Written by: Alana Levin

Translated by: Saoirse, Foresight News

Editor’s Note: The cryptocurrency industry has evolved over more than a decade from a single asset to a diverse ecosystem. This article distills the core content of Alana Levin's "2025 Cryptocurrency Trends Report," using "three overlapping S-curve" as the central framework, while breaking down the five major trends for 2025: the expansion of mainstream crypto asset scale, the all-dimensional explosion of stablecoins, revenue growth of centralized exchanges, on-chain innovation as a testing ground, and the future upgrade of products through crypto tracks. The following will take you deeper into these key directions. Click to view the full "Cryptocurrency Trends Report".

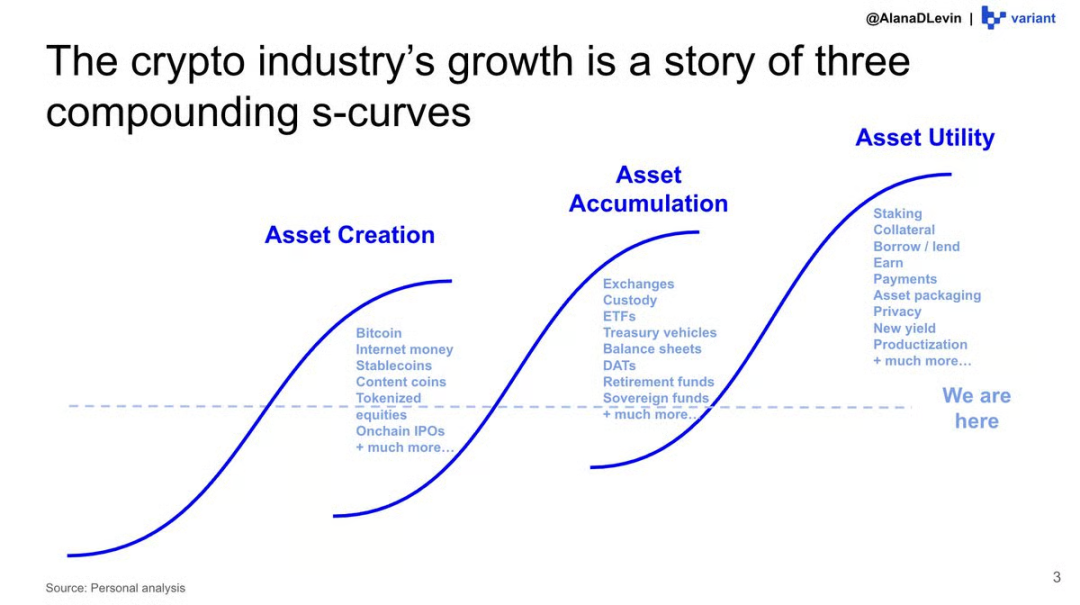

The development of the cryptocurrency industry can be interpreted as the evolution of three overlapping "S-curve growth curves," corresponding to three stages: asset creation, asset accumulation, and asset utilization.

Stage One: Asset Creation. The asset creation stage began with the launch of Bitcoin in 2009. Since then, this field has continuously expanded, covering various asset types including first-layer currency assets, project tokens, stablecoins, content tokens, meme coins, NFTs, and tokenized stocks. Between 2024 and 2025, the cryptocurrency industry enters the phase of the "S-curve" with the most rapid growth. In just a few years, the number of tradable tokens listed has surged from about 20,000 to millions. Although there is still significant room for innovation and growth in the field (such as tokenized credit, on-chain structured products, and more tokenization of real-world assets), the most groundbreaking "from 0 to 1" transformations in the industry have essentially occurred.

Stage Two: Asset Accumulation. The more assets that exist in the market and the higher their value, the stronger the willingness of people to hold these assets. This logic provides development momentum for several subfields within the cryptocurrency industry, including custody products, exchanges, and security solutions. Different custody solutions serve different user groups: applications supporting stablecoins may use embedded wallets like Turnkey; institutional investors typically choose qualified custodians; while active on-chain users tend to prefer "super app" wallets like Phantom. The growing demand for buying, selling, and holding crypto assets has also driven the expansion of asset distribution channels. Many established exchanges (like Coinbase) have seen a significant surge in trading volume; traditional fintech companies like Robinhood have increased their investment in cryptocurrency businesses; and emerging trading platforms like Axiom have achieved explosive growth. Additionally, asset management companies are beginning to offer crypto asset allocation services in retirement accounts; publicly listed companies are gradually incorporating Bitcoin and stablecoins into their balance sheets; and some sovereign wealth funds are also starting to invest in crypto assets. Currently, the industry has just entered the rapid growth segment of the asset accumulation stage of the "S-curve."

Stage Three: Asset Utilization. Once people hold assets, a natural demand for usage arises. Crypto assets are currently the most composable, accessible, and programmable financial assets, and a series of highly promising practical application scenarios have emerged: stablecoin payments, borrowing and lending through protocols like Morpho, providing liquidity for on-chain exchanges, and network staking, among others. However, the application scenarios for tokenized assets are still in the early exploration stage, and the industry has just begun the growth process of the asset utilization stage of the "S-curve." The author believes that in the coming years, expanding the application scenarios of crypto assets and enhancing their practical value will be one of the largest and most attractive "blue ocean opportunities."

