RWA (Real World Assets) is becoming the "new favorite" of global capital.

In simple terms, RWA refers to transferring valuable and owned items from the real world—such as houses, bonds, stocks, and other traditional financial assets, as well as artworks, private loans, and carbon credits, which are not easily traded—onto the blockchain, transforming them into tradable and programmable crypto assets. This allows for low-cost, round-the-clock trading of these assets on-chain, regardless of your location.

The OKX Research Institute believes that RWA is not a fleeting crypto trend but an important bridge for the integration of Web3 and the trillion-dollar traditional financial market. From the asset securitization of the 1970s to today's RWA, the core focus has been on enhancing asset liquidity, reducing transaction costs, and expanding the user base. This report aims to deeply analyze the RWA landscape and explore its future possibilities.

### 1. Overview of the RWA Market: Development History, Scale, and Institutional Drivers

Taking the rental housing scenario as an example, RWA is reconstructing traditional models: no need for intermediaries, no need for a security deposit and three months' rent upfront; users can "rent for a month" with automatic deductions via mobile; upon moving out, a "one-click settlement" allows for instant return of the deposit; temporary relocations can transfer the remaining rental period on-chain, ensuring full transparency and immutability. Landlords can confirm property rights on-chain through RWA, with rent automatically distributed by smart contracts, and even "future rental periods" or "rental income rights" can be monetized in advance. RWA transforms real estate into flexible, tradable crypto assets, enhancing efficiency.

RWA is the inevitable result of traditional financial assets achieving machine-readable status on-chain; it is not about creating new assets but about building a new, efficient operating environment for old assets.

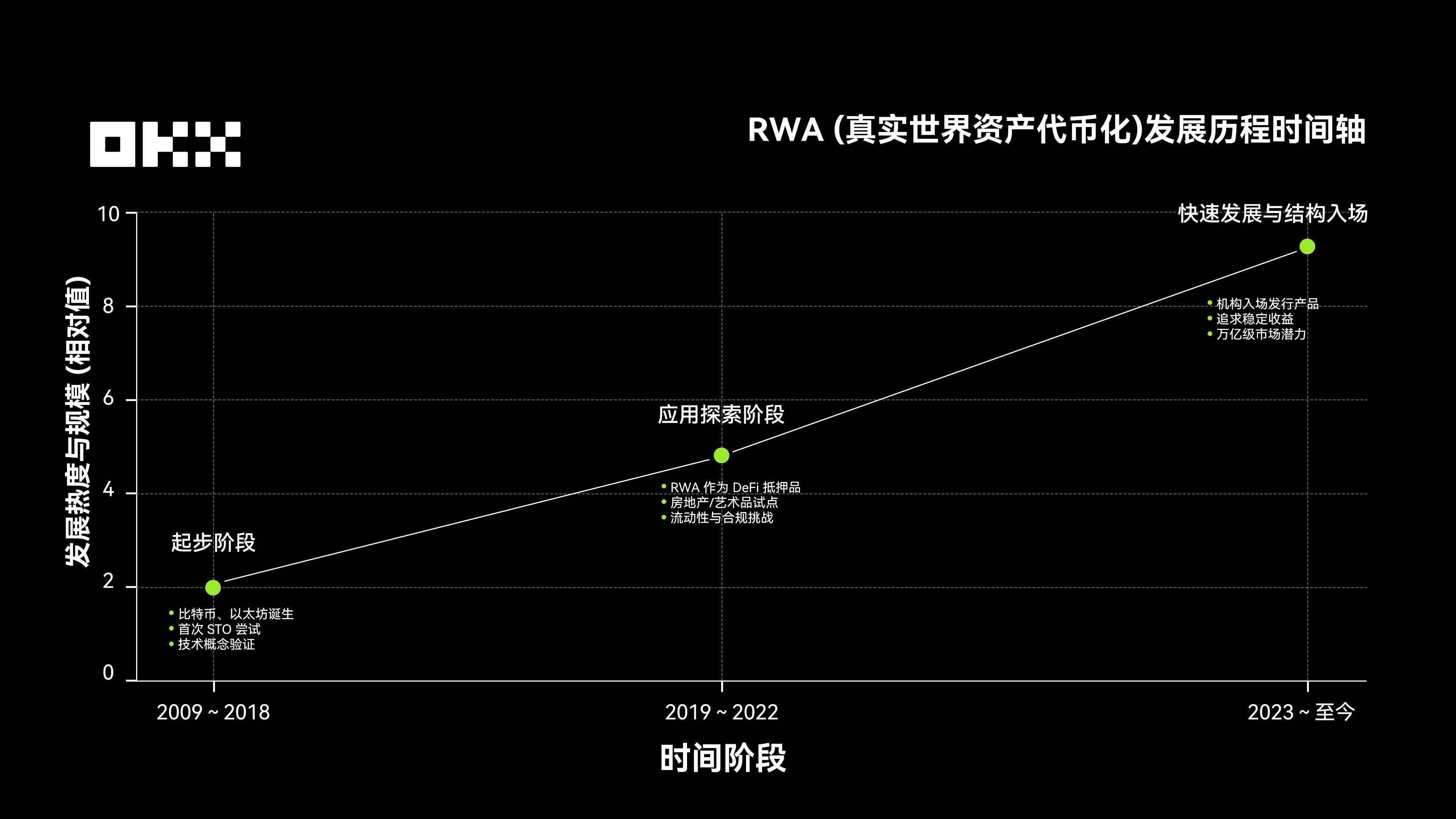

The development of RWA has roughly gone through three stages: from 2009 to 2018, the initial stage, with the birth of Bitcoin and Ethereum, which initiated early explorations of asset tokenization and STOs; from 2019 to 2022, the application exploration stage, where RWA was introduced into DeFi as collateral, and assets like real estate and artworks began pilot projects on-chain, but still faced liquidity and compliance challenges; since 2023, with investors seeking stable returns and institutions actively issuing tokenized products, the RWA market has entered a rapid development phase, continuously expanding in scale and moving towards a trillion-dollar new financial market.

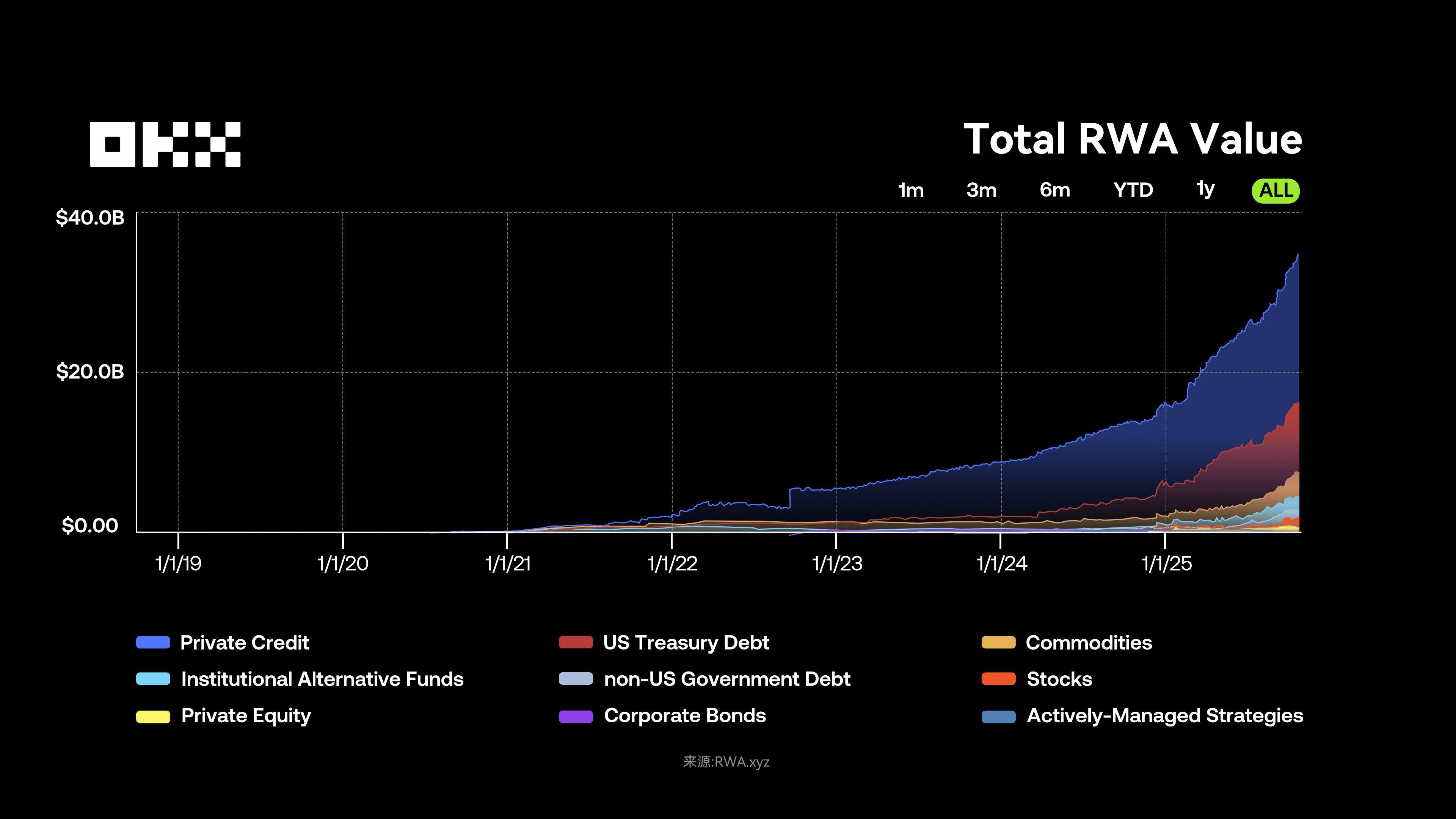

From a macro perspective, RWA first enhances payment and collateral efficiency, then expands credit, ultimately supporting AI wallet transactions, which may reshape capital markets in the next five to ten years. The RWA market has shown exponential growth since 2019, when it was valued at $50 million, with particularly significant growth expected in 2024-2025. As of November 3, 2025, the total on-chain RWA (excluding stablecoins) reached $35 billion, a more than 150% increase compared to the same period last year; the total market capitalization of stablecoins surpassed $295 billion, with over 199 million users holding them, reflecting that the tokenization narrative is moving from concept to large-scale application.

