Author | @PillageCapital

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Bitcoin has never been the currency of the future; it is merely a battering ram in the regulatory war. Now, this war is nearing its end, and the capital that once supported it is quietly withdrawing.

For the past 17 years, we have convinced ourselves that "magical internet money" is the ultimate form of finance. But that is not the case. Bitcoin is a battering ram in a regulatory battle—a siege weapon created to breach a specific wall, that wall being the state's zero-tolerance stance on "digital anonymous assets."

This mission is essentially complete. Tokenized U.S. stocks have begun to be issued, tokenized gold is legally compliant and growing in scale, and the market capitalization of tokenized dollars has reached hundreds of billions.

As the financial system upgrades and legitimizes, the so-called narrative of "digital gold 2.0" is collapsing, returning to what we truly wanted in the 1990s: tokenized certificates based on real assets.

I. Prehistory: E-gold

To understand why Bitcoin is becoming obsolete, you must first understand why it was created. It was not a miraculous spontaneous growth but was born in the shadow of multiple failed digital currency experiments.

In 1996, E-gold (the world's first true digital gold currency system) went online, and by the mid-2000s, it had about 5 million accounts and processed billions of dollars, proving one extremely important thing: the world indeed needs digital anonymous assets backed by hard value.

Then, it was crushed by the state.

In December 2005, the FBI raided E-gold; in July 2008, the founder pleaded guilty. The message was clear: Centralized digital gold currencies are too easy to destroy; just knock on a door, seize a server, or prosecute a person, and the whole system is over.

Three months later, in October 2008, Satoshi Nakamoto published the Bitcoin white paper. He emphasized that the fundamental flaw of traditional currencies and early digital currencies lies in their high dependence on trust in central banks and commercial banks, while experiments like E-gold further proved that as long as there is a "trust point," attacks are easy.

Satoshi witnessed a true digital currency innovation being stifled. If you want digital anonymous assets to survive, you cannot let them be easily crushed again.

Bitcoin was born for this purpose. It was not created to pursue efficiency but to enhance survivability.

II. The Rebellion Narrative: A Necessary Illusion

In the early days, bringing new users into Bitcoin was almost like magic. You had them download a wallet on their phone, and when the first coins arrived, the shock was visible. They had just opened a financial account and immediately received value, without permission, without any documents, without regulation.

It was like a slap in the face; the traditional banking system suddenly seemed outdated and closed off—you didn't even realize how suppressed you had been until then.

At Money 20/20 in Las Vegas, a speaker displayed a QR code on a giant screen and held a live Bitcoin lottery. The audience sent Bitcoin in real-time, accumulating the prize pool. A traditional finance person next to me quietly said that this speaker might have just violated a dozen laws. He might have been right, but no one cared. That was the point.

This was not just finance; it was a rebellion. An early Reddit post that went viral perfectly encapsulated this sentiment: Buy Bitcoin because "this is a fierce counterattack against the thieves and robbers trying to steal my hard-earned money."

The mechanism driving growth was almost perfect. You fought for the "cause"—posting, promoting, debating, bringing people in—while directly increasing the value of the coins in your own wallet and your friends' wallets. Rebellion brought you economic benefits.

And because the network could not be shut down, it continued to grow after every regulatory crackdown and negative report. Eventually, everyone began to believe that "magical internet money" was the end itself, not a stopgap.

This illusion was so powerful that the traditional system eventually began to cooperate: BlackRock started applying for a Bitcoin ETF, the U.S. president discussed Bitcoin as a reserve asset, pension funds and universities began to buy in, and Michael Saylor convinced convertible bond buyers and shareholders to foot the bill for hundreds of billions in corporate Bitcoin purchases, while mining expanded to consume enough electricity to rival medium-sized countries.

Ultimately, after more than half of the campaign funds came from the crypto industry, the call for cryptocurrency legalization was finally heard. Ironically, it was the government's early heavy-handed crackdown on banks and payment channels that facilitated a $30 trillion "battering ram," forcing regulators to compromise.

III. Collapse: When Victory Stifles Transactions

The track has been upgraded, and the monopoly has broken. Bitcoin's advantage has never been just censorship resistance; it has also been monopoly. For a long time, if you wanted tokenized anonymous value, Bitcoin was the only choice. Bank accounts were closed, fintech companies were scared into inaction by regulators. If you wanted instant, programmable money, you had to accept all of Bitcoin's characteristics—including all its roughness and shortcomings.

