To be pragmatic, there aren't many #DeFi projects in this bull market that have truly impressed me. Most DEXs are still following the old playbook: competing on fees, breadth, and incentives, ultimately either leading to a situation where there's nothing left to gain or resulting in a "pseudo-decentralized" liquidity pool.

As someone who has been in the crypto space for many years, I was recently blown away by the project @Terminal_fi. This is not an ordinary DEX; it is backed by Ethena Labs, which has created the USDe synthetic dollar, essentially holding the key to "crypto-native dollars" to reconstruct the trading market. Moreover, #Terminal is not positioned as a competitor to Uniswap or HyperLiquid, but rather aims to unify the capital flow and yield flow of the entire #Ethena ecosystem, making USDe / sUSDe the "new capital base" of DeFi, with supported assets including USDe, sUSDe, USDtb (BlackRock BUIDL supported dollar yield assets), ETH, and BTC.

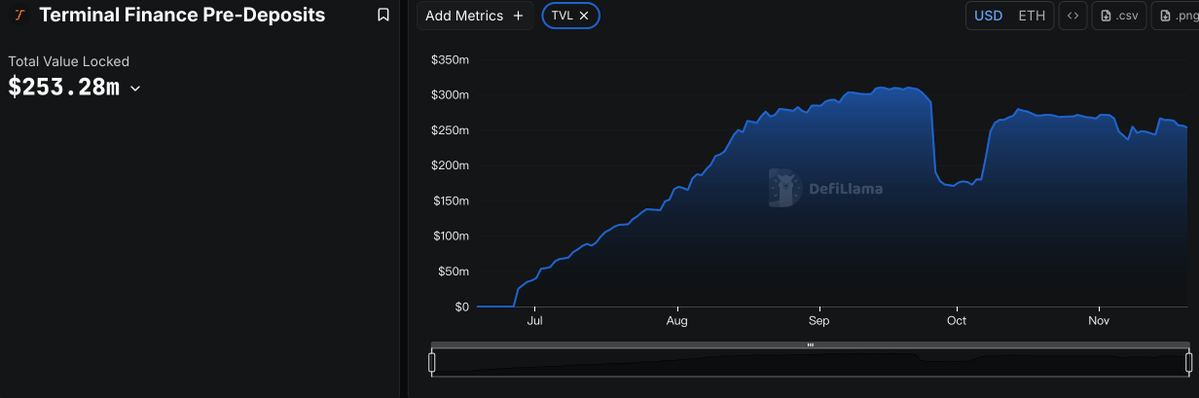

When I first saw its data, I was indeed a bit restless. First of all, this project achieved over $300 million in locked assets before officially launching, setting a new record for DEX pre-launch. How did they do it? They created three "VIP investment pools" allowing people to deposit funds early: 225 million USDe (Ethena's synthetic dollar), 10,000 ETH, and 100 BTC. Now, all three pools have been completely filled, resembling a "celebrity store opening queue" in the crypto space. Even more impressively, the over 10,000 wallet addresses that participated in the pre-deposit will later receive airdrop rewards, making user engagement incredibly smooth. Furthermore, #Terminal DEX is expected to launch this December, and this round of airdrops is bound to be substantial!

The core weapon of #Terminal is that it has welded "earning" and "trading" together. In traditional DEXs, the transaction fees are lost after trading, but here they employ a clever operation called 【Yield Skimming】—the stablecoins you deposit (like sUSDe) are already earning staking rewards, and now these rewards will automatically roll back into the trading pool. Terminal will skim these rewards and distribute them to LPs, turning them into thicker liquidity to reduce slippage. Essentially, your deposited funds earn interest while also saving on transaction fees, providing a double buff. Their CEO stated, "We are playing with interest-bearing dollars; liquidity efficiency crushes traditional stablecoins."

