Original Title: 《VanEck Mid-November 2025 Bitcoin ChainCheck》

Written by: Patrick Bush, Matthew Sigel

Compiled and Organized by: BitpushNews

The Bitcoin sell-off is driven by mid-term holders rather than long-term whales, and the futures market shows a deeply oversold condition following tariff-driven liquidations.

(Note: VanEck has a Bitcoin risk exposure.)

Key Points

Long-term whales continue to hold, with tokens aged over 5 years steadily increasing.

The sell-off is concentrated among mid-term holders, not the oldest wallets.

The futures market appears to have been cleaned out, with funding rates and open interest at oversold levels.

Bitcoin (BTC) investors are feeling fearful

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

ETP Outflows Drive Early Weakness

The price action over the past 30 days has been particularly unfriendly to holders, with BTC down 13%, accompanied by motivated sell-offs.

Since October 10, 2025, BTC ETP balances have seen an outflow of 49.3 thousand BTC, approximately -2% of total assets under management (AUM), as weak holders who bought near price peaks chose to capitulate amid interest rate uncertainty and wavering AI narratives.

More concerning is that many attribute the price weakness to early BTC whales.

For example, a "Satoshi-era" whale sold $1.5 billion worth of BTC in the week of November 14, 2025, emptying his entire wallet. Many believe that seasoned whales often signal long-term trends in BTC by buying and selling at key moments. As a result, the cryptocurrency community has turned bearish, with the fear/greed index dropping to its lowest level since March 2025 at the onset of tariff panic.

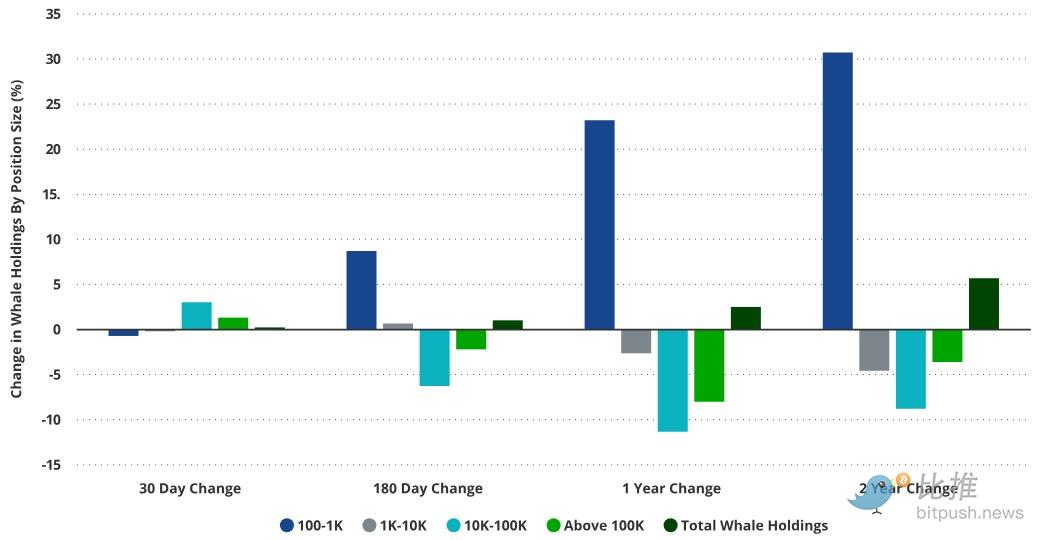

Smaller whales accumulate over 1-2 years while the largest whales sell; recent net changes flat

Whale positions decrease long-term, increase short-term

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

Rather than assuming recent weakness stems from large holders' sell-offs, it is more insightful to closely examine the complete distribution of fund flows across groups.

On-chain data reveals a more nuanced rotation than simple "whale sell-offs." If we observe the whale holdings of over 1,000 BTC, it is clear that they have been reducing their BTC risk exposure since November 2023.

In fact, whales holding 10K-100K BTC have reduced their supply by -6% and -11% over the past 6 months and 12 months, respectively. This portion of the supply has been absorbed by "small fish" holding 100 to 1,000 BTC. These smaller investors have increased their holdings by +9% and +23% over the past 6 months and 12 months, respectively. For context, BTC itself has risen approximately 170% over the past two years.