So we accepted and embraced it because there was no other choice.

But that era is over.

Just look at Tether to see what happens when there is more than one available track. USDT was initially issued on Bitcoin, but then most of the circulation migrated to the cheaper and more user-friendly Ethereum. By the time Ethereum's gas fees skyrocketed, retail and emerging markets pushed issuance to Tron. The same dollar, the same issuer, just a different channel.

Stablecoins have no loyalty to any chain. They treat blockchains as disposable pipelines. Assets and issuers are the core; the track is merely a combination of fee structures, availability, and system connectivity. In this sense, the "blockchain rather than Bitcoin" faction has actually won.

Once you understand this, Bitcoin's status changes completely. When there is only one available track, everything is forced to sit on it, making it easy to confuse asset value with the value of the underlying pipeline. But when tracks multiply and alternatives increase, value naturally shifts to cheaper, better-connected pipelines.

This is our current situation. Most people outside the U.S. can hold tokenized U.S. stocks; what was once the killer application of crypto, perpetual contracts, is being replicated by compliant institutions like CME; banks are beginning to support the custody and withdrawal of USDT; Coinbase is evolving into a hybrid of a bank and brokerage, where users can remit, write checks, buy stocks, and purchase crypto assets. The network effects that once supported Bitcoin's monopoly are gradually unraveling, replaced by universal network infrastructure.

Once the monopoly disappears, Bitcoin is no longer the only way to access these benefits. It becomes a product competing with compliant, high-quality products that are more in line with users' real needs.

During the competition, we overlooked a simple fact: Bitcoin is a terrible payment system. We still need to scan QR codes and copy long strings of meaningless characters to transfer funds. There are no unified usernames, and cross-chain and cross-layer transfers are an obstacle course; a wrong address means losing assets forever.

In 2017, Bitcoin transaction fees once soared to nearly $100. A Bitcoin café in Prague had to accept Litecoin to stay in business. I once had dinner in Las Vegas and struggled for half an hour to pay with Bitcoin because people were frantically fiddling with their mobile wallets, causing the transaction to fail.

Even today, wallets often have basic malfunctions. Balances do not display, transactions stall, and funds are lost due to incorrect addresses; this is the norm in the crypto world.

People click "sign" in their browsers but have no idea what they are signing. Even mature institutions like Bybit can lose billions due to hacks, with almost no recourse.

We have always told ourselves: these user experience issues are just growing pains. But ten years later, the real improvement in user experience has not come from some clever protocol but from centralized custodial services. These services provide users with password management, account recovery, and fiat recharge channels.

From a technical standpoint, this is the crux of the problem. Bitcoin has never learned how to truly function without rebuilding the intermediary system it seeks to replace.

This transaction is no longer worth the risk. When other underlying systems upgrade, Bitcoin is left with speculation.

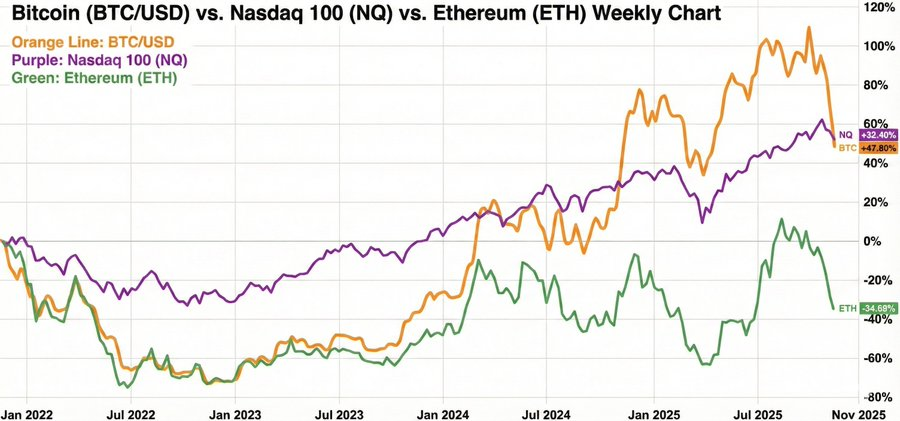

Look at the returns over the past four years (a complete cryptocurrency cycle). The Nasdaq's returns have outperformed Bitcoin; you have borne the survival risks of regulation, endured severe price pullbacks, faced hacks and exchange collapses, and the final returns are not even as good as a regular tech stock index, with the risk premium evaporating.