Looking at the assets they are integrating, they are all top-tier in the crypto space: not only can you use USDe/sUSDe, which are yield-bearing "investment dollars," but you can also directly trade BlackRock's BUIDL fund token USDtb. In simple terms, they are connecting high-quality traditional financial assets with cryptocurrencies like ETH/BTC in the shortest path possible, elevating the framework far beyond just creating a meme coin exchange. The strategic head of #Ethena put it more bluntly: "Our assets are already the blood of #DeFi; Terminal is just creating a heart for this blood."

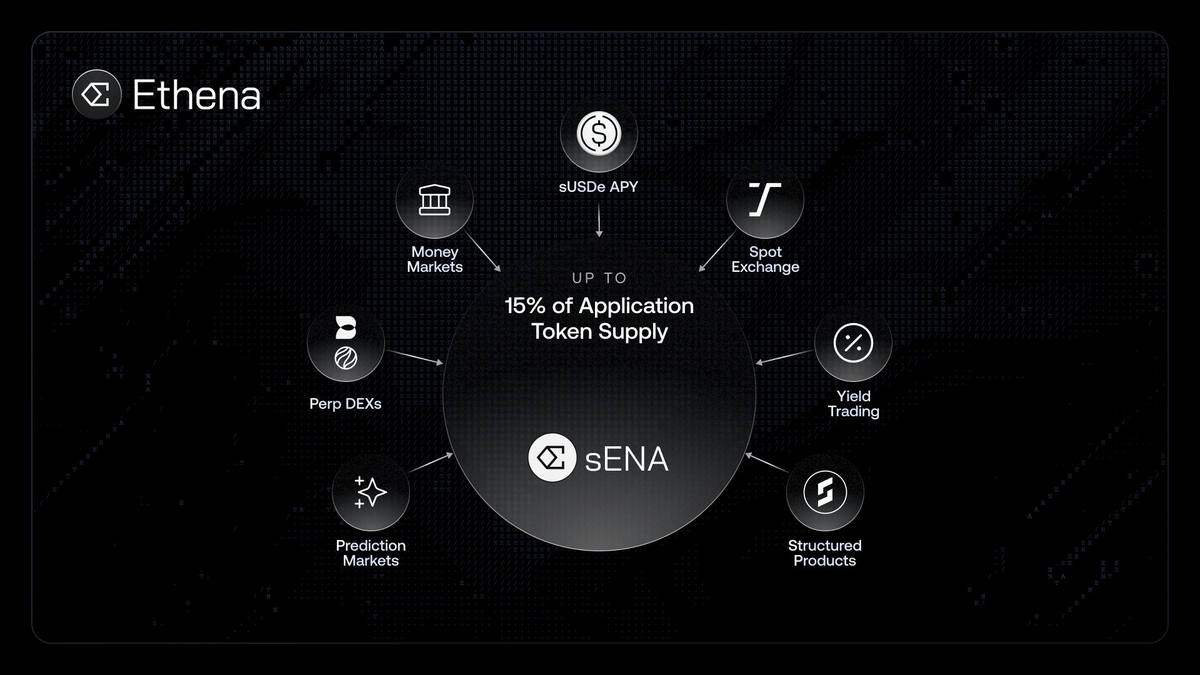

Finally, let's talk about how to benefit from this: the pre-deposit phase has already ended, but don't panic! Their token airdrop hasn't been distributed yet. According to the rules announced by #Ethena, those who have held sENA (Ethena ecosystem token) since the end of June will be able to receive Terminal tokens based on their points ratio, potentially receiving up to 10% of the total supply. This is equivalent to giving early ecosystem users a "subscription certificate for original shares."

Overall, #Terminal's operation essentially expands #Ethena's "synthetic dollar empire" from the payment layer to the trading layer. Additionally, it combines #Ethena's $10 billion network expansion with deep ties to Binance, making its potential quite evident. While others are still competing over minimal gas fees, it has directly restructured the liquidity production relationship, turning every locked fund into a "golden egg-laying goose." At this juncture, where institutional funds are accelerating their entry, such exchanges bridging TradFi and DeFi are likely to become the next cycle's traffic entry point, warranting close attention and focus. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。