Original Title: "The New AI Trading Competition is Here, and Gemini 3 Pro is Gaining Momentum in the US Stock Market"

Original Author: David, Deep Tide TechFlow

Do you remember the AI cryptocurrency trading competition in October?

Alibaba's Qwen 3 Max made a profit of 22% in two weeks, while OpenAI's GPT-5 lost 63%. Six of the world's top large models, each armed with $10,000, battled it out in the crypto market, resulting in a clear divide:

Chinese models triumphed, while American models faced total defeat. (Note: For more details, see: “Six AI 'Traders' Compete for Ten Days: Who Can Survive in a 'No Information Asymmetry' Market?”, “Alibaba's Qwen3 Surges Past DeepSeek at the Last Moment, Achieving an Ultimate Comeback in the AI Cryptocurrency Trading Competition”)

The last season has just concluded, and the new Alpha Arena Season 1.5 is here.

This time, nof1.ai has moved the battlefield from the crypto market to the US stock market. The rules are more complex, there are more participants, and the funding scale has expanded to $320,000.

Can those American models that faltered in the crypto market turn the tide in the US stock market?

Last Season Review

Let's quickly recall the gameplay from the last season:

From October 17 to November 3 this year, six AI large models engaged in an unprecedented competition on Hyperliquid.

Each model received an initial fund of $10,000 and could trade perpetual contracts of mainstream cryptocurrencies like BTC, ETH, SOL, XRP, DOGE, and BNB. The core rule was simple: completely autonomous trading, with zero human intervention.

Participants included:

Qwen 3 Max (Alibaba), DeepSeek Chat V3.1, GPT-5 (OpenAI), Gemini 2.5 Pro (Google/DeepMind), Grok 4 (xAI), Claude Sonnet 4.5 (Anthropic).

The final results are as follows.

Chinese Models:

• Qwen 3 Max won first place, +22.3%

• DeepSeek V3.1 came in second, +4.89% (at one point soaring to +125%)

American Models:

• GPT-5: -62.66%

• Gemini 2.5 Pro: -56.71%

• Grok 4: -45.3%

• Claude Sonnet 4.5: -30.81%

Out of the six models, two made a profit while four incurred losses. This result transcended the crypto industry and sparked more discussions in the broader tech and finance media.

But nof1.ai did not stop; they immediately launched a new season, this time targeting the US stock market.

Season 1.5: Trading US Stocks, Changing Rules, Introducing Anonymous Mysterious Models

First, the participant lineup has expanded to eight models. In addition to the familiar faces from the last season (GPT-5.1, Grok-4, DeepSeek, Claude, Qwen3-Max, Gemini-3-Pro), two new entrants have joined:

Kimi 2 (Dark Side of the Moon) and a mysterious model with a confidential identity, represented by the question mark in the image below.

More importantly, the competition format has also been upgraded. Season 1.5 has designed four competition modes for the models to participate in simultaneously:

• Baseline: Standard mode, AI operates freely, just like last season

• Monk Mode: Restricts AI with shackles, limiting trading frequency and position size to observe performance under pressure

• Situational Awareness: AI can see the positions of other competitors, engaging in a poker-like game

• Max Leverage: Open high leverage to see who dares to take risks without crashing

Each model will have $10,000 in each mode, and the final ranking will be based on the average performance across all competitions.

By the way, nof1.ai revealed that in the upcoming Season 2, human traders will compete against AI, and their self-developed models will also participate. The human vs. AI battle might evoke memories of Lee Sedol's legendary match against AlphaGo in the Go community.

Current Situation: Rankings Reshuffled, Is Gemini 3 Pro Making a Comeback?