This report is divided into five major sections: macro trends, stablecoins, centralized exchanges, on-chain activities, and future outlook. Each section uses the "three overlapping S-curves" as an analytical framework to help readers understand the main trends and potential opportunities in the current cryptocurrency industry. Below is a summary of the core trends in the current cryptocurrency industry:

Macro Trends: The Advantage of Leading Assets Remains Strong

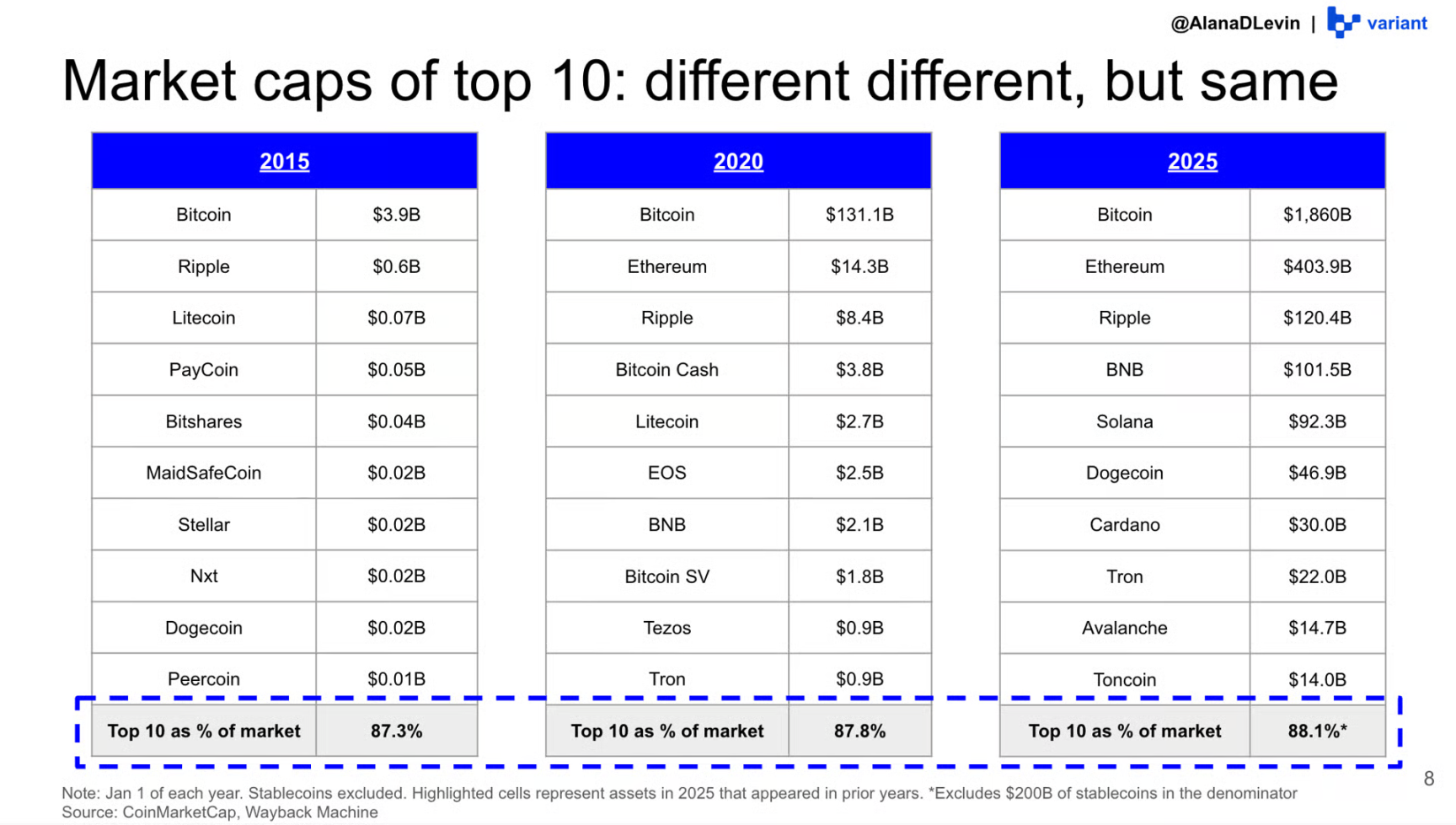

The scale of mainstream crypto assets continues to expand. Despite the continuous growth of the total market capitalization of cryptocurrencies, the concentration of value among the top 10 crypto assets remains remarkably stable, making it extremely difficult for new assets to break into the top five. Many leading assets exhibit significant "Lindy effect" (the longer they exist, the more stable their value) and market imitation.

Note: This is the data for the top 10 cryptocurrencies by market capitalization in 2015, 2020, and 2025, with leading assets like Bitcoin accounting for over 87%, maintaining long-term market dominance.

Stablecoins: Explosive Growth Across All Cycles

Stablecoins have achieved explosive growth across the three S-curves of "asset creation, asset accumulation, and asset utilization": the issuance of new stablecoins has reached record levels; channels for asset entry continue to increase; and the application scenarios for stablecoins are becoming increasingly diverse.

