Crypto News

November 18 Highlights:

1. Forward Industries transfers 1.44 million SOL to Coinbase, suspected to begin selling off.

2. SlowMist reveals serious vulnerabilities in NOFX AI: could lead to the leakage of exchange API keys and private keys.

3. The White House reviews joining CARF rules; the U.S. may strengthen tax reporting on overseas crypto accounts.

4. The Ethereum Foundation promotes a privacy tools framework, with Kohaku providing modular privacy components.

5. Bloomberg ETF analyst: Grayscale may launch the first Dogecoin ETF on November 24.

Trading Insights

Analysis of the 8 Stages of Bottom Fishing in the Crypto Market: Which step are we currently in?

- First Stage: Confidence Boom - The atmosphere in the group is enthusiastic, everyone is confident, sharing visions, promoting, and actively pushing daily, all believing they are "doing great things."

- Second Stage: Confidence Weakening - Coin prices enter a sideways trend, growth stagnates, confidence in the group declines, but some still push forward, not completely giving up hope.

- Third Stage: Initial Bottom Fishing - Coin prices begin to drop, most see it as a "buying opportunity," and actively increase their positions.

- Fourth Stage: Weak Bottom Fishing - Coin prices continue to decline, initial buying funds are exhausted, and enthusiasm in the group significantly cools down.

- Fifth Stage: Negative Outburst - Negative emotions spread in the group, voices of blame and insults towards the project team emerge, and dissatisfaction is released.

- Sixth Stage: No One Cares - Almost zero communication in the group, insults disappear—most have cut losses and are no longer concerned about project developments.

- Seventh Stage: Faith Shattered - Coin prices continue to oscillate at low levels, eroding the last remaining faith of retail investors, with some forced to cut losses.

- Eighth Stage: Recovery Phase - The market begins to recover, the whales test the waters (pulling up sharply) to observe retail reactions; after repeated testing, retail investors hesitate to chase, and the whales initiate a real upward trend.

Key Question: Which stage are we currently in?

This needs to be assessed based on the specific coin's price trend (whether it is in a low-level sideways trend or continuously declining), community activity (volume of communication/emotions), and retail behavior (whether they are still bottom fishing or have exited).

Comprehensive judgment:

- If there are still insults in the community and some are observing, it is likely in the 5th-6th stage;

- If it is in a low-level sideways trend and the community is silent, it may be in the 7th stage;

- If there is a test pull-up and retail investors hesitate to chase, it may have entered the early 8th stage.

LIFE IS LIKE

A JOURNEY ▲

Below are the actual trading signals from the Big White Community this week. Congratulations to those who followed along; if your trades are not going well, you can come and test the waters.

Data is real, and each trade has a screenshot from the time it was sent.

