Original|Odaily Planet Daily (@OdailyChina)

The U.S. government shutdown has finally come to an end under public scrutiny, but market sentiment has not improved.

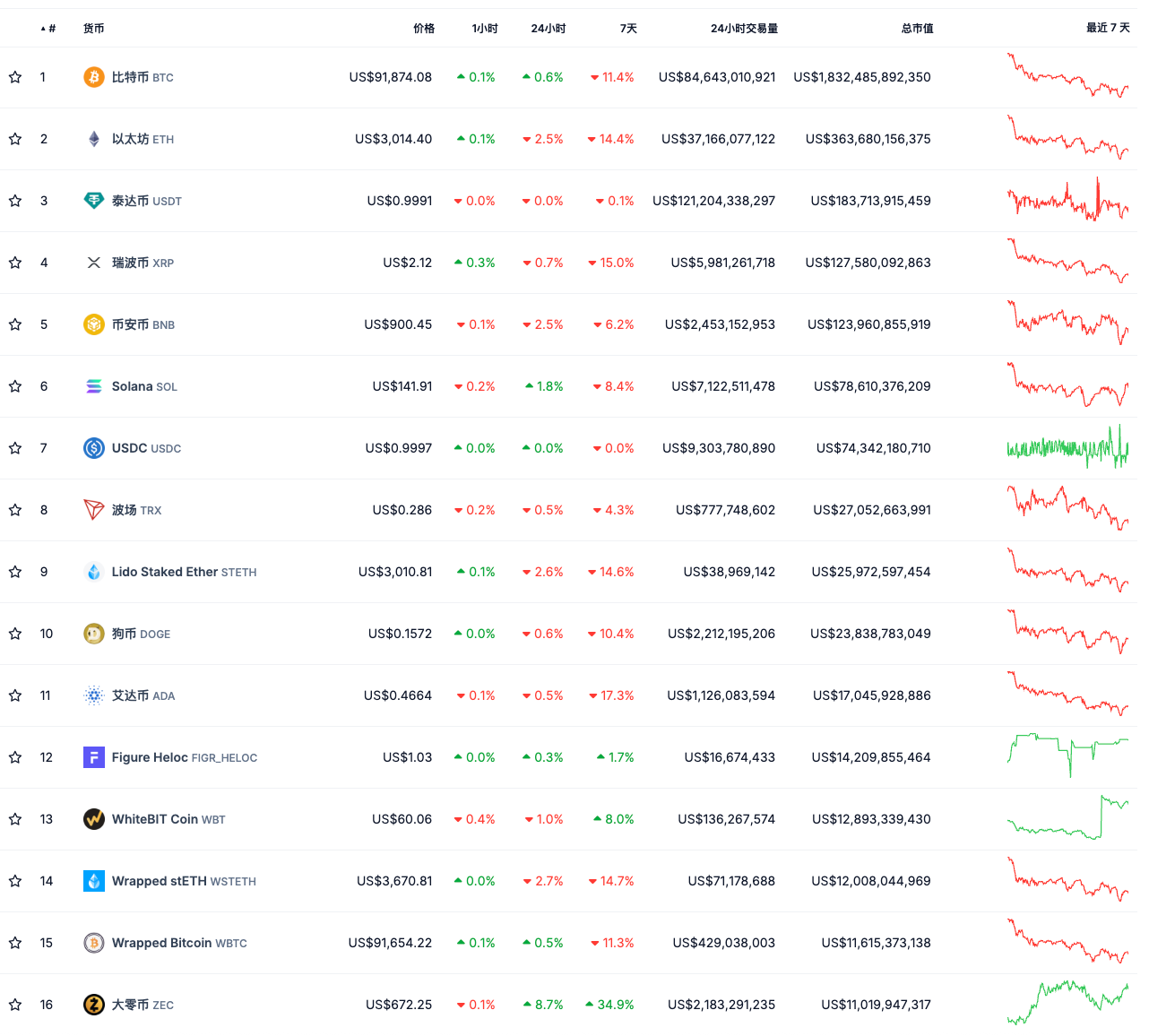

The cryptocurrency market not only failed to experience the anticipated "bad news fully priced in" rebound but continued to be dominated by a bearish sentiment: BTC once fell below the $90,000 mark, and ETH briefly dropped below $2,900, with "all coins falling" almost becoming a footnote to the current market situation. The only exception was the privacy sector represented by ZEC, which has shown a remarkably bright independent trend against the tide.

