Original source: Newbies Love to Record

The rise of Perp DEX is unstoppable. Following Hyperliquid's lead in capturing the market, a number of emerging decentralized exchanges have also begun to shine. This year, Aster, backed by CZ and Yzi Labs, launched and kicked off a trading competition, with its trading volume at one point surpassing Hyperliquid. Equally noteworthy is Pacifica, founded in January this year by former FTX COO Constance Wang and two other founders—this project has progressed rapidly, launching its testnet in just two months and officially starting its mainnet on June 10.

Currently, Pacifica has 30,000 active users, with a trading volume reaching as high as $5.9 billion in the past week. Although Pacifica's development is swift, there is still significant room for growth compared to the current leaders Lighter and Hyperliquid in terms of trading volume. Additionally, starting from October 30, the platform's regular points distribution has increased to 20 times the previous amount, with the current total supply of points exceeding 135 million. For Pacifica, which has yet to issue tokens, the points program is undoubtedly attractive to users.

This article has compiled a registration and trading tutorial for Pacifica. The points program has been launched for less than half a year and is still in its early stages. If you also wish to participate in this points feast, feel free to continue reading.

Pacifica Registration Tutorial

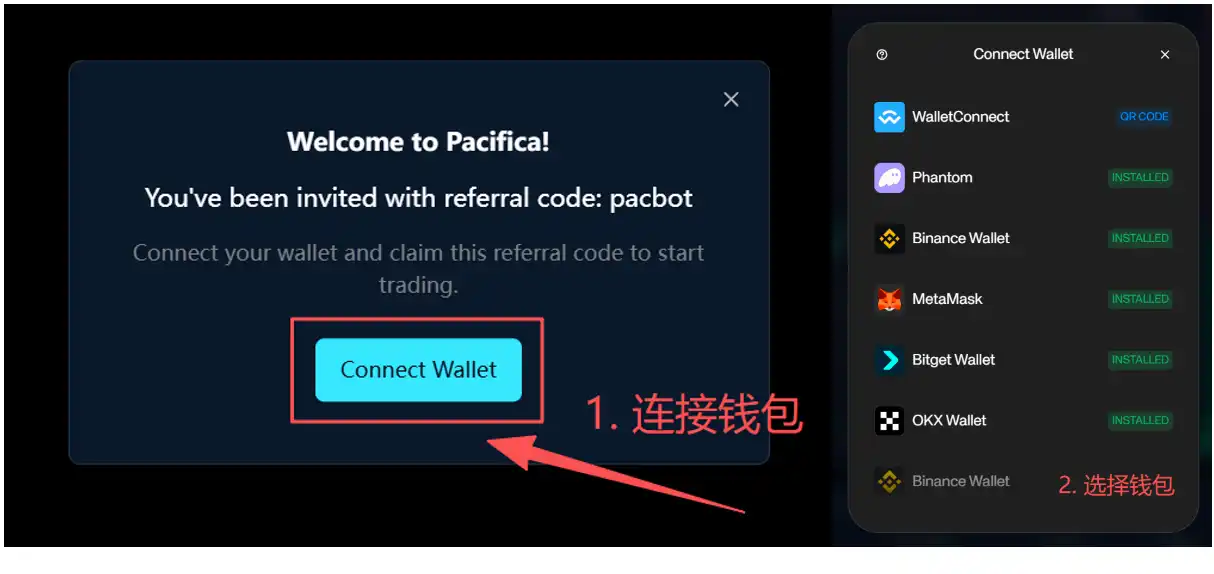

1. Open the Pacifica official website, complete registration and wallet binding

Pacifica Official Website: https://app.pacifica.fi/

After completing the wallet connection, there will be 2-3 confirmation prompts; just follow the instructions to confirm.

2. Set the language

The website currently supports multiple languages. If you are a Chinese-speaking user, click "中文" or "繁体中文"; if you prefer the English page, you can skip this step.