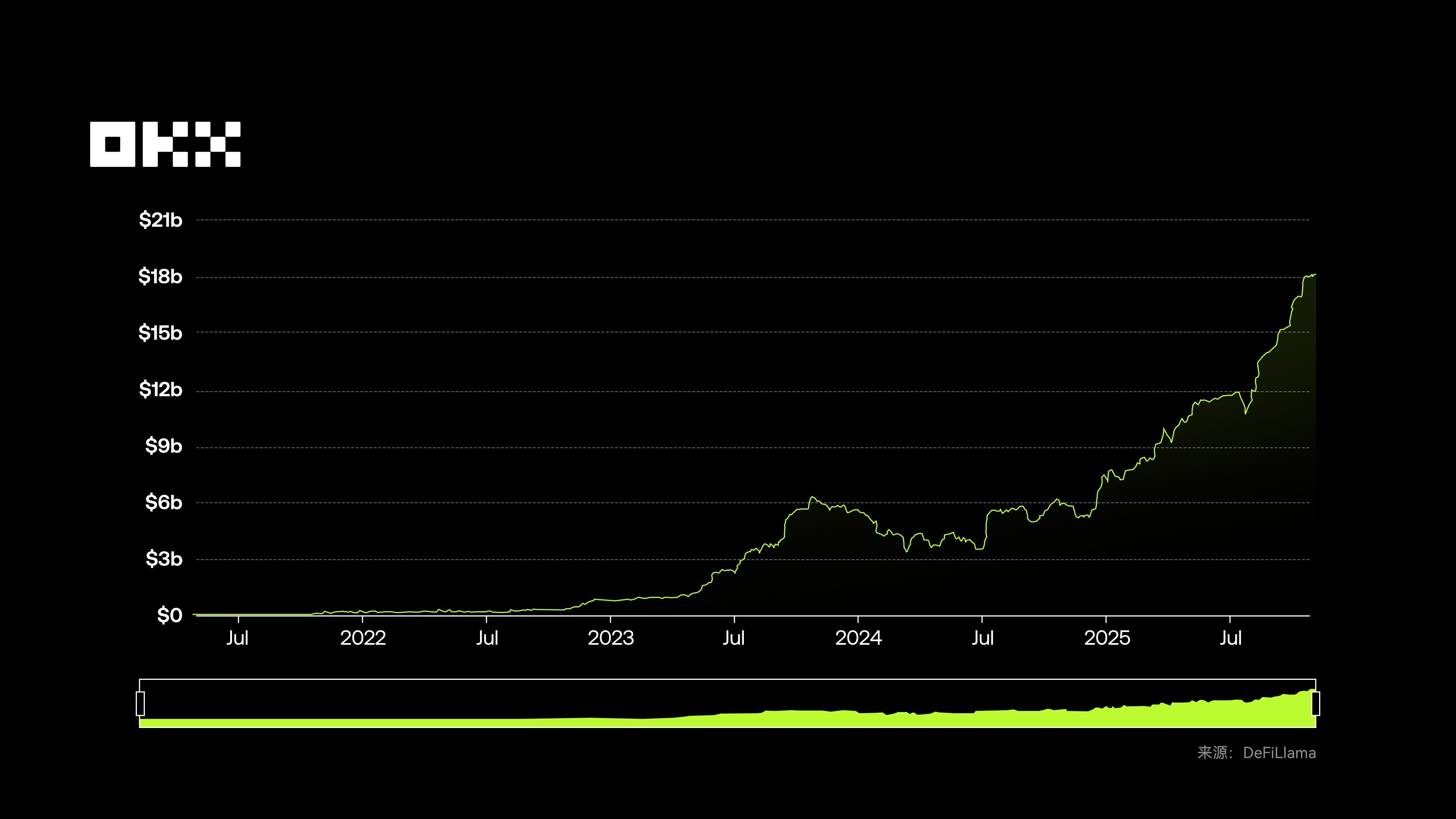

According to DeFiLlama data, the total locked value (TVL) of global RWA reached $18.117 billion, continuing its growth trend. (Note: The total on-chain RWA value accounts for the total value of all related tokens issued on-chain; TVL specifically refers to the value of RWA stored in DeFi protocols as collateral or income-generating assets. A significant portion of RWA (such as BlackRock's BUIDL) is held directly by users in wallets and has not been deposited into DeFi protocols, so TVL will be much lower than the total issuance.)

This growth is driven by the simultaneous resonance of institutional entry, regulatory clarity, and technological maturity: the unclear global interest rate environment has made tokenized U.S. Treasury bonds (yielding about 4%) a low-risk asset of choice for DeFi users and institutions; regulatory frameworks like the EU's MiCA provide a legal blueprint; asset management giants like BlackRock and Franklin Templeton have issued products that validate the compliance and feasibility of RWA. Meanwhile, DeFi protocols have introduced RWA as collateral and yield benchmarks to avoid volatility, with MakerDAO accepting RWA collateral to release stablecoin liquidity, creating a resonance between on-chain and off-chain funds.

### 2. Insights into the RWA Sector: User Profiles, Structure, and Six Major Assets

According to RWA.xyz data, as of November 3, 2025, the number of RWA asset holders has surpassed 520,000. Institutional investors dominate the market (about 50-60%), participating through platforms like BlackRock BUIDL and JPMorgan TCN; qualified/high-net-worth individuals account for 10-20%, mainly through platforms like Ondo and Paxos; retail investor participation remains low but is gradually increasing through new models like fractional ownership.

The current RWA market appears prosperous, but institutional capital primarily chases a few safe assets, such as U.S. Treasury bonds and top private credit, creating a red ocean. True growth lies in whether non-liquid long-tail assets (such as SME invoices, carbon credits, and consumer credit) can be scaled on-chain, but the composability of DeFi and the risk isolation of traditional finance present fundamental conflicts. Without accompanying disclosure and constraint tools, RWA will forever be just an on-chain mirror of traditional finance, rather than a more efficient capital market.

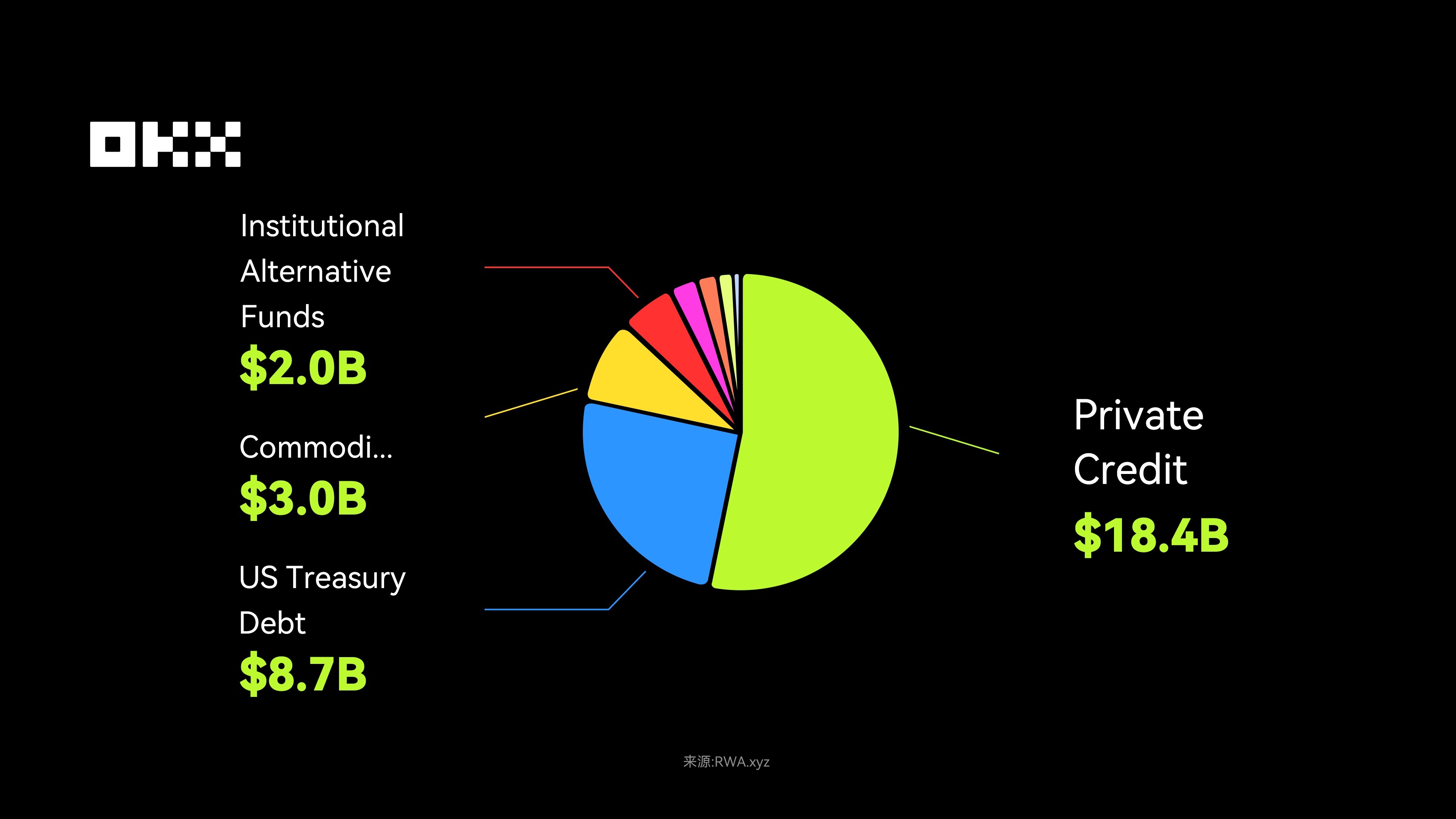

The on-chain RWA asset structure reveals market preferences: private credit and U.S. Treasury bonds are core assets, with the former commanding a significant share due to high yields, while the latter serves as an "entry-level" product for institutional capital; commodities and institutional alternative funds are approximately $3 billion and $2 billion, respectively. Non-U.S. government bonds ($1 billion), public equity ($690 million), and private equity ($580 million) make up the long-tail assets, which have greater growth potential. In the long run, the space for asset tokenization far exceeds the current scale. BCG estimates that by 2030, global asset tokenization business opportunities could expand to $16.1 trillion, accounting for about 10% of global GDP.