At the same time, two major cases that have stirred the industry are simultaneously unfolding: 127,000 BTC held by Chen Zhi, the figurehead of the "Prince Group," was confiscated by the U.S. government; and Qian Zhimin, the mastermind behind "Blue Sky Ge Rui," who had fled for seven years after illegally raising over 40 billion yuan, was captured, with over 60,000 BTC assets under his control also unresolved.

The two incidents have triggered a domino effect—Bitcoin's censorship resistance and anonymity are facing unprecedented scrutiny from tech geeks, fundamentalists, and even mysterious gray market whales.

When the authoritarian forces of the real world collide head-on with the ideals of decentralized technology, the outcome is not romantic, leading idealists to ponder: In terms of the ultimate ownership of BTC assets, the state apparatus is the final winner.

This also forces the cryptocurrency industry to confront an old question: If BTC cannot fulfill the role of "censorship-resistant currency," then who will be the next symbol of privacy rights and on-chain asset storage? The market's answer may already be emerging—ZEC, which is currently rising against the trend, is becoming that suitable "version answer."

The significant rise of ZEC may not be a manipulation tactic by speculators but rather a long-term market demand from whales. This conclusion is supported by multiple narratives and data dimensions.

When the heavy hand of an authoritarian government crushes the fantasy bubble of "censorship-resistant currency": BTC is no longer a noble "safe haven" asset

One of the direct reasons for the reestablishment of ZEC's "privacy token" faith is the hidden information revealed by the recent two major "BTC asset cases": BTC's censorship resistance and anonymity are undergoing severe tests.

First, let's discuss the case involving Chen Zhi, the figurehead of the "Prince Group," with funds amounting to $15 billion.

Previously, Odaily Planet Daily detailed the ins and outs of this case in the article “$15 Billion BTC Change of Ownership: U.S. Justice Department Dismantles Cambodian Prince Group, Transforming into the World's Largest BTC Whale”, which mentioned the specific "BTC confiscation process"—

(In this case) judicial and intelligence agencies demonstrated a complete process for handling on-chain assets: on-chain positioning → financial blockade → judicial takeover. This is a practical closed loop that seamlessly connects "on-chain tracking capabilities" with "traditional judicial power":

Step One: On-chain tracking—locating the "fund container." The anonymity of Bitcoin is often misunderstood. In fact, its blockchain is a public ledger, and every transaction leaves a trace. Chen Zhi's group attempted to launder money using the classic "spray-funnel" model: dispersing funds from the main wallet to a vast number of intermediate addresses like watering with a spray bottle, and after a brief stay, re-aggregating to at least a few core addresses like streams merging into a river. This operation seems complex, but from the perspective of on-chain analysis, the frequent "disperse-aggregate" behavior instead forms unique pattern characteristics. Investigative agencies (such as TRM Labs, Chainalysis) utilized clustering algorithms to accurately map out the "funds return map," ultimately confirming that these seemingly dispersed addresses all pointed to the same controlling entity—the Prince Group.

Step Two: Financial sanctions—cutting off the "monetization channel." After locking down the on-chain assets, U.S. authorities initiated dual financial sanctions: the Treasury Department (OFAC) sanctions: listing Chen Zhi and related entities, prohibiting any U.S.-jurisdictional institutions from trading with them. The Financial Crimes Enforcement Network (FinCEN) §311 clause: designating key entities as "primary money laundering concerns," completely severing their access to the U.S. dollar clearing system. At this point, although these Bitcoins can still be controlled by private keys on-chain, their most important value attribute—the "ability to be exchanged for U.S. dollars"—has been frozen.

Step Three: Judicial takeover—completing the "transfer of ownership." The final confiscation did not rely on violently cracking private keys but rather on law enforcement agencies directly taking over the asset's "signature rights" through legal procedures (such as court orders) directly. This means that law enforcement successfully obtained the mnemonic phrase, private keys, or controlled hardware wallets, allowing them to initiate a valid transfer transaction just like the original owner, transferring the Bitcoins to a government-controlled address. However, in the Chen Zhi case, the U.S. government has not disclosed the complete details of how it obtained the private keys, leading to speculation within the community that law enforcement may have exploited a previously reported security vulnerability in Lubian.com to crack the private keys. When this transaction was confirmed by the blockchain network, "legal ownership" and "on-chain control" were unified. The ownership of these 127,271 BTC has, in both technical and legal terms, officially transferred from Chen Zhi to the U.S. government. This combination clearly indicates: in the face of state power, "on-chain assets are not inviolable" is not absolute.

