As expected, after Williams' speech, the US stock market rebounded, the VIX dropped significantly, and investor sentiment improved. Even during the weekend, when liquidity is typically very low, $BTC managed to maintain a slight rebound. Although purchasing power is still insufficient, at least it has temporarily stopped falling. If it continues to decline over the weekend, it’s hard to predict how low it could go.

The main concern in the market right now is the worry about the Federal Reserve. It’s not just about whether there will be a rate cut in December, but rather the fear that the Fed's "dragging" could lead the US into an economic recession. After all, signs of risk are evident from corporate bankruptcies to rising unemployment rates. Fortunately, Nvidia's earnings report indicates that the AI bubble can still hold for a while.

A rate cut in December is a signal from the Fed that it does not want to let the US fall into an economic downturn. Even if it’s a case of closing the barn door after the horse has bolted, they still want to take action. If the Fed continues to maintain high interest rates and only plans to cut rates twice by 2026, it poses a significant threat to the market.

Looking at Bitcoin's data, today's trading volume is still quite high. Many investors likely see the rebound as the last opportunity to exit, which is why we can observe some loss-making investors reducing their holdings. Especially in recent days, investors who bought the dip, regardless of profit or loss, have shown strong selling. Next, we will have to see how the US stock market reacts on Monday.

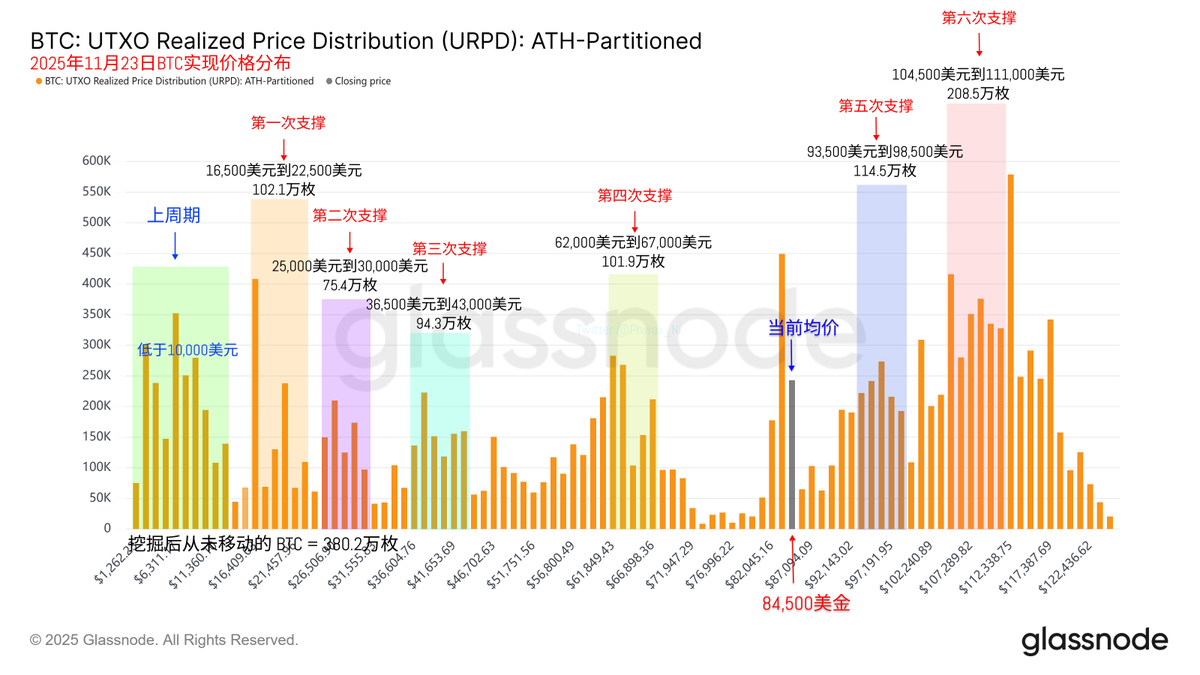

Although there has been a lot of trading, it hasn’t significantly affected the $BTC chip structure. We can still see that the two loss-making support levels show no signs of collapsing, especially at the $112,000 position, where over 570,000 BTC are concentrated, which I did not expect.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。