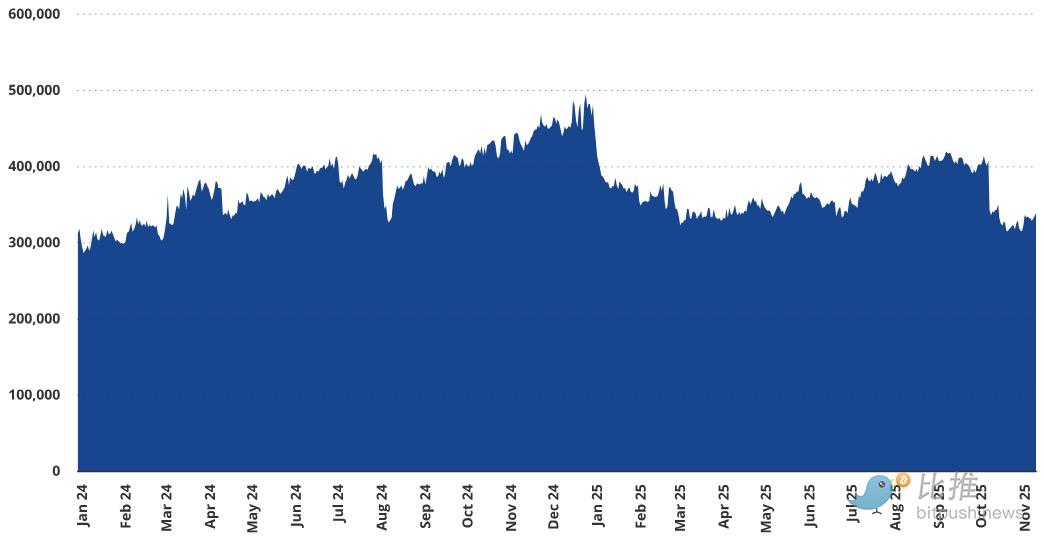

Bitcoin Futures (BTC) Open Interest Grew +6% in November

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

Short-term whales turn net buyers

Short-term data tells a different story: some whale groups have been accumulating. The group holding 10K–100K BTC has increased its holdings by approximately +3%, +2.5%, and +84 basis points (bps) over the past 30 days, 60 days, and 90 days, respectively. This may reflect the tariff-driven sell-off and subsequent liquidation, which reduced BTC futures open interest by about 19% within 12 hours and pushed prices down by over 20%.

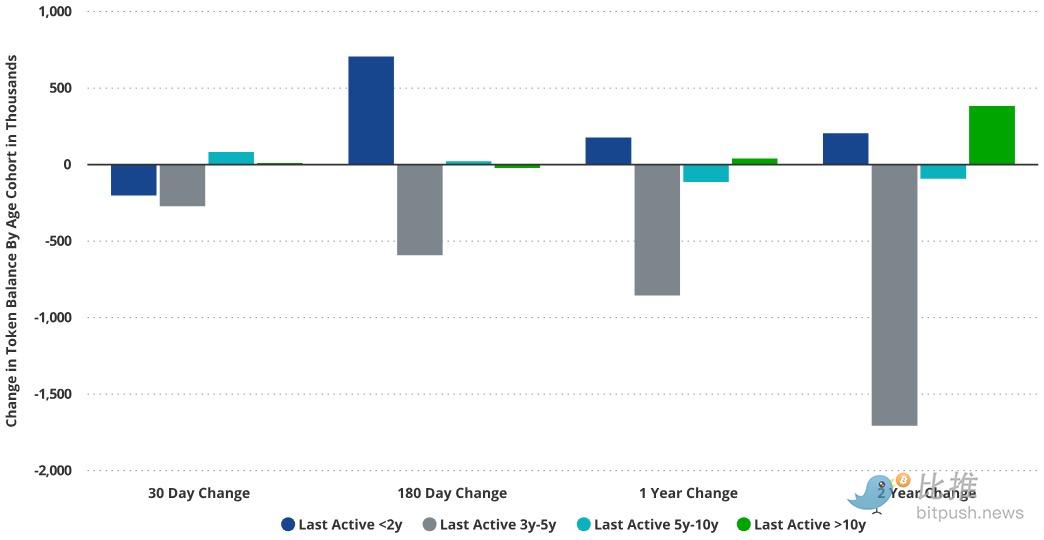

The oldest BTC whales are holding while mid-term traders are selling

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

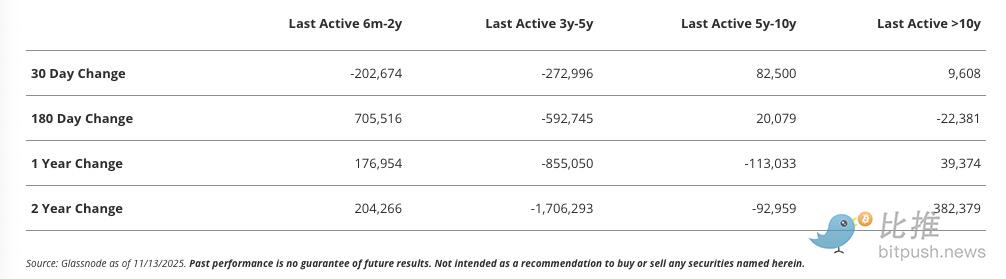

Mid-term holders are the real sellers

However, analyzing "whale data" solely by holder size provides an incomplete picture. This perspective overlooks the rotation phenomenon where experienced older whales transfer their tokens to new, novice holders. To deepen our understanding, we examine Bitcoin balances by "last active transfer time," an indicator of the time elapsed since the tokens were last transferred. The implied meaning of the transfer is that these tokens are likely sold to different holders.

Over the past 30 days, selling pressure has concentrated among the 5-year coin age group, while older tokens have mostly maintained or increased their holdings. Interestingly, over the past 6 months, ownership has shifted from the (3-5 year) group to the (6 months-2 year) group, marking a transfer of funds from mid-term holders to new participants.