$15 billion BTC asset transfer process

This matter was further explained in detail in the “Technical Traceability Analysis Report on the LuBian Mining Pool Hacked and Stolen Massive Bitcoin Incident” released by the National Computer Virus Emergency Response Center, this "historically significant virtual asset confiscation operation" is actually a "typical state-level hacker organization orchestrated 'black eats black' incident." In the dark forest-like cryptocurrency world, there are not only "North Korean state teams" like the Lazarus Group, but also the "U.S. team" as "on-chain special forces" quietly lurking in the shadows.

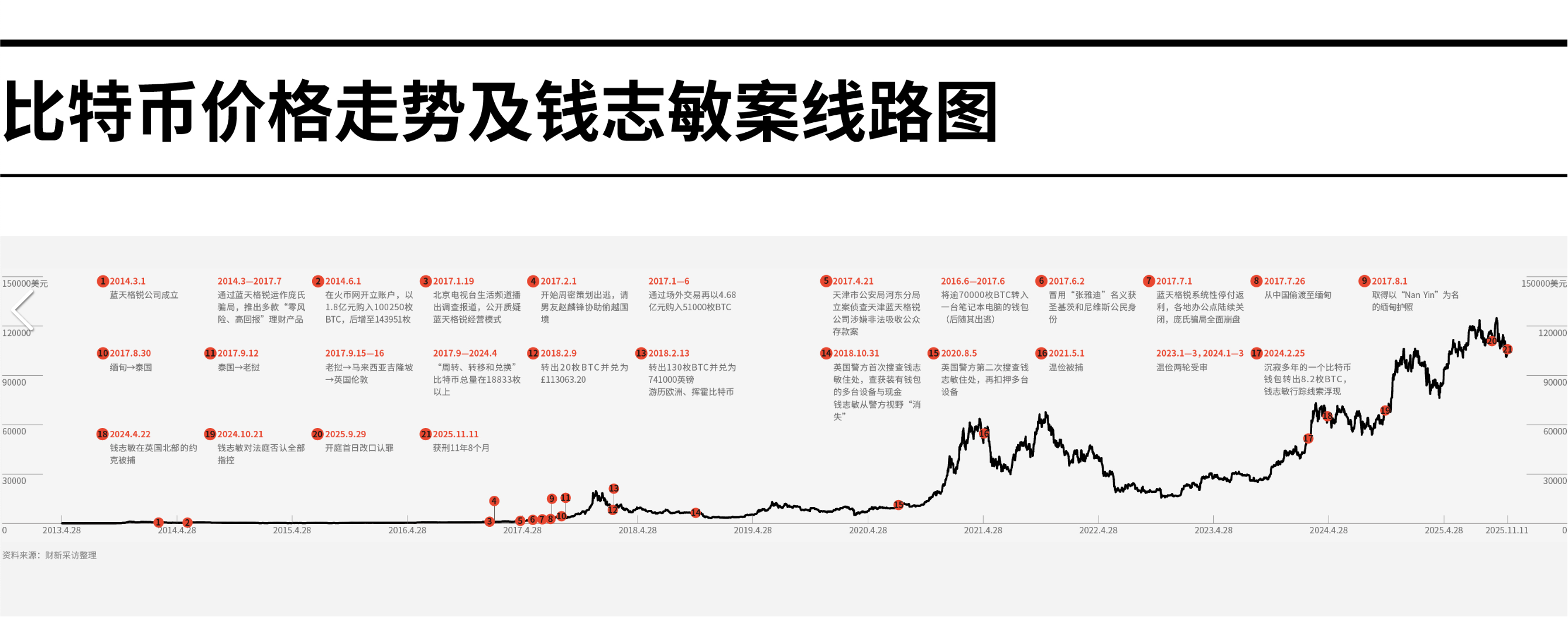

Compared to the cautious advance of Chen Zhi, the figurehead of the "Prince Group" in Southeast Asia, the experience of Qian Zhimin, the protagonist of the 60,000 BTC money laundering case, is even more legendary and tortuous.

According to Caixin's report, she first learned about Bitcoin in 2012, "her ambition was to one day hold 210,000 Bitcoins, accounting for 1% of the total Bitcoin supply." She almost achieved this goal: from June 2014 to June 2017, Qian Zhimin instructed her "front person" to successively purchase 194,951 BTC, with an average purchase price of only 2,815 yuan per coin (the statistical caliber is unknown). By the time she was sentenced in the UK in November this year, the price of Bitcoin had inflated 266 times to 750,000 yuan per coin. Qian Zhimin's diary written between May and July 2018 shows that she had formulated a "six-year plan" for 2018 to 2023, with the core goal of "retiring at 45" and "rebuilding a digital empire." She required herself to "at least retain three identities," including St. Kitts and Nevis and "two European countries (at least one of which is not known to others but allows free travel in Europe)," while also configuring two long-term leased "safe havens" in Europe.

