Author: Yue Xiaoyu

1. What is the biggest fear in the current market?

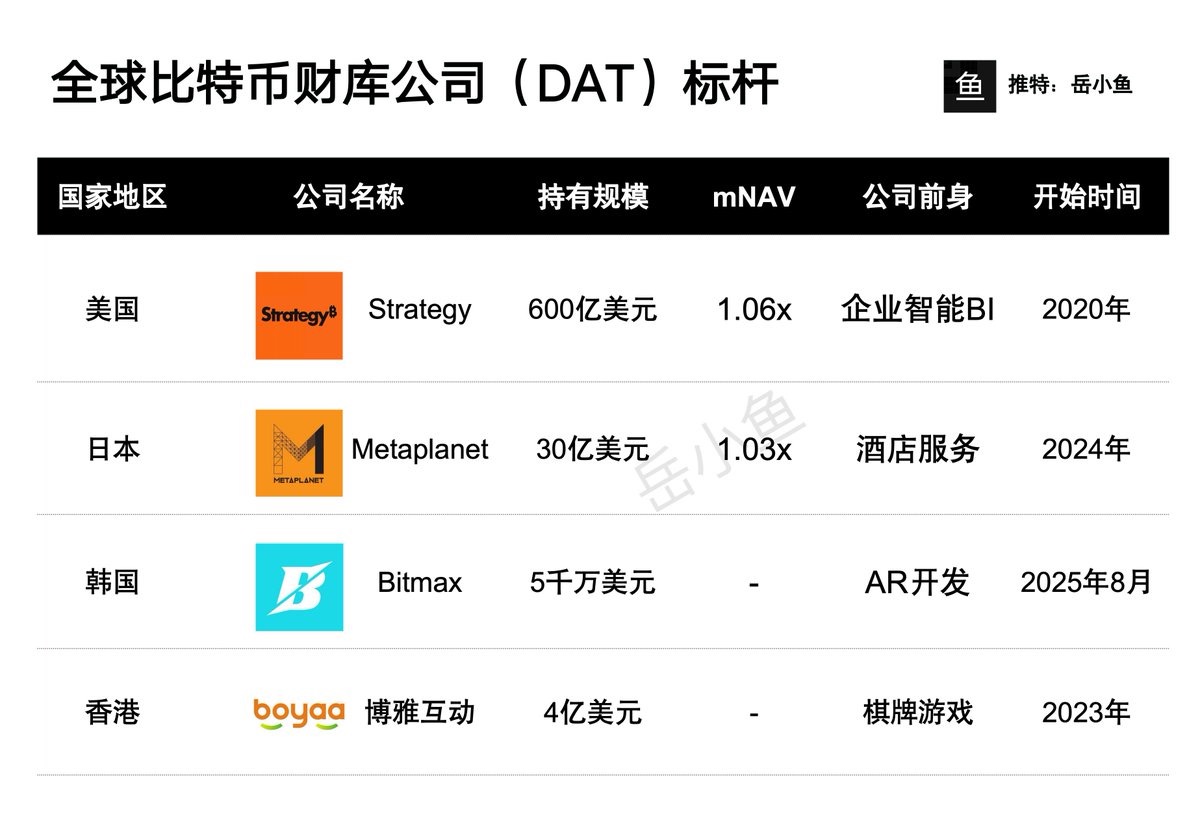

It is the selling of coins by DAT (Digital Asset Treasury) companies.

Previously, listed companies borrowed money to buy coins, and the market was thriving, with prices spiraling upwards;

Now that the market has worsened, once these companies start selling coins, confidence will collapse, leading to a market crash.

2. How to assess the current operational status of DAT companies?

The main indicator currently used in the market is: mNAV (Market Net Asset Value).

In other words, how many coins a company holds is its asset, mainly looking at the ratio of the company's market value to its digital asset holdings.

If the ratio is greater than 1, this indicates a premium given by the market, suggesting that investors recognize the company's value and future growth potential;

If the ratio is less than 1, it indicates that the assets exceed the market value, and the assets cannot support the market value, which will trigger a reassessment of the DAT model by the market.

Currently, the mNAV of the leading DAT company, Strategy, is 1.03, close to a negative premium.

At this point, a death spiral is very likely to occur: asset devaluation → further decline in stock price → financing difficulties.

It can be said that the current market situation is a significant test for the DAT model.

3. The DAT model is not just about traditional companies borrowing money to buy coins; more importantly, the interests of traditional companies are tied to the ecosystem of this token.

For example, if a company is an Ethereum DAT, to increase the value of its own stock, it needs to find ways to boost the coin price, which naturally creates a strong incentive to participate in the ecosystem of this token.

For instance, participating in staking on PoS chains to enhance network security, or lending tokens to DeFi protocols to provide liquidity, or even investing in startups within the ecosystem to support practical applications.

Only when the ecosystem thrives can the price of Ethereum be supported, and the company's stock can have a narrative space.

Thus, listed companies will become the biggest promoters of the token ecosystem.

Even though recently Ethereum founder Vitalik has come out to say that centralized companies pose a threat to decentralized Ethereum.

But conversely, this is also a significant driving force for the development of the Ethereum ecosystem.

4. Returning to BTC, Bitcoin treasury companies will also drive the development of the Bitcoin ecosystem.

So how specifically will they promote it?

First, it is still necessary to make Bitcoin flow.

Currently, traditional institutions buy coins but still keep them in cold wallets or centralized custody platforms, generating no additional income.

Therefore, DAT companies want to increase their premium; they cannot simply hoard coins; they must use digital assets to create revenue, which provides narrative space.

This is the intrinsic driving force behind the renaissance of the Bitcoin ecosystem.

Recently, I just read a research report released by the Bitcoin Layer 2 network GOAT Network, which similarly explains this point to the market, with the vision of becoming the revenue layer for Bitcoin.

Thus, the market test faced by the DAT model is not just the death spiral caused by falling prices; more importantly, it needs to answer a question: how to create $2 worth of value from $1 worth of BTC?

Hoarding $1 worth of Bitcoin can only support a $1 market value for the company, but ways need to be found to create more premium.

Helping digital assets build ecosystems is one of the ways to break the deadlock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。