Original Title: The Supercycle Is Here. Just Not the One You Were Promised

Original Author: Lomashuk (@Lomashuk)

Compiled by|Odaily Planet Daily (@OdailyChina); Translator|Asher (@Asher0210)_

Recently, if you casually scroll through X for five minutes, it's easy to conclude that we are back in a bear market. BTC prices continue to decline, and altcoins are plummeting, with retail sentiment nearly evaporated. The ultimate bullish narrative proposed by Su Zhu, which embodied the industry's imagination of "cryptographic assets breaking free from cyclical constraints and achieving escape velocity"—the "Supercycle"—now seems more like a collective illusion.

However, the supercycle has not ended. The real issue is that we have been misreading it all along. In traditional narratives, the supercycle is an eternal prosperity of "digital always going up," where traditional finance fully embraces crypto, and the market breaks free from the four-year cycle of boom and bust. However, as more and more people directly deny this vision, we see a deeper, calmer reality— the supercycle has indeed started, but it is entirely different from what people once imagined. In fact, as crypto accelerates its integration into global finance, 90% of assets in the market are being ruthlessly revalued to near zero.

The Great Divergence in the Crypto Market

The most undeniable reality is that in this cycle, the era of "a rising tide lifts all boats" has completely ended. In past bull markets, retail investors could randomly pick an altcoin on CoinMarketCap and earn decent returns in the next market cycle. But today's market gives a completely different answer— the vast majority of altcoins are declining indiscriminately, with no signs of reversal.

In fact, most crypto assets are slowly heading towards zero. Once-prominent meme coins, countless governance tokens, "Ethereum killers," and air projects from the last cycle— they no longer have the potential to return to historical highs. The price stagnation reflects not a temporary emotional downturn, but rather that they have lost their survival value in the current narrative and fundamentals; they have become true "zombie assets."

Meanwhile, the market structure is maturing, and investors are more rational than ever. Capital is no longer buying into a white paper, a vision, or a Discord community, but is returning to the most basic fundamentals of cash flow, fee income, and use cases.

In this differentiated crypto market landscape, only two types of assets can traverse the cycles:

- Public chains that have become systemic infrastructure— such as Ethereum and Solana;

- Protocols that can continuously generate real fees and income.

Web 3 projects outside of this, no matter how dazzling their narratives, are being ruthlessly eliminated by the market.

The Continuous Evolution of Crypto Adoption

Although speculative sentiment at the price level has hit a low, the underlying architecture of the global financial system is undergoing a silent and profound rewrite. For a long time, "regulation" has been seen as the biggest resistance to the entire industry; however, in 2024 and 2025, this shadow hanging overhead unexpectedly transforms into certainty. The increasingly clear policy framework has not stifled this technology but has instead illuminated a green light for those once viewed as traditional "enemies."

