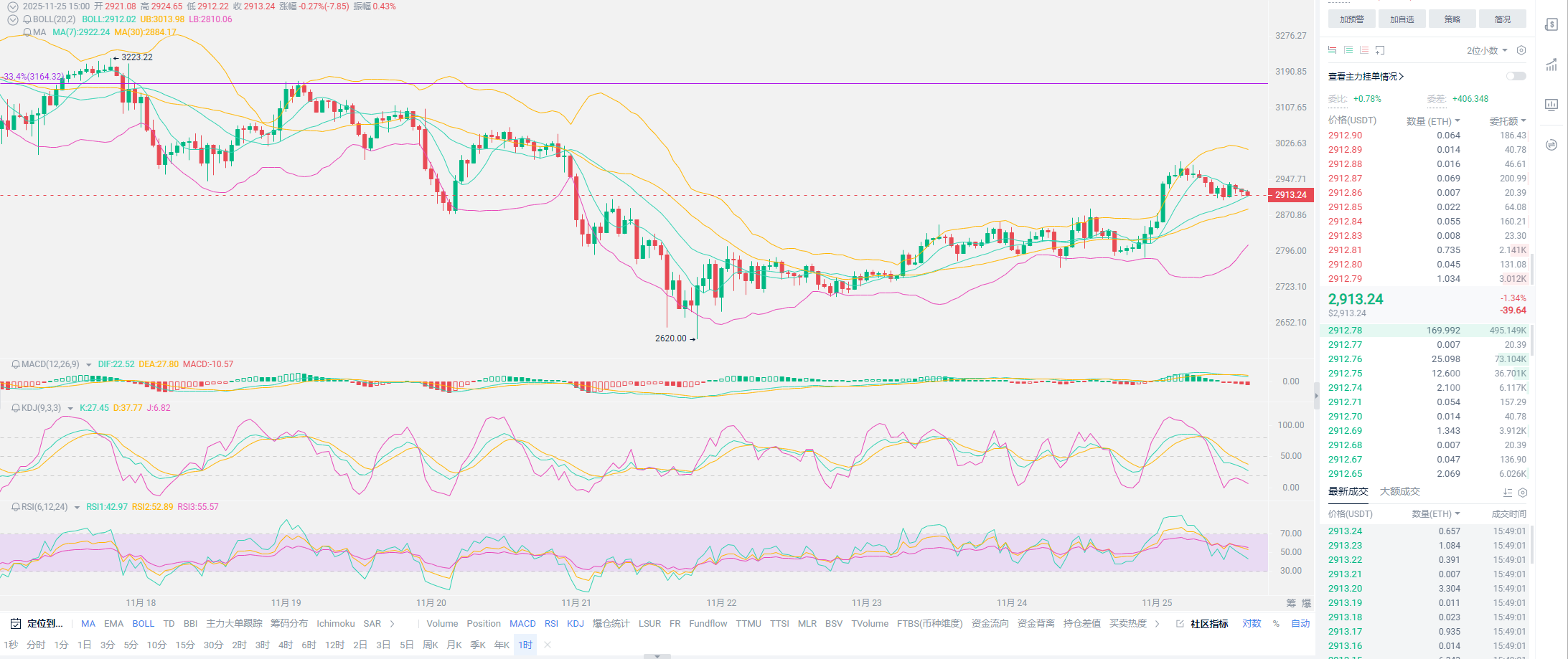

Many friends have been asking Lao Cui, where exactly is the bottom space for this decline? Bitcoin has touched the 80,000 mark twice, and the market trend seems to have exceeded our expectations. At this stage, it can be said that it is completely out of control. Lao Cui has also conducted a long-term review, ultimately attributing the main reason for this decline to the control of the Trump family and the main forces in the U.S. One of the most bizarre aspects of this decline is that there has been no previous news impact, and the market's feedback has been like a dull knife cutting flesh. Since October of this year, many external reports have indicated that Trump has mentioned privately more than once the idea of using the cryptocurrency market to resolve old U.S. debts. This debt resolution, as I have mentioned before, indicates that as long as there is this thought, it proves that there is imaginative space above Bitcoin. People tend to question their mindset during unfavorable times, and the repeated emphasis on such issues only increases everyone's confidence.