Note: This is a chart showing the growth rate of stablecoin supply, with the time required to add each additional $100 billion in circulation continuously shortening, indicating an accelerating development trend.

There are strong network effects in the stablecoin space: the more stablecoins in circulation, the higher their practical value; the more institutions and individuals holding stablecoins, the greater the space for building products and services around stablecoins.

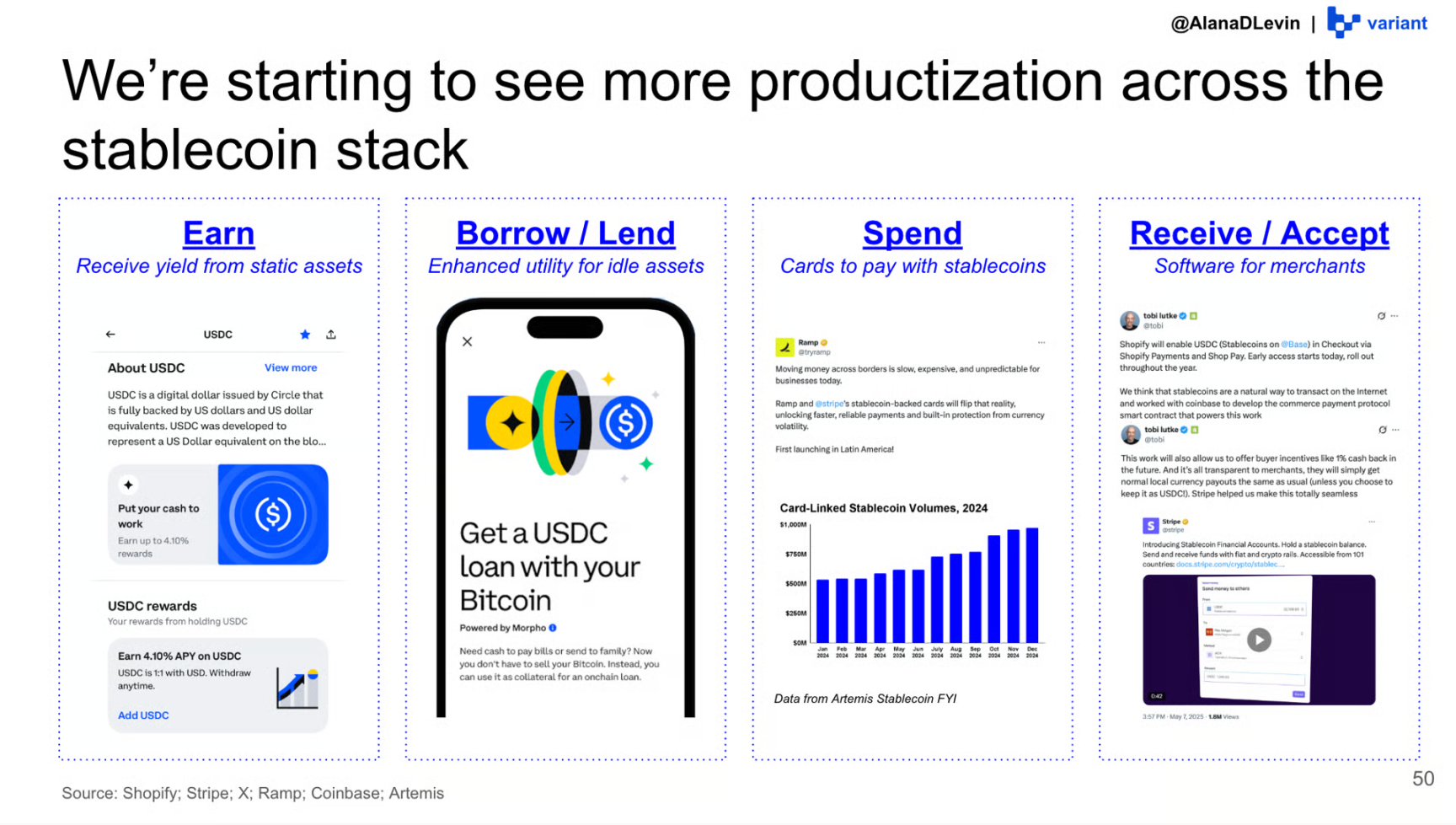

Note: This chart shows the trend of productization of stablecoin application scenarios, from earning yields, lending, and consumption to receiving, demonstrating its diverse ecological practices.

Currently, payment, yield-generating products (such as lending protocols), and exchanges are the main beneficiary areas of stablecoin productization. However, we believe that there is still significant room for innovation in stablecoins across all three stages corresponding to the S-curves.

Centralized Exchanges: Core Winners in the Accumulation Stage

Centralized exchanges have performed outstandingly on the "asset accumulation" curve, being one of the most clear beneficiaries of this stage. Over the past five years, both trading volume and revenue of centralized exchanges have seen substantial growth.