**Search for the public account: *Big White Talks About Coins*

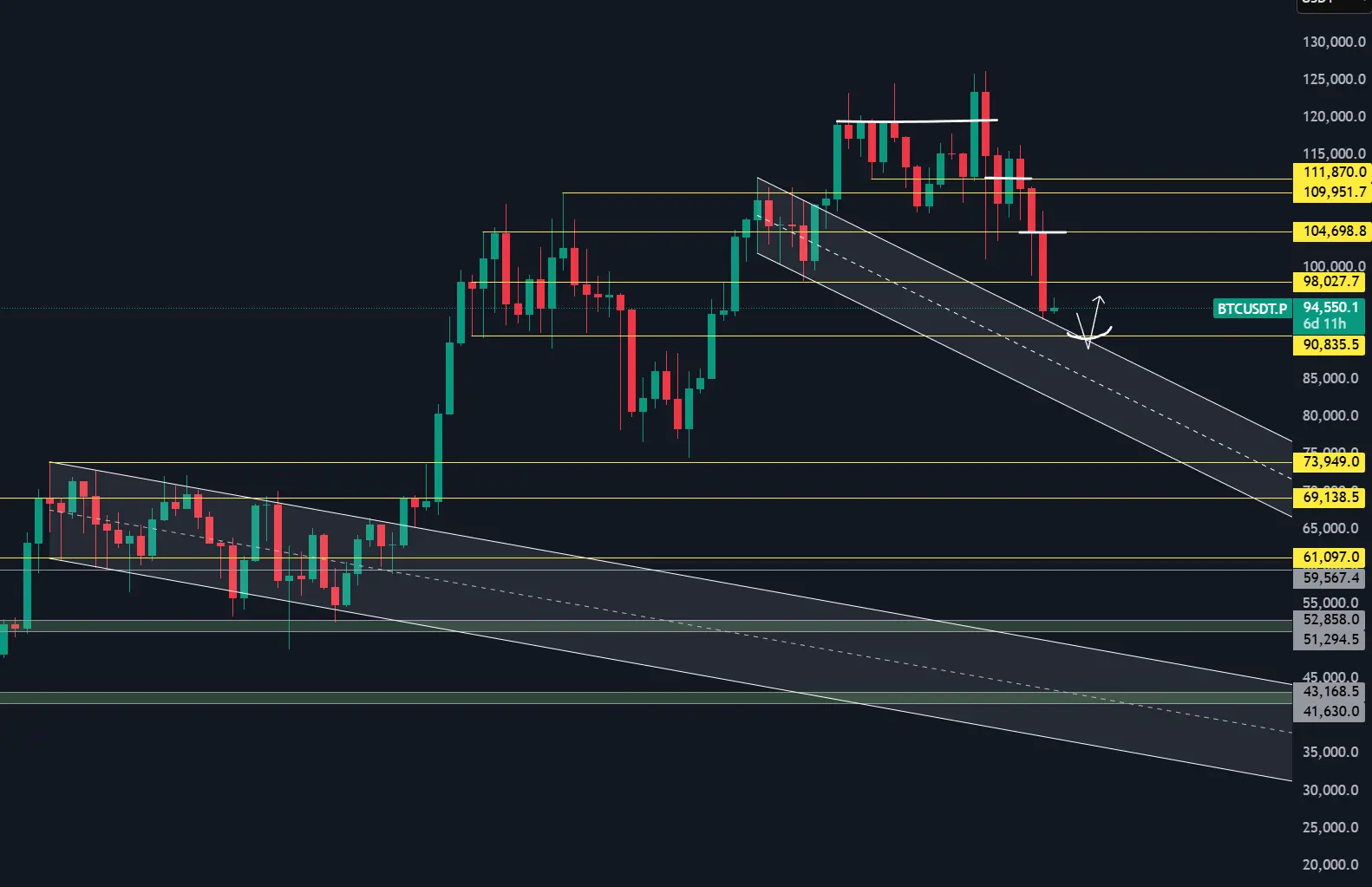

BTC

Analysis

Currently, there are no significant negative factors in the risk market. The decline in Bitcoin is mainly driven by the drop in U.S. stocks, with the Nasdaq and S&P indices experiencing a larger decline compared to the first half of the year. The VIX index has surged to a high of 23.44, the highest since October 17, indicating that U.S. stocks have entered a panic phase after a short-term correction. Although Nvidia's earnings report is due early Thursday, the market still appears to lack confidence. However, confidence may increase slightly as we approach Nvidia's earnings on Tuesday and Wednesday. Currently, BTC is expected to see reduced selling pressure after the U.S. stock market closes; the next focus will be on the sentiment in the Asian market!

The weekly K-line has broken the key level of 98,000. It was mentioned yesterday that even if there is a short-term rebound this week, as long as it is not a large bullish engulfing candle, caution is still needed for another dip to the key level of 90,800, which may also fill the CME gap. This will be an important support-resistance exchange point in the previous consolidation range. If there is a false breakdown followed by a recovery, it will still be attempted. Today, large whales on-chain are buying heavily, and all positions are firmly held.

