Selected News

He Yi confirms Binance is recovering improper profits from users involved in Alpha's violations

MON pre-market price falls below $0.03, 24-hour decline reaches 7.59%

PIPPIN briefly rises over 80%, some altcoins rise again today

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content into English:

[POL]

Today, POL is in the spotlight due to significant partnerships and integrations. Mastercard has partnered with Polygon to launch username-based crypto transfer features for self-custody wallets, simplifying the process by replacing complex wallet addresses with readable usernames. Additionally, Europe's largest fintech company, Revolut, has integrated Polygon for stablecoin payments, trading, and POL staking, with cumulative trading volume on Polygon exceeding $690 million. These developments highlight Polygon's growing influence in the crypto space, particularly in payment solutions and fintech collaborations.

[ASTER]

Today's discussions around ASTER focus on its significant price increase, with the token rising over 18% in the past 24 hours, making it the largest gainer among the top 100 cryptocurrencies. The community is buzzing about ASTER's strong performance amid an overall market downturn, comparing it to tokens like HYPE, while also mentioning strategic buybacks and burns. Notable figures, including Binance founder CZ, have further boosted market confidence due to profitable trades in ASTER. Discussions also touch on ASTER's future growth potential, with some predicting its price could soon reach $4.

[METADAO]

Today's discussions about MetaDAO are dominated by the Solomon ICO, which has raised over $100 million, sparking debates about insider trading and market manipulation, especially on platforms like Polymarket. While some praise the success and potential of MetaDAO's Launchpad model, others criticize the lack of transparency and fairness in its processes. This event underscores MetaDAO's growing influence in the crypto space, with many still viewing it as a promising platform for future projects, despite the controversies.

[POLYMARKET]

POLYMARKET continues to be a focal point in the prediction market space, with discussions centering on its partnerships and user engagement. Key topics include the collaboration with chess.com to host a rapid chess championship, high trader retention rates, and integration with Newton Protocol to enhance security. However, issues surrounding insider trading and market manipulation related to the Solomon ICO have sparked debates about the platform's integrity. Despite these concerns, POLYMARKET remains in the spotlight for its potential and challenges.

[KRAKEN]

Today, Kraken has become a hot topic due to Citadel Securities' $200 million investment, raising its valuation to $20 billion. This investment is part of a larger $800 million funding round aimed at supporting global expansion, new payment products, and a planned IPO in 2026. The strategic partnership with Citadel is seen as a significant move, enhancing Kraken's market position and future growth prospects. Additionally, Kraken's strong customer support, low fees, and professional trading interface are highlighted as key advantages, positioning it to potentially surpass Coinbase in valuation.

Featured Articles

On November 22, 2025, a silent showdown is taking place on a Polymarket prediction market. On one side is a mysterious trader named @totofdn. On the other side is an automated arbitrage bot named sunshines. It all started with a trivial order. The arbitrage bot was drained by the trader's counterplay.

At the end of 2025, a Chinese crypto equipment company, Bitmain, was placed on the U.S. national security review list. On November 21, the U.S. Department of Homeland Security launched "Operation Red Sunset," pushing Bitmain to the review table under the guise of national security. The accusations were pointed: investigating whether its equipment has remote backdoors that could deliver a fatal blow to the U.S. power grid in extreme situations. Why would a Chinese mining company be accused of potentially endangering the U.S. power grid? This reflects America's extreme anxiety over core resources. At this moment, Silicon Valley is witnessing the most expensive "silence" in tech history.

On-chain Data

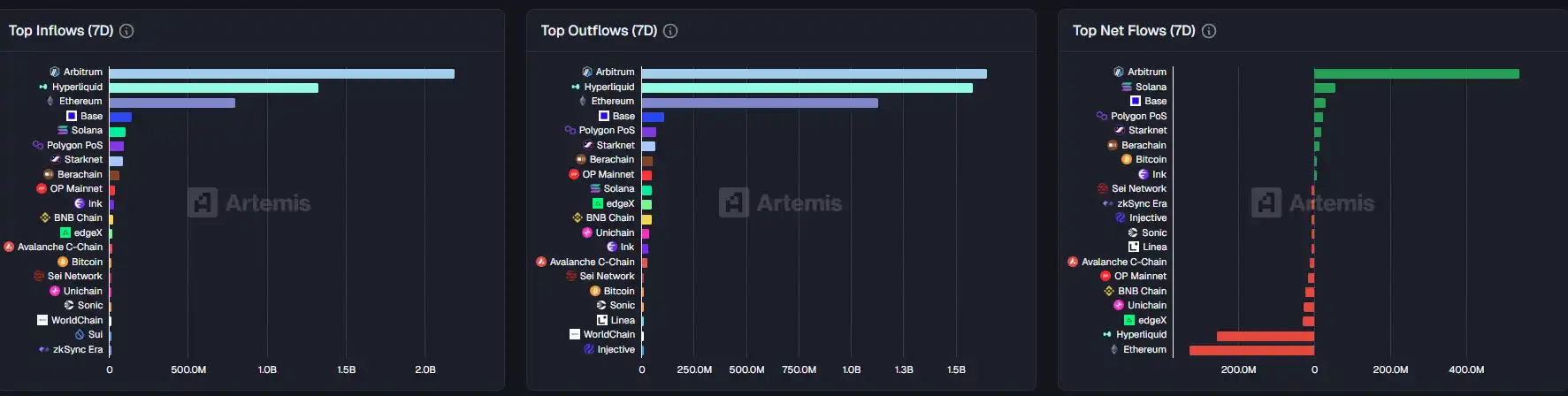

On-chain capital flow situation for the week of November 24

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。