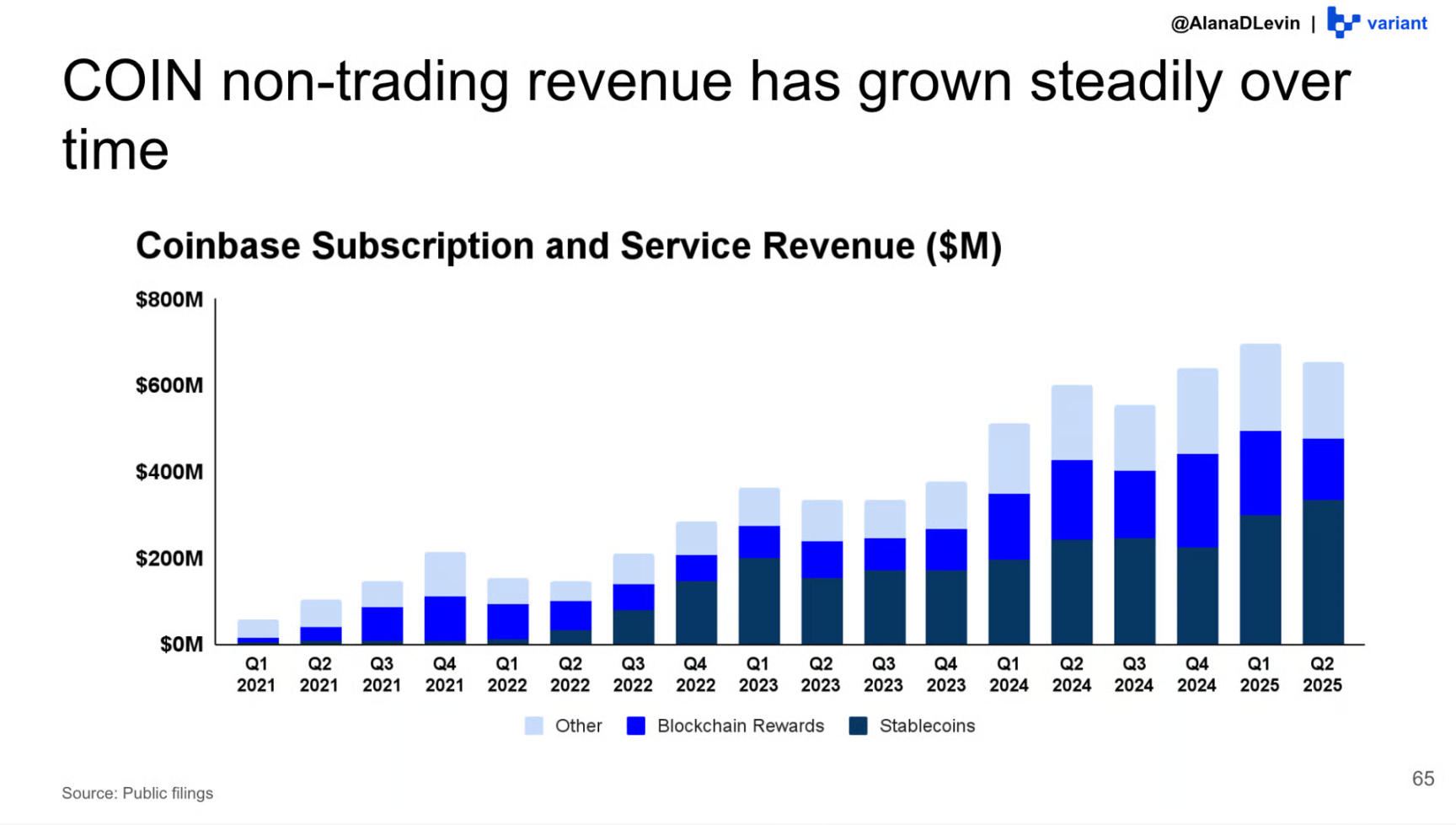

Note: This is a chart showing the growth of Coinbase's non-trading revenue (subscription and service revenue), which has shown a steady upward trend driven by multiple sectors from 2021 to 2025.

