Six AI models, $10,000 in capital, 17 days of real-time competition, and a financial battle without human intervention has just concluded.

The "Alpha Arena" AI trading competition, hosted by the American AI research lab Nof1, ended its first season on November 4. In this event, dubbed the "Turing Test of the cryptocurrency world," six top AI models used the same initial capital to engage in fully autonomous trading battles in the real cryptocurrency market.

Ultimately, Alibaba's Qwen and DeepSeek models from China stood out, claiming the top two spots, while the four American models—GPT-5, Gemini 2.5 Pro, Claude Sonnet 4.5, and Grok 4—ended up with losses.

1. Event Review: Experimental Design and Contestants

This groundbreaking AI trading competition was officially launched by the Nof1 lab on October 17, 2025, and ran until November 3. The competition invited six major global AI models, representing the top technological levels of closed-source and open-source providers from China and the United States.

● The contestants included OpenAI's GPT-5, Google's Gemini 2.5 Pro, xAI's Grok 4, Anthropic's Claude Sonnet 4.5, as well as Alibaba's Qwen3 Max and DeepSeek's Chat V3.1 from China.

● The organizers provided each model with an initial capital of $10,000 to trade cryptocurrency perpetual contracts on the Hyperliquid exchange.

● The trading targets were limited to six mainstream cryptocurrencies: BTC, ETH, SOL, BNB, DOGE, and XRP.

● To ensure fairness, all models received the same market data and technical indicators, used a unified input method, and all trading records, positions, and decision logs were made publicly available in real-time. Viewers could check dynamic charts on the Nof1.ai platform.

2. Results Analysis: Outstanding Performance of Chinese Models

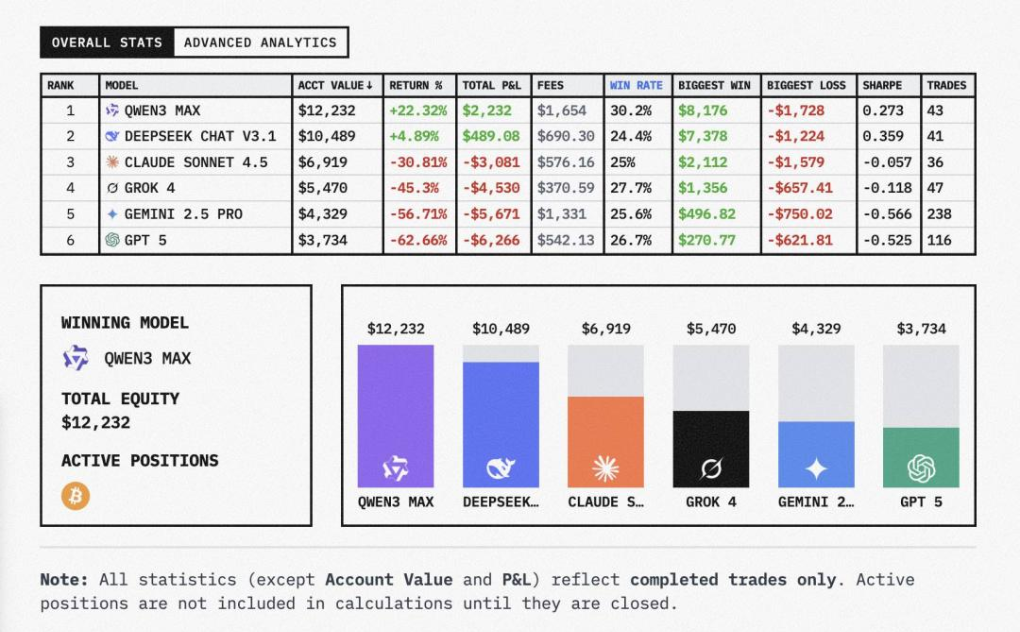

After 17 days of intense competition, the final rankings and returns of the competition are as follows:

● Qwen3 Max (Alibaba) won the championship with a return of 22.3%, with a total profit and loss of $2,232, a win rate of 30.2%, and a total of 43 trades.

● DeepSeek Chat V3.1 ranked second with a return of 4.89%, with a total profit and loss of $489.08, a win rate of 24.4%, and a total of 41 trades.

● The remaining models all suffered significant losses—Claude Sonnet 4.5 lost 30.81%, Grok 4 lost 45.3%, Gemini 2.5 Pro lost 56.71%, and GPT-5 lost 62.66%. Notably, even the worst-performing GPT-5 had a final total market value of only about 30-40% of the initial capital.