Too many friends come to Lao Cui thinking about how to operate to maintain profits after losing their principal. If you only have spot positions and do not consider contracts, then it is to hold firmly and buy the dip. The U.S. has 38 trillion in national debt, and considering the funds in the cryptocurrency market, it would require at least 1.8 million for each Bitcoin to complete the debt resolution task. This conversion method assumes that all 21 million Bitcoins are in the hands of the U.S., which is clearly unrealistic. At this stage, Lao Cui can conclude that Bitcoin can never reach such heights. If such a goal could be achieved, it would only indicate a complete collapse of the gold market and a total collapse of the monetary system. The consequences would be a complete disruption of world order, and World War III would begin. However, you can look for clues; although the current price has been in a downward trend, including the turnover of Bitcoin, Trump's wallet has not shown any signs of loosening, and there has been basically no outflow from the U.S. side, even pension funds have started buying.

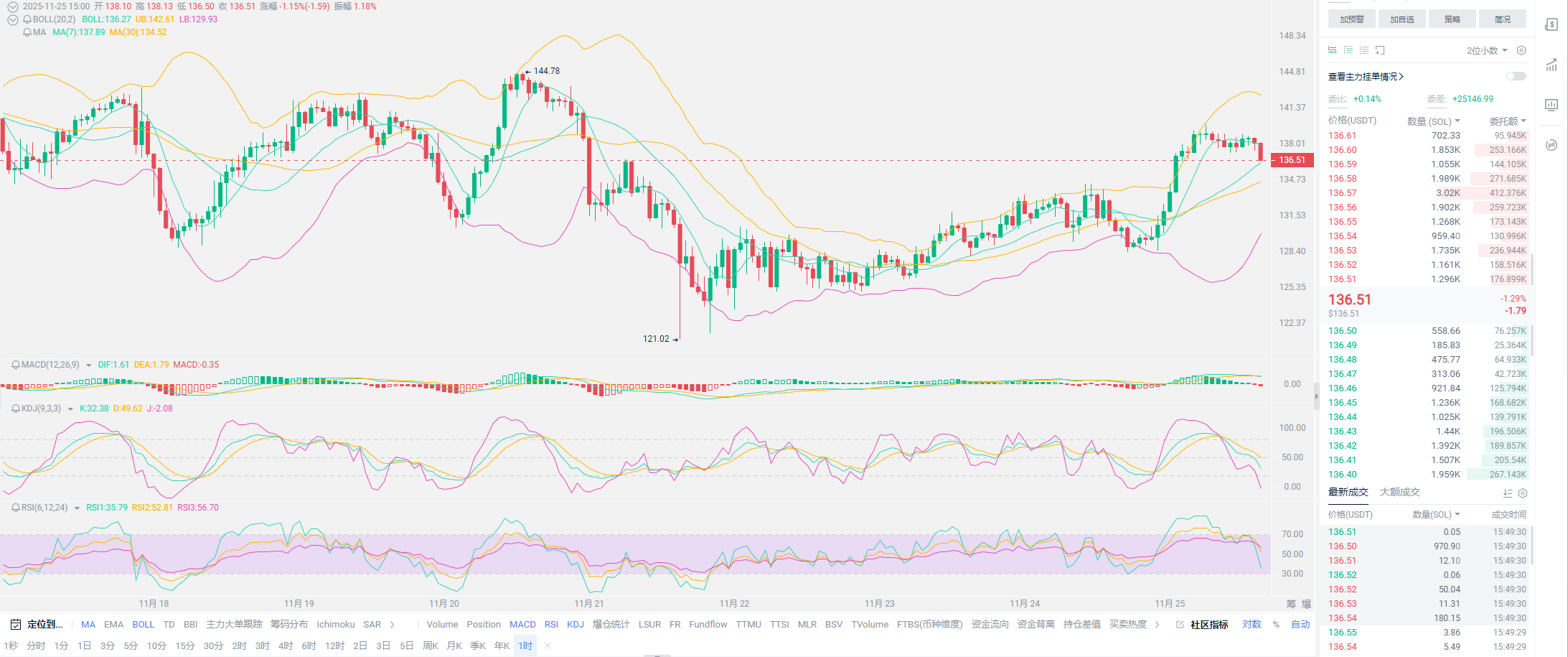

This decline seems more like an external process of Bitcoin flowing into the U.S. From another perspective, the amount of Bitcoin flowing into Coinbase at this stage is almost in the tens of thousands daily. In Lao Cui's view, this decline makes one consider whether Bitcoin below 100,000 is perhaps the only opportunity in this life? Investing on an annual basis will not lead to losses. Many data support Lao Cui's view that this decline is an existence beyond reason; this is not an excuse to shirk responsibility. Today's data shows that the number of addresses holding more than 10,000 Bitcoins has reached a new high in five months, totaling 90. As December approaches, the probability of a 25 basis point rate cut has risen to 70%, confirming that this rate cut will come. A special reminder: as December approaches, everyone needs to be cautious in their trades, especially short sellers, who should clear their positions as soon as possible. Long users should prepare to enter.