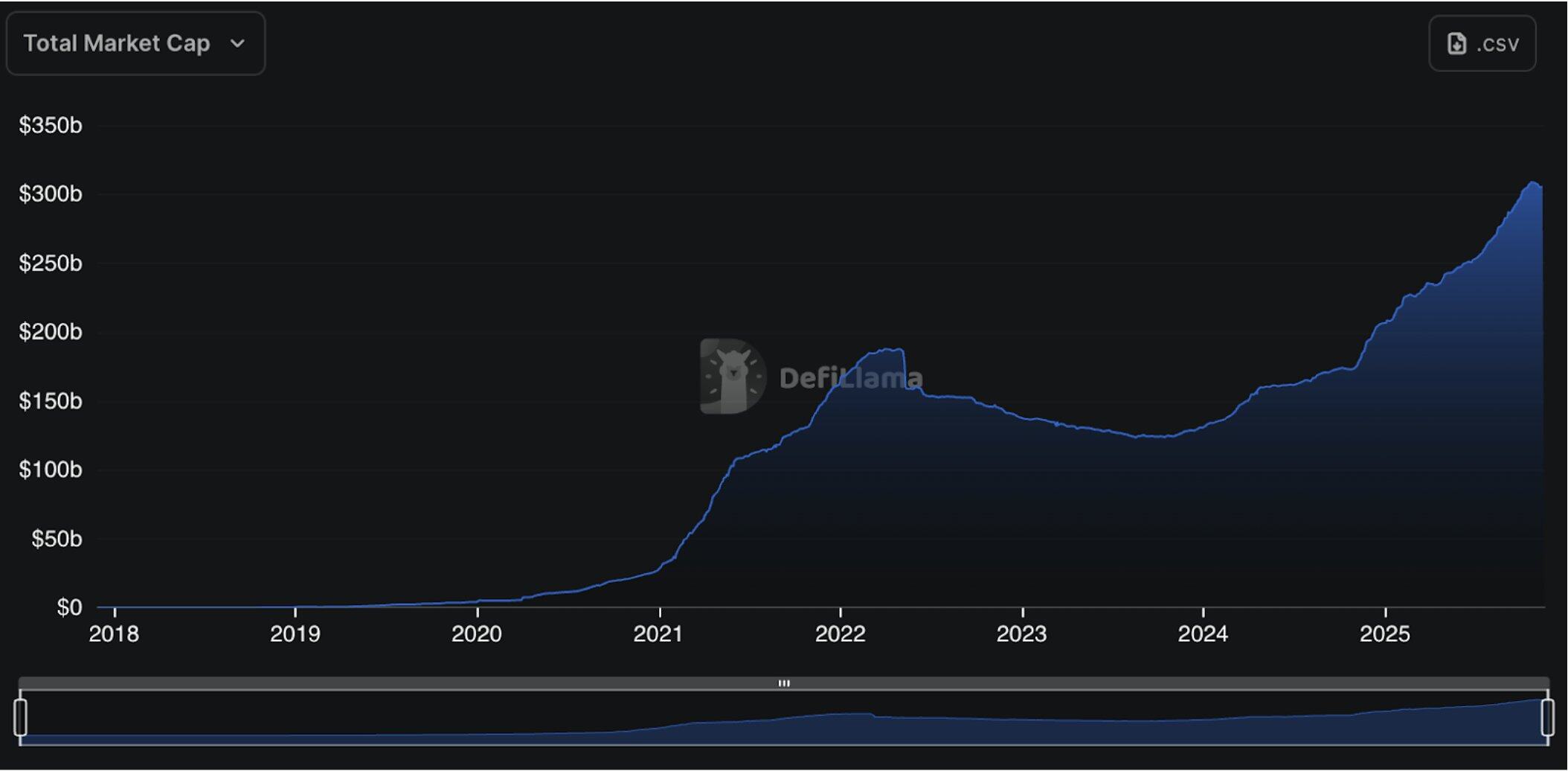

Meanwhile, the supply of stablecoins is hitting historical highs with unstoppable momentum, becoming a new engine of global liquidity.

New types of internet banks are evolving into crypto-native financial gateways, while Visa and Mastercard are directly embedding stablecoin settlements into their core payment networks:

- Visa is processing stablecoin transactions worth billions of dollars, providing underlying power for the next generation of internet banks;

- Mastercard has acquired ZeroHash;

- Stripe has fully shifted to stablecoins as the infrastructure for global payments;

- CashApp has integrated USDC on the front end;

- Revolut has launched zero-fee stablecoin exchange paths.

They may all realize that to continue to survive, they must embrace this technology rather than resist it. This deep integration is forming a sticky and irreversible demand base— it may not reflect in short-term speculative trading but continues to amplify in real global trading volumes.

Funds May Return On-Chain

The macroeconomic environment is quietly changing the rules of the game. As the Federal Reserve lowers interest rates and ends quantitative tightening (QT), the once easily obtainable 4% risk-free return on U.S. Treasury bonds is gradually disappearing. In the face of declining yields, capital will not remain idle.

