After the New York Federal Reserve Chairman released "dovish" signals last Friday, raising the probability of a rate cut in December to 70%, two Federal Reserve executives spoke last night in support of a rate cut in December. Currently, the probability of a 25bp rate cut in December has increased again, now at 81%, while the probability of maintaining the current interest rate is 19%! In less than a week, the expectation for a rate cut in December has shown a V-shaped reversal!

The cryptocurrency market is also experiencing a breather, with Bitcoin and Ethereum both rebounding. Bitcoin rebounded to 89,000 early this morning, showing signs of challenging the 90,000 mark again, while Ethereum is slightly stronger, approaching the 3,000 mark!

On-chain data now shows an increase in buying pressure, providing momentum for short-term bulls, but whether this can be sustained remains to be seen. I mentioned yesterday morning that the Federal Reserve's speech during the U.S. trading session is very important; any positive remarks could drive a price rebound. Recently, cryptocurrencies like Bitcoin and Ethereum have been significantly affected by this. Therefore, although there is currently a preference for supporting a rate cut, the recent back-and-forth between hawkish and dovish remarks is also a norm, so bulls may still face limitations.

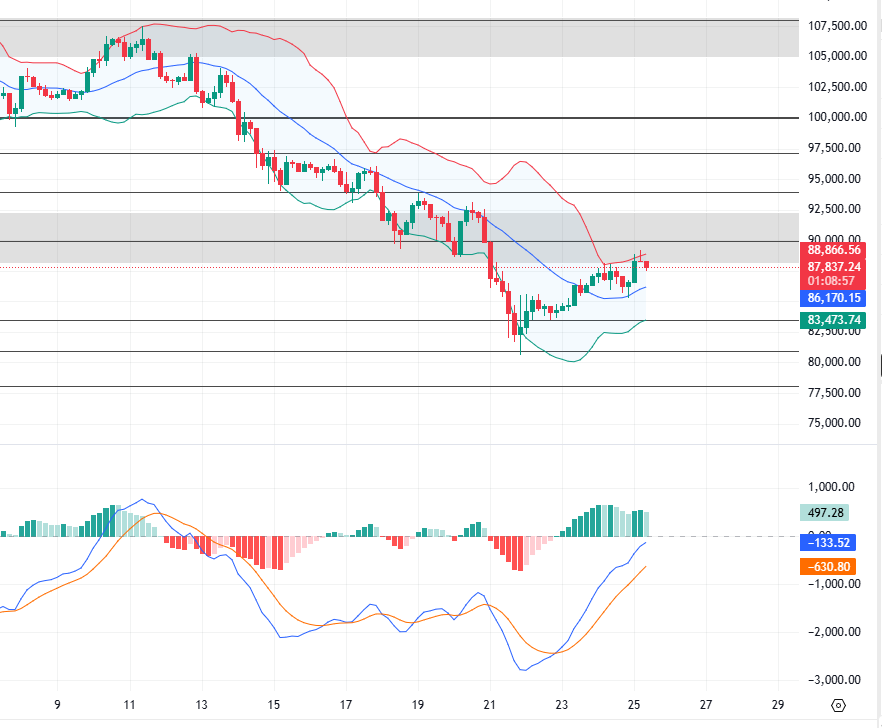

Currently, as prices rise, they are approaching the short-term resistance at the 90,000 mark, which may create pressure. Although there are signs of continued rebound on the hourly chart, resistance still exists above. During the day, we should first pay attention to the rebound and pullback situation in the Asian and European sessions to see the strength of the correction. The focus remains on the dynamics related to the Federal Reserve during the evening U.S. session.

Short-term trading suggestions for Bitcoin:

1. Defend long positions near the 85,000-84,500 area, target 86,000-86,500

2. Short positions near the 89,300-90,000 area on rebound, target 88,000-87,500

Ethereum is currently oscillating and rebounding in line with the cryptocurrency market's rhythm, but it is slightly stronger compared to Bitcoin, having risen more than 5% in the past 24 hours, testing the 3,000 mark again. From a macro perspective, this is benefiting from the rising expectations of a Federal Reserve rate cut, and institutional buying has started, which has also provided some momentum for Ethereum's price rebound.

From a technical perspective, the daily chart shows a large bullish candle with increased trading volume, and it has stabilized above 2,800 USD in the short term. The hourly chart shows a step-by-step upward trend, with bulls temporarily in control. However, there is still considerable pressure above, as the 3,000 to 3,030 USD range is difficult to surpass, and several long-term moving averages are still in a bearish arrangement. To truly reverse and move upward, these hurdles must be crossed.

Overall, this rebound mainly relies on improved market sentiment and capital inflow. The key now is whether it can stabilize around the 3,000 USD mark, as macro uncertainties have not been eliminated, and we still need to observe changes in liquidity and moving average pressures. In the short term, we should first look at the rebound's pressure and pullback consolidation. The upper resistance is currently at the 3,000 mark, while the short-term support is at 2,820 and 2,760 positions.

Short-term trading suggestions for Ethereum:

1. Defend long positions near the 2,800-2,750 area, target 2,860-2,900

2. Short positions near the 2,970-3,030 area on rebound, target 2,900-2,860

[Friendly Reminder: Market conditions change rapidly, suggestions are for reference only, for more real-time consultation, feel free to communicate with me online]

—— Original by the author, welcome to follow and like

This article is exclusively published by (WeChat public account: Jian Crypto) for reference only. Trading itself is not difficult; the challenge lies in human psychology and self-discipline. I hope we can all continuously improve ourselves through learning, refine ourselves, and strive for long-term strength.

Market conditions fluctuate in real-time and have time constraints. Feel free to scan the QR code to follow the public account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the column public account (as shown above) Jian Crypto, and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。