Among the older group, those whose tokens last moved over 5 years ago, the turnover rate remains lower compared to other groups. In contrast, the largest outflow occurs in tokens last moved 3-5 years ago, with that group consistently declining during each study period. Over the past two years, the supply of this portion of tokens has decreased by 32% as these tokens were sent to new addresses. Given that many of these tokens may have been accumulated during the previous Bitcoin cycle's downturn, their holders appear to be opportunistic cycle traders rather than long-term investors.

Meanwhile, tokens last moved over 5 years ago have net increased by +278K BTC (compared to two years ago). This growth reflects the aging of younger tokens into the 5-year-plus category rather than re-accumulation, but it still indicates the continued conviction of long-term whales. While more granular analysis may yield additional insights, the overall trend remains encouraging: the longest-term holders continue to accumulate and hold.

BTC Futures Basis at Lowest Level Since Fall 2023

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

Futures Market Shows Reset in Speculative Activity

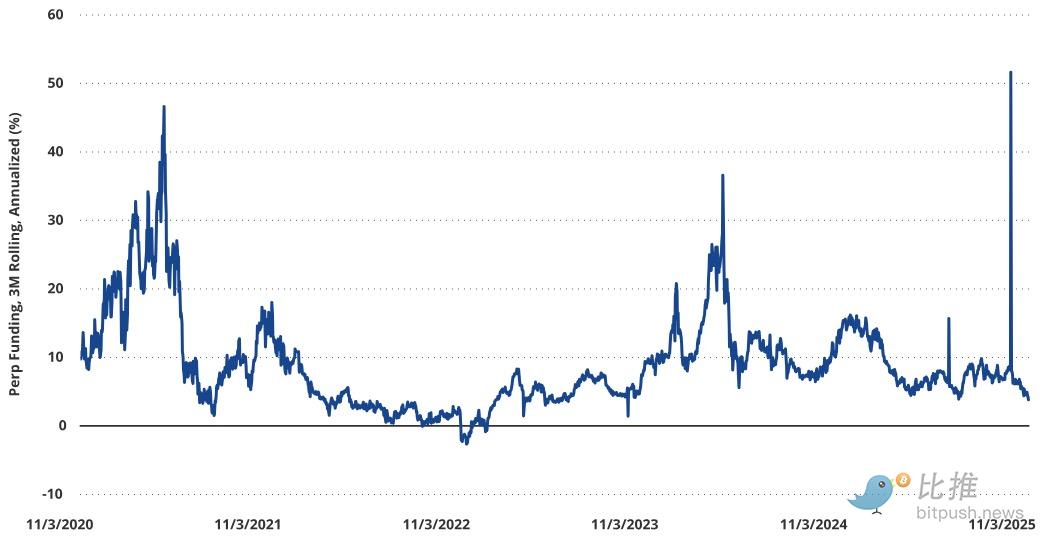

One of the best indicators of speculative sentiment is the annualized basis cost paid by traders willing to go long on Bitcoin perpetual futures. Since perpetual contracts never settle, their prices align with spot prices by charging interest to one side of the trade. If the perpetual contract price is higher than the spot price, the long side must pay a rate related to the difference between the spot/perpetual prices. Given the asymmetric upside potential of cryptocurrencies, perpetual contract basis is almost always positive.

During periods of low demand for long positions in cryptocurrencies like BTC, the basis collapses. Recently, we have seen a sharp collapse in Bitcoin perpetual contract open interest, which has decreased by -20% in BTC terms and -32% in USD terms since October 9, 2025. This partly explains the sharp collapse in funding rates. Of course, if people are bullish on BTC, this rate would quickly rise.

Historically, when Bitcoin begins a long-term decline, a clear signal often appears: the funding rate for perpetual contracts skyrockets, averaging as high as 40% on certain days during previous frenzies. But this time is different; since March 2024, we have not seen the funding rate skyrocket.

An interesting subplot here is that innovative protocols like Ethena, along with professional trading firms, have been engaging in large-scale "spot buying + perpetual contract shorting" arbitrage operations. Ethena alone reached a scale of $14 billion in October 2025, although it later shrank to $8.3 billion, but such a large arbitrage position has effectively suppressed the funding rate, distorting this traditional indicator somewhat.

Nevertheless, even so, the current degree of funding rate collapse, combined with the large-scale liquidation of perpetual contract open positions, indeed indicates that the market has overshot. Another key indicator, NUPL (which can be understood as the average profit and loss level of all network holders), also shows that the current level of overselling is similar to that during the tariff panic in spring 2025 and the yen collapse in August 2024.

For investors, after a month of violent washouts, it may actually be a more opportune time to look for entry points. Market panic often presents good opportunities for positioning.

Bitcoin On-Chain Changes Monthly Dashboard and Highlights

As of November 14, 2025

Note: The 30-day change and 365-day change are relative to the 30-day average, not absolute values.

Data Source: Glassnode, as of November 13, 2025. Past performance is not indicative of future results. This is not intended as a recommendation to buy or sell any securities mentioned in this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。