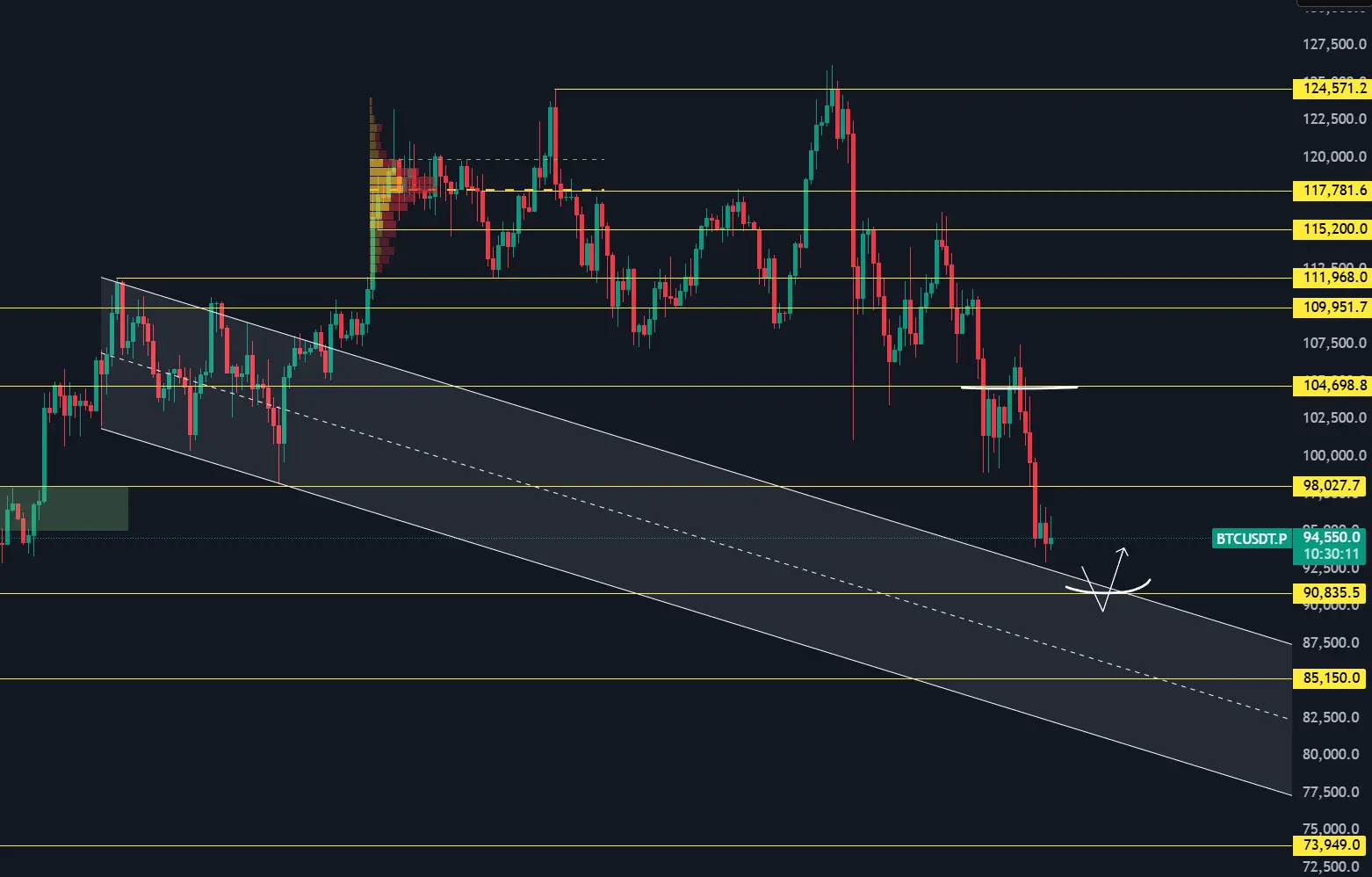

ETH

Analysis

As of the U.S. stock market close, the panic index VVIX closed at 117.86. Historically, this data rarely exceeds 110, and generally, when VVIX exceeds 100, it indicates that market panic is intensifying, and investor sentiment becomes very unstable. It also suggests that the VIX may fluctuate between 20% to 30% in the coming month.

Ethereum is still close to the 3,000 point edge, having dropped below its lowest point in nearly three months.

The 24-hour decline is 3.96%, currently rebounding to around 3,020, about 5% away from yesterday's high, and the data company is basically in a floating loss state.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。