Bitcoin has fallen over 20% from its October high of 126,000, breaking through the 100,000 mark to around 93,000. According to market rules, a drop of over 20% officially indicates a bear market, and we are now firmly in the bear market zone. Ethereum has been even more astonishing, dropping nearly 40% to the 3,000 mark. The direct result of this is that over 2 million people have been liquidated, with more than 20 billion dollars evaporated.

Ironically, among those who were liquidated, over 90% were ordinary people who believed the bull market would continue. They watched the market surge and missed out, thinking they couldn't afford to miss it again. They also share a common belief that it was all due to leverage. But is that really the case? In my view, that's just an excuse. The losses have never been caused by leverage; leverage is merely a magnifying glass. The real cause of liquidation is the obsession with believing in a trend that one cannot clearly see. Liquidation itself is not terrifying; what is terrifying is that after one round of liquidation, nothing has been learned, and when the next market comes, the same mistakes are repeated.

Today, I will briefly review where you went wrong and why, despite seeing the direction, you still lost so thoroughly.

1. Inability to See the Structure of the Trend

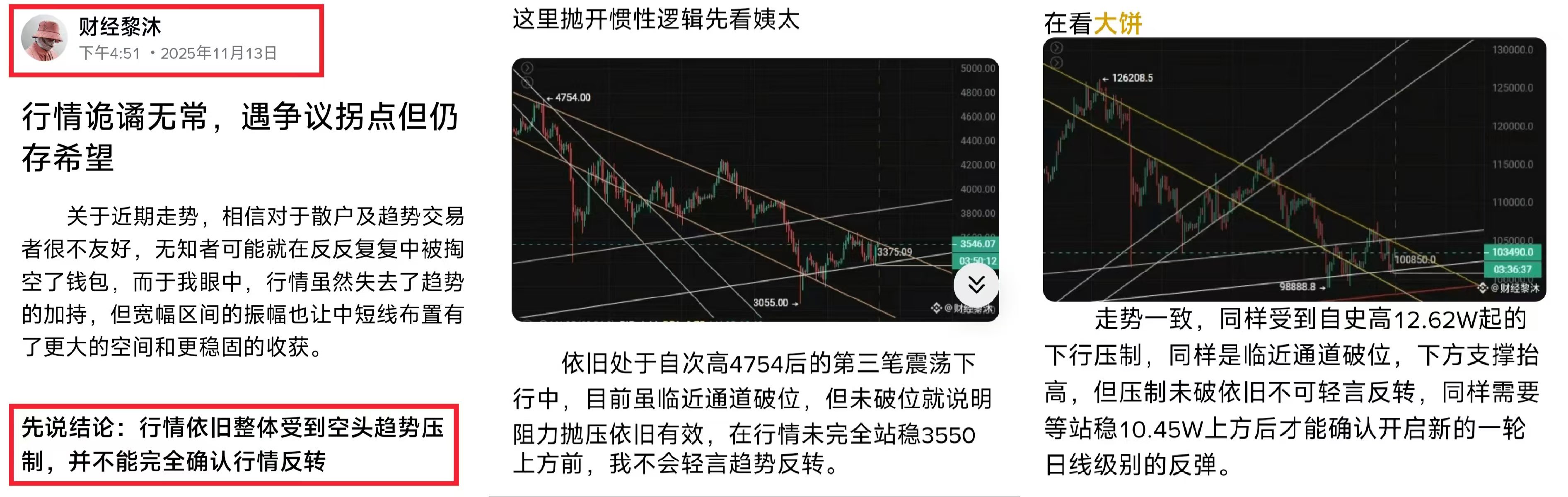

This is the most fatal mistake for most traders, always mistaking a rebound for a reversal. Here’s a question: do you remember what indicator I used most frequently in past articles? It’s the moving average. A mature trader will always remember the "Do Not Go Against the Fourfold Principle" and use a very slow moving average system to discern the market's direction. When the price is below this slow-moving tunnel, it indicates that the overall trend is under bearish pressure. At this time, any upward surge should only be seen as the occasional sun in winter, not a reversal. Those who were liquidated were precisely the ones who mistook the sun for spring and rushed in with high leverage, only to be buried by an impending snowstorm.

2. Lack of Risk-Reward Ratio Concept

Similarly, this is a common issue among most retail traders, turning trading into a gamble with extremely poor odds. Except for the first day of entering the market, the rest is spent either trying to break even or amplifying losses. At this point, you might want to think about whether you calculated the odds when chasing highs or cutting losses. If you’re right, how much can you earn? If you’re wrong, how much will you lose? Most people enter the market when emotions are at their peak, but at that position, there may be less than 5% room for movement either up or down. However, once a reversal occurs, it could lead to a deep abyss of over 10% or even 20%, which proves the saying: when you see flowers blooming, decay and withering are sure to follow. This is like a trade with a very poor risk-reward ratio. A professional trader will act like an experienced hunter, patiently waiting for the lowest risk entry point, while amateurs will bet based on feelings. This is why every strategy I provide will only have minimal losses but potentially huge profits.

3. Mistaking Emotion for Signal

Impulsively entering the market during a flourishing period. Seeing prosperity while ignoring that the roots of risk have already begun to rot; the more it blooms, the closer it is to withering. Retail traders chasing highs operate on this principle, which everyone should understand. Just like in life, when a certain project or sector reaches your ears as a way to make big money, the harvest is not far off. So what should you do? Wait, observe, learn. A reliable trader cannot simply chase red and cut losses on green; they will wait until the main trend, secondary trend, trading volume, structure, and even the market provide clear signals before acting. Just like the rebound after this crash, the market did not give any reliable trend confirmation; it was merely a structural trap, a premature reversal illusion. Those who rushed in were not acting on trading signals but rather on their own hopes and fears.

(PS: Take a look at the thought process before this round of decline; isn’t it just like this?)

At this point, regarding the odds, timing, and structure of trading, I believe everyone should resonate with this. But have you noticed? After all this talk, the essence behind it is actually a confrontation between two mindsets: one is the gambler's mindset, and the other is the operator's mindset. Gamblers always want to seize every market fluctuation, while operators only bet within their advantageous range. Gamblers care about how much they can earn, while operators focus on whether the trade is worth it. By now, you should understand. So before the next crash or surge arrives, please do not obsess over predicting the price points; instead, ask yourself, are you a gambler or an operator?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。