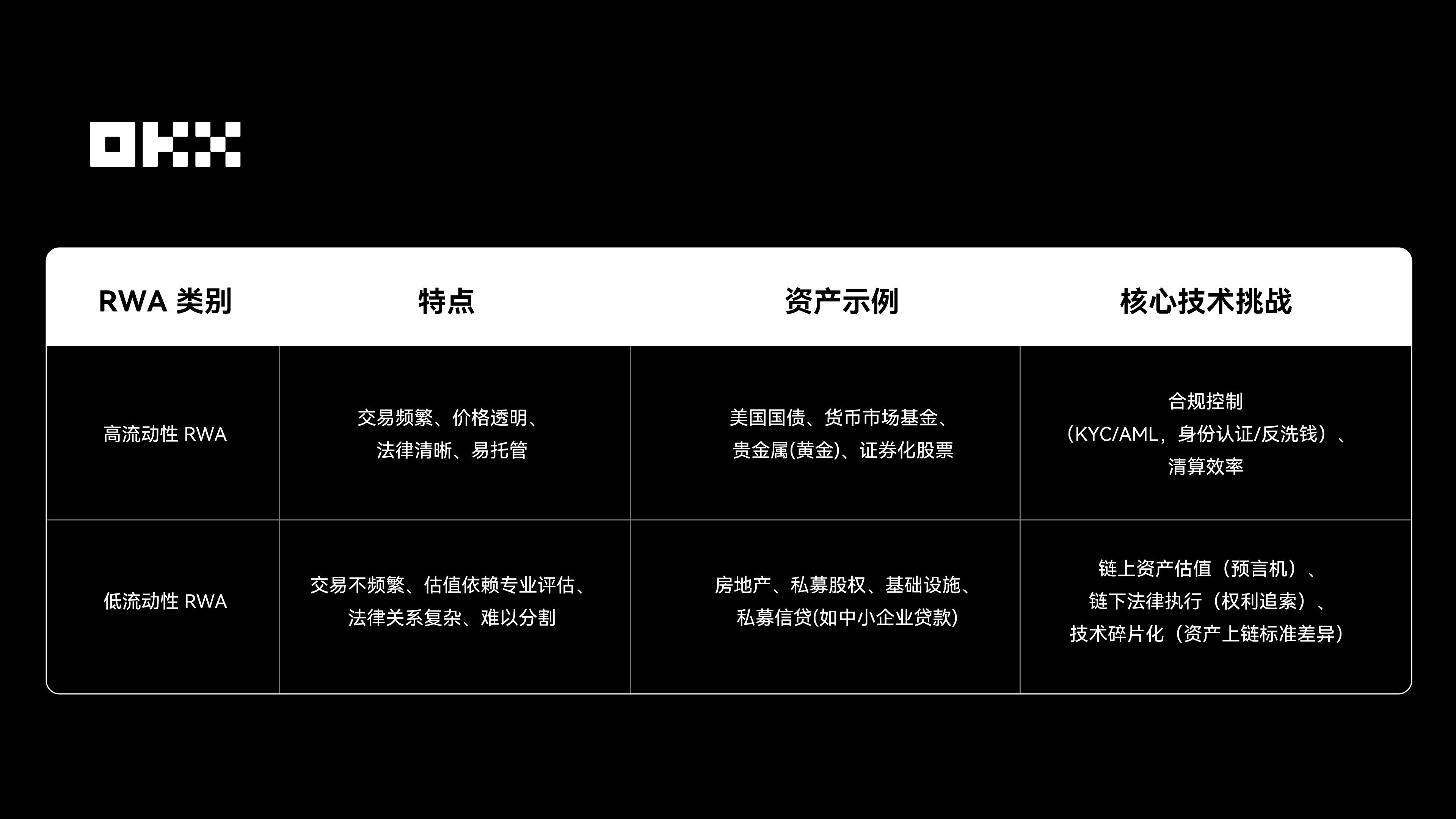

It is important to note that not all assets are suitable for tokenization. The real growth points often come from assets with stable cash flows but modest returns, such as short-term government bonds, HELOCs, and consumer credit, which are predictable and cash-rich, making them ideal candidates for on-chain packaging. Conversely, assets with extremely poor liquidity (such as certain real estate) may struggle with liquidity issues even if tokenized.

A common but misleading understanding is: "Tokenization can create liquidity." The reality is that tokenization cannot generate liquidity; it can only expose and amplify the inherent liquidity characteristics of the asset. For highly liquid assets (like U.S. Treasury bonds and blue-chip stocks), tokenization can optimize and expand, making liquidity available around the clock, globally, and programmably, which is an enhancement. For low-liquidity assets (like individual real estate or specific private equity), tokenization merely changes the form of ownership registration and does not address the fundamental issues: information asymmetry, valuation difficulties, complex legal transfers, and insufficient market depth. On-chain property NFTs will still have zero liquidity without buyers.

The core logic is that liquidity comes from a strong network of market makers, a clear price discovery mechanism, and market confidence, rather than the token standard itself. Blockchain addresses settlement and custody efficiency, not asset attractiveness. The insight for the market is that successful RWA projects (like tokenized U.S. Treasury bonds) do not create new assets but provide better channels for cash cow assets that have high demand and low trading efficiency. Furthermore, the current slow-growing RWA sectors (like real estate) face issues not with technology but with the non-standard and low-frequency trading characteristics of the assets themselves. The primary value of tokenization lies in transparency and process automation, with liquidity improvement being a secondary possibility.

There are significant differences in the scale of RWA across different public chains. Aside from private, permissioned blockchains like Canton developed by Digital Asset, RWA assets are still primarily concentrated on the Ethereum network. Additionally, networks like Polygon, Solana, and Arbitrum also have varying scales of deployment.

When analyzing from the perspective of yield-generating assets or investment potential, the core focus remains on categories like private credit, U.S. Treasury bonds, and commodities. Although they are smaller in scale, they are the true "yield-driven" RWAs. Therefore, understanding the RWA market requires distinguishing between perspectives dominated by total market capitalization and those dominated by yield-generating assets.

(1) Private Credit: Core High-Yield RWA Asset

Private credit has a scale of $1.6 trillion in traditional finance, making it the largest asset class among non-stablecoin RWAs. It packages non-publicly traded debt instruments like corporate loans, invoice financing, and real estate mortgages into tradable tokens through blockchain smart contracts.

The growth of private credit stems from high yields and relative stability, providing DeFi users with annualized returns of 5%-15%, with volatility independent of the crypto market. Tokenization fragments non-liquid assets, attracting global crypto capital and enhancing liquidity while empowering traditional lenders. Moreover, it does not redefine credit but offers a more efficient receipt mechanism. Once these assets are on-chain, they can be inserted into lending markets, used as collateral, or packaged into asset-backed securities like other crypto assets.