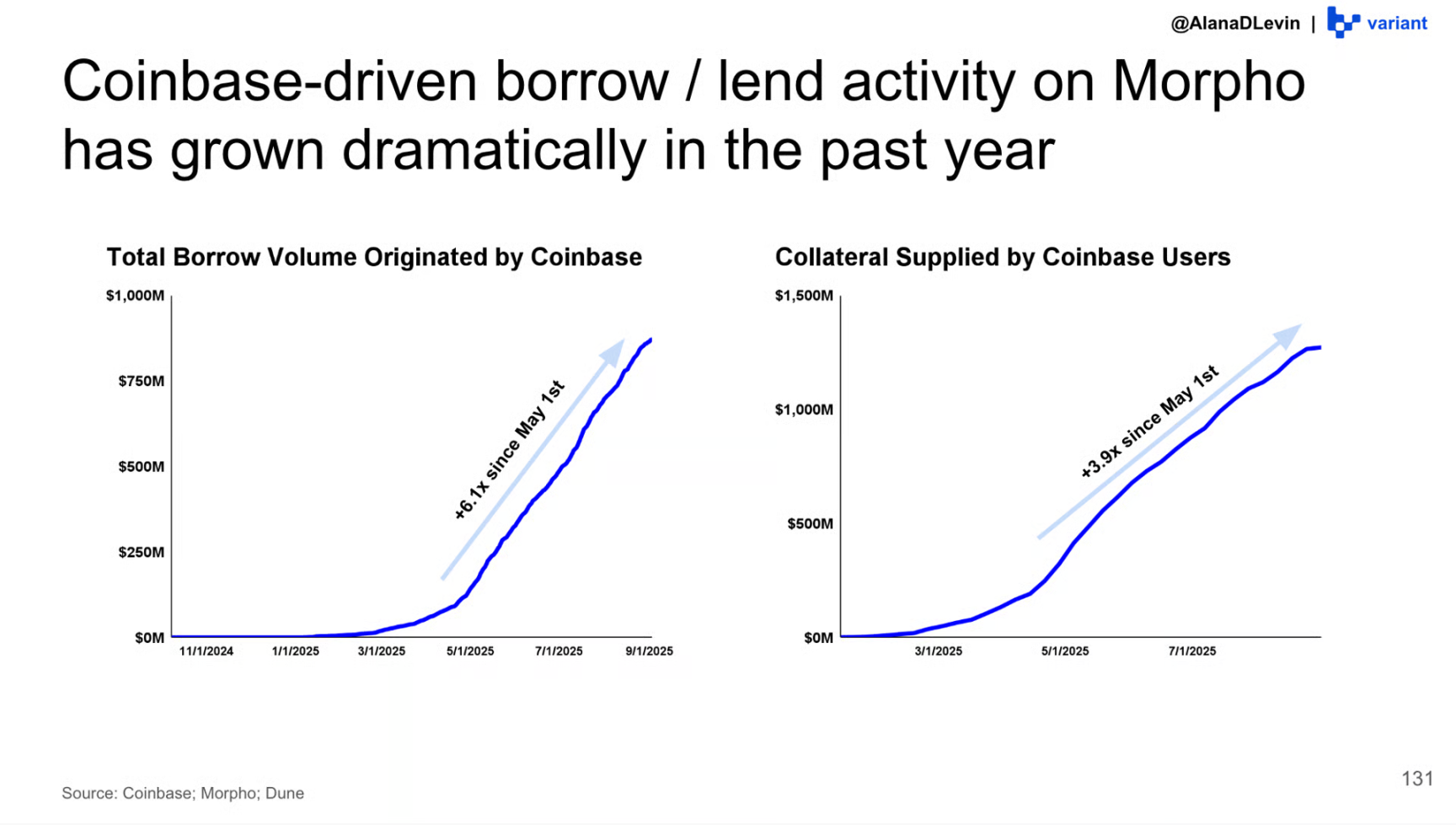

Note: This chart displays Coinbase's lending activities on Morpho, with significant growth in borrowing volume and collateral supply over the past year, especially after May.

It is noteworthy that the growth in trading volume has led to a "second-order effect": users are keeping their assets on exchanges, allowing exchanges to expand more practical functions such as staking, yield products, and lending services. In the future, many new application scenarios for crypto assets may be built directly on-chain, but by integrating with centralized exchanges, these applications are expected to reach a broader user base.