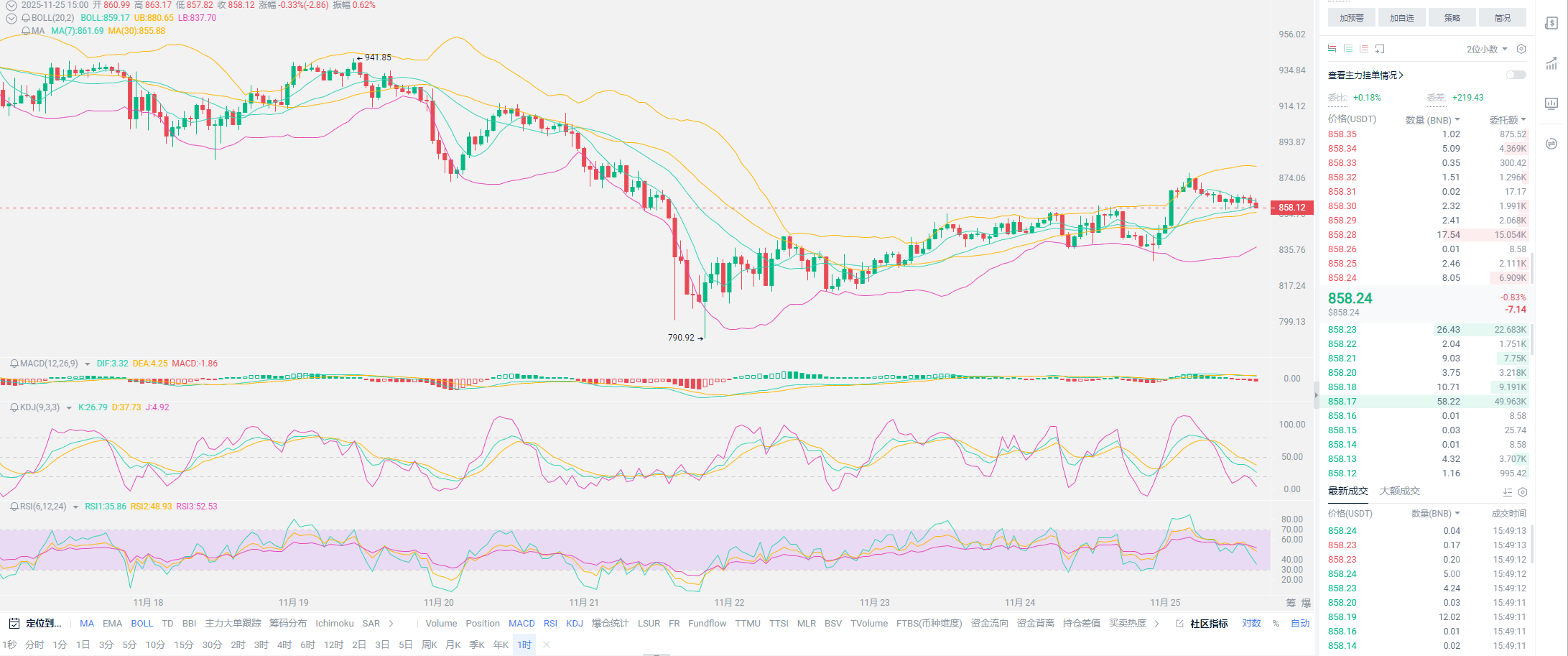

The support from the data level almost indicates that the market is about to reverse; BlackRock's ETF daily trading volume has exceeded 8 billion. Many friends do not have a deep understanding of Bitcoin ETFs. Not all funds flowing into ETFs will enter the Bitcoin market; a considerable portion is for buying into the Bitcoin ecosystem, such as building complete links or Bitcoin derivatives. Just a few days ago, it was revealed that ETF funds were used to buy Bitcoin spot. At this stage, the bullish and bearish news has basically reversed, but this does not mean that the market will start moving now. There will still be bearish trends, but the main body will not change. Since mid-October, Bitcoin has experienced an unconventional violent decline amidst a chorus of good news, especially the spike event on October 11, where the price quickly plunged based solely on a negative news about tariffs on China (the domestic holding ratio is not high, and there is not much correlation between the two). This phenomenon seems more like a deliberate operation to first create good news to guide the market to go long, and then use bad news to wash out the bulls. This method is very common in Lao A.

The volatility in the cryptocurrency market is such because of the lack of legitimate regulation, or rather, the inability to regulate, causing excessive price fluctuations. In this environment, it is necessary for everyone to have the ability to assess the situation and clearly understand why each wave of movement occurs. If it is confirmed that there is a premeditated decline, it can only indicate that the depth will not be too deep. This article is also written in a hurry, so the quality may not be very high; it is more about sharing facts and hot analyses. The investment market is always changing but remains fundamentally the same. Gold is experiencing a short-term correction, and the U.S. stock market has faced consecutive setbacks; after