Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content:

[HYPERLIQUID]

Hyperliquid became the market focus today due to a significant event: a $3 million withdrawal from OKX was dispersed to 19 wallets to go long on POPCAT, ultimately leading to a rapid liquidation and a loss of $4.9 million in HLP. Following the incident, Hyperliquid suspended its cross-chain bridge for maintenance.

Additionally, Hyperliquid launched NVDA-PERP, the first permissionless perpetual contract targeting a single stock in the cryptocurrency space, which is seen as a major innovation. The platform's innovative features and its collaboration with Polymarket on prediction markets have also sparked discussions, highlighting its influence in the crypto ecosystem.

[POPCAT]

POPCAT experienced significant volatility today due to malicious manipulation on Hyperliquid. A trader withdrew $3 million USDC from OKX, dispersed it to 19 wallets, and established a long position of $20 million to $30 million, creating a false buy wall at $0.21. After the buy orders were canceled, the price plummeted, resulting in a total liquidation of $63 million and a loss of $4.9 million in HLP. The incident is related to previous manipulative behavior, prompting Hyperliquid to suspend its Arbitrum cross-chain bridge, leading to widespread discussions about high leverage risks and the security of decentralized exchanges.

[POL]

Today's focus on POL is the integration of Polygon by Calastone, the world's largest fund network, which plans to launch tokenized fund shares for 4,500 financial institutions across 58 markets. This move highlights Polygon's role in on-chain institutional finance, providing faster settlement, lower costs, and greater transparency.

Additionally, Polygon's influence in the Latin American market, stablecoin adoption, and rising transaction fees (indicating increased network activity) are also receiving attention.

[ORD]

ORD is buzzing today about the launch of ZapApp, a self-custodial crypto application based on Solana that supports KYC-free and gas-free transactions. Following the launch of ZapApp, the official team distributed $DOG tokens as a celebration, igniting market enthusiasm. The application aims to simplify the trading process and challenge traditional exchange models by eliminating listing fees, sparking discussions about exchange fairness and ZapApp's potential disruptiveness.

Selected Articles

On October 22, U.S. President Trump officially signed a pardon for CZ, but there remains much public misunderstanding surrounding the pardon itself. On November 15, CZ's personal lawyer, Teresa Goody Guillén, a partner at the well-known law firm Baker Hostetler, was interviewed by Morgan Creek founder Anthony Pompliano. In her conversation with Pompliano, Teresa mentioned many previously undisclosed details regarding the accusations and the reasons and processes behind the pardon. CZ himself has also retweeted and liked Teresa's interview content.

Recently, Stable completed two rounds of substantial pre-deposit activities in a short time, with the first round of $825 million being quickly snapped up, and the second round of qualified subscriptions exceeding $1.1 billion, attracting significant industry attention. However, behind the impressive data, there are backgrounds worth clarifying: the project is driven by key figures from Tether, with USDT naturally forming a strong binding as the native asset; the pre-deposit amounts are highly concentrated among early institutions and insiders; and the time gap between the implementation of the "GENIUS Act" and the project's accelerated advancement is too tight.

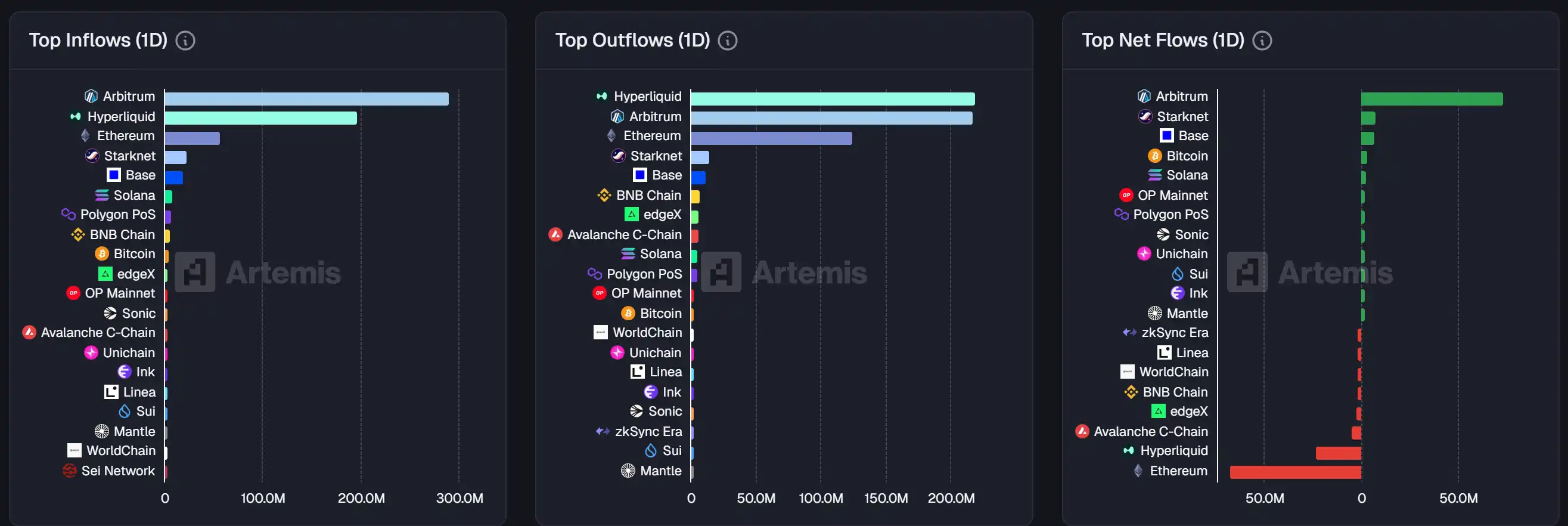

On-chain Data

On-chain capital flow situation for the week of November 18

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。