On-Chain Activities: A Testing Ground for Innovative Applications

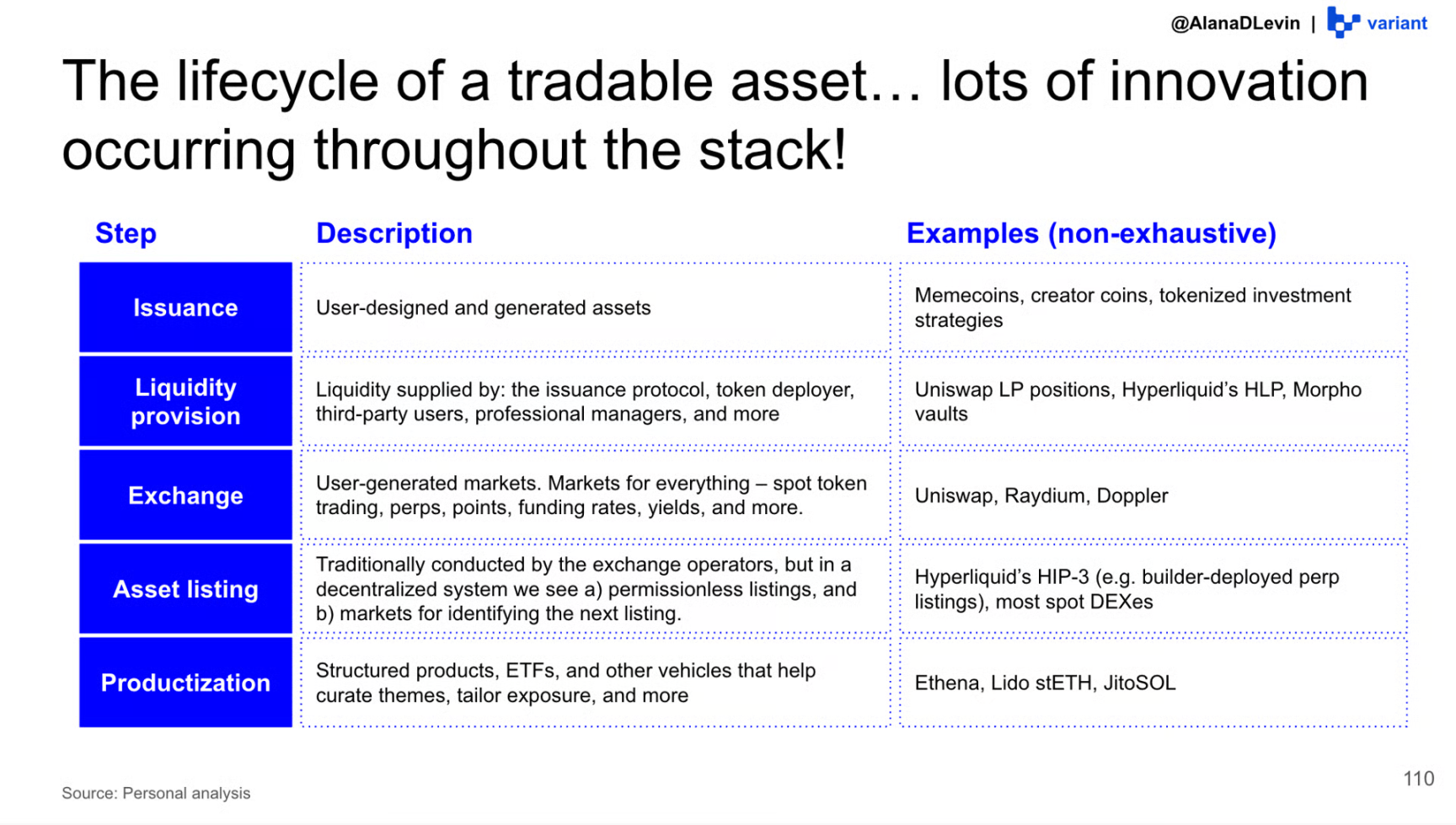

If you want to understand new ways to apply crypto assets, on-chain activities are the core observation scene—this is the testing ground for industry innovation. In the blockchain ecosystem, every stage of the asset lifecycle (issuance, liquidity provision, trading, listing, and productization) is permissionless and completely transparent; whereas in the traditional financial system, these stages are subject to strict access controls. This open characteristic greatly expands the innovative space for asset creation and utilization.

Note: This is a lifecycle chart of tradable assets, showing innovation and examples at each step from issuance, liquidity supply to productization.