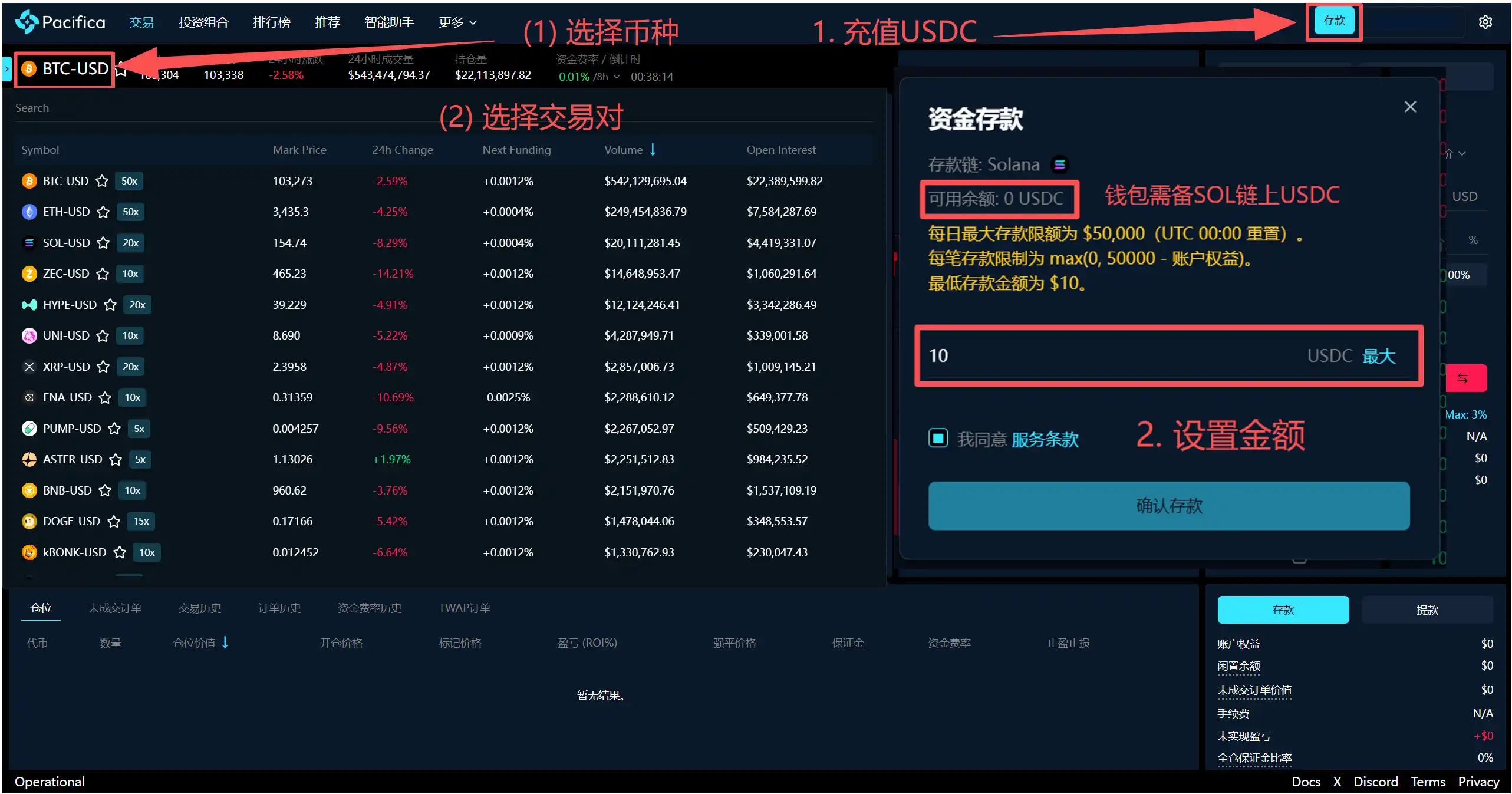

3. Deposit USDC and choose the cryptocurrency you want to trade

Pacifica is built on Solana, so when depositing, you need to select USDC on the Solana chain. Be sure to verify the wallet address for on-chain transfers.

