Author: FinTax

News Overview

On November 11, 2025, the tax authorities of Beijing, Fujian, Guangdong, and Sichuan provinces, as well as Xiamen in Fujian and Shenzhen in Guangdong, simultaneously exposed six typical cases of overseas income that were not declared in accordance with the law. The recovered tax amounts and late fees ranged from 510,000 to 6,987,000 yuan. Additionally, the tax authorities are guiding residents who have not declared their overseas income in accordance with the law. At the same time, the tax authorities remind taxpayers who have obtained overseas income that if they discover issues with their previous declarations, especially underreporting or failing to report overseas income, they must promptly correct and eliminate tax risks.

FinTax Brief Commentary

1. Upgraded Tax Supervision of Overseas Income: What Signals Are Being Released by Two Waves of "Tax Supplementation"?

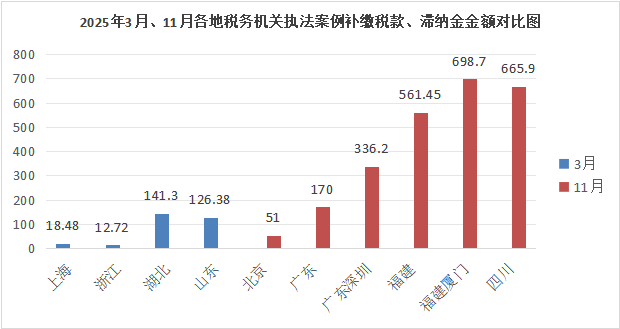

In fact, this is not the first large-scale inspection action by tax authorities this year. As early as March 2025, tax authorities in Hubei, Shandong, Shanghai, and Zhejiang conducted simultaneous inspections, legally addressing the risks of taxpayers who had not declared their overseas income, with recovered tax amounts ranging from over 120,000 to over 1.4 million yuan. The two waves of "tax supplementation" in 2025 exhibit the following distinct characteristics, collectively sending a strong regulatory signal:

Unified deployment across regions, concentrated actions. In the two actions of 2025, tax authorities across the country were highly consistent in the timing and wording of their announcements, indicating that these large-scale investigations into individual overseas investment income were not spontaneous local actions, but rather a new round of CRS special supervision deployed by the State Administration of Taxation.

Multiple rounds of batch inspections, upgraded regulatory methods. Based on tax big data analysis clues, tax authorities can conduct batch inspections and identify suspicious cases of unreported overseas income among residents, while systematically advancing law enforcement using the "five-step work method." The upgrade in regulatory methods signifies a shift from individuals "voluntarily declaring" overseas income to strict substantive inspections by tax authorities.

Variable tax supplementation amounts, covering a wide range of individuals. The enforcement cases disclosed in November 2025 show a significant increase in the average supplementary payment amount compared to March, reflecting a gradual increase in enforcement intensity. Additionally, many residents received text messages and phone reminders from the tax bureau, conveying the message that the targets of tax inspections are no longer limited to a specific group; whether middle-class or high-net-worth individuals, their tax compliance regarding overseas income is under the scrutiny of tax authorities.

The tax supervision of individual overseas income is developing towards precision, normalization, and standardization. The national tax authorities have increasingly smooth channels for obtaining taxpayers' overseas income information, enabling precise identification of unreported overseas income, with broad coverage and deep enforcement. Furthermore, tax authorities emphasize taxpayers' proactive error correction and voluntary rectification in enforcement cases, allowing time and space for taxpayers with tax risks to make corrections. Therefore, 2025 is not only a critical watershed for the internationalization of China's tax supervision but also an important window period for taxpayers to self-check tax risks and implement tax compliance.

Add FinTax CEO Assistant now to experience the enterprise-level cryptocurrency financial suite FinTax Suite, achieving real-time integration and tracking of crypto assets, easily coping with high-frequency trading and market fluctuations, generating various financial reports to meet institutional daily management and audit needs!

2. Why Now? Three Major Backgrounds for the Upgrade of Overseas Income Tax Supervision

2.1 Improving Policy and Legal Foundations

Since 1998, China has gradually clarified the legal basis for taxing residents' overseas income, establishing a legal system for overseas income taxation centered on the "Interim Measures for the Collection and Management of Individual Income Tax on Overseas Income." In 2020, the State Administration of Taxation issued the "Announcement on Individual Income Tax Policies Related to Overseas Income" (SAT Announcement No. 3 of 2020), further detailing the scope of overseas income and its tax collection management methods. In 2025, the State Administration of Taxation issued the "Management Measures for Comprehensive Income Settlement and Payment of Individual Income Tax" (Order No. 57 of the State Administration of Taxation), reiterating that taxpayers obtaining overseas income must declare it truthfully according to relevant regulations. Thus, China has constructed a relatively complete legal system for overseas income taxation, and the strengthening of supervision is a natural continuation of policy implementation.

2.2 International Tax Information Sharing Realized

In February 2014, the Organization for Economic Cooperation and Development (OECD) approved the "Standard for Automatic Exchange of Financial Account Information" (AEOI). This standard consists of two parts: one is the "Model Agreement between Competent Authorities," which stipulates how tax authorities of different countries conduct automatic exchanges of financial account tax information; the other is the "Common Reporting Standard" (CRS), which sets out the requirements and procedures for financial institutions to collect and report information on foreign tax residents' personal and corporate accounts.

In September 2014, China committed to implementing AEOI. In September 2018, China exchanged non-resident financial account tax information for the first time. Following the CRS framework, Chinese tax authorities can obtain key information about residents' accounts held in overseas financial institutions through the information exchange mechanism, including the account holder's name, address, taxpayer identification number, year-end balance or net worth, interest, dividend income, and income from the transfer of financial assets obtained during the calendar year. This information is generally reported by overseas financial institutions to the local tax authorities, which then exchange it with Chinese tax authorities. The entities obligated to report information are extensive, covering various financial institutions such as banks, securities firms, insurance companies, and trusts.

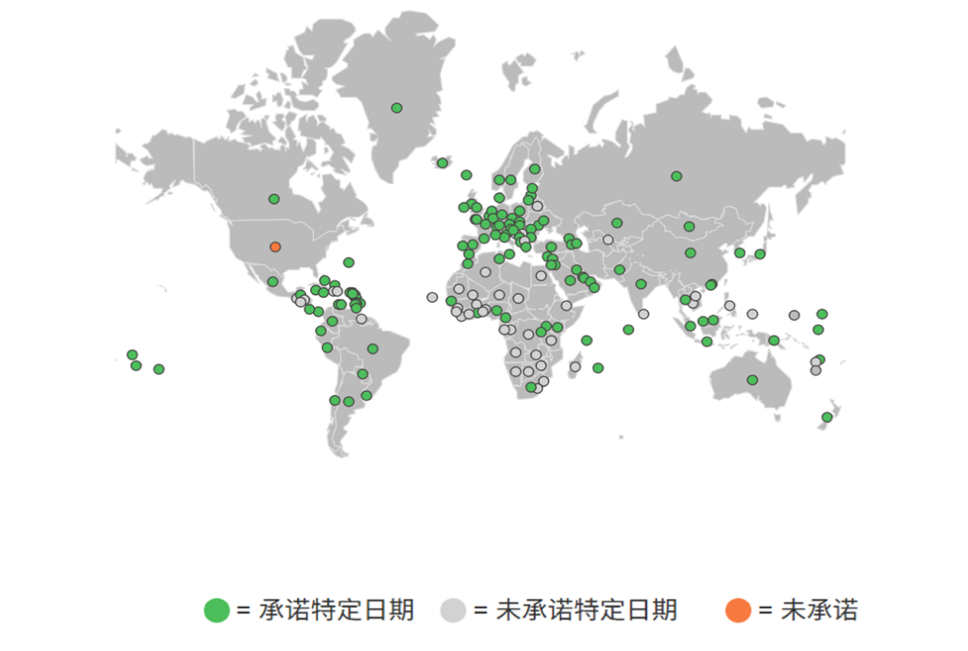

Currently, CRS has been widely implemented globally. China has integrated CRS rules into its domestic policy system, continuously increasing the breadth and depth of international tax collection cooperation, and has achieved regular automatic exchanges of financial account information with over 100 countries and regions (including the UK, Singapore, Switzerland, etc.). The sharing of international tax information provides key data support for tax supervision, enabling Chinese tax authorities to more accurately and comprehensively identify unreported overseas income.

Chart: Current Status of Commitment Execution of the Automatic Exchange of Financial Account Information Standard (AEOI) by Various Countries

2.3 Comprehensive Improvement of Tax Collection and Management Capabilities

China's level of modernization in tax collection and management continues to improve, with increasing efficiency. Against the backdrop of the Golden Tax Phase IV, data-driven tax management, and inter-departmental collaboration, tax authorities can effectively advance the investigation of overseas income, expanding from high-net-worth individuals to ordinary investors, achieving normalization of supervision and precision in law enforcement.

Tax big data has become an important support for tax authorities in implementing tax supervision. Since 2021, the national smart tax supervision platform Golden Tax Project Phase IV (referred to as "Golden Tax IV") has gradually been implemented, achieving comprehensive deep application in 2025 and entering the planning and promotion stage of Golden Tax Phase V. Golden Tax IV is built using modern technologies such as big data, cloud computing, artificial intelligence, and blockchain, supporting real-time sharing of full data across dozens of departments, including taxation, banking, and industry and commerce. This means that through inter-departmental collaboration, tax authorities can integrate relevant payment data, entry and exit data, and foreign exchange payment data of Chinese residents to comprehensively assess risks and implement penetrating supervision. In practice, this plays a crucial role in tax authorities' acquisition of overseas tax-related information and tax risk investigations.

3. Next Stop: The Era of Tax Transparency for Crypto Assets Has Arrived

3.1 Crypto Asset Income No Longer Concealed

Currently, Chinese tax authorities have achieved in-depth supervision of core data such as overseas account balances and investment income through CRS information exchanges and other means. In the context of global tax transparency and regulatory technology upgrades, the tax issues related to cross-border income from crypto assets deserve more attention.

CRS also applies to certain capital flows related to crypto assets. In August 2022, the OECD approved a series of amendments to the CRS framework, incorporating specific electronic currency products and central bank digital currencies; at the same time, it clarified that indirect investments in crypto assets through derivatives and investment tools are also included in the CRS regulatory scope.

Additionally, in October 2022, the OECD launched the Crypto Asset Reporting Framework (CARF). This framework is known as the "CRS for the Crypto World," stipulating the standardized reporting of tax information on crypto asset transactions, with the aim of automatically exchanging such information. Although mainland China has not explicitly joined CARF, as a deeply participating country in CRS, it is expected to follow suit. Hong Kong has committed to participating in CARF exchanges starting in 2028, and exchanges registered in Hong Kong may report information about mainland residents back to the mainland. At that time, mainland tax authorities will find it easier to identify tax violations in this area.

With the expansion of the CRS scope and the implementation of the CARF framework, on-chain activities such as crypto trading, DeFi income, and NFT transactions conducted through overseas trading platforms will no longer be blind spots for taxation. Tax authorities can track users' transaction records on compliant crypto platforms through cross-border information exchanges, and even decentralized wallet addresses may be identified through off-chain identity information associations. Meanwhile, China's tax collection and management policies regarding crypto asset income are yet to be clarified, leaving a policy buffer period for tax planning for crypto asset holders.

3.2 Recommendations for Crypto Asset Tax Compliance Measures

Regarding overdue declarations or willfully concealing overseas income, Articles 32 and 63 of the "Tax Collection and Management Law" stipulate that taxpayers who fail to declare on time or make false declarations will face progressive penalties, including tax recovery, accumulation of late fees, administrative penalties, and even criminal penalties: starting from the day after the statutory declaration deadline, a late fee of 0.05% of the overdue tax will be charged daily; for tax evasion, in addition to full recovery of the tax owed, a fine of 50% to 500% of the tax owed will also be imposed; if the amount involved reaches the standard for criminal prosecution, criminal responsibility will be pursued.

From a legal liability perspective, the costs of late fees and fines for post-payment may far exceed the original taxes owed. Crypto asset holders may consider making truthful tax declarations while reasonably arranging their taxes. Specifically, they can improve their tax compliance system from three aspects: first, comprehensively sorting out overseas assets and income, organizing information on various financial accounts and digital asset wallets opened overseas, and establishing complete transaction record archives. Second, either independently or with the help of professionals, classify various crypto income and accurately assess the nature of the income and tax payment status. If taxes have already been paid overseas, they should also accurately calculate the tax credit amount and obtain legal tax payment certificates. Third, based on the above, establish a personal tax health check mechanism, utilizing professional tax tools to automate the tax compliance process.

4. Conclusion

The continuous actions of tax authorities from the beginning to the end of this year indicate that the tax supervision of individual overseas income is developing towards precision, normalization, and standardization. The domestic "tax supplementation wave" has attracted attention, and the era of global tax transparency has already arrived. As a new asset class, crypto assets are being rapidly incorporated into the tax regulatory frameworks of various countries. For Web3 practitioners, tax planning capabilities are indispensable; only those market participants who proactively adapt to regulatory requirements and focus on compliance can maintain a competitive advantage in the global crypto ecosystem and achieve sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。