Original Author: arndxt

Original Compilation: AididiaoJP, Foresight News

Over the past few months, my stance has undergone a significant shift:

Initially, I moved from a bearish to a bullish perspective, believing that the market was simply experiencing a general pessimism that often sets the stage for a short squeeze. However, now I genuinely worry that the system is entering a more fragile phase.

This is not about a single event, but rather considering five mutually reinforcing dynamics:

The risk of policy missteps is rising. The Federal Reserve is tightening financial liquidity amid data uncertainty and visible signs of economic slowdown.

The AI/tech conglomerate is shifting from a cash-rich model to a leveraged growth model. This shifts the risk from pure equity volatility to more classic credit cycle issues.

Discrepancies in private credit and loan valuations are beginning to surface, with early but concerning signs of model-based valuation pressures emerging beneath the surface.

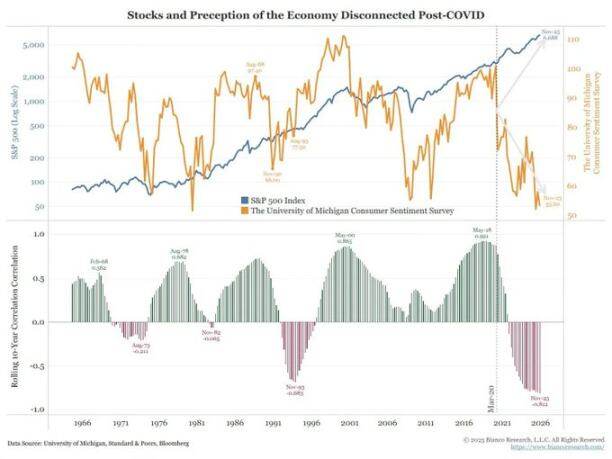

Economic division is solidifying into a political issue. For an increasing number of people, the social contract is no longer credible, which will ultimately be reflected in policy.

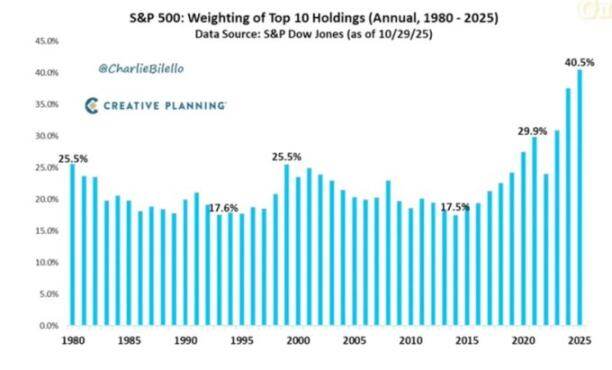

Market concentration has become a systemic and political vulnerability. When about 40% of the index market value is actually composed of a few tech monopolies sensitive to geopolitical and leverage issues, it becomes a matter of national security and policy objectives, rather than just a growth story.

The basic scenario may still be that policymakers ultimately "do what they always do": inject liquidity back into the system and support asset prices before the next political cycle arrives.

But the path to achieving this outcome looks bumpier, more credit-driven, and politically more unstable than the standard "buy the dip" strategy assumes.

Macroeconomic Stance

For most of this cycle, holding a "bearish but constructive" stance has been reasonable:

- Inflation is high but slowing.

- Policy remains broadly supportive.

- Risk asset valuations are elevated, but adjustments typically encounter liquidity interventions.

Now, several factors have changed:

- Government shutdown: We have experienced a prolonged shutdown that disrupted the release and quality of key macro data.

- Statistical uncertainty: Senior officials themselves acknowledge that federal statistical agencies are compromised, which means confidence in those data series that anchor trillions of dollars in positions is declining.

- Turning hawkish amid weakness: Against this backdrop, the Federal Reserve has chosen to adopt a more hawkish stance in both interest rate expectations and its balance sheet, tightening even as leading indicators deteriorate.

In other words, the system is tightening amid ambiguity and emerging pressures, rather than moving away from these pressures, which presents a very different risk profile.

Tightening Policy in an Uncertain Environment

The core concern is not just about policy tightening, but where and how it tightens:

- Data uncertainty: Key data (inflation, employment) have been delayed, distorted, or questioned following the shutdown. The Federal Reserve's own "dashboard" has become less reliable precisely when it is most needed.

- Interest rate expectations: Although leading indicators point to deflation emerging early next year, the market-implied probability of near-term rate cuts has been pulled back due to hawkish comments from Federal Reserve officials.

- Balance sheet: The stance of the balance sheet under quantitative tightening, along with a bias towards pushing more duration into the private sector, is essentially hawkish for financial conditions even if policy rates remain unchanged.

Historically, the Federal Reserve's errors have often been timing errors: raising rates too late, cutting rates too late.