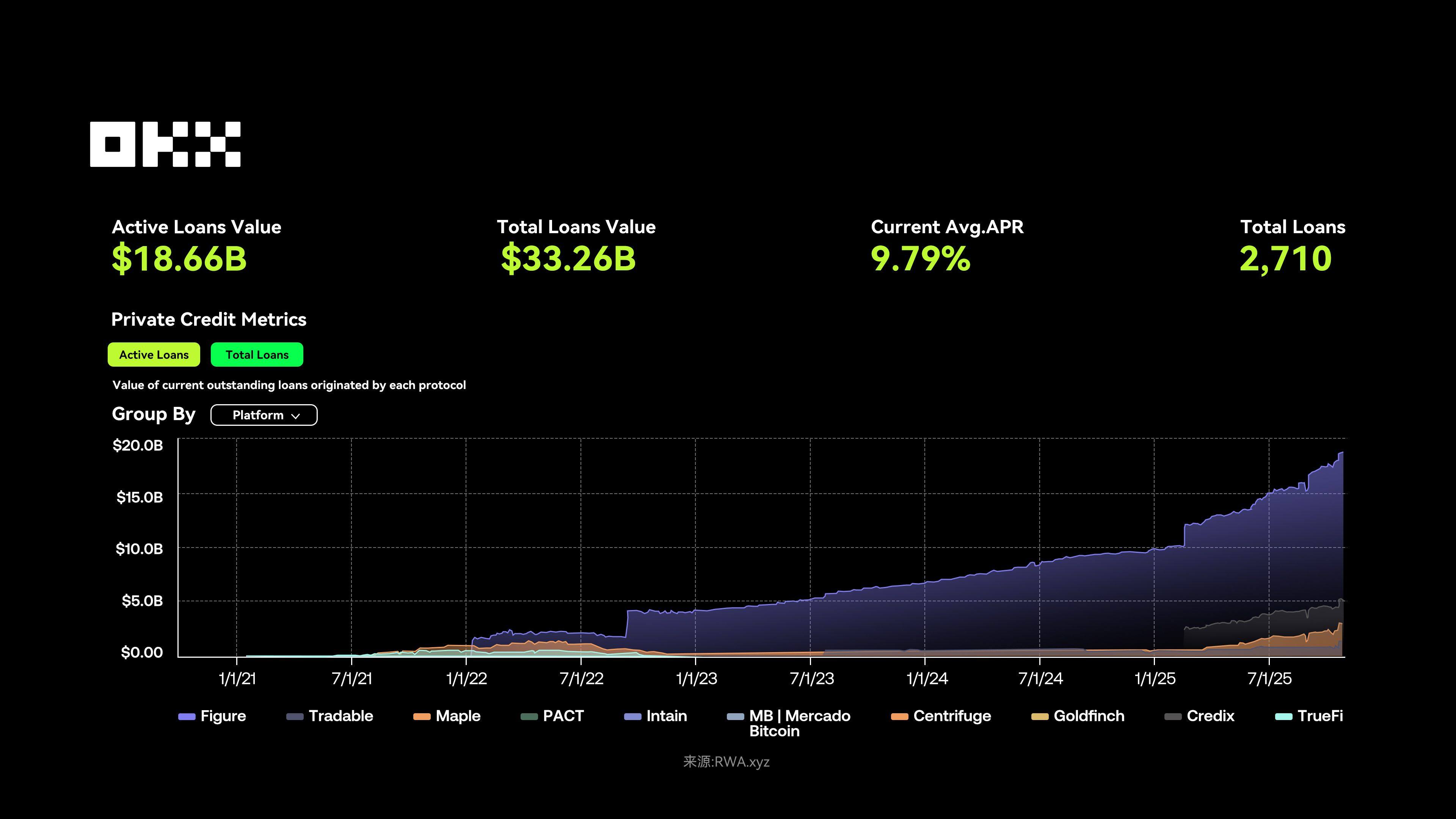

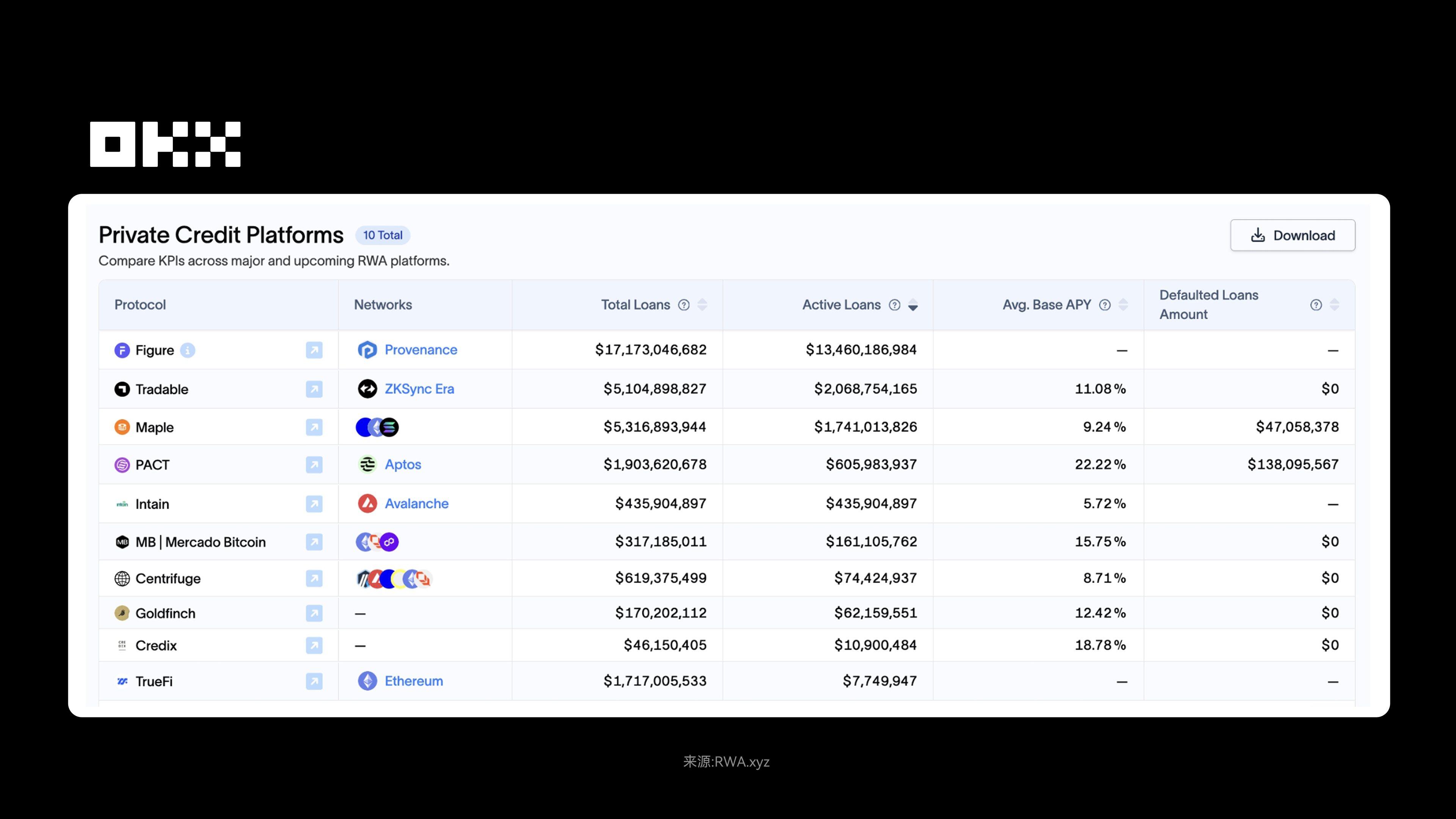

As of November 7, 2025, the active loan scale of private credit in the RWA sector is approximately $18.66 billion, with an average annualized interest rate of 9.79% and a total of 2,710 loans. The Figure platform holds about 92% market share, with total loans reaching $17.2 billion; Centrifuge has seen its TVL grow from $350 million to over $1.3 billion through a multi-chain architecture and interoperability with DeFi protocols, with historical annualized returns of 8%-15%.

The on-chain prosperity of private credit replicates the traditional credit cycle: starting with high-quality credit and then expanding to lower-quality collateral. The collapse of certain yield-generating stablecoins may signal the entry into the "junk bond" phase—these products essentially lend user funds to opaque on-chain/off-chain hedge funds, bearing significant counterparty risk behind high yields. The Stream Finance incident illustrates that the real threat in the modular lending market is liquidity freeze: even if the protocol's solvency is normal, a run triggered by the collapse of low-quality assets can drain the entire shared liquidity layer, leading to temporary paralysis for users, which is not only a technical risk but also a collapse of reputation and trust.

Figure follows a high-compliance route in the U.S. It addresses the pain points of traditional lending, such as numerous intermediaries, slow approvals, and poor asset liquidity. The platform uses its self-developed Provenance blockchain to tokenize the entire process of Home Equity Line of Credit (HELOC), allowing for rapid settlement and custody of assets on-chain. In other words, from application to disbursement, the borrower experience is extremely fast—pre-approval can be done in 5 minutes, and funds can be received within 5 days. This high-efficiency model not only meets the needs of borrowers but also encourages institutional investors to participate. With over $16 billion in home equity loans and more than 50% of the active market share, Figure is almost a monopoly in the HELOC market and successfully went public on NASDAQ in September 2025.

Centrifuge takes a completely different approach, leaning towards DeFi infrastructure and focusing on multi-chain interoperability. It solves the problem of traditional illiquid assets (such as corporate invoices and accounts receivable) being difficult to put on-chain. Its core product, Tinlake, can split assets into different risk levels (Senior/Junior) while providing DeFi users with annualized returns of about 8%–15%. Centrifuge's greatest advantage lies in its deep integration with the DeFi ecosystem—platforms like Aave and MakerDAO can directly use its assets as collateral. Through this method, the platform's total locked value (TVL) has surpassed $1 billion, providing an efficient on-chain financing channel for small and medium-sized enterprises and asset owners.

(2) U.S. Treasury Bonds: The "Entry-Level" RWA for Institutional Capital

As of the end of October 2025, the total scale of U.S. Treasury bonds has exceeded $38 trillion. The tokenization of Treasury bonds actually originated during the DeFi bear market from 2020 to 2022, when market yields were generally low, prompting users to seek more stable and reasonably rewarding assets. U.S. Treasury bonds fit this demand perfectly: government-backed, nearly zero risk, with annual yields of 4%-5%, significantly higher than bank deposits (1%-2%) and some DeFi lending products. However, the problems are also evident—insufficient liquidity (buying and selling must go through brokers or securities accounts), high entry barriers (KYC required), and geographic restrictions (non-U.S. users find it difficult to invest directly). By 2023, the Federal Reserve's interest rate hikes pushed Treasury bond yields above 5%, coupled with the explosion of the stablecoin market, rapidly increasing the demand for tokenization.

Early projects like Ondo Finance's OUSG (2023) and Franklin Templeton's FOBXX are representatives of this trend. By 2024, BlackRock officially joined the fray, promoting the market scale from $85 million in 2020 to $4-5 billion in Q1 2025, with the overall market surpassing $8 billion. In terms of yield, BlackRock's BUIDL offers an annualized return of 4%-5%, while Ondo's USDY even exceeds 5%, allowing participation in "sustainable yield farming" in DeFi scenarios, further amplifying returns.

Technically, the tokenization of Treasury bonds relies on ERC-20/ERC-721 to achieve on-chain ownership transfer; BUIDL and USDY essentially package the programmability of extremely conservative debt instruments. They do not redefine Treasury bonds but provide an on-chain interface. Once these assets are on-chain, they can be used as collateral in DeFi, participate in yield farming, and even circulate across chains. This "Wrap as a Service" model is key to the scaling of RWA from pilot projects to widespread adoption. On the regulatory front, support from the EU's MiCA and the U.S. SEC accelerates implementation.

In terms of stability, U.S. Treasury bonds have nearly zero default risk (AAA rating), are resistant to inflation, and withstand market volatility; on-chain tokenization can enhance transparency and security through smart contracts and audits. Even better, their liquidity and accessibility have significantly improved—24-hour trading, minimum participation of $1, and global user access; in DeFi, they can also be used as collateral to borrow USDC. As institutions continue to join, with improved KYC support and diversified products (including both short-term and long-term Treasury bonds), the compliance and universality of tokenized Treasury bonds are becoming stronger.