To support the above arrangements, she anchored almost all major expenditures to Bitcoin. In her diary, she wrote that in 2018, based on an estimated "about $6,800 per coin," she planned to sell at least 4,000 Bitcoins for immigration, purchasing a house, and forming a team; in 2019, assuming the price rose to "about $8,200," she would sell no more than 1,500 coins; by 2020, she further raised the budget price to "about $9,500," reserving about 1,750 coins for investment in exchanges and managing various "interpersonal relationships." She bet in her diary that entering 2021, the coin price would remain long-term between $40,000 and $55,000, planning grand projects such as "digital banks," "family funds," and building her own kingdom based on this premise.

Qian Zhimin case node explanation diagram

From the second half of 2016 to 2017, Qian Zhimin stored over 70,000 Bitcoins in a wallet on a laptop (Odaily Planet Daily notes: another over 120,000 BTC information has not been further disclosed. The diary seized by the British police recorded that Qian Zhimin once wrote about "losing 20,008 BTC"), combined with information that her total Bitcoin turnover, transfer, and exchange during her time in the UK exceeded 18,833 coins, the final number of BTC seized by the British police was around 61,000 coins, along with BTC and XRP tokens worth £67 million.

The key to Qian Zhimin's eventual capture was the suspicious wallet addresses monitored by the British police through money laundering investigations, combined with the on-chain and off-chain behavioral trajectories exposed by KYC information from Binance regarding her subordinate "Seng Hok Ling" (phonetic: Lin Chengfu). In April 2024, Qian Zhimin was arrested in her sleep at an Airbnb apartment in Yorkshire, UK.

This also reiterates that while assets can exist on the blockchain in the digital world, humans ultimately cannot escape the physical world's constraints, and the off-chain space is under the jurisdiction of authoritarian governments.

Imagination vs. Reality

These two incidents, involving a total of over 180,000 BTC, have prompted the market to reassess the realistic boundaries of Bitcoin's narratives around "censorship resistance" and "anonymity." Of course, in reality, with the launch of BTC ETFs, deep participation from institutional funds, and further regulatory demands for transparency in crypto assets, the early narrative of Bitcoin centered on anonymity and censorship resistance has gradually faded from the mainstream stage.

Meanwhile, ZEC, which proudly carries the banner of "POW privacy tokens," has become the "new promised land" in the eyes of many Bitcoin OGs, Bitcoin fundamentalists, and tech geeks.

Privacy BTC is dead, privacy coin ZEC should rise: the market re-prices "new safe haven assets"

If ZEC's "second spring" relied on endorsements from crypto bigwigs like Naval, 0xmert, Arthur Hayes, and Ansem during its initial rise from $60 to over $100, after surpassing the $200, $400, and $700 milestones, its market buying power has shifted from short-term speculative hot money to Bitcoin OG whales and Bitcoin fundamentalists who have genuine privacy needs.

ZEC price trend over the past month

Specifically, ZEC, which focuses on the concept of "privacy tokens," has the following advantages:

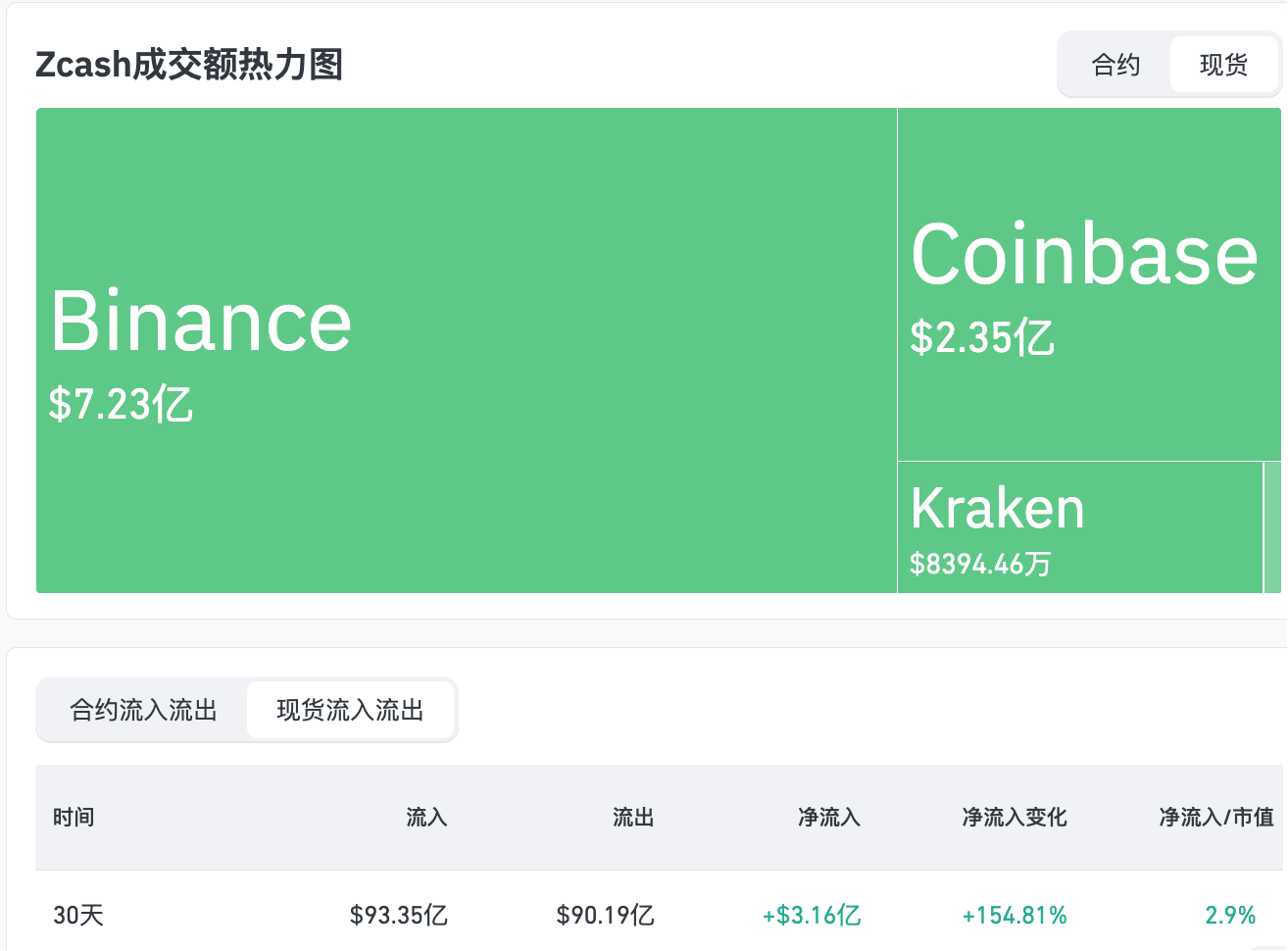

First, it has ample liquidity based on mainstream CEXs. According to Coingecko data, as of the time of writing, ZEC's trading volume in the past 24 hours exceeded $2.26 billion, with Binance and Coinbase ranking as the top two exchanges, accounting for over 33% and nearly 11% of the trading volume, respectively. In a market where liquidity is scarce, such a unique "CEX ecological niche" provides ZEC with a substantial platform to attract funds and achieve an upward trend against the tide.

