Author: Prathik Desai

Source: Token Dispatch

Translation: Shaw Jinse Finance

Introduction

There is a simple theory behind why companies purchase cryptocurrencies on their balance sheets. If the assets they acquire appreciate, their stock prices should also rise. The purpose of companies holding cryptocurrencies is to provide investors with a clearer and more leveraged way to hold cryptocurrencies, managed by a trustworthy team.

This strategy works well in a bull market because almost any strategy can succeed in such market conditions. However, in a bear market, the effectiveness of this strategy diminishes, as the logic reverses.

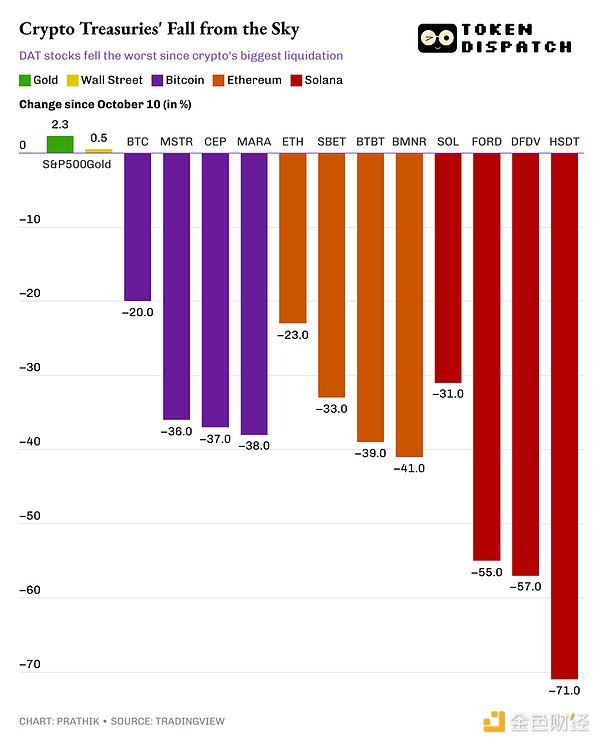

According to most traditional definitions, cryptocurrencies have officially entered a bear market. Bitcoin (down about 30%), Ethereum (down about 40%), and Solana (down about 55%) are all far below their peaks and have fallen below the 200-day moving average. The Bitcoin spot ETF, which was expected to represent stability and regulated demand, has seen net outflows for three consecutive weeks. On-chain data indicators also confirm this. The realized market value ratio (MVRV) of Bitcoin has dropped to its lowest level in two years, with many holders now in a loss position.

If most of your company's assets are in cryptocurrencies, the situation is dire. Worse still, if the market no longer views you as a company but as a publicly traded cryptocurrency wallet, your employees may also be seen as part of its value.

This is what the Digital Asset Treasury (DAT) is currently experiencing. This article will illustrate a "hypothetical" scenario that was once considered extremely rare for DATs, which has now become a reality with the arrival of the bear market.

The DAT Dilemma Has Emerged

The Digital Asset Treasury (DAT) refers to companies that have intentionally or unintentionally become publicly traded cryptocurrency investment vehicles and have operational departments. For most of the past year, the market viewed them as high beta versions of underlying cryptocurrencies. During market downturns, high beta becomes less attractive.

Now that the economic recession has arrived, the situation is quite severe. A few months ago, when I wrote my first quantitative analysis article, DAT stocks had already retreated from their highs. The risks were evident at that time, but they seemed distant. Now, these risks are imminent.

Since the most severe liquidation event in cryptocurrency history in October, the stock prices of DATs have fallen far more than the price declines of the tokens they hold.

Their market capitalization to net asset value ratio (mNAV) — the simplest indicator measuring the market's valuation of their treasury reserves — has dropped to 1 or lower. Even the most well-known representative of corporate Bitcoin strategies, Strategy (formerly MicroStrategy), has seen its mNAV drop to the lowest point in 21 months.

All of this was expected and is not surprising. The bear market has transformed the theoretical risks of Bitcoin treasury trading, including dilution, leverage, cyclical volatility, and investor patience, into observable and measurable realities. The question of "What if…" is now evident in the mNAV charts.

mNAV Factors and Why the Market Suddenly Cares About It

If you hold Bitcoin, you know what you own. But if you hold shares in a company that holds Bitcoin, the situation is a bit more complex. Different DATs may vary. Taking Strategy as an example, you might hold low-interest bonds that can be converted into company stock at maturity.

A simple way to measure this complexity is to use mNAV. It reflects how much extra shareholders are willing to pay for this packaging.

When the mNAV ratio is above 1, shareholders believe this packaging adds value to the company's existing business. They may have confidence in the management team, growth prospects, or believe that a company with a Bitcoin balance sheet should have more upside potential than Bitcoin itself. Sometimes they simply enjoy the volatility. For traditional investors who have never ventured into cryptocurrencies, this can be a more attractive and direct route.

When the mNAV is below 1, investors believe the company's value is less than the value of the cryptocurrencies it holds.

The decline in value may be due to excessive cryptocurrency leverage, poor operational performance, or poor corporate governance. But the basic concept of an mNAV below 1 is simple: the exposure to the crypto assets obtained by purchasing the company is not as good as directly buying the asset.