We may be on the verge of repeating this pattern: tightening policy amid slowing growth and data ambiguity, rather than preemptively easing in response.

AI and Tech Giants Become Leveraged Growth Stories

The second structural shift is characterized by changes in the features of tech giants and leading AI companies:

Over the past decade, the core "seven giants" have effectively been equity-like bonds: dominant businesses, massive free cash flow, large stock buybacks, and limited net leverage.

In the past two to three years, this free cash flow has increasingly been reinvested into AI capital expenditures: data centers, chips, infrastructure.

We are now entering a phase where incremental AI capital expenditures are increasingly financed through debt issuance, rather than solely relying on internally generated cash.

The implications are as follows:

Credit spreads and credit default swaps are beginning to fluctuate. As leverage rises for AI infrastructure financing, companies like Oracle are seeing credit spreads widen.

Equity volatility is no longer the only risk. We are now witnessing the beginnings of classic credit cycle dynamics in industries that previously felt "invincible."

Market structure amplifies this. These same companies occupy an oversized share of major indices; their shift from "cash cows" to "leveraged growth" alters the risk profile of the entire index.

This does not automatically mean the end of an AI "bubble." If returns are real and sustainable, debt-financed capital expenditures can be justified.

But it does mean that the margin for error is much smaller, especially in a higher interest rate and tighter policy environment.

Early Fault Lines in Credit and Private Markets

Beneath the surface of the public markets, private credit is showing early signs of stress:

The same loan is being valued by different managers at significantly different prices (e.g., one at 70 cents on the dollar, another at about 90 cents).

This divergence is a typical precursor to broader disputes between model-based and market-based valuations.

This pattern resembles the following situations:

- 2007 — Rising bad assets and widening spreads, while stock indices remained relatively calm.

- 2008 — Markets previously viewed as cash equivalents (e.g., auction rate securities) suddenly froze.

Additionally:

The Federal Reserve's reserves are beginning to decline.

There is an increasing recognition internally that some form of balance sheet expansion may be needed to prevent issues within the financial system.

None of this guarantees a crisis will occur. But it aligns with a situation in which credit is quietly tightening while policy remains framed as "data-dependent" rather than preemptive.

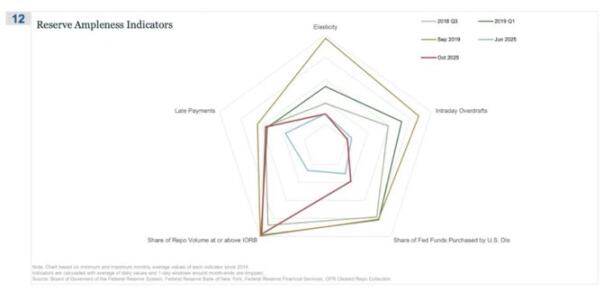

The repo market is where the "reserves are no longer abundant" story first becomes apparent.

On this radar chart, the "percentage of repo transactions at or above the IORB rate" is the clearest sign that we are quietly exiting a truly abundant reserve regime.

In Q3 2018 and early 2019, that line contracted relatively: ample reserves meant that most secured financing comfortably traded below the lower bound of the interest on reserves balance (IORB).

By September 2019, just before the repo market collapsed, that line sharply expanded as more repo transactions were conducted at or above the IORB rate, a typical symptom of collateral and reserve scarcity.

Now looking at June 2025 vs. October 2025:

The light blue line (June) remains safely inside, but the red line for October 2025 extends outward, approaching the contours of 2019, indicating that the proportion of repo transactions touching the policy rate lower bound is rising.

In other words, dealers and banks are pushing up quotes for overnight financing as reserves are no longer comfortably abundant.

Combined with other indicators (more intraday overdrafts, higher purchases of federal funds by the U.S. discount window, and an increase in delayed payments), you get a clear message.

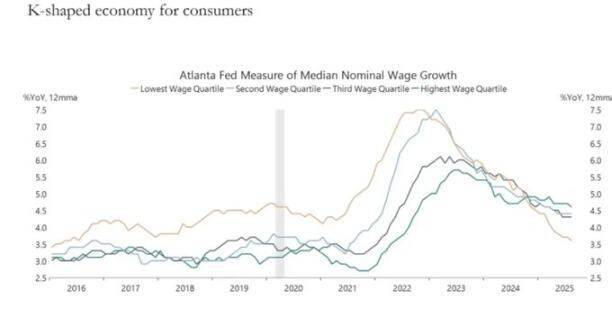

The K-Shaped Economy is Becoming a Political Variable

What we refer to as the "K-shaped" economic divergence, in my view, has now become a political variable:

Household expectations are diverging. Long-term financial outlooks (e.g., 5-year expectations) show striking gaps: some groups expect stability or improvement; others expect a sharp deterioration.