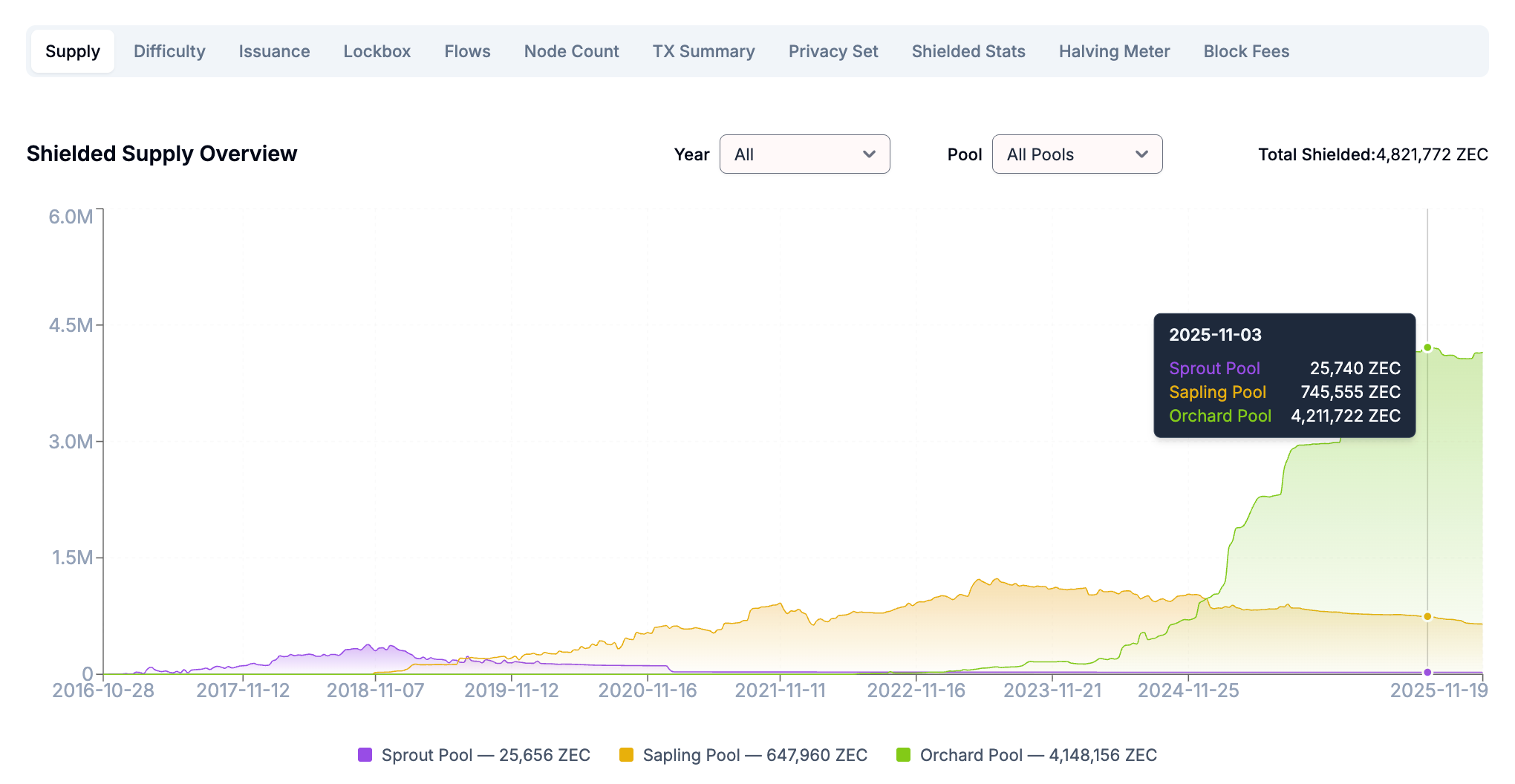

Second, there is a genuine market demand for its differentiated "anonymous privacy pool" (Shielded pool). Data shows that the total amount of tokens in Zcash's (ZEC) privacy pool (Shielded Supply) approached 5 million on November 3; as of the time of writing, this figure remains above 4.82 million, accounting for about 30% of the total circulating supply; there were over 26,000 transactions on-chain in the past 24 hours, with over 2,200 shielded transactions. This indicates that ZEC's real adoption data is very stable and active.

Third, it has a relatively stable token circulation and a smaller market cap compared to other mainstream tokens. According to Coingecko data, ZEC has a total circulation of nearly 16.4 million tokens and a total market cap of around $11 billion, ranking 16th in the cryptocurrency market cap rankings; excluding stablecoins like USDT, USDC, stETH, wstETH, and WBTC, it ranks 11th, indicating significant room for growth compared to other mainstream coins with market caps often in the hundreds of billions or even trillions.

Fourth, it has a more complete compliance framework and faces less regulatory pressure. Unlike controversial privacy tokens like XMR and DASH, which have faced legal issues, ZEC, as a mainstream privacy POW token, does not have direct conflicts with regulatory agencies, and its POW mechanism also ensures stronger censorship resistance to some extent. Coupled with the roadmap released by ZEC's development organization Electric Coin Co. (ECC) for Q4 2025, ZEC possesses certain technical advantages. Additionally, compared to XMR, ZEC's optional privacy mode provides institutions with the space to maintain compliance and reporting, making ZEC an acceptable asset for regulatory agencies.

Fifth, ZEC benefits from its established ecological position and a community with a strong geek and technical atmosphere. As the birthplace of ZK-Rollup technology, the ZEC community includes many tech leaders, crypto OGs, and well-known angel investors, including the still highly active crypto KOL Cobie (who claims to have held ZEC since 2016) and Gemini co-founder Tyler Winklevoss (who stated in 2021 that ZEC is "the most undervalued cryptocurrency").

Considering these five major advantages, ZEC naturally becomes the preferred target for many BTC whale holders, fundamentalists, and advocates of censorship-resistant assets for "sensitive asset migration." This is also supported by multiple data points.

Analyzing ZEC's market performance from a trading perspective: from real adoption driving to market mainstream focus

In a previous article titled “Buying ZEC to Crash BTC? The 4 Major Industry Truths Behind the Surge of Privacy Coins”, we detailed the possible reasons for the warming of the privacy token sector, and the data performance of ZEC during its rise this month further proves that its main driving force for growth lies in the combined effects of market sentiment and real adoption, rather than speculative manipulation.