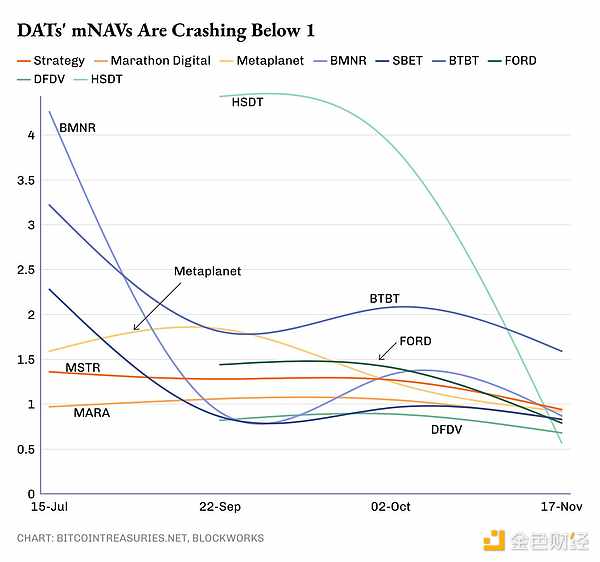

For most of 2025, the mNAV of cryptocurrency treasury companies has been slowly declining after experiencing the initial growth that newly established DATs typically go through. Since October, these companies' mNAV has approached or fallen below 1.

When the mNAV drops below 1, it also becomes difficult to issue new shares at a premium, making it challenging to fund additional cryptocurrency purchases. Most DATs have enriched their treasuries through equity financing, including at-the-market (ATM) offerings, follow-on offerings, or convertible bonds. This economic model can only function effectively when the stock trading price is higher than the value of the tokens held per share.

This model is prevalent across various crypto assets and companies of different sizes. Whether it is Bitcoin, Ethereum, or Solana treasuries, their mNAV has approached or even fallen below 1. Both small experimental projects and flagship projects have not been spared. The reasons may vary — some attribute it to leverage, others to equity dilution, and some to business model issues. But the market has clearly indicated that this form of packaging itself carries risks, while the underlying assets do not.

In some cases, even considering the company's other businesses, investors still value the company lower than the value of the cryptocurrencies it holds. Strategy is a prime example.

Is Strategy on the Brink?

Michael Saylor's Strategy has been the most prominent DAT strategy experiment globally. It has consistently executed this strategy on a large scale. This is the purest bet on the long-term appreciation of Bitcoin by a company in the public market.

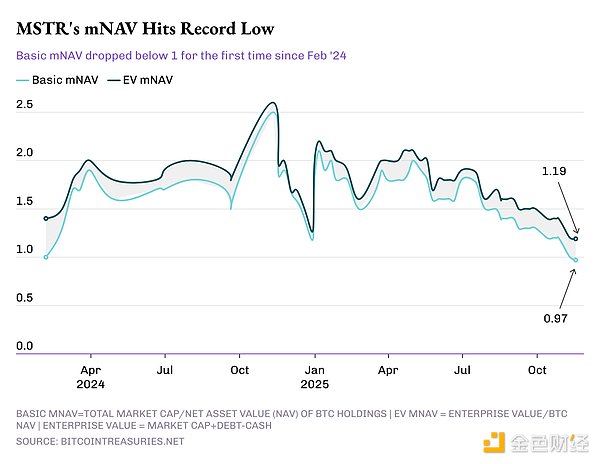

However, its mNAV is currently at the lowest point in 21 months and has now fallen below 1.

For most of 2024 and early 2025, Strategy's trading price maintained a considerable premium compared to the value of the Bitcoin it holds. Investors viewed its stock MSTR as a leveraged Bitcoin exposure tool with an accompanying operational business. In a cyclical market, this premium is reasonable: the company accumulates Bitcoin, the price of Bitcoin rises, and the leverage amplifies the stock's upside potential.

The same logic now applies in reverse.

Strategy's fundamental mNAV has fallen below 1 for the first time since early 2024. The company has slowed its pace of Bitcoin purchases over the past two months. But as I type this, my phone alerts me that Strategy has added 8,178 Bitcoins to its treasury. However, the risks of this system remain enormous.

Because of this example, the DAT route now appears riskier than ever. When investors are skeptical about projects with first-mover advantages and an average Bitcoin purchase cost below $75,000, the entire packaging strategy begins to show cracks.

Slowing Bitcoin Purchases

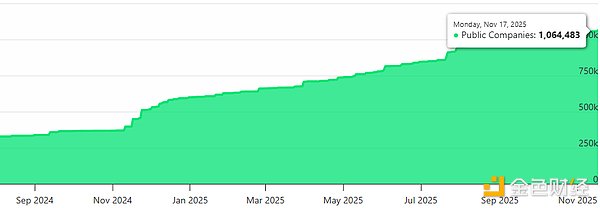

Another concerning signal is that the number of Bitcoins purchased by companies is decreasing.

Since August 1 of this year, DATs have collectively purchased 115,000 Bitcoins, of which only 17,000 were acquired after October 11. This includes the 8,178 Bitcoins purchased by Strategy at the time of writing this article. In the two months leading up to the October liquidation event, DATs had added 90,000 Bitcoins to their treasuries.

While this is rational behavior in a bear market, it exacerbates the mNAV premium issue. If a company does not increase its reserves when prices are falling, it indicates negative sentiment within the DAT management team. This can lead shareholders to question whether the company's operations are strong enough to warrant continued investment. Once this doubt arises, the mNAV premium will disappear.

What Comes Next?

For most of the past year, DAT businesses and cryptocurrencies have been viewed as interchangeable concepts. But in reality, they are not. Cryptocurrencies have no debt covenants or operational losses, while companies do. These DATs still need to deliver good performance to maintain investor confidence.

The bear market has exposed old issues that have always existed within DATs and has sounded an important alarm for investors.

The leverage risk exposure of cryptocurrencies now appears more dangerous, and the underlying operational businesses will undergo thorough scrutiny. Sustained and stable accumulation will be difficult to package as a marketing slogan. All of this will be reflected in the mNAV.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。