Concerns about a potential collapse in the job market are driving a key figure at the Federal Reserve to break her silence. On November 25, at 8 AM UTC, San Francisco Fed President Mary Daly publicly supported a rate cut at the Fed's December meeting, becoming the latest official to join the intense debate within the Fed.

As she made these remarks, the Fed is facing one of the most complex policy decisions in decades: whether to continue cutting rates to protect a seemingly fragile job market or to pause in order to curb still stubborn inflation.

Although Daly does not have a vote on the Federal Open Market Committee (FOMC) this year, as a close ally of Fed Chair Jerome Powell, she rarely publicly diverges from Powell's position, making her statement a focal point of market attention.

1. Daly's Argument: Job Market Vulnerability Exceeds Inflation Risks

In an interview on Monday, Daly articulated her stance, emphasizing that the likelihood of a sudden deterioration in the job market far exceeds the risk of inflation surging again.

● “In terms of the labor market, I am not as confident as I used to be about getting ahead of the curve,” Daly stated, “It is now sufficiently fragile and faces the risk of non-linear shifts.”

● “Non-linear changes” refer to the potential for a cliff-like deterioration in the job market, where companies may conduct large-scale layoffs all at once, leading to a sharp spike in the unemployment rate in a short period.

● Daly pointed out that once such a change occurs, the Fed would find it difficult to quickly remedy the situation through conventional rate cuts, often requiring fiscal policy support.

2. Risk Comparison: Job Collapse vs. Inflation Out of Control

Daly conducted an asymmetric assessment of the two major risks, which forms the core logic of her support for a rate cut.

● In her view, the probability of a sudden deterioration in the job market is higher, more destructive, and harder to reverse, potentially leading to a rapid spike in unemployment, a cliff in consumption, and a surge in recession probabilities. In contrast, the likelihood of inflation suddenly rebounding is lower and more controllable, which can be corrected through subsequent tightening policies.

● Daly specifically mentioned that the market's previous concerns about the inflationary impact of Trump's tariff policies are much milder than initially expected earlier this year. This judgment directly undermines the core argument of some hawkish members who advocate for pausing rate cuts to prevent inflation from spiraling out of control.

3. Internal Divisions at the Fed: Hawks vs. Doves in a Stalemate

● Overall Landscape: In a Rare Stalemate

○ According to the latest market analysis and media reports (such as Capital Economics), there is significant disagreement within the Fed regarding whether to cut rates in December.

○ The hawks (who advocate for pausing rate cuts) and doves (who support further rate cuts) are evenly matched, with predictions suggesting a potential 6-6 historic tie.

● Dove Camp (Expected 4-6 votes in favor of rate cuts)

○ Key Figures: Including Fed Governor Bowman, Milan, Waller, and New York Fed President Williams.

○ Main Position: They continue to call for rate cuts, believing that preventing economic downturn risks is the current top priority.

○ Key Developments:

■ Williams (who has permanent voting rights and is seen as the "third in command" at the Fed) recently stated that “there is still room for further rate cuts in the short term,” which significantly impacted market expectations.

■ Analysts believe that Fed Chair Powell and Governor Cook may align with Williams' position in the final vote, thus providing the dove camp with the crucial 6 votes.

● Hawk Camp (Expected 6 votes against or skeptical of rate cuts)

○ Key Figures: Comprising four regional Fed presidents (Collins from Boston, Goolsbee from Chicago, Mester from St. Louis, and Schmidt from Kansas City) and two Fed governors (Barr and Jefferson).

○ Main Position: They are skeptical or outright opposed to further rate cuts, more concerned about persistent inflationary pressures.

○ Key Developments:

■ Fed Governor Barr (who has voting rights) recently issued a clear cautious signal, expressing concerns about inflation remaining around 3%, well above the 2% target, and emphasized the need for “care and caution” in monetary policy.

4. 2025 Voting Committee Lineup: Strengthening Hawkish Forces

This change in the 2025 FOMC may lead to a significant strengthening of hawkish forces within the committee.

● The diversity of opinions among the 2025 FOMC voting members will increase. This intensification of internal divisions may pose greater challenges for the Fed in formulating monetary policy, increasing uncertainty about the rate-cutting process in 2025.

● Barron's Weekly believes that the rotating voting members may tilt the Fed's decisions in 2025 towards the “hawkish” side.

● Reuters analysis suggests that the increase in hawkish voting members in the FOMC may exacerbate the risk of divisions, although this may not change policy outcomes.

5. Decision Dilemma: Balancing Dual Mandates

The decision dilemma facing the Fed is essentially the tension between its dual mandates: maximum employment and price stability.

● Daly emphasized in the interview that she still believes the Fed can bring inflation back to the 2% target without causing an increase in the unemployment rate.

● She stated that failing to achieve this would mean a policy failure, even though the economy has been in a “low hiring, low firing” balanced state for some time.

● However, Daly believes that the risk of this balance breaking in a negative direction is increasing. She pointed out that if this situation persists, coupled with some additional layoffs, it could disrupt the balance and make the economy very fragile.