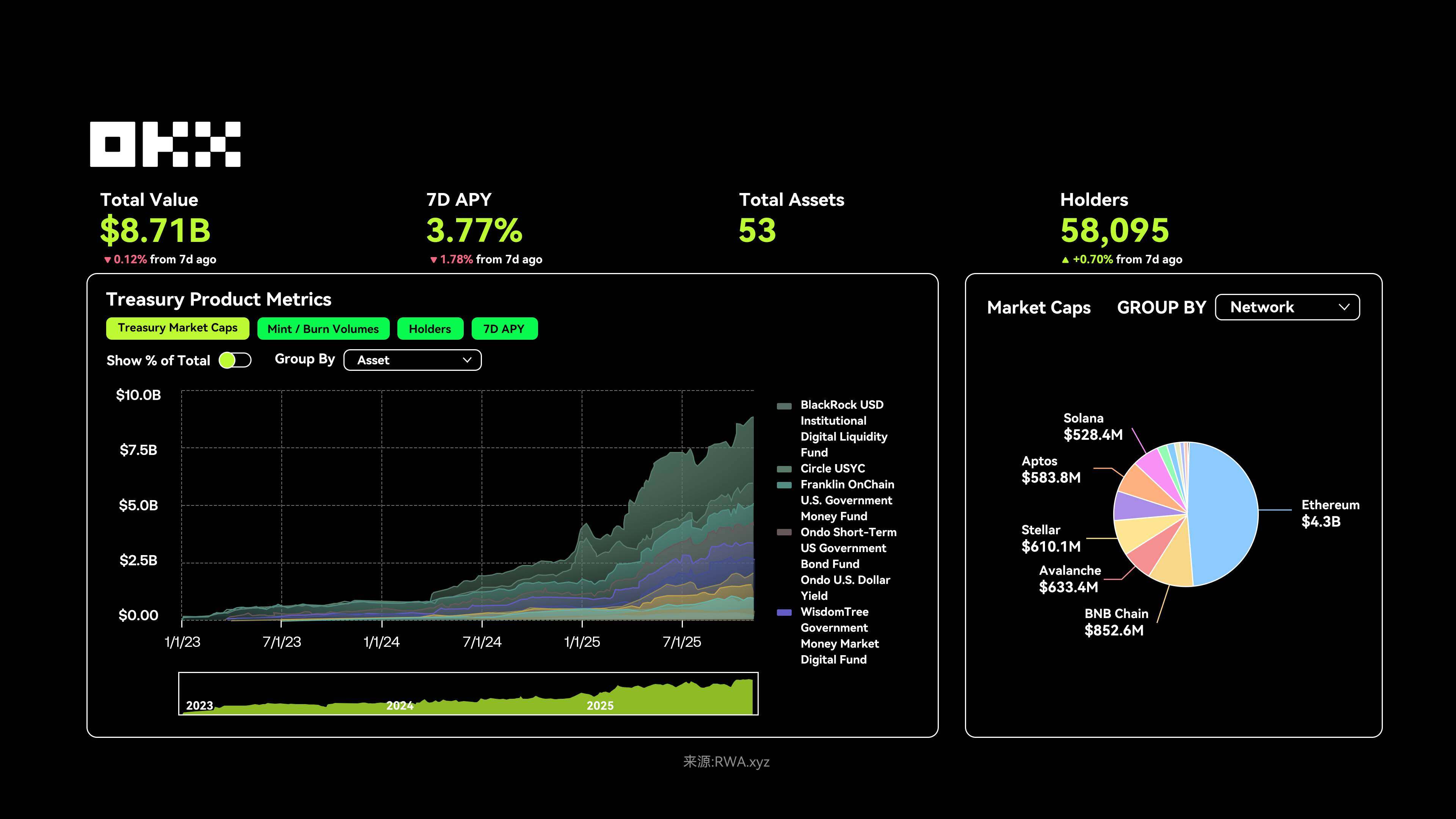

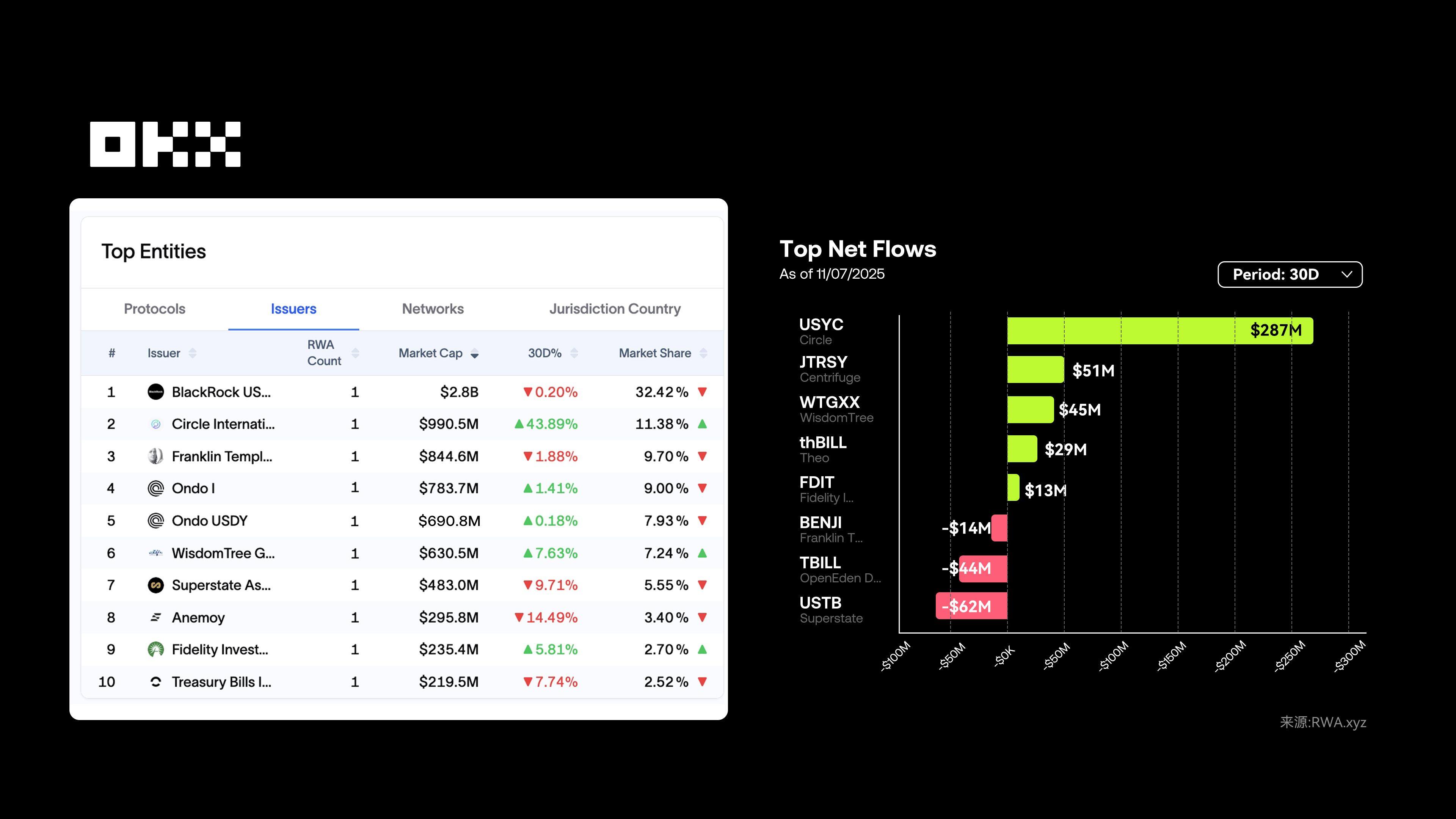

As of November 7, 2025, the total locked value of the tokenized U.S. Treasury bond market is approximately $8.7 billion, with over 58,000 holders, and a 7-day average annualized yield (APY) of 3.77%, slightly down from earlier, reflecting changes in the interest rate environment. In terms of on-chain distribution, Ethereum accounts for over $4.3 billion, with a clear multi-chain trend, such as VanEck's VBILL fund expanding into multiple ecosystems.

The tokenized U.S. Treasury bond market is currently mainly dominated by institutions like BlackRock BUIDL, Circle USYC, and Ondo Finance. In 2025, as interest rates return to normal levels and stablecoin regulations become clearer, this sector is heating up rapidly. The core goal is straightforward: to bring U.S. Treasury bonds onto the blockchain, allowing users to obtain stable, readily available returns. At the same time, these products strictly differentiate between U.S. qualified investors and global non-U.S. investors, with entry barriers ranging from retail (like USDY/USYC) to high-net-worth (like OUSG/BUIDL), enabling users to reasonably diversify investments based on geographic location, risk tolerance, returns, and fees.

BlackRock BUIDL is the leader in institutional-level U.S. Treasury bond tokenization. It addresses the issues of high entry barriers and poor liquidity in traditional investments. With the backing of BlackRock's brand and Securitize's compliance pathway, BUIDL has a market capitalization of approximately $2.8 billion, accounting for about one-third of the market. The entry barrier is high (at least $5 million), aimed only at U.S. qualified institutions. Returns are based on the SOFR rate (simply put, the average overnight borrowing rate secured by U.S. Treasury bonds) minus management fees, yielding about 3.85% annually, while on-chain transparent audits make it the highest compliance benchmark for the integration of traditional finance and Web3.

Circle USYC primarily serves non-U.S. users and qualified institutions, addressing their inconvenience in purchasing U.S. Treasury bonds, currently with a scale of about $990 million. It is deeply integrated with USDC and supported by Bermuda regulations, offering a 7-day annualized yield of about 3.53% APY, with returns automatically updated daily through net asset value, eliminating the need for manual collection. The fund does not charge management fees, only a 10% performance fee, which is relatively high. USYC supports T+0 real-time redemptions and multi-chain circulation, with a moderate entry barrier ($100,000 and KYC/AML verification), and accelerates global expansion through partnerships with traditional financial institutions like DBS Bank.

Ondo Finance takes a mass-market approach, covering different user groups through its OUSG and USDY products, addressing the high KYC barriers and liquidity issues in U.S. Treasury bond investments. OUSG (approximately $783 million) targets U.S. qualified institutions, investing in short-term Treasury bond ETFs, requiring strict verification (net assets ≥ $5 million, minimum investment of $100,000 USDC); USDY (approximately $690 million, with over 16,000 holders) targets global non-U.S. investors, requiring no strict verification, allowing users to earn returns simply by depositing USDC, greatly simplifying retail participation. Its advantages include low management fees (0.15%), multi-chain compatibility (Ethereum, Solana), and the ability to use U.S. Treasury bond yields (approximately 3.7% APY) as "liquid money" for DeFi collateral. Strategically, Ondo is building a full-stack RWA infrastructure through acquisitions like Strangelove, providing asset issuance, secondary markets, custody, and compliance tools to prepare for institutional-level RWA solutions.

The success of tokenized Treasury bonds does not lie in disrupting Treasury bonds themselves but in serving as a compliant, low-risk "Trojan horse" that brings institutional capital and trust onto the chain. BUIDL and USDY essentially package conservative debt instruments into programmable formats, making ancient financial products portable, composable, and available 24/7. This is the true product-market fit (PMF) of the first phase of RWA: serving machines rather than humans, providing a risk-free yield curve for on-chain finance, and paving the way for more complex RWA financial engineering. In the next phase, whoever can build a killer application for on-chain money market funds based on this will capture immense value.

(3) Commodities: Gold Tokenization Leads Growth

In the RWA sector, commodities refer to the tokenization of traditional goods such as oil, gold, silver, and agricultural products through blockchain, granting them digital ownership and enabling trading on-chain.

