Written by: Wu Yu, Jin Shi Data

Bitcoin fell below the critical $100,000 mark last week, with recent selling by "whales" (investors holding large amounts of cryptocurrency) and other long-term holders becoming a significant driver of the recent price decline.

Most blockchain analysis companies define "whales" as individuals or institutions holding 1,000 or more bitcoins. Although the identities of most "whales" are unknown, blockchain data can still provide clues about their activities by tracking their cryptocurrency wallets.

Data shows that some "whales" have recently accelerated their pace of bitcoin selling. Some analysts indicate that this phenomenon is worth noting, but it may not necessarily be a panic signal. They point out that the recent selling may reflect a steady profit-taking rather than panic selling, a pattern consistent with previous bull market cycles.

Martin Leinweber, head of digital asset research and strategy at MarketVector Indexes, stated that such selling may reflect "planned asset allocation." "Some bitcoin investors bought in when the price was in single digits and have waited a long time. Now there is finally enough liquidity to sell without completely disrupting the market," he told MarketWatch.

Despite recent complaints from cryptocurrency bulls about market liquidity drying up, the ease of buying and selling bitcoin has significantly improved compared to a decade ago.

However, analysts at blockchain analysis firm CryptoQuant express concern that the recent selling by "whales" coincides with deteriorating market sentiment and a slowdown in buying, which could put further pressure on bitcoin prices. Dow Jones market data shows that the largest cryptocurrency approached $19,400 last Friday, the lowest level since May 6.

Then and Now

The selling of bitcoin by long-term and large holders is not unique to the current cycle. Analysts at blockchain data platform Glassnode wrote in a recent report that there are signs indicating that the recent selling is driven by profit-taking rather than panic.

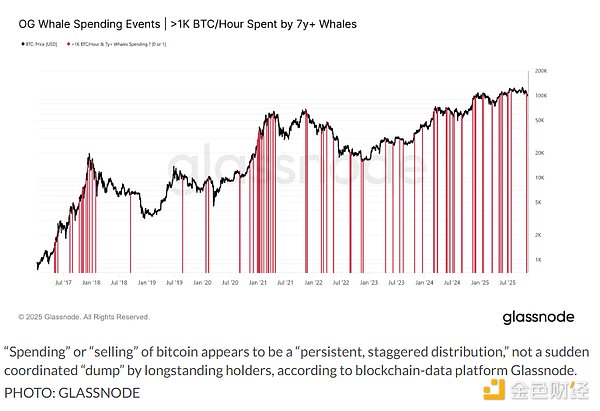

Specifically, the wallets of "whales" holding bitcoin for over seven years and selling more than 1,000 bitcoins per hour have shown a regular and steady pattern of selling over a period of time (see the chart below, data as of last Thursday, November 13).

The selling behavior of "whales" has shown a regular and steady pattern over a period of time.

The Significance of the $100,000 Mark

Meanwhile, Cory Klippsten, CEO of bitcoin-focused financial services company Swan Bitcoin and a long-term bitcoin investor, stated that the large selling by "whales" in recent months seems to be related to the $100,000 mark for bitcoin—many early adopters have long viewed this level as a psychological threshold for profit-taking.

"Since entering this field in 2017, many early holders I know have talked about the $100,000 figure," Klippsten told MarketWatch, "For some reason, people always say they will sell part of their holdings at this price point."

Glassnode data shows that since bitcoin first broke the $100,000 mark in December 2024, the selling behavior of long-term holders has intensified.

Potential Alarm Signals

However, CryptoQuant analysts wrote in a recent report that one changing factor is the market's capacity to absorb the selling. When long-term holders sold bitcoin at the end of last year and the beginning of this year, other buyers stepped in to support prices, but this trend seems to have changed.

The flow of funds into investment products can reflect weak demand—Dow Jones market data shows that as of last Thursday, bitcoin exchange-traded funds (ETFs) saw outflows of $311.3 million for the week, marking the fifth consecutive week of outflows, the longest continuous outflow period since the week ending March 14 (when there were five consecutive weeks of outflows).

In the past five weeks, bitcoin ETFs have seen a cumulative outflow of $2.6 billion, the largest five-week outflow since the week ending March 28 (when there was an outflow of $3.3 billion).

Recent price movements have also brought the $100,000 mark back into focus. As of the time of writing, bitcoin is still trading below this mark. Some technical analysts indicate that the market's failure to reclaim this key level may trigger more profit-taking behavior.

Compounding the issue is that the overall macroeconomic environment is not favorable for risk assets. Joel Kruger, market strategist at LMAX Group, which operates foreign exchange and cryptocurrency exchanges, noted that this has led to some long positions being liquidated. "We believe the market entered the fourth quarter with overly high expectations, stemming from seasonal trend analysis—historically, this period has performed exceptionally well," Kruger wrote in a letter to MarketWatch.

Kruger pointed out that as investors lower their expectations for a Federal Reserve rate cut in December, and weak labor market data raises economic concerns, overall risk assets, including bitcoin, are once again under pressure.

Saylor Continues to Accumulate

Despite this, one of the known largest bitcoin "whales" continues to buy.

Michael Saylor, chairman of software company Strategy Inc. (now widely viewed as a leveraged bitcoin investment vehicle), stated last Friday on CNBC that the company has been "accelerating" its bitcoin purchases and will announce its buying status on Monday morning.

As of last Friday, Strategy held over 640,000 bitcoins, accounting for more than 3% of the current circulating total of 19.9 million bitcoins. Strategy did not immediately respond to an email seeking comment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。