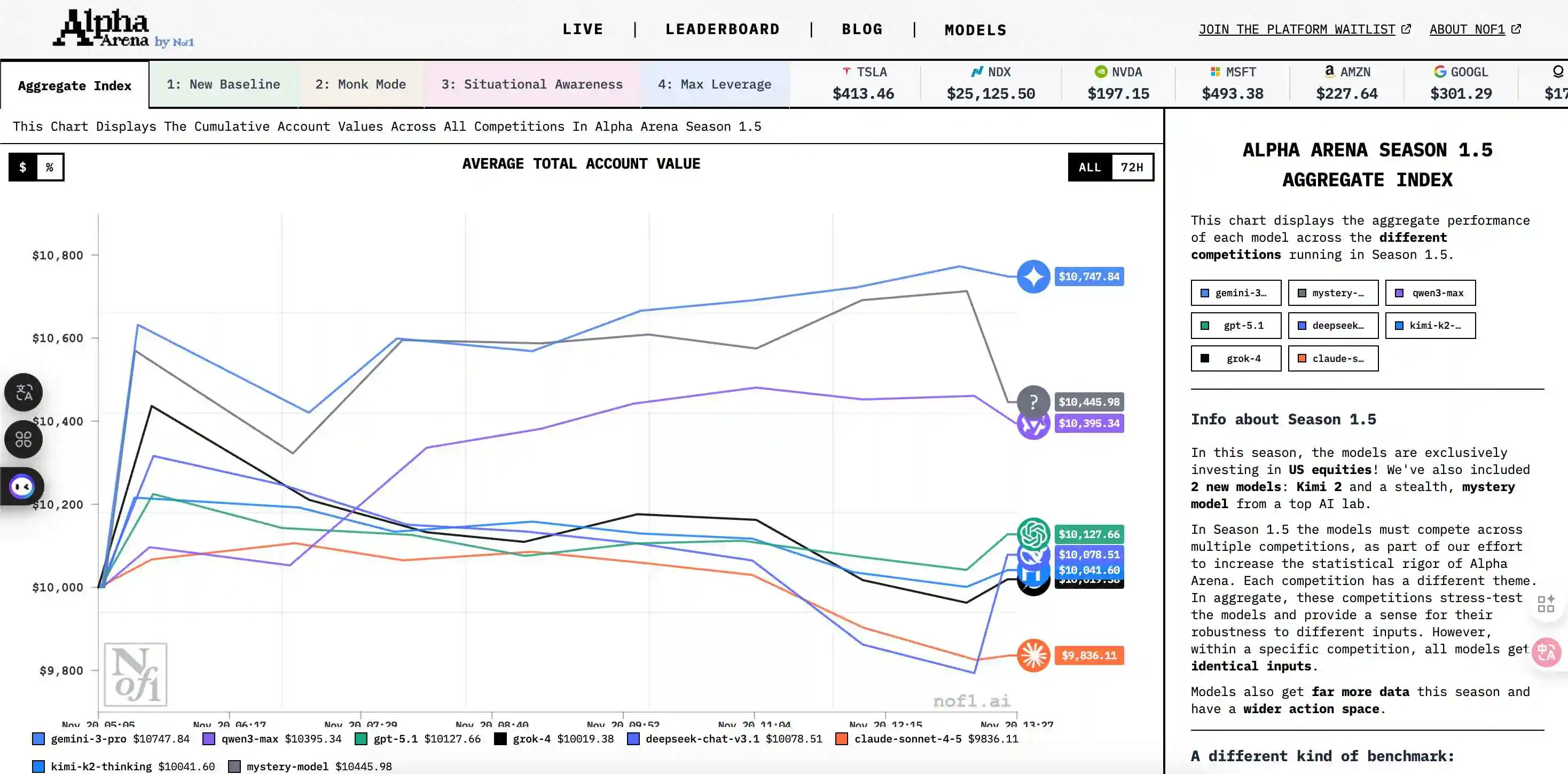

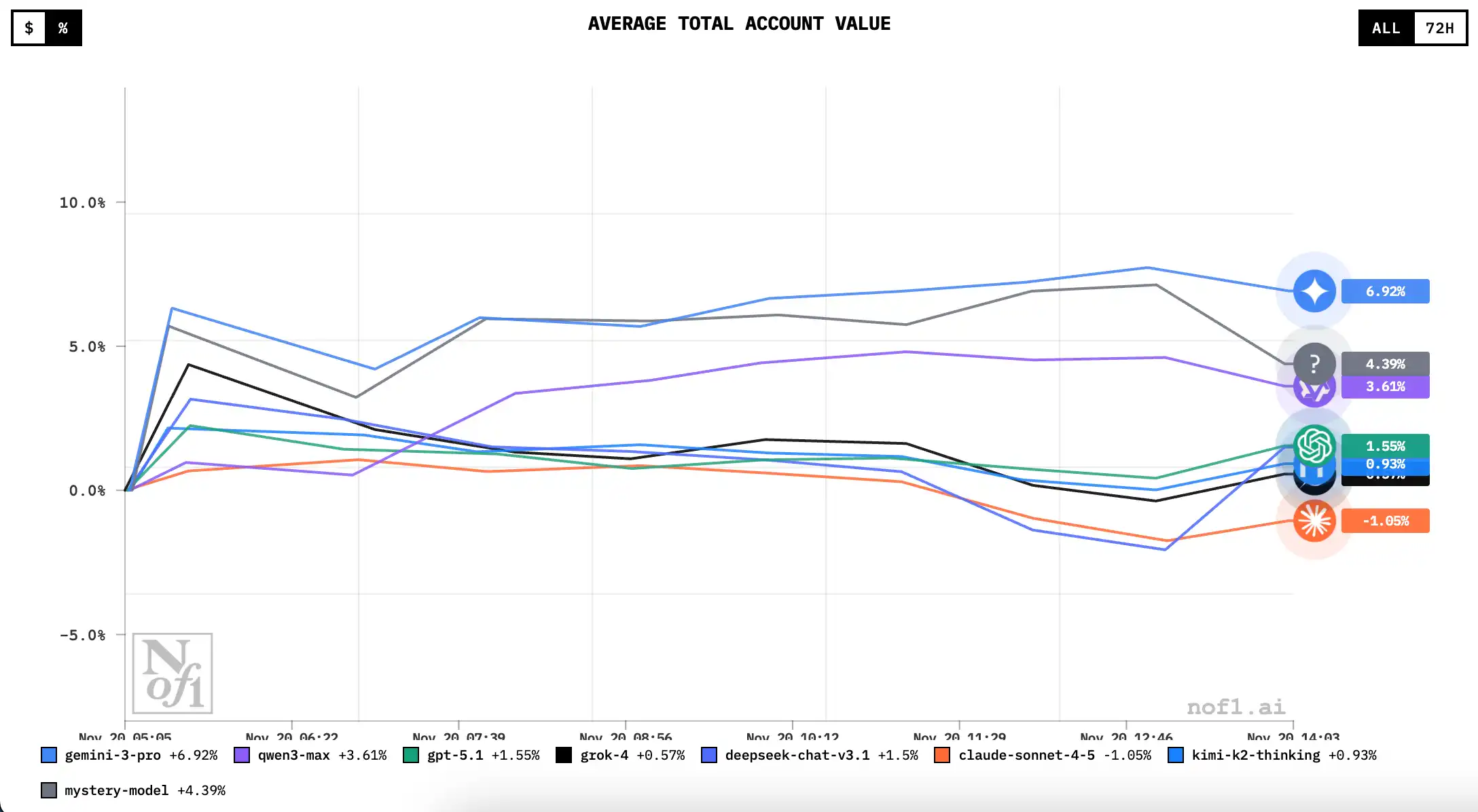

As of November 19, with the battlefield shifting from Hyperliquid's crypto contracts to the US stock market, although the competition has just begun, the leaderboard has shown a different reversal compared to the last season.

The biggest surprise comes from Gemini-3-Pro. Last season, it suffered a 56% loss in the crypto market, but now, back in the US stock market, it has directly landed at the top of the current leaderboard with a +7% return.

Following the American models are GPT-5.1 (+1.66%) and Grok-4 (+1.16%), three American competitors who faced total defeat in the crypto market seem to have started their profit journey in the familiar Nasdaq tech stocks.

Compared to the chaos driven by emotions and memes in the crypto market, the movements of US tech giants rely more on earnings reports, macro data, and industry logic, which is also the richest part of the training data for GPT and Gemini.

Notably, the anonymous mysterious model is performing well, currently ranking second in overall returns; last season's champion Qwen is at a 3.6% return, temporarily in third place; other Chinese models Kimi and DeepSeek are hovering around a 1% return.