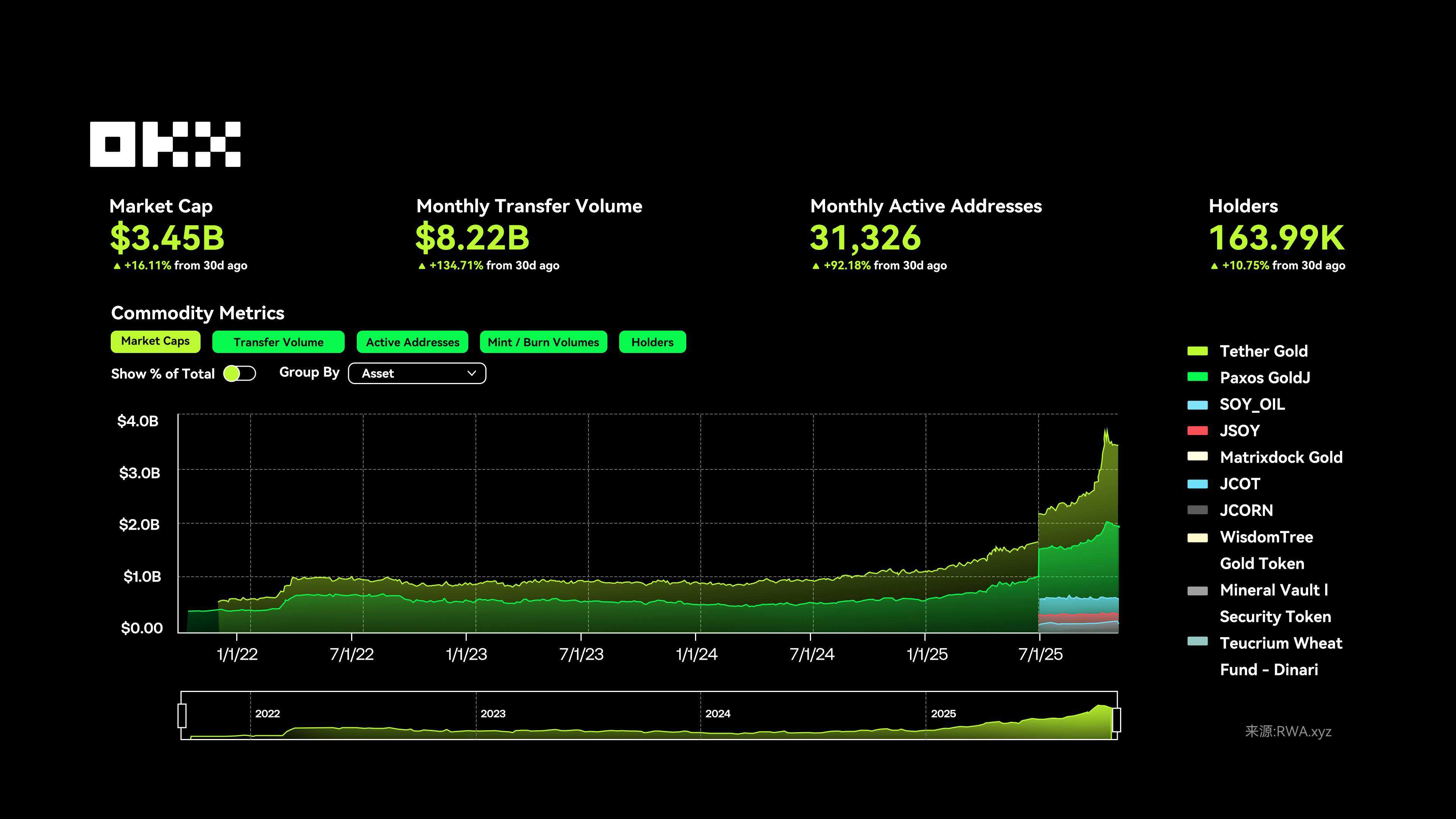

As of November 10, the current commodity tokens in the RWA sector show significant growth, with the total scale gradually increasing from less than $10 in the early days to approximately $3.5 billion, a monthly trading volume of $8.22 billion, 31,326 monthly active addresses, and 164,000 holders. Notably, gold tokens have performed exceptionally well, while tokenized assets for commodities like oil and soybeans have recently shown an accelerating upward trend, with overall market activity and scale rapidly expanding.

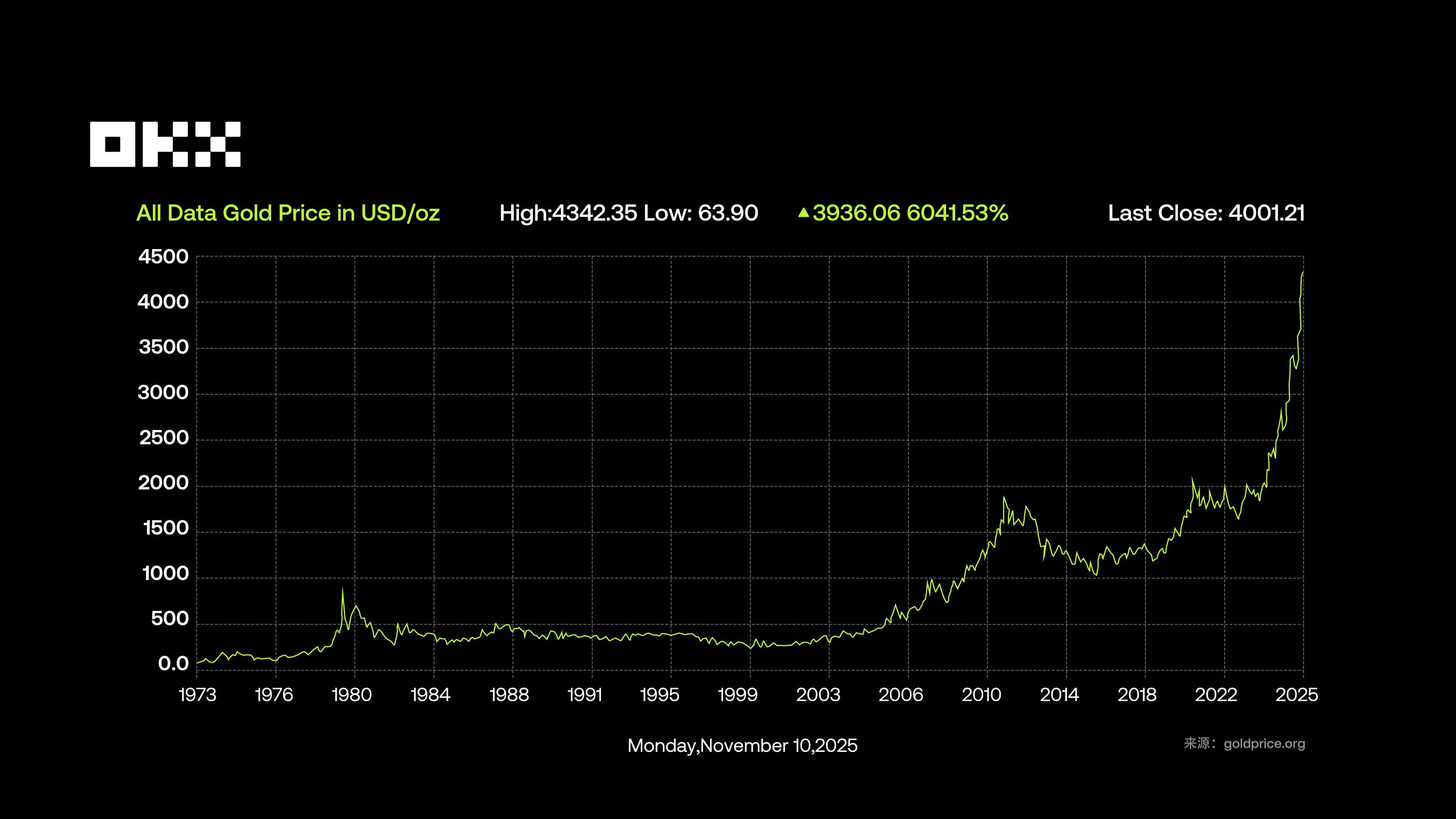

As of November 10, 2025, the spot price of gold has risen to approximately $4,075 per ounce, a cumulative increase of 55.3% within the year, reaching a historical high. The price increase is primarily driven by geopolitical tensions, inflation expectations, and central banks' continued purchases of gold—global central banks net purchased over 600 tons of gold in the first three quarters of 2025. In terms of market scale, the total global gold stock is approximately 216,000 to 282,000 tons (including minerals, central bank reserves, and jewelry), with a total value of about $27 trillion at current prices. The global annual demand is about 4,500 to 5,000 tons, with demand in the second quarter of 2025 reaching 1,249 tons (valued at approximately $13.2 billion, a year-on-year increase of 45%), and total annual demand expected to exceed 5,000 tons.

The asset structure in the RWA commodity sector is relatively concentrated, with gold tokens becoming the preferred choice for users looking to invest in RWA commodities due to their traditional safe-haven attributes and mature on-chain issuance mechanisms. This growth reflects both the increasing market demand for on-chain commodity assets and gold's pioneering breakthrough as a "digitally native" physical asset in the RWA field. Gold tokens such as Tether Gold and Paxos Gold are core assets in the RWA commodity sector, with their market capitalization far exceeding that of other commodities (such as oil and agricultural product tokens). Especially after July 2025, the market capitalization of gold RWA tokens has seen explosive growth, becoming the main driver of the overall sector's expansion.

The tokenized gold market is currently dominated by products like Tether Gold (XAUt) and Paxos Gold (PAXG). Although both are pegged 1:1 to physical gold, they exhibit significant differences in strategic focus and user service. The former is suitable for users seeking trading convenience and profit opportunities, while the latter is more appropriate for holders who prioritize safety and prefer long-term allocations.

Tether Gold (XAUt) is the largest tokenized gold, issued by Tether, with each token corresponding to one ounce of physical gold stored in professional vaults. As of November 2025, its market capitalization is approximately $2.1 billion, accounting for 56.8% of the market, making it the absolute leader. XAUt can be traded on exchanges like OKX, supports small holdings, and allows users to pay a fee of 0.1%–0.5% to exchange for physical gold. Some DeFi protocols also support collateralization or earning yields. Technically, it operates on multi-chain networks such as Ethereum, Solana, and Algorand. According to data released by Tether, its gold reserves exceed 7.7 tons. However, due to centralized custody and past transparency controversies surrounding Tether, users still need to be cautious about custody and audit risks.

Paxos Gold (PAXG) emphasizes compliance and targets institutional and conservative users. It is issued by Paxos Trust Company, regulated by the New York Department of Financial Services, with each token corresponding to one ounce of physical gold stored in the London vault. Its advantages lie in compliance and traceability, allowing users to query the serial numbers and storage information of the gold bars corresponding to their tokens on-chain. As of November 2025, its market capitalization is approximately $1.12 billion, with a market share of 30.3% and over 41,000 holding addresses. PAXG supports purchases starting from 0.01 ounces and can be traded on OKX or the Paxos website. It can also be redeemed for physical gold bars, unallocated gold, or fiat currency. Settlements can be completed as quickly as the same day, with total costs ranging from 19 to 40 basis points, no custody fees, audited by KPMG, and monthly reserve reports published, leading the industry in transparency.

(4) Listed Stocks: Tech Stocks and ETF Tokenization Become Mainstream

In the RWA sector, stocks refer to the tokenization of traditional publicly listed company stocks into crypto assets using blockchain technology. Each token represents partial ownership of the company's stock, allowing holders to enjoy rights such as dividends and voting. Through tokenization, stocks can be traded on the blockchain around the clock, achieving high liquidity and cross-border settlement while maintaining compliance and transparency.