peaks, there will always be short-term corrections. It is a normal rule that the way of heaven avoids fullness, and the way of humanity avoids excess. The cryptocurrency market is no different; most friends face such a downward situation, and losses are the norm, as is the case for Lao Cui. Lao Cui's spot principal is currently also in a state of loss; otherwise, Lao Cui would not have resorted to contracts to make up for the losses in spot trading.

Lao Cui summarizes: All the text in this article seems to summarize the recent market trends. Currently, based on known conditions, the bottom space for Bitcoin and even the entire cryptocurrency market will not be too much. As the time for rate cuts approaches, the market has begun to show signs of recovery. Whether Bitcoin can fall below 80,000 is a major test. The maximum depth is likely to be below 80,000. If there are short positions in the market, those above 80,000 should exit early and not wait for an absolute low point. The best timing for users to buy the dip is always in right-side trading. The current market can only be described as a short-term rebound from the bottom, not the end of the bearish trend; waiting for the market to stabilize above 90,000 is the opportunity for everyone to enter. Of course, spot users can enter freely below 100,000, and they can take profits and exit without waiting for half a year. Today's price points will likely revolve around repairing the market, so for those with short positions, these next two days will be the time to exit; be sure to seize this opportunity, and do not easily enter short positions in the future; the short-term outlook is still bearish. At the end of the article, if you have any questions, feel free to ask; Lao Cui is here to guide you!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one area, aiming for the ultimate victory, while the novice fights for every inch, frequently switching between long and short, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。