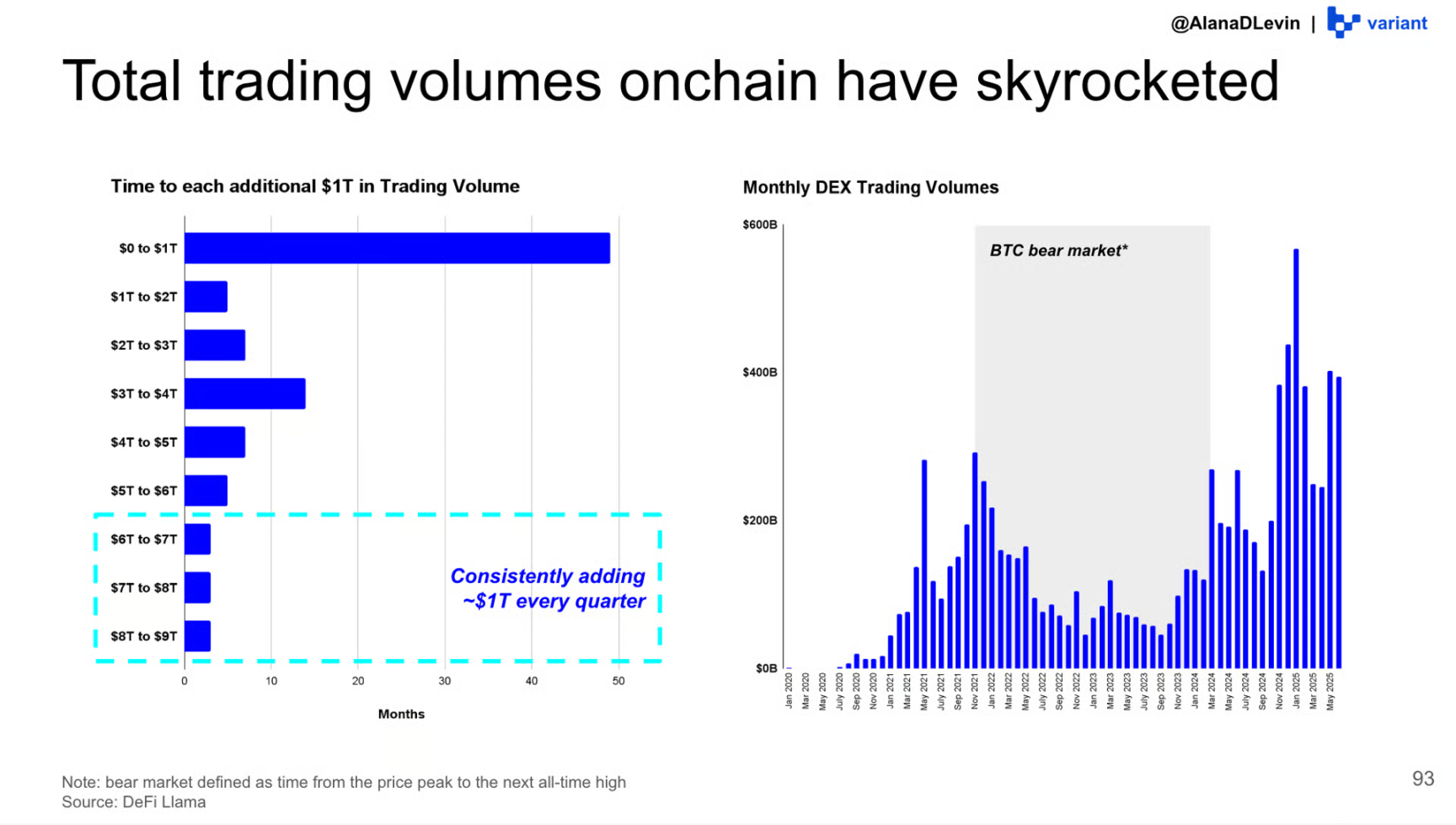

Note: This is a chart showing the total on-chain trading volume, indicating that the time required to add an additional trillion in trading volume is shortening, with quarterly increases of about a trillion, and monthly volumes of decentralized trading also rising.

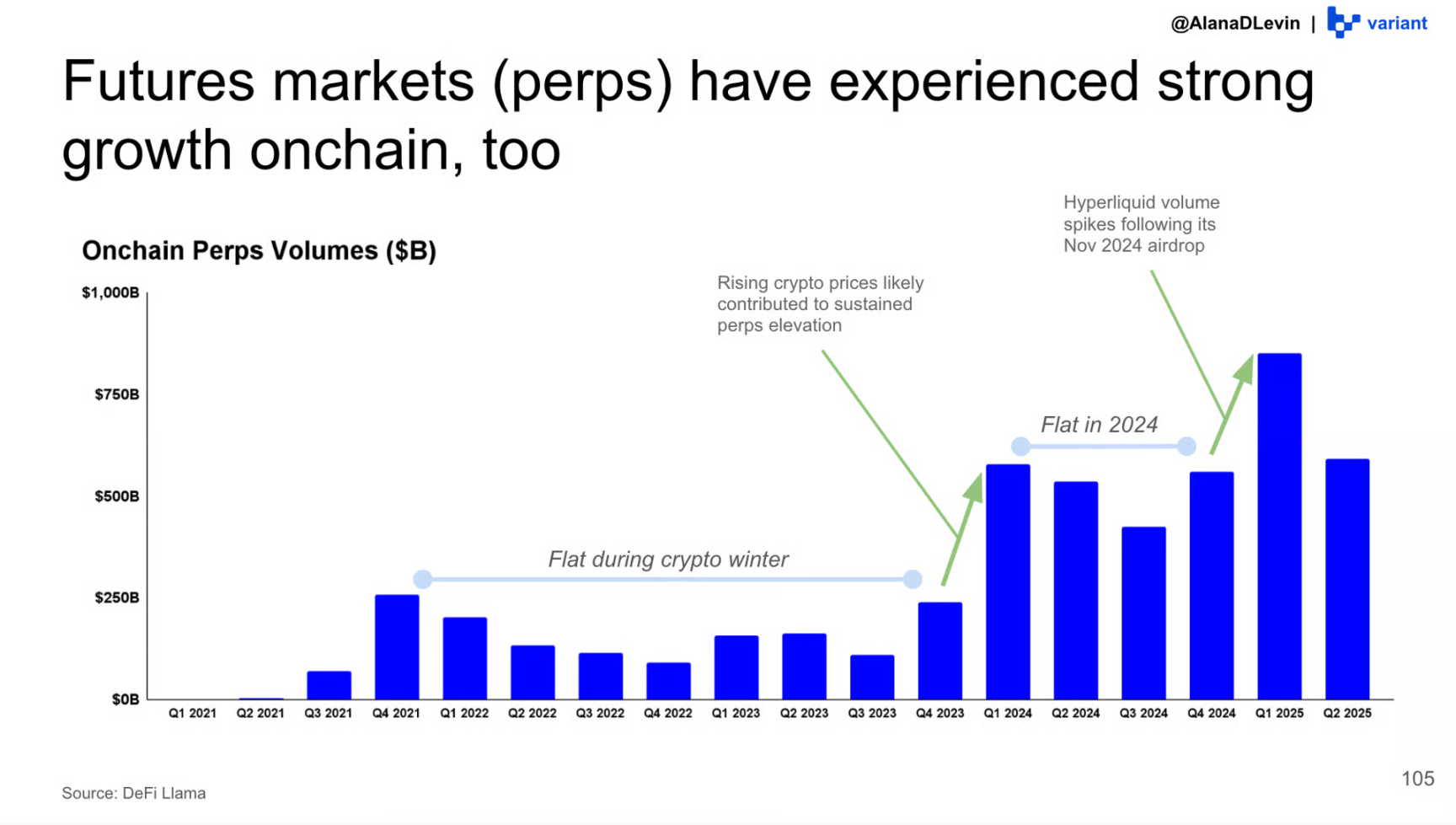

Note: This chart shows the changes in trading volume in the on-chain perpetual futures market, which has seen significant growth since 2024 after experiencing a crypto winter, with fluctuations influenced by price and projects.