Ethereum's situation is even worse. The tokens that were supposed to provide the highest returns for risk-taking investors have instead been continuously underperforming.

Part of the reason is structural. A large number of early holders have concentrated almost all their net worth in crypto assets. Now, they have gradually taken profits and exited, leading to a continuous selling pressure worth billions.

New inflows of capital are entirely different. ETF buyers and wealth management institutions mostly just allocate 1% or 2% of their funds as a routine matter. While this capital is sticky, it is not aggressive. These moderate allocations must contend with ongoing OG sell-offs, exchange fees, mining issuance, scam tokens, and hacks to barely maintain prices from falling.

The era where "bearing regulatory blows could yield huge excess returns" is over.

Developers are not foolish; they can sense when technology has lost its edge. Developer activity has fallen back to 2017 levels.

Meanwhile, the core codebase has effectively stagnated. By design, changing a decentralized system is inherently difficult. Those ambitious engineers who once viewed crypto as cutting-edge are now gravitating towards new fields like robotics, space, and AI, where they can do more exciting things than just "moving digits."

When speculative returns diminish, product experiences worsen, and talent departs, the outlook is not hard to imagine.

IV. Error Correction is More Important than "Pure Decentralization"

Decentralization advocates tell a simple story: code is law; money is uncensorable; no one can stop or reverse a transaction.

But most people actually do not want such a system. What they want is a "financial track that works properly" and "someone to help fix things when problems arise."

This is most evident in users' attitudes towards Tether. When funds are stolen by North Korean hackers, Tether freezes those balances. For example, if someone accidentally sends a large amount of USDT to a contract address or a "black hole address," but can still sign from the original wallet, complete KYC verification, and pay the relevant fees, Tether will blacklist the frozen tokens and mint replacement tokens to the correct address. Although this involves some paperwork and time delays, at least there is an executable process. Tether's process includes human intervention, allowing for error correction.

This is certainly a counterparty risk, but it is also the kind of risk that people truly value. If you lose money due to a technical issue or a hack, there is at least a "chance of recovery." In the on-chain Bitcoin world, that possibility is zero. If you paste the wrong address or sign the wrong transaction, that loss will be permanent—no appeals, no customer service, no second chances.

Our trust in issuers is also much stronger than in the early days. Back then, "regulation" meant that early cryptocurrency companies would lose their bank accounts because banks feared regulators would revoke their banking licenses. More recently, we have watched some crypto-friendly banks collapse over a single weekend. Regulators seemed more like "executioners" than "referees." But today, the same regulatory framework has become a safety net: it requires disclosure, forcing issuers to enter auditable structures, and allows the political and judicial systems to punish outright theft. Cryptocurrency and political power are now entangled deeply enough that regulators can no longer casually destroy the entire sector; they can only choose to tame it. In such an environment, "bearing issuer and regulatory risks" seems much more rational than "losing everything because a private key is lost."

No one really needs a completely unregulated financial system. Ten years ago, the failure of the regulatory system made "unregulated chaos" seem more attractive. But as regulated financial channels continue to upgrade and improve functionality, this trade-off is reversing. People's true preferences have emerged: they want "robust financial channels," but they also want "referees on the field."

V. From "Magical Internet Money" to "Tokenization of Real Assets"

Bitcoin has completed its mission. It is that battering ram that broke through the wall blocking E-gold and all similar attempts. It made the idea of "forever banning tokenized assets" politically and socially impossible. But this victory also brings a paradox: when the system finally agrees to upgrade, the value of the battering ram itself will rapidly diminish.

Crypto assets will still play a role, but we no longer need a $30 trillion "rebellion." Hyperliquid can develop prototype functionality with just 11 employees and force regulators to respond. Once a feature runs well in a testing environment, traditional finance will replicate it and fit it into a regulatory framework.

Today's mainstream strategy is no longer to bet most of your net worth on "magical internet money" and hold it for ten years, praying for good luck. That was a reasonable gamble only in an era when old financial channels collapsed and the logic for rising was extremely clear. Capital is already adjusting direction. Even the "unofficial central bank of the crypto world" is shifting: Tether's balance sheet now holds more gold than Bitcoin. Tokenized gold and other real-world assets (RWAs) are rapidly growing.

The era of "magical internet money" is coming to an end. The era of "tokenization of real assets" is beginning. The door has been kicked open, and we can stop worshipping the battering ram and instead focus on the assets and transactions that truly matter in the new world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。