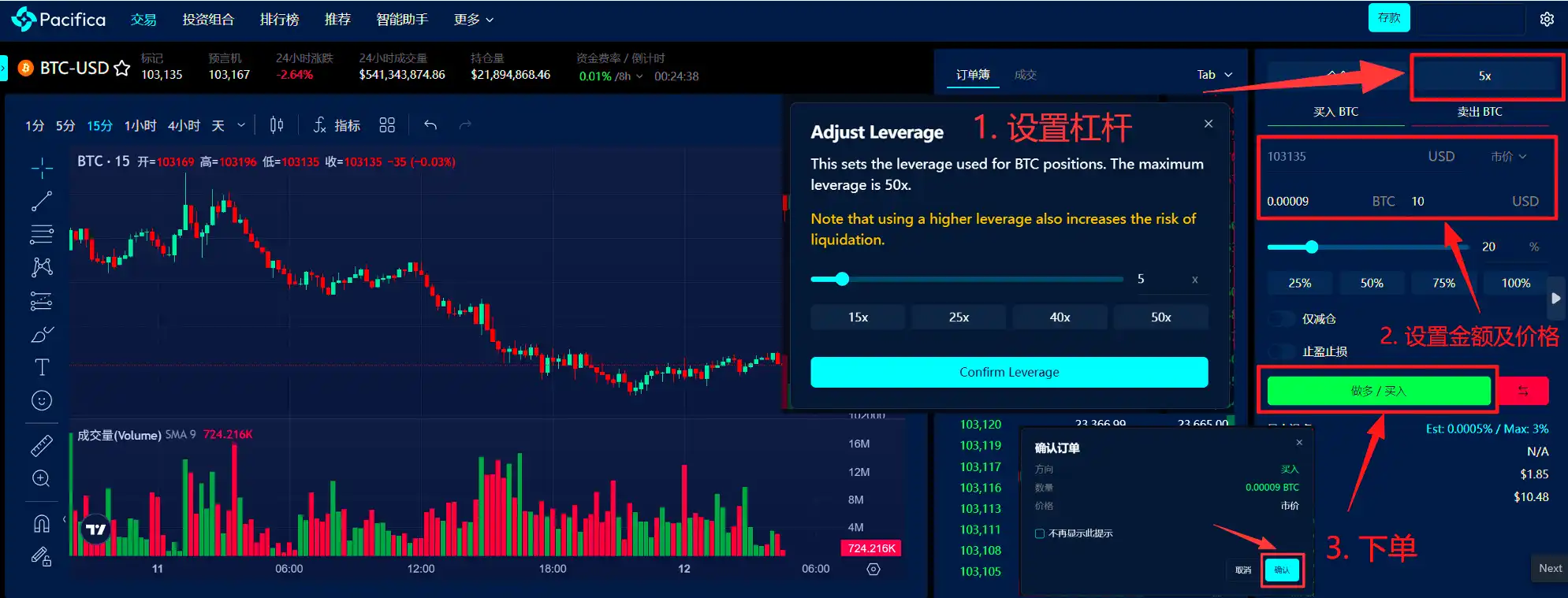

4. Start your first trade (using BTC as an example)

After completing the deposit, you can select the cryptocurrency you want to trade from the top left corner. Currently, Pacifica supports most mainstream tokens and is continuously listing new tokens.

According to the example in the image:

- Set the leverage multiplier (new users are advised to use low leverage, avoid high leverage)

- Trade direction: Long/Short

- Opening amount/Market order

- Number of tokens to trade

- Click "Confirm" to complete the order

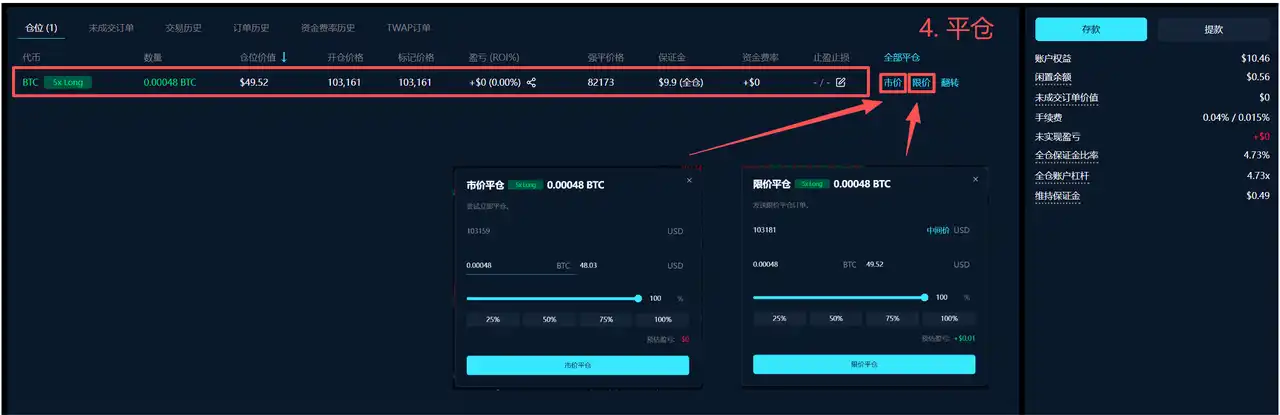

5. After placing an order, if you want to close the position or set a limit close, you can refer to the operation in the image below.

Pacifica Points Rules

Pacifica's points program will launch on September 4, 2025, with snapshots taken every Thursday at 00:00 UTC. Distribution will be completed within 24 hours and will be allocated to eligible active users. The specific distribution formula has not yet been disclosed, but it is primarily based on the trading volume of all platform users. Currently, 10,000,000 points are distributed weekly to trading users (previously 500,000 points, increased to 20 times on October 30), and the allocation is based on the total number of users and trading volume for that week, making the acquisition of points dynamic.

According to feedback from various traders online since November, approximately 1 point can be earned for every $600 to $1000 in trading volume. To reduce slippage, you can choose tokens with low volatility and low funding rates for trading.

What is the value of points?