Additionally, some on-chain protocols have gradually developed into fundamentally solid mature businesses. Decentralized exchanges, lending platforms, token issuance platforms, and perpetual contract exchanges have all shown clear signals of "product-market fit."

Future Outlook: Transitioning from Products to Platforms

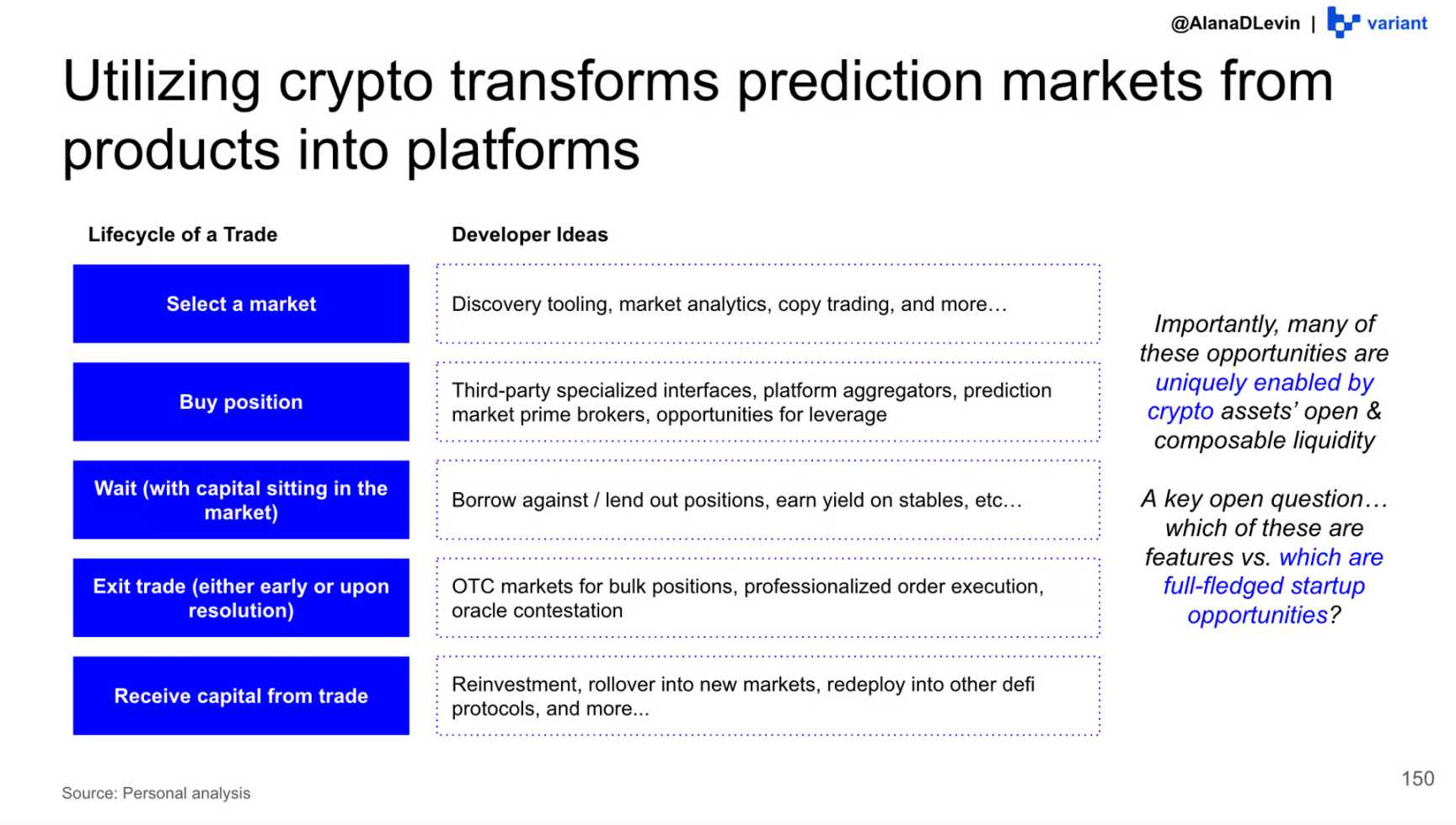

Developing based on cryptocurrency infrastructure is expected to achieve an upgrade from "products to platforms." This report uses the growth of prediction markets as an example to detail how crypto infrastructure drives the rapid development of emerging markets. At the same time, the report summarizes some of the entrepreneurial opportunities in the crypto field that the Variant institution is currently focusing on (not an exhaustive list).

Note: This chart shows how cryptocurrency is transitioning prediction markets from products to platforms, presenting the trading lifecycle and innovative directions that developers can explore.

Note: This is a list of entrepreneurial opportunities in the cryptocurrency field compiled by the Variant institution, covering multiple directions such as stablecoins, payments, trading, and lending, providing ideas for practitioners.

Under the framework of the three overlapping S-curves of "asset creation, asset accumulation, and asset utilization," the cryptocurrency industry has made significant progress, but there is still vast exploration and innovation space ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。