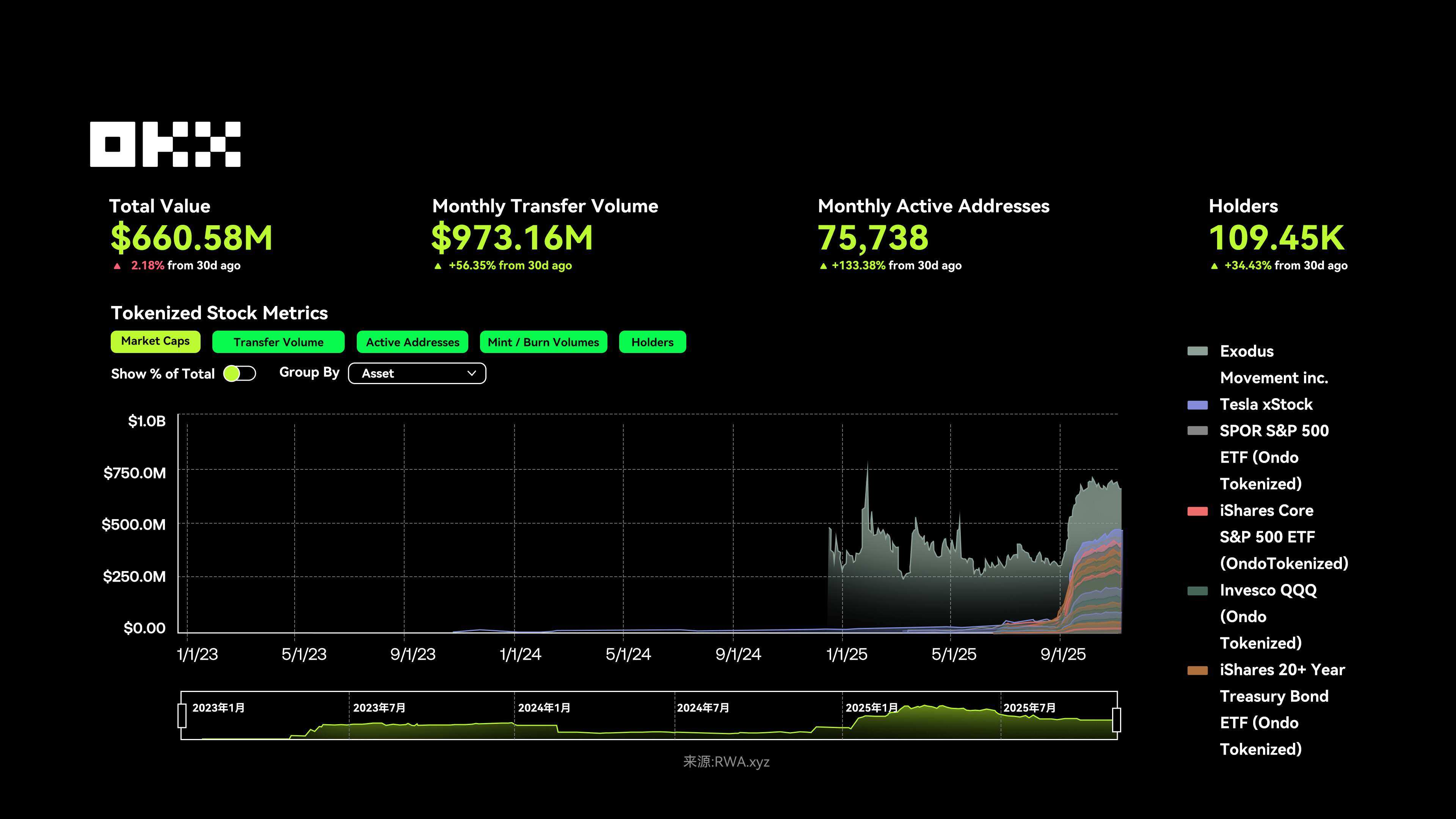

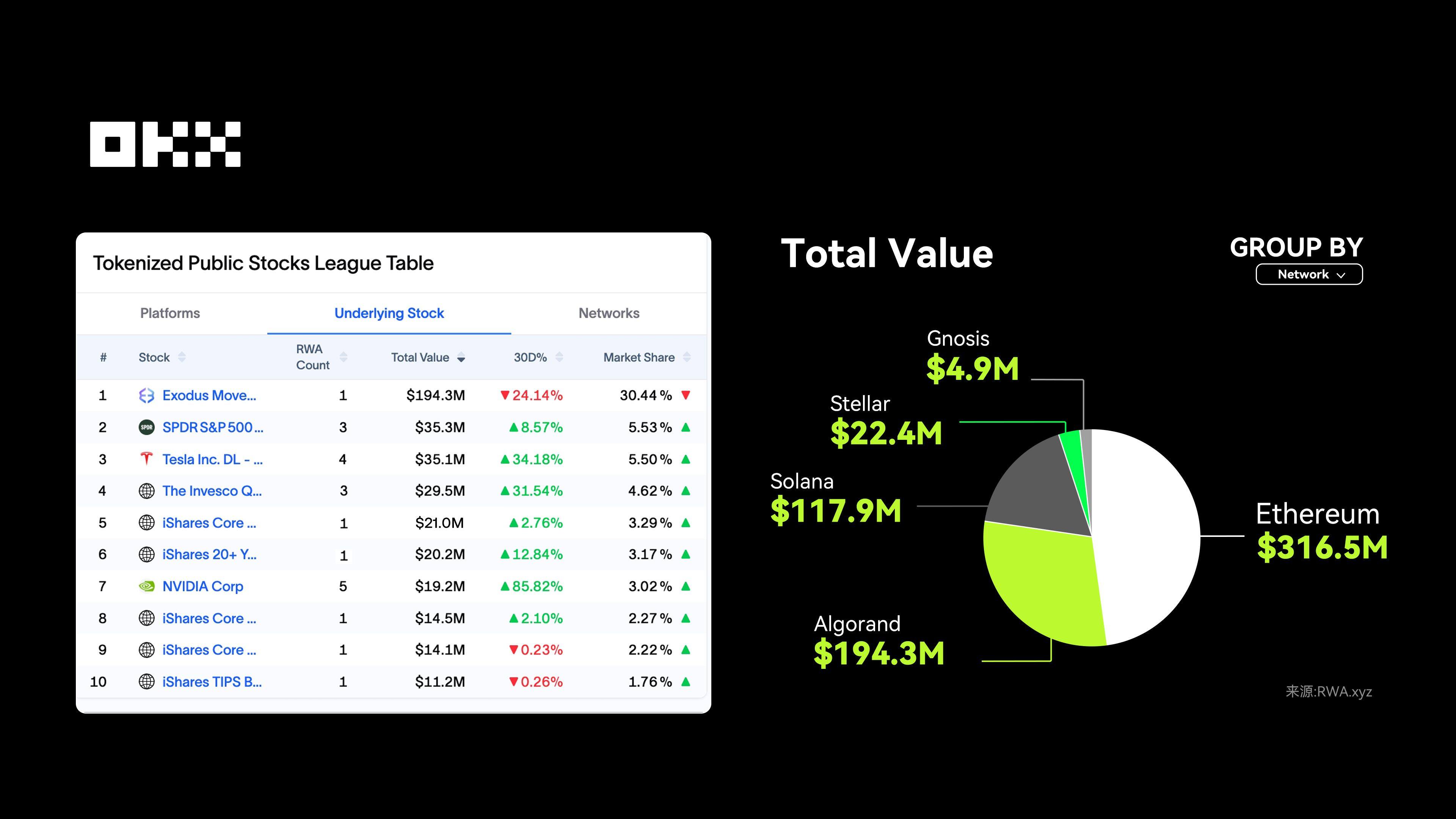

As of November 10, 2025, the total locked value of listed stocks is approximately $661 million, with a monthly trading volume of $973 million (up 56.35% month-on-month), active addresses totaling 75,738 (up 133.38% month-on-month), and the total number of holders exceeding 109,000 (up 34.43% month-on-month). Overall, user participation and trading enthusiasm are continuously rebounding, indicating that the market is entering a new growth cycle.

Tokenized stocks are facing a "triple inquiry" regarding structure, liquidity, and regulation. The mainstream model relies on SPV packaging, which has been criticized for not allowing users to obtain complete shareholder rights, but supporters argue that this is a necessary path from 0 to 1. The most critical pain point is liquidity: weekend market makers are unwilling to hold naked positions, leading to large spreads and low depth. A black swan event, like a midnight tweet from Elon Musk, can instantly crash on-chain prices, with spot prices rebounding on Monday, leaving retail investors perpetually at a disadvantage; DeFi lending may liquidate at these prices, potentially triggering a chain reaction of liquidations. The real opportunity may not lie in the next Robinhood but in the "water sellers" providing the infrastructure for it.

From an asset structure perspective, the core of tokenized stocks remains technology stocks and ETF products, with the market highly concentrated in a few leading projects. For example, Exodus Movement Inc. (EXOD) holds the top position with a total value of $194 million. On October 20, 2025, Exodus announced the expansion of its common stock tokens to Solana through the Superstate issuance platform (previously primarily operating on the Algorand chain), becoming a representative case of "native on-chain stocks," indicating that compliant equity tokenization is moving from concept to reality.

The popularity of tech giants has also extended to the blockchain. Tesla xStock (TSLAx), issued by Backed Finance on Solana, has a total value of approximately $29.44 million, with over 17,000 holders, indicating that tech stocks still carry heat in the crypto market. Additionally, the combined market capitalization of tokenized ETFs like SPDR S&P 500 ETF (SPYon) and iShares Core S&P 500 ETF (IVVon) exceeds $45 million, issued by Ondo Finance, further reinforcing the strategic position of ETF tokenization in providing broad market exposure.

From the issuance side, the growth of this sector is almost dominated by a few platforms. They generally adopt a 1:1 backing of physical assets and achieve asset mapping and yield distribution through on-chain infrastructure. Ondo Finance ($ONDO) leads with approximately 47.8% market share ($316 million), focusing on ETF tokenization (SPYon, IVVon, QQQon, etc.), operating on its self-developed Ondo Chain and Nexus framework, making it the core driving force behind tokenized ETFs.

Although Securitize currently only issues the EXOD asset, it occupies nearly 30% of the market share with a total value of $194 million. As a compliant platform regulated by the SEC, Securitize focuses on institutional-level equity tokenization and has processed over $10 billion in assets by 2025. Furthermore, Backed Finance (BackedFi) holds approximately 18.6% market share ($123 million), primarily targeting technology stock tokenization (TSLAx, NVDAx, etc.), ensuring precise price synchronization through Chainlink oracles, and actively expanding into the Solana multi-chain ecosystem. WisdomTree, as a representative of traditional financial giants, has its WisdomTree 500 Digital Fund (SPXUX) accounting for about 3.4% market share, focusing on the issuance of digital ETF funds and accelerating compliance implementation based on traditional finance (TradFi) experience.

Overall, the top four platforms collectively control over 90% of the market share. As mainstream exchanges like Robinhood and Kraken gradually open tokenized stock trading in mid-2025, along with the maturation of cross-chain settlement and regulatory recognition mechanisms, tokenized stocks are transitioning from niche experiments to mainstream asset classes.

However, centralized custody and fragmented regulation remain potential risks that this sector needs to continuously monitor.

While tokenized public stocks offer convenience, they do not address the fundamental pain points, as the experience provided by traditional brokers is already sufficiently good. The next wave of growth is more likely to stem from a core contradiction: providing efficiency premiums for traditional inefficient assets.

The main battleground for growth will shift from the transparent and efficient public markets (listed stocks, Treasury bonds) to private markets (private credit, private equity). The real pain points in these markets lie in difficult exits, unclear valuations, and slow settlements—for example, selling a share of a private equity fund may take months and rely on emails and manual matching. Tokenization can shorten this process from months to minutes through on-chain clearing and fragmented ownership, releasing liquidity for non-standard assets. The true product-market fit (PMF) lies in the tokenization of private credit and Pre-IPO equity (such as SpaceX), which not only lowers investment barriers but also addresses industry-level challenges of capital lock-up and price discovery.

(5) Real Estate: Fragmented Ownership Lowers Investment Barriers

The RWA real estate sector refers to the tokenization of traditional real estate assets through blockchain, allowing ownership or revenue shares to be traded and managed on-chain. Market growth is primarily driven by fragmented ownership, enabling global users to invest in high-value properties with entry barriers as low as $50 (such as Lofty AI) while enjoying rental income and the high efficiency of instant settlements.