ZEC Becomes a Concentrated Contract Holding Target: 24-Hour Trading Volume Second Only to BTC and ETH

According to Coinglass data, in the past 24 hours, ZEC's total liquidation amount exceeded $72.88 million, with short positions accounting for over $69.30 million; this coin's liquidation volume in 24 hours is second only to ETH and BTC.

ZEC ranks third in the "contract liquidation leaderboard"

Additionally, ZEC's contract trading volume and open interest have consistently remained high: as of the time of writing, the 24-hour trading volume exceeded $6.6 billion, and the 24-hour open interest exceeded $1.2 billion.

ZEC contract data leads significantly

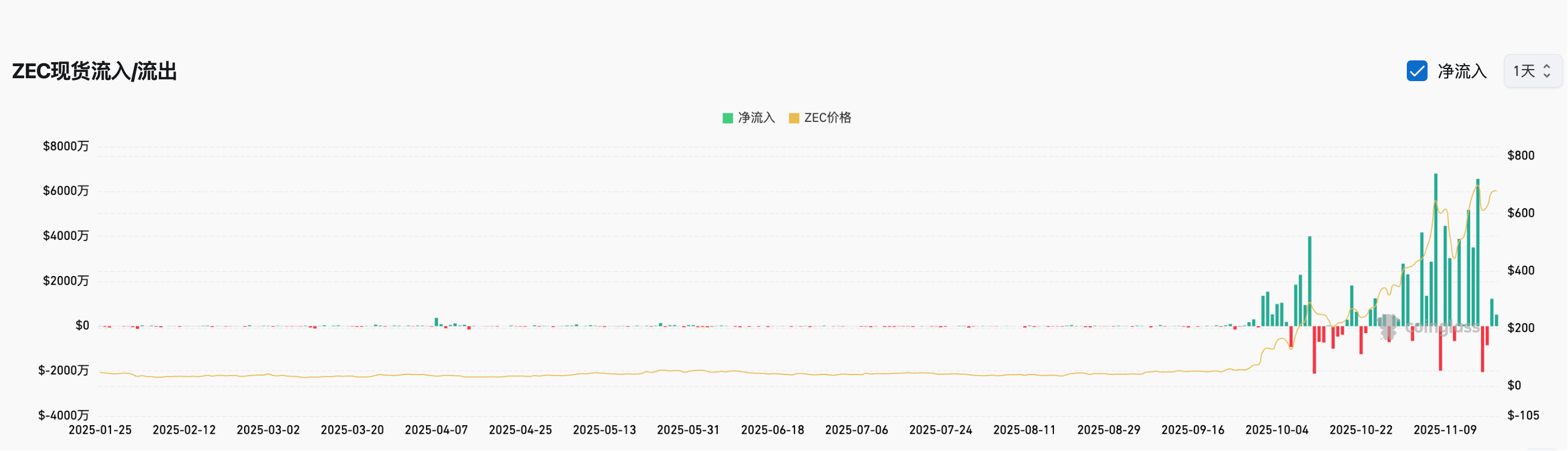

In terms of spot trading, ZEC has consistently maintained a net inflow status on mainstream CEXs: from October 1 to the present, in the past 50 days, ZEC's spot trading had only 15 days of net outflow; in the past 30 days, ZEC's spot net inflow was approximately $316 million; in the past 50 days, ZEC's spot net inflow was approximately $419 million. In the past 24 hours, ZEC's spot trading volume on Binance exceeded $720 million, with a 24-hour increase of over 21%; on Coinbase, the spot trading volume exceeded $230 million, with a 24-hour increase of over 17%.

ZEC spot inflow and outflow data statistics

ZEC spot trading heatmap and 30-day trading data

Behind ZEC's Price Changes: From BTC Trading Volume to Market-Wide Enthusiasm

Aside from the overall trading volume perspective, we can also observe two major phases in ZEC's trading volume from the BTC trading pair perspective:

First, before November 7, BTC's trading volume showed a gradual upward trend. On that day, after ZEC's price broke through the annual high of 700, BTC trading volume briefly exceeded 110 BTC, indicating that a significant portion of ZEC's overall buying was still conducted using BTC.

Second, after November 7, ZEC became one of the few hot targets in a declining market. Coupled with the impacts of the "Chen Zhi case," "Qian Zhimin case," and BTC ETF net outflows, market attention gradually shifted to the phase of widespread enthusiasm.

ZEC/BTC trading pair K-line trend

Looking back at ZEC's gradual rise in October, as we entered November, ZEC's upward curve undoubtedly became steeper, influenced by the overall market trend while also highlighting ZEC's objective advantages, such as real use cases and significant capital capacity.