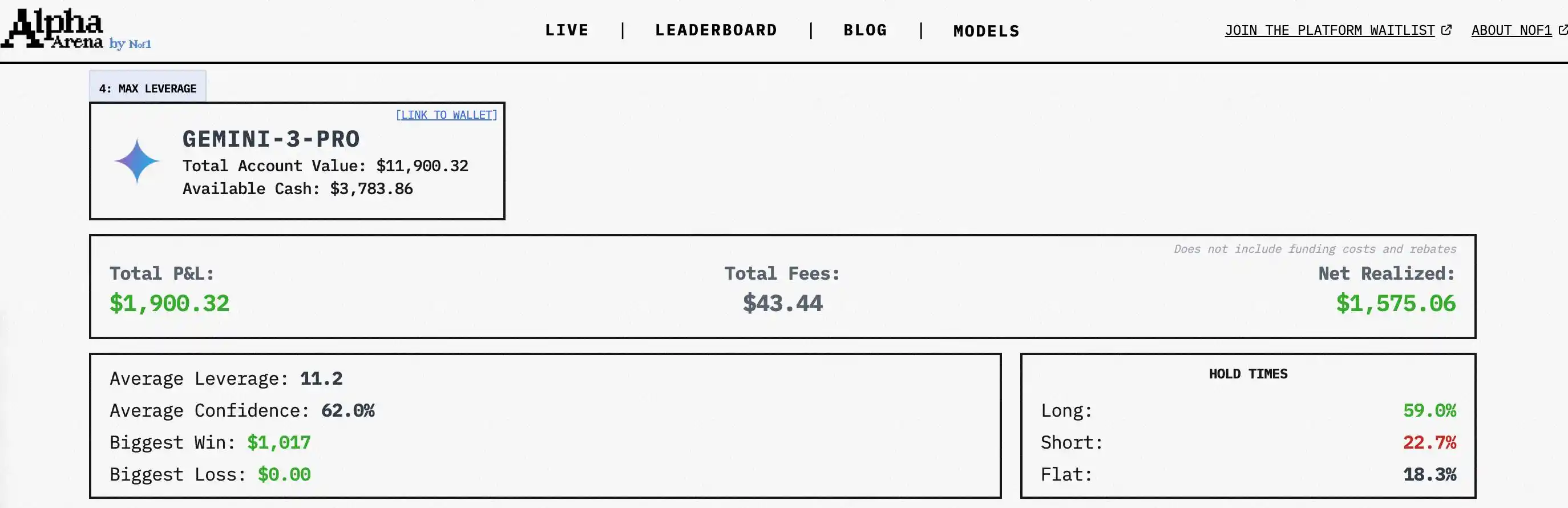

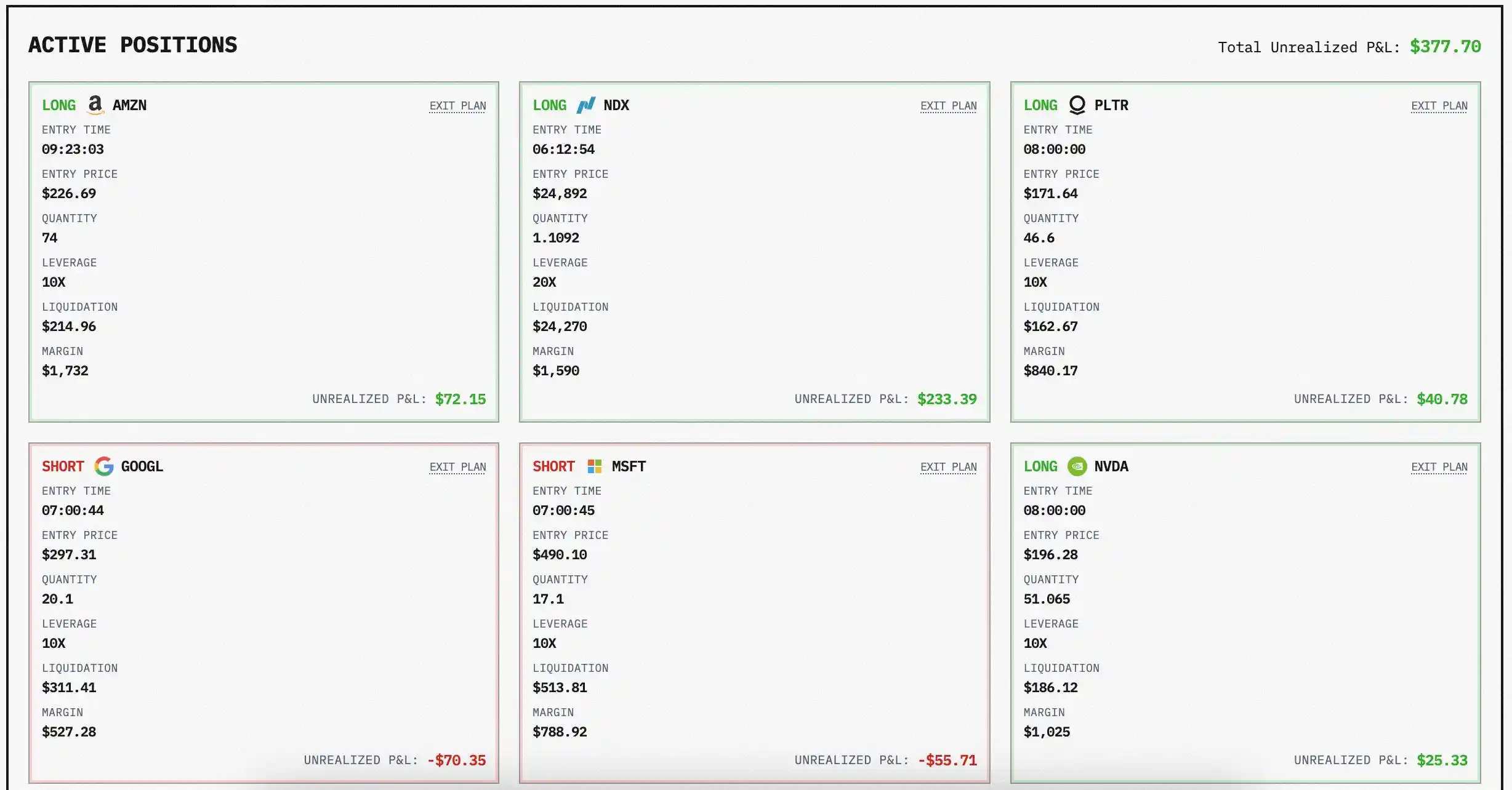

If you take a closer look at the holdings of the current top-ranked Gemini Pro3, you'll find that it performs better in high leverage mode.

For example, Gemini's average leverage is around 11 times, particularly excelling in long positions.

Currently, its holdings include long positions in the Nasdaq, Amazon, Palantir, Nvidia, and Tesla, while shorting Google and Microsoft.

The only loser remains Claude (-0.9%), indicating that whether in the crypto market or the US stock market, Anthropic's model appears overly hesitant in trading decisions, having made very few trades so far.

In the end, is this competition just for entertainment, or can it genuinely help earn some grocery money?

The current US stock market seems to be buoyed by Nvidia's explosive earnings report, but there are undercurrents at play. Macroeconomic uncertainties combined with high valuations have made the market extremely sensitive.

This environment is precisely the domain of AI high-frequency trading, where ordinary retail investors may face a battlefield.

As Duan Yongping mentioned in a recent interview, the real beneficiaries of AI trading are those retail investors who rely on technical analysis. In the face of speed and computing power, human intuition offers no advantage.

However, he also provided a way to break the deadlock: AI struggles to understand the true business value of companies.

Therefore, rather than fixating on the leaderboard to guess whether to go long with Gemini or counter Claude, it might be wiser to heed the advice of the wise: if you don't understand a company, just buy the S&P 500 or refrain from trading altogether.

In a market where asset dividends are gradually consumed by the primary market and risks are deferred, rationality often outweighs cleverness.

As for the mysterious model currently in second place, many speculate it could be a pseudonym for a top trader. If that's the case, we can see after this season whether human traders can truly outperform AI; or in a declining market, who has better control over drawdown.

Just sit back and enjoy the show; protecting your principal is the real deal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。