6. Market Impact and Future Path

Following Daly's remarks, the market reacted swiftly and significantly. U.S. Treasury yields fell sharply, with the 2-year yield dropping over 8 basis points at one point, the S&P 500 rallied at the close, and the dollar index came under pressure.

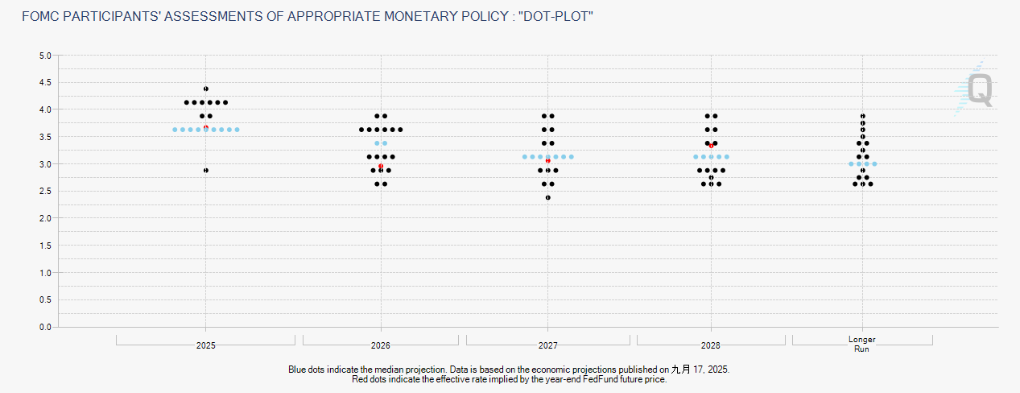

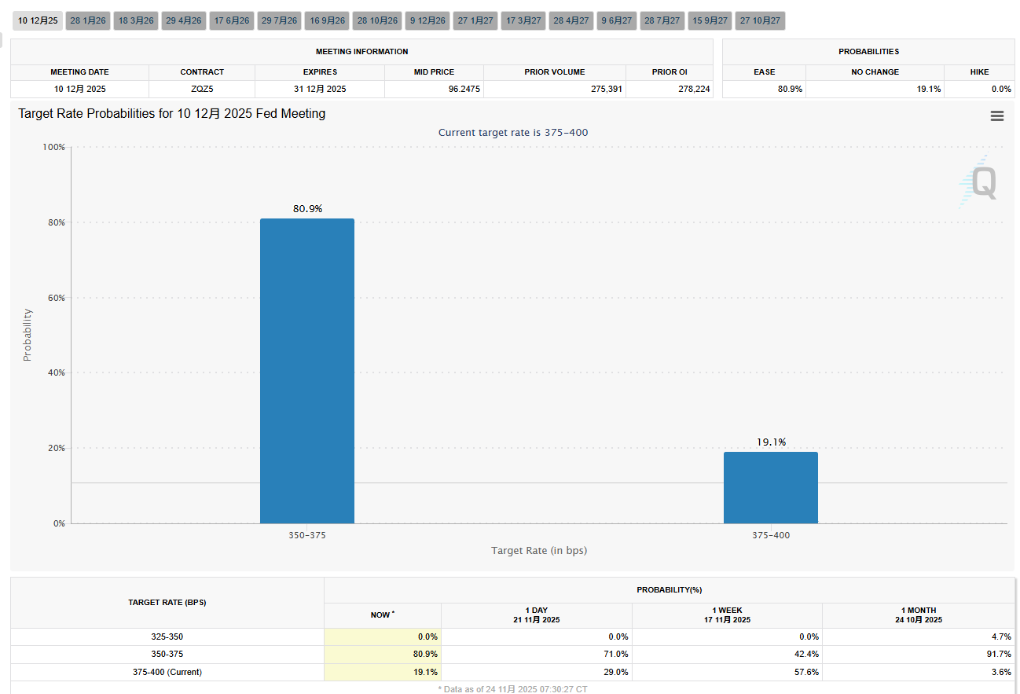

● Federal funds futures indicate that the probability of a 25 basis point rate cut in December jumped from around 65% before the remarks to 82%.

● Expectations for another rate cut in the first quarter of 2025 have also been re-evaluated. The market currently generally believes that unless the December non-farm payrolls or CPI significantly exceed expectations, the Fed is likely to cut rates for the third consecutive time.

● Regarding the future path of interest rates, Daly stated that the Fed should not delay rate cuts now out of fear that it may need to reverse policy direction in the future. “I am not willing to assume that we will be powerless next year,” leading to either an inability to cut rates further in the event of a sharp economic downturn or an inability to raise rates when “necessary.”

Daly's statements are like a stone thrown into a calm lake, creating ripples both within the Fed and in the financial markets. As a close ally of Powell, her support for rate cuts is likely to have the Chair's tacit approval.

Ahead of the monetary policy meeting on December 9-10, Fed officials will continue to digest data and weigh the balance point of their dual mandates.

Regardless of the final outcome, the Fed is navigating an increasingly narrow channel, with one side facing the risk of a “non-linear” collapse in the job market and the other side grappling with concerns that inflation has not fully dissipated.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。