Yesterday we mentioned that the market had two consecutive lower shadows. For the bears to continue the decline, they needed to engulf those two lower shadows. Today, we can see that the bears have indeed engulfed the previous two lower shadows, and the market has also experienced a decline, validating our judgment about the bears. At the same time, another lower shadow was formed today. Should we consider bottom fishing here? Let's analyze the market first, but our short positions are already being exited in batches.

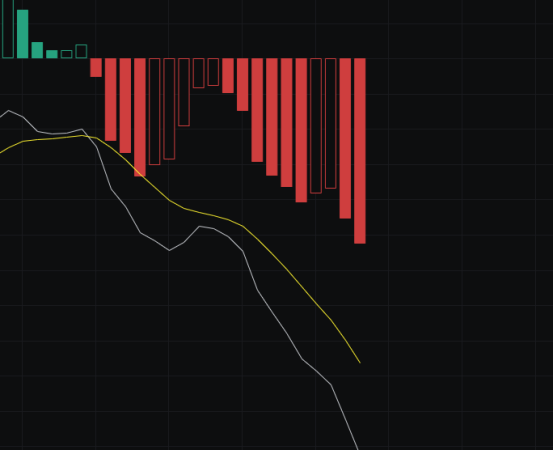

From the MACD perspective, the energy bars continue to decline, and both the fast and slow lines are also falling. The MACD indicates a bearish trend, so we continue to hold a bearish outlook here.

Looking at the CCI, after a few days of consolidation, it has reached a new low in the past two days. With such a low indicator, can we bottom fish? At the very least, we should wait for signs of a bottom.

From the OBV perspective, it continues to flow out and has reached a new low. Those who bottom-fished earlier have been trapped, and there are no signs of a bottom at this position, making it unsuitable for bottom fishing.

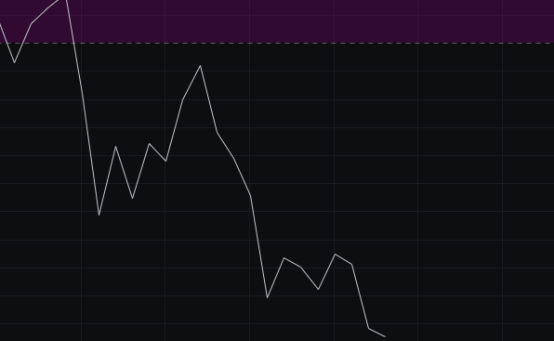

Looking at the KDJ, since it broke below 20, it has dropped by more than ten points, which aligns with our previous judgment that a KDJ break below 20 would lead to further declines. Currently, it is consolidating here, but even in consolidation, the market still trends towards bearishness.

From the MFI and RSI perspectives, both indicators have entered the oversold zone. If the bulls cannot exert force to pull the market back and keep the indicators hovering in the oversold area, the market will continue to decline.

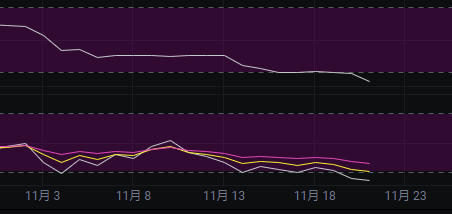

Looking at the moving averages, they have been pressing down for several days, with no signs of flattening. Therefore, from the moving average perspective, the bearish trend remains, and we will continue to maintain a bearish outlook.

From the Bollinger Bands perspective, the current trend is still within a downward channel, although the upper band is not showing a significant decline. Logically, with such a large drop, the upper band should also follow suit. We will continue to observe this. At the same time, the price has approached the lower band, but there has not been a negative divergence, so we can consider that it has not fully dropped yet, leaving room for further declines.

In summary: Yesterday's market engulfed the lower shadows of the previous two days, and the trend aligns with our judgment. Today, another lower shadow was formed, and based on our analysis of the indicators, it is not yet the time to bottom fish. Today's resistance is seen at 85000-86500, and support is at 81000-79000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。