Real-world pressure indicators are flashing:

- The delinquency rate for subprime auto loan borrowers is rising.

- Home purchases are being postponed until later in life, with the median age of first-time homebuyers approaching retirement age.

- Youth unemployment indicators are marginally rising in multiple markets.

For an increasing number of people, this system is not just "inequitable"; it is failing:

They have no assets, limited wage growth, and almost no realistic path to participate in asset inflation.

The perceived social contract — "work hard, get ahead, accumulate some wealth and security" — is unraveling.

In this environment, political behavior is changing:

Voters are no longer choosing the "best managers" of the current system.

They are increasingly willing to support destructive or extreme candidates from both the left and right, as the downside feels limited to them: "It can't get worse."

This is the backdrop against which future policies on taxation, redistribution, regulation, and monetary support will be decided.

This is not neutral for the markets.

Market Concentration Becomes Systemic and Political Risk

The concentration of market capital in a few companies, less discussed, has systemic and political implications:

Currently, about the top 10 companies account for approximately 40% of the market value of major U.S. stock indices.

These companies simultaneously:

- Are core holdings in pension funds, 401(k) plans, and retail portfolios.

- Are increasingly reliant on AI, face exposure to risks from China, and are sensitive to interest rate paths.

- Operate as de facto monopolists in multiple digital domains.

This creates three intertwined risks:

Systemic Market Risk

Any shock to these companies, whether from earnings, regulation, or geopolitics (e.g., Taiwan, demand from China), will quickly transmit throughout the household wealth complex.

National Security Risk

When so much national wealth and productivity is concentrated in a few externally dependent companies, they become strategic vulnerabilities.

Political Risk

In a K-shaped, populist environment, these companies are the most obvious focal point, easily triggering discontent:

- Higher taxes, windfall taxes, buyback restrictions.

- Antitrust-driven breakups.

- Strict AI and data regulations.

In other words, these companies are not just growth engines; they are also potential policy targets, and the likelihood of them becoming targets is rising.

Bitcoin, Gold, and the (Currently) Failed "Perfect Hedge" Narrative

In a world filled with risks of policy missteps, credit pressures, and political instability, one might expect Bitcoin to thrive as a macro hedge tool. However, the reality is:

Gold is performing as a traditional crisis hedge: steadily strengthening, with low volatility and increasing correlation in portfolios.

Bitcoin's trading resembles a high-beta risk asset:

- Closely tied to liquidity cycles.

- Sensitive to leverage and structured products.

- Long-term holders are selling in this environment.

The initial narrative of decentralization/money revolution remains conceptually appealing, but in practice:

- Today's dominant flows are financialized: yield strategies, derivatives, and shorting volatility behavior.

- Bitcoin's behavioral experience is closer to tech beta rather than a neutral, robust hedge tool.

I still see a reasonable path where 2026 could become a major turning point for Bitcoin (the next policy cycle, the next round of stimulus, and further erosion of trust in traditional assets).

However, investors should recognize that at this stage, Bitcoin is not providing the hedging properties many expect; it is part of the same liquidity complex we are concerned about.

A Scenario Framework Leading to 2026

A useful way to construct the current environment is to view it as a managed deflation of a bubble that creates space for the next round of stimulus.

The process may look as follows:

Mid-2024 to 2025: Controlled Tightening and Pressure

- Government shutdowns and political dysfunction create cyclical drag.

- The Federal Reserve leans hawkish in rhetoric and balance sheet, tightening financial conditions.

- Credit spreads moderately widen; speculative areas (AI, long-duration tech, some private credit) absorb initial shocks.

Late 2025 to 2026: Re-liquefaction Entering the Political Cycle

- As inflation expectations decline and markets correct, policymakers regain "space" for easing.

- We see rate cuts and fiscal measures aimed at supporting growth and electoral goals.

- Considering lags, inflation consequences emerge after key political junctures.

Post-2026: System Repricing

Depending on the scale and form of the next round of stimulus, we either get:

- A new cycle of asset inflation, accompanied by higher political and regulatory intervention,

- A more abrupt confrontation with debt sustainability, concentration, and social contract issues.

This framework is not definitive, but it aligns with current incentives:

- Politicians prioritize re-election over long-term equilibrium.

- The most readily available toolkit remains liquidity and transfer payments rather than structural reforms.

- To use the toolkit again, they first need to squeeze out some of today's bubbles.

Conclusion

All signals and everything point to the same conclusion: the system is entering a more fragile phase in the cycle.

In fact, historical patterns suggest that policymakers will ultimately respond with a significant amount of liquidity.

To reach the next stage, we need to navigate a period defined by the following characteristics:

- Tightening financial conditions,

- Rising credit sensitivity,

- Political volatility,

- And increasingly nonlinear policy responses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。