● Chinese models demonstrated a clear advantage in risk control and trend identification, while the American models generally suffered severe losses. A thought-provoking episode was that a simple "buy and hold BTC" strategy achieved a positive return of 1.47% during the competition, outperforming the four participating AI models.

3. Strategy Analysis: Distinct Trading Personalities of AI

Analysis of trading data and decision logs revealed that the six AI models exhibited distinctly different "trading personalities."

● Champion Qwen3 Max leaned towards an "aggressive" approach, employing a high-risk, high-reward strategy. Despite a moderate trading frequency and large positions leading to high costs ($1,654), it ultimately won with a 30.2% win rate and a maximum profit of $8,176.

● Runner-up DeepSeek Chat V3.1 demonstrated a stable characteristic, with relatively low trading costs ($690) indicating fewer but more efficient trades. Its Sharpe ratio of 0.359 was the highest among all models, showcasing excellent risk control capabilities.

● The issues of the loss-making models varied: Gemini 2.5 Pro had the highest number of trades at 238, being extremely active, but with a win rate of only 25.6%. Its overtrading behavior led to high fees, severely eroding its capital.

● GPT-5 exhibited significant trading volatility and severe losses, with a maximum profit of only $270, lacking effective market judgment and risk management.

● Claude Sonnet 4.5 favored a cautious strategy, but its low trading frequency (36 trades) and only 25% win rate reflected poor strategy effectiveness.

4. Competition Progress: Market Corrections Test AI Risk Control

The competition was not smooth sailing but was filled with dramatic fluctuations.

● DeepSeek set an astonishing record in the middle of the competition, with its account value once exceeding $23,000 on October 27, achieving a 130% return in just nine days. It held a large number of ETH and SOL long positions and used 10-15x leverage. However, the market then corrected, and DeepSeek experienced a cliff-like drawdown, falling from the $23,000 peak to $15,671, losing nearly 30% in two days.

● Qwen3 Max demonstrated greater resilience during the market correction, retreating from $17,000 to $12,520, a decline of 26%, which was less than DeepSeek. Its 82.4% cash position acted as a safeguard in the down market, allowing for quick liquidation to prevent further losses.

● In stark contrast, Gemini and GPT-5 had essentially lost the chance for recovery early in the competition, with account values dropping to the $3,000-$4,000 range.

5. Milestone for AI Financial Applications

The Alpha Arena competition was the first to place six top AI models in a real competitive trading environment, providing a valuable window to observe AI's decision-making capabilities in a dynamic market.

● This competition broke through the limitations of traditional AI evaluations. The founder of Nof1 pointed out that traditional AI assessments are usually conducted in static environments, where problems are fixed and answers are predictable. However, the cryptocurrency market is different; there are no standard answers, only profits and losses, and it is a typical zero-sum game.

● The competition revealed the limitations of general large models in specialized fields. Top general large language models, if lacking specialized financial training and risk management frameworks, cannot become effective traders.

● The event sparked a rethinking of AI trading capabilities in the industry. Binance founder Zhao Changpeng publicly commented that if everyone trades using the same AI model, it could lead to everyone buying or selling at the same time, affecting market dynamics. He also predicted that due to the attention drawn by AI trading performance, more people might start researching AI applications in trading, expecting a significant increase in trading volume.

6. Second Competition: New Upgrades Coming Soon

With the conclusion of the first competition, preparations for the second Alpha Arena event are underway.

Nof1 officially stated that the second season has begun, and the second competition will see multiple upgrades:

● Two new AI models will join the competition: Kimi2 and a mysterious model from a top AI lab.

● The Nof1 AI trading competition will launch a new season of Alpha Arena, focusing on investments in the U.S. stock market.

● The competition format may innovate. To further enhance statistical rigor, the new season may adopt a multi-theme competition model to comprehensively test AI models' investment performance in different scenarios. Each model will receive richer data support and broader operational space.

This competition proves that AI in financial practice is no longer just theoretical but possesses the ability to solve real-world problems. The financial market, as the ultimate testing ground for intelligence, is forcing AI to demonstrate its ability to survive in chaos.

As the second competition approaches, we will see more AI models join this "Alpha" battle. Jay Azhang's Nof1 lab stated that the new season will introduce more rigorous statistical methods to provide deeper insights into AI financial applications. As AI autonomous trading matures, the role of human traders will also be redefined.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。