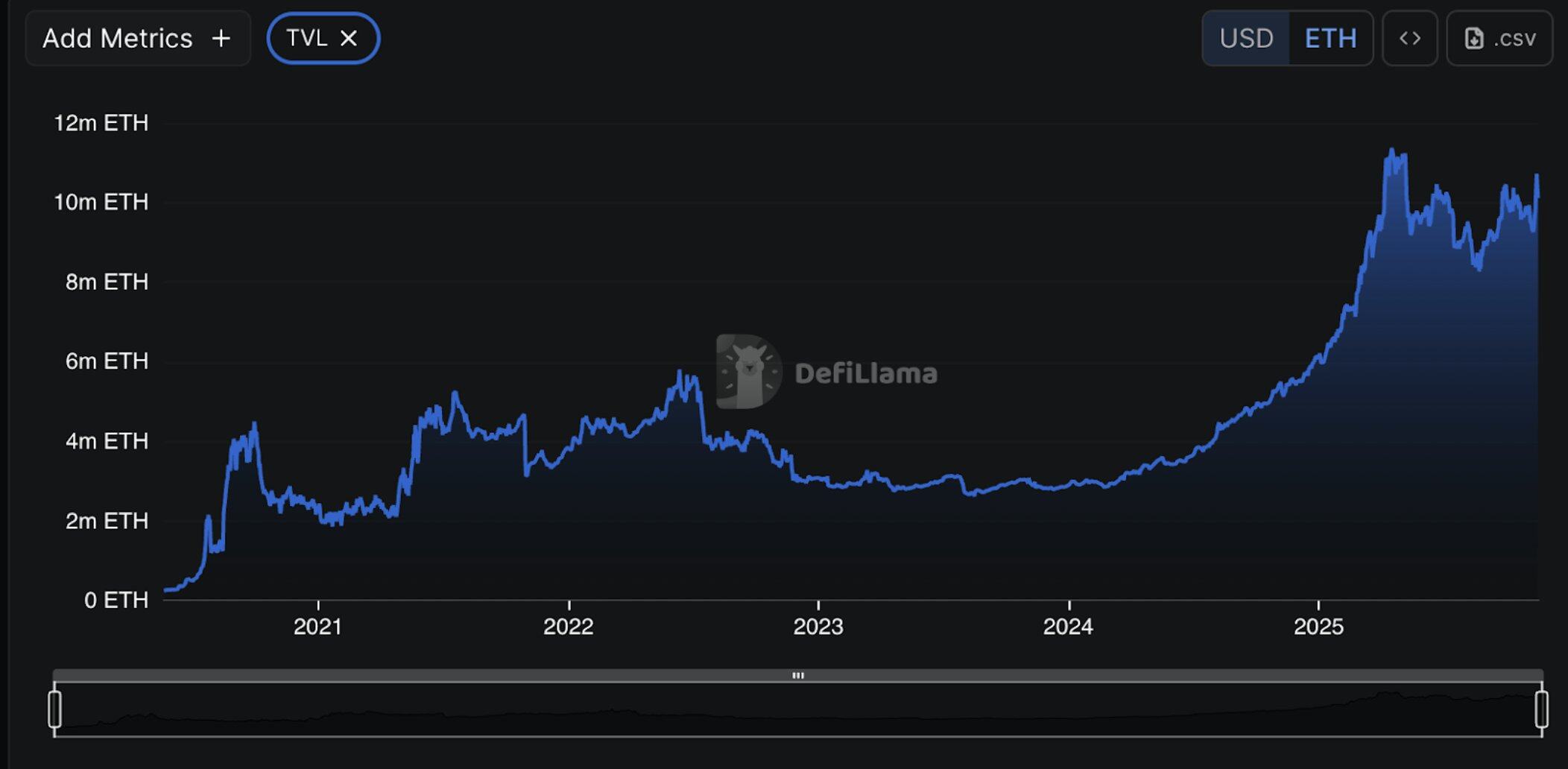

What is about to emerge is a trend of large-scale capital flowing back on-chain, but unlike before, this time the funds will not rush into Ponzi-like projects but will flow into DeFi protocols that can generate real returns through trading fees and lending spreads. As traditional yields decline, the actual returns of DeFi protocols are becoming a new high ground for capital, and data has already shown— Aave's TVL has reached an all-time high, further reflecting the market's strong pursuit of real on-chain returns.

The Next Generation of Decentralized Finance and the AI Economy

Crypto infrastructure is being utilized by new financial primitives, and these primitives have finally found product-market fit. Derivatives and perpetual contracts initially gained preliminary recognition among "geek players," but are now expanding into a liquid on-chain hedging environment available to institutions. Prediction markets have also evolved from niche experiments into reliable global information sources: Google has integrated Polymarket, and Kalshi has partnered with the NBA.

However, the ultimate catalyst that makes this supercycle truly unstoppable is artificial intelligence. We are building a world composed of AI agents that will not walk into a JPMorgan bank to open a checking account but will directly generate wallets, use cryptocurrencies for transactions, exchanges, and fee payments, and they will instantaneously create new auction markets based on user intent.

In this system, blockchain will become the native underlying layer of the "cyber economy," with AI agents coordinating and trading on top of it.

Conclusion

We are in a true supercycle, but it is completely different from the frenzy and short-term surges of 2021. The current supercycle is quieter, more robust, and structural: it no longer relies on speculative sentiment and will not cause all assets to rise together.

In this process, the prices of tokens and projects without actual value will continue to decline, which is the market's natural selection mechanism. Meanwhile, cryptocurrencies are quietly integrating into the global financial system, from stablecoin settlements to institutional on-chain hedging, from payment infrastructure to the AI economy's foundation, blockchain is becoming the new infrastructure of the global economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。