Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.89 trillion, with BTC accounting for 58.3%, valued at $1.68 trillion. The market capitalization of stablecoins is $302.8 billion, which has decreased by 0.68% over the past week. Notably, the number of stablecoins has continued to decline for four weeks, with USDT making up 60.93%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen. Specifically, CC 7 has dropped by 32.32%, IP has decreased by 29.88% over the past week, ICP has fallen by 29.03%, BTC has decreased by 13.15%, and ETH has dropped by 14.13%. The cryptocurrency world has seen significant losses, making it a grim sight.

This week, the net outflow from the U.S. Bitcoin spot ETF was $1.211 billion; the net outflow from the U.S. Ethereum spot ETF was $500 million.

Market Forecast (November 24 - November 28):

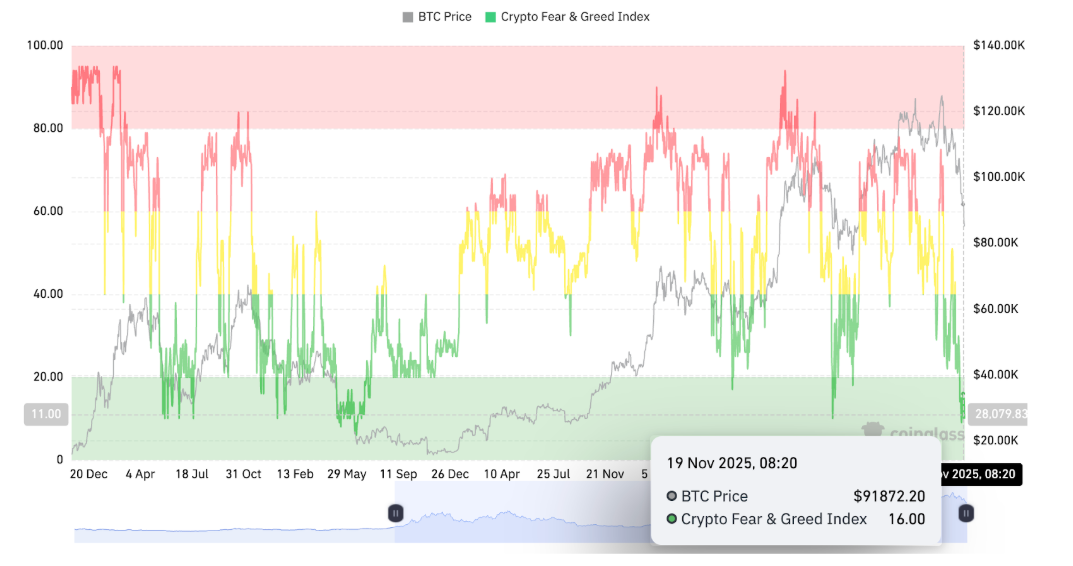

Currently, the RSI index is at 34.42 (weak zone), the fear and greed index is at 15 (higher than last week, in the extreme fear zone), and the altcoin season index is at 43 (neutral, higher than last week).

BTC core range: $85,000-89,000

ETH core range: $2,800-3,100

SOL core range: $128-156

Market sentiment: The market is currently very fragile, experiencing a relentless decline. Any market news, especially with a negative tone, can deliver a heavy blow, and it could drop to even lower levels at any time. This indicates that the market is fleeing due to the "four-year cycle" theory and increasing uncertainty regarding the U.S. economy/government, making decisions to "preserve capital." The recent market decline is primarily driven by: U.S. employment data exceeding expectations, reduced probability of interest rate cuts in December, BlackRock's sell-off, and the continued prosperity of AI draining liquidity. In the short term, a "moderate decline" is highly probable, with the current BTC price reaching the shutdown price for some miners, and the cost price for Strategy is $74,080. Whether the market can stop falling and whether we can see a "Christmas boom" again will depend on the external economic data from the U.S. after it reopens, the interest rate cuts in December, and news of large institutions re-entering the market.

For conservative investors: The current price offers better cost-effectiveness for long-term allocation. Consider making small, incremental purchases near key support levels to lower the average cost. This is not the market bottom, so there is no need to rush into a heavy position all at once.

For active traders: Within the current clear range of fluctuations, consider making light long positions near support levels and reducing positions or shorting near resistance levels. Be sure to set stop-loss orders.

