Trump's executive order opening 401k plans to crypto could reshape Bitcoin's demand structure more than ETFs ever did.

While ETF flows are reactive and sentiment driven. 401k contributions are automatic, recurring, and almost never sold.

This effectively links Bitcoin to $9 trillion in long term savings that buy every pay cycle regardless of what the market is doing.

Vanguard data shows only about 5% of participants make any portfolio changes in a given year.

Once allocations are set they tend to stay set.

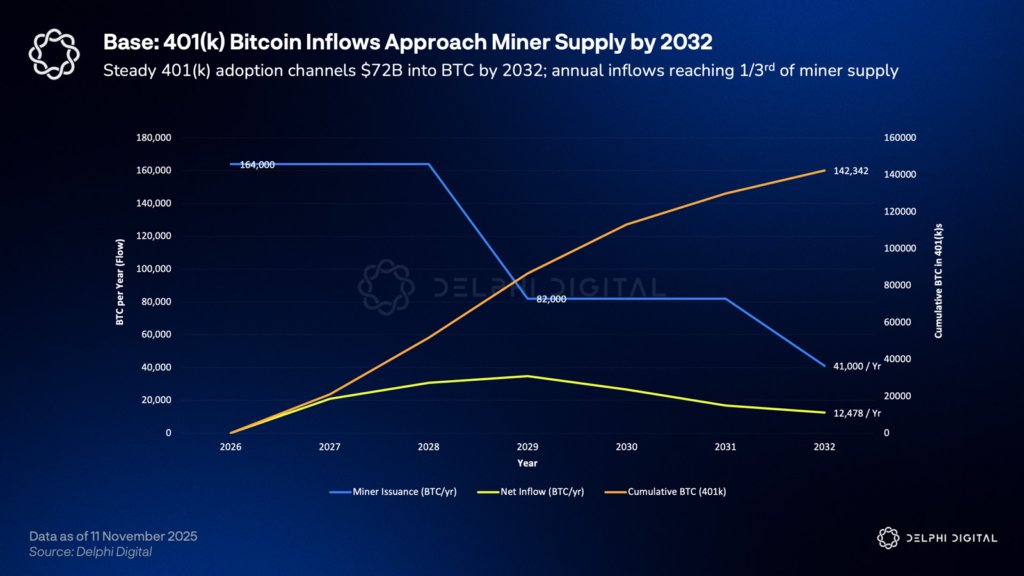

The base case estimate suggests that even sub 1% allocation to Bitcoin could translate into roughly $80 billion in net demand by 2032. The aggressive scenario puts that figure closer to $195 billion.

Retirement plans could form a system that steadily converts earned income into digital scarcity at scale.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。