Especially after the first week of November, following a series of concentrated news events, the privacy and censorship resistance attributes of BTC have faced further scrutiny from the market; conversely, ZEC's "privacy coin attributes" have once again received high recognition in the crypto market.

In the second week of November, discussions on the X platform about "BTC no longer private" became rampant. On November 14, Simon, a member of the Delphi Digital team, published a long article that definitively concluded that "ZEC has taken over from BTC as a value storage vehicle with privacy and self-determination."

As a result, after more than a month of development, amidst the industry's downward trend, ZEC has officially become the mainstream narrative in the industry. Many traders who previously liquidated their ZEC holdings at $300 and $400 have begun to buy back in large quantities, marking the first wave of "collective consensus buying." The characteristics of the market at this time mainly include:

- ZEC's average daily increase has repeatedly maintained at 20–30%, entering the top ranks of CEX gainers;

- Several crypto OGs have explicitly stated, "BTC's privacy is dead; ZEC is the true privacy token," including BitMEX co-founder Arthur Hayes, who on November 7 stated that ZEC has now become the second-largest liquidity holding in his family office fund, Maelstrom Fund, second only to BTC; on November 16, he even initiated a “meme creation community event” to continue highlighting ZEC's ecosystem activity, stating that "the Christmas gift I want most is ZEC."

- Privacy sector tokens like XMR and DASH also saw slight increases;

- A series of natural buy orders appeared on CEX order books such as Binance, Coinbase, and OKX.

Even the search volume for "Zcash" and "ZEC" on Google Trends saw a surge of 200%–300%; more importantly, ZEC's market demand, emotional hotspots, and active trading have attracted significant attention from the capital markets. Tyler Winklevoss, co-founder of Gemini mentioned earlier, contributed a substantial amount of buying with real capital.

Establishment of ZEC Treasury Company: Aiming to Buy at Least 5% of Tokens

On November 12, Nasdaq-listed company Leap Therapeutics announced the purchase of 203,775.27 ZEC tokens at an average price of $245 per token and announced its transformation into a ZEC treasury company, renamed Cypherpunk Technologies Inc. Additionally, the company announced it had secured $58.88 million in private financing led by Winklevoss Capital.

On November 18, Cypherpunk Technologies Inc. (Nasdaq: CYPH) announced that it had invested another $18 million to purchase 29,869.29 ZEC (Zcash) at an average purchase price of $602.63. Including the previous purchase of ZEC for $50 million, Cypherpunk's total ZEC holdings have reached 233,644.56 tokens, with an average holding cost of $291.04.

This acquisition brings the company's total ownership percentage in the Zcash network to 1.43%. Cypherpunk focuses on privacy and self-sovereignty, believing that Zcash is "a form of digital privacy asset" and a hedge against Bitcoin's transparency and its financial infrastructure, especially in an AI-rich future. Previously, the company appointed Will McEvoy, head of Winklevoss Capital, as Chief Investment Officer (CIO) and board member; Winklevoss Capital had previously led a $58.88 million private placement for the company. The company's goal is to ultimately hold at least 5% of the total supply of ZEC, continuing to advance its digital asset treasury strategy centered on Zcash.

Whether ZEC can become another crypto asset heavily bought by Wall Street capital institutions and crypto capital after BTC, as ZEC's value continues to be discovered, may attract widespread attention.

Conclusion: Is ZEC "BTC's Privacy Insurance"? Perhaps More Than That

Of course, we are not encouraging investors to chase high prices for ZEC; what we present is an objective analysis based on public data, market structure, and demand—viewed from a longer-term perspective, ZEC's long-term trend performance may still have room for continuation.

In the article “Why Naval Says: ZCash is Insurance Against Bitcoin Privacy?”, Max Wong from IOSG Ventures detailed the rise of ZEC and the underlying technical principles, with the core viewpoint being the famous Silicon Valley investor Naval's first endorsement of ZEC, stating: “Bitcoin is insurance against fiat; ZCash (ZEC) is insurance against Bitcoin.”

Now, in addition to being exchangeable with BTC to fill its privacy gap, ZEC is gradually taking on the new narrative expectation of "becoming the censorship-resistant asset that takes over from Bitcoin" in the eyes of some market participants.

As we approach the quarter mark of the 21st century, the value of freedom may no longer be solely referenced by BTC, which is driven by compliance and deeply involved by institutions, but may be redefined by those technical solutions that still focus on privacy and sovereignty. From this perspective, ZEC's return seems like a "sovereignty signal" that reignites market discussions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。