Although private credit and U.S. Treasury bonds occupy the vast majority of the market share, real estate tokenization is still in a phase of rapid growth with significant long-term potential. However, the structural challenges of real estate tokenization will not automatically disappear with "on-chain" solutions: pricing lacks transparent benchmarks, property transfers are complex, and cash flow costs remain high. Even with property tokens or NFTs, property rights still rely on off-chain contracts and registration systems, which is also why RWA is primarily concentrated in standardized assets like Treasury bonds while real estate remains in the pilot stage.

Players in the real estate sector are highly focused on addressing the two major pain points of compliance and liquidity, mainly divided into equity tokenization and trading settlement platforms, such as:

RealT is a pioneer in fractional property ownership models, managing over $500 million in assets as of November 2025. Its core model involves equity tokens, with each token corresponding to an LLC equity share of underlying U.S. residential properties, allowing token holders to enjoy rental dividends and potential property appreciation. The entry barrier is low, typically requiring only a few hundred dollars to purchase, with earnings automatically distributed to compatible wallets, facilitating retail participation in U.S. real estate.

Propy focuses on the real estate transaction process and has processed over $1 billion in transactions to date. Its model involves NFT-Backed Deeds, mapping property deeds through NFTs to enable automated sales and property transfers. Users can complete tokenized property buying, payments, and compliance verification within the app, significantly enhancing transaction efficiency and addressing the complex legal and custody issues in traditional transactions.

Lofty is an emerging player experiencing rapid growth, with a TVL growth rate of 200%. Its model involves AI-driven fractional rental properties, tokenizing rental property assets. Users face extremely low investment barriers, with tokens available for purchase starting at $50, and all investment management (such as rental income and exit mechanisms) is processed in real-time through the app, making it easy for retail investors to participate in real estate.

(6) Stablecoins: Absolute Dominance

After including stablecoins, the understanding of the RWA market by asset class market capitalization reveals that stablecoins undoubtedly have a market cap more than ten times that of all other RWA categories combined, ranking first. This indicates that stablecoins serve as the liquidity foundation and base for the entire on-chain RWA ecosystem. The future growth potential and innovation narrative of the RWA sector primarily lie in how to leverage this infrastructure tool to bring trillion-dollar non-monetary real-world assets (such as bonds, credit, and stocks) onto the blockchain.

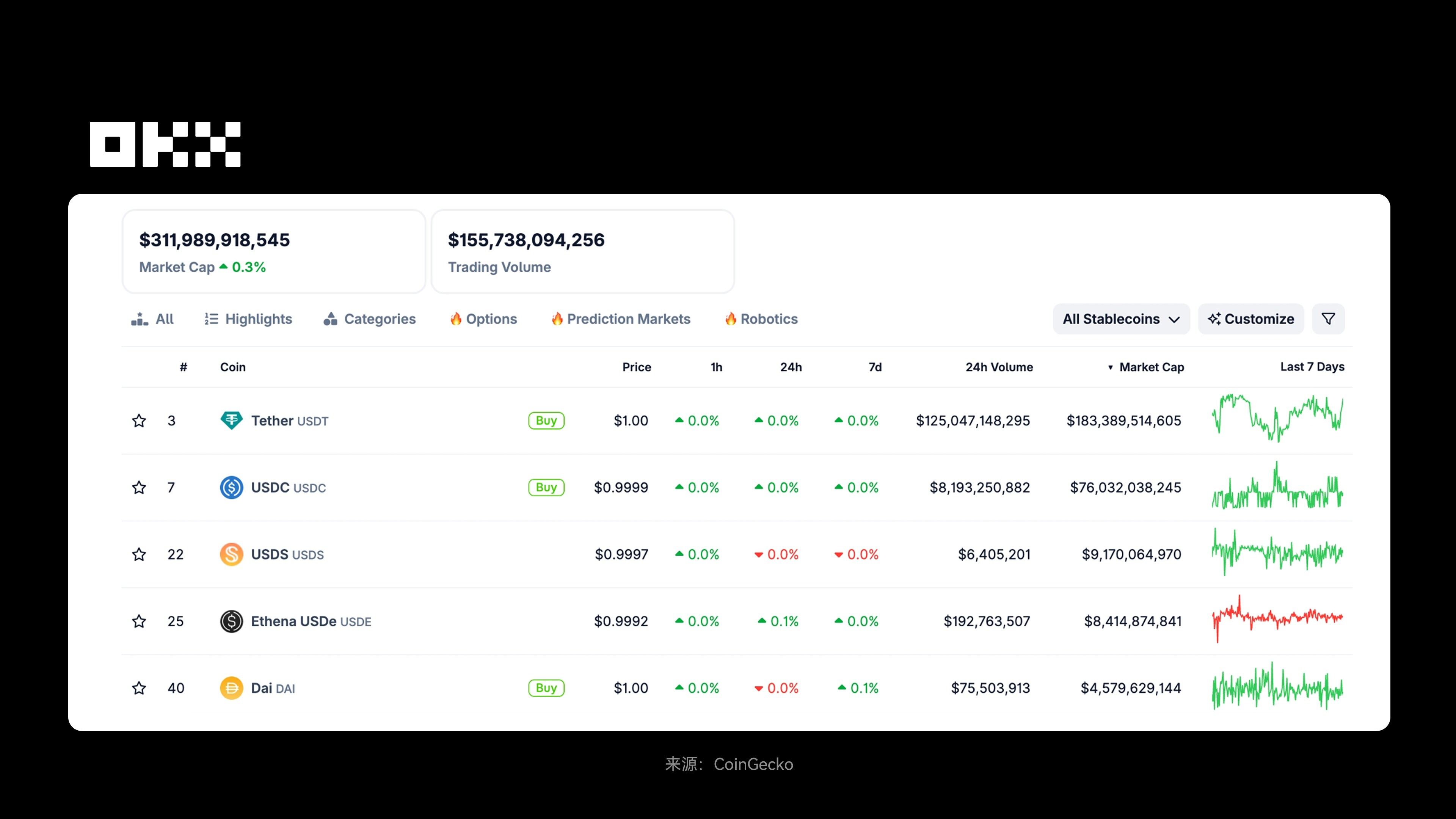

Stablecoins are cryptocurrencies that are pegged to fiat currencies, commodities, or other financial assets, designed to maintain price stability on-chain. According to CoinGecko data, as of November 11, the total scale of stablecoins is $311.99 billion. In terms of issuance networks, Ethereum leads in stablecoin market capitalization, followed by TRON, with networks like Solana and Arbitrum also holding a certain share, reflecting the distribution differences of stablecoins in a multi-chain ecosystem.

The stablecoin market is highly concentrated, with USDT and USDC accounting for over 80% of the market capitalization, primarily backed by fiat collateral, cash, and U.S. Treasury reserves. The degree of centralization is high, and they are mainly used in traditional scenarios such as cross-border payments, transaction settlements, and corporate payrolls. In contrast, smaller stablecoins like DAI, USDe, and sDAI adopt yield-bearing or over-collateralized models, are partially decentralized, and rely on on-chain monitoring and smart contracts to serve DeFi, on-chain lending, and asset tokenization, with higher risks and volatility. Overall, centralized fiat-collateralized stablecoins are low-risk and transparent, while innovative stablecoins emphasize on-chain financial functions and automated yields.

The centralization of stablecoins stems from the inherent demand for fiat support: issuance and management must rely on regulated financial institutions. While decentralization is technically feasible, it is challenging to design and costly, leading most transactions to occur on Layer 2. Users are willing to pay a premium for decentralization at the core settlement layer, but for lower costs and speed, they prefer to accept centralization at the upper layer.

Issuers have the incentive to keep activities within their controlled networks (such as Circle's Arc, Tether's Stable, and Plasma), while crypto and fintech players prefer transactions to occur on networks they control (such as Base and Robinhood Chain). This competition will determine the future landscape of the stablecoin ecosystem.

The table below provides an overview of major stablecoins globally (as of November 11, 2025).

As the most mature and strategically core liquidity infrastructure in RWA, stablecoins first allow leading centralized stablecoins (like USDT and USDC) to introduce the stable value and low-risk returns of off-chain assets onto the blockchain by allocating high liquidity RWAs such as U.S. Treasury bonds, reconstructing the trust foundation of 1:1 fiat peg. Secondly, yield-bearing stablecoins (like USDe and USDM) convert the returns of off-chain assets into on-chain native yields using derivatives or tokenized Treasury bonds, enabling stablecoins to not only serve payment functions but also provide low-volatility investment returns. Finally, stablecoins act as a unified pricing and settlement tool, achieving cross-scenario interoperability across various RWA projects, enhancing asset liquidity and capital efficiency, and becoming the core value bridge of the on-chain RWA ecosystem.

It is noteworthy that stablecoins and tokenized Treasury bonds are forming a complementary relationship, with the former serving as on-chain cash for payments and the latter as on-chain savings for yields and collateral, together constructing a dual-layer currency structure for on-chain finance.

Why is RWA a Key Narrative in 2025?

In 2025, the narrative of RWA reaches its peak, but it may not ultimately be dominated by crypto companies. Platforms like Robinhood aggregate traffic through a unified window (stocks, crypto, future private credit) and earn distribution fees; meanwhile, traditional financial giants controlling trillions in assets (like BlackRock and Fidelity) hold the top of the value chain. They have the capability to launch their own Layer 2 or private chains, integrating assets, tokenized services, trading, and settlement into a closed loop.

The long-term story of RWA is not about crypto disrupting traditional finance, but rather traditional finance moving onto the blockchain. Crypto companies may retreat to the role of infrastructure providers, with their opportunities lying in serving long-tail assets that traditional giants cannot efficiently cover or establishing irreplaceable competitive advantages in key areas such as cross-chain settlement, privacy computing, and dynamic risk pricing. Its core value lies in activating the liquidity of illiquid assets and providing investment opportunities for approximately 1.7 billion unbanked individuals globally, achieving true financial inclusivity.

Despite the broad prospects, RWA still faces multiple challenges: fragmented regulation increases the costs and compliance pressures of cross-border issuance, and the SEC may classify some RWAs as securities; legal complexities, oracle vulnerabilities, and centralized custody introduce counterparty risks; market volatility and privacy compliance issues slow down the pace of adoption. During credit expansion cycles, underwriting standards may loosen, and the quality of collateral may quietly deteriorate, laying the groundwork for the next recession. When DeFi protocols introduce RWA as collateral, they must have a penetrating understanding of the credit risks of the underlying assets.

Therefore, strategically, a hybrid model that integrates CeFi and DeFi is needed to maintain growth momentum. Users are best advised to choose diversified portfolios and operate through audited platforms; issuers should embed ERC-3643 compliance standards from the outset; and regulatory bodies need to establish a unified framework to avoid fragmentation. Overall, RWA is not a bubble but an important cornerstone of crypto finance, expected to support approximately 30% of global financial assets by 2030.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant volatility. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。