Understanding Now

Review of Major Events This Week

- On November 18, mainstream crypto treasury (DAT) company mNAV fell below 1, with:

Strategy (MSTR) reporting an mNAV (the ratio of enterprise value to the value of held BTC) of 0.937. Strategy's market cap has dropped to $56 billion, currently holding 649,870 bitcoins valued at $59.9 billion.

Metaplanet's mNAV is currently at 0.912. Metaplanet's market cap has fallen to $2.61 billion, currently holding 30,823 bitcoins valued at $284 million.

Bitmine (BMNR) ranks first in Ethereum institutional holdings, currently holding approximately 3.51 million ETH, valued at about $10.63 billion, with its market cap dropping to $8.81 billion, and mNAV currently at 0.83.

SharpLink (SBET) ranks second in Ethereum institutional holdings, currently holding 860,000 ETH, valued at about $2.61 billion, with its market cap dropping to $2.02 billion, and mNAV currently at 0.84.

On November 18, the open-source AI platform Sentient announced that the registration for short-selling qualifications is now live. The deadline is November 29. Additionally, details of the second quarter airdrop event will be announced soon.

On November 19, a spokesperson for the U.S. Department of Labor stated that the department plans to complete the missing weekly initial unemployment claims data from the government shutdown by Thursday local time.

On November 20, NVIDIA (NVDA.O) announced Q3 revenue for fiscal year 2026 of $57 billion, compared to $35.082 billion in the same period last year, with market expectations of $54.923 billion. It also projected Q4 revenue for fiscal year 2026 to be $65 billion, with market expectations of $61.6 billion. The growth rate of chip sales, which are at the core of the AI boom, exceeded Wall Street's expectations, while providing a strong revenue forecast for the current quarter, leading investors to believe that the AI investment frenzy will continue. NVIDIA CEO Jensen Huang stated, "I do not see an AI bubble." The market rebounded after NVIDIA released its earnings report, with Bitcoin rising to $91,500 and Ethereum climbing to $3,000, while NVIDIA's stock rose over 5% in after-hours trading, and Nasdaq futures opened up 1% on Thursday.

On November 20, the public sale of Monad (MON) tokens on the Coinbase platform raised $147.1 million, achieving 78.4% of its total target. This public sale offered 7.5% of MON tokens at a unit price of 0.025 USDC, with an FDV of $2.5 billion, and will close on Sunday, November 23, at 10:00. According to data from the Polymarket website, the probability of the total amount raised by Monad's public sale reaching $300 million is currently reported at 84%, reaching $400 million at 56%, while the probability of reaching $600 million is only 27%.

Macroeconomics

On November 20, the number of initial unemployment claims in the U.S. for the week ending November 15 was 220,000, lower than the expected 230,000;

On November 20, the U.S. unemployment rate for September was 4.4%, higher than the expected 4.30%, compared to the previous value of 4.30%;

On November 20, the U.S. seasonally adjusted non-farm payrolls for September were 119,000, exceeding the expected 50,000, with the previous value revised from 22,000 to -4,000;

On November 21, according to the Federal Reserve's rate observer, the probability of a 25 basis point rate cut in December is 28.5%.

ETF

According to statistics, from November 17 to November 21, the net outflow from the U.S. Bitcoin spot ETF was $1.217 billion; as of November 21, GBTC (Grayscale) had a total outflow of $24.987 billion, currently holding $14.105 billion, while IBIT (BlackRock) currently holds $66.239 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $112.02 billion.

The net outflow from the U.S. Ethereum spot ETF was $500 million.

Envisioning the Future

Event Preview

Bitcoin MENA will be held from December 8 to 9 at the Abu Dhabi National Exhibition Centre (ADNEC);

Solana Breakpoint 2025 will be held from December 11 to 13 in Abu Dhabi.

Project Progress

The Makinafi token MAK will have its ICO on November 25 at Legion;

The TGE date for the meme launchpad Bitdealernet token BIT is November 27;

U.S. Senator Cynthia Lummis stated at the SALT conference in Jackson Hole, Wyoming, that the final draft of the legislation on the structure of the cryptocurrency market is expected to be submitted to U.S. President Trump before Thanksgiving (November 27).

Important Events

The European Union will ban trading of the Russia-related stablecoin A7A5 starting November 25;

On November 26 at 21:30, the U.S. will announce the number of initial unemployment claims for the week ending November 22 (in ten thousands);

On November 26 at 23:00, the U.S. will announce the year-on-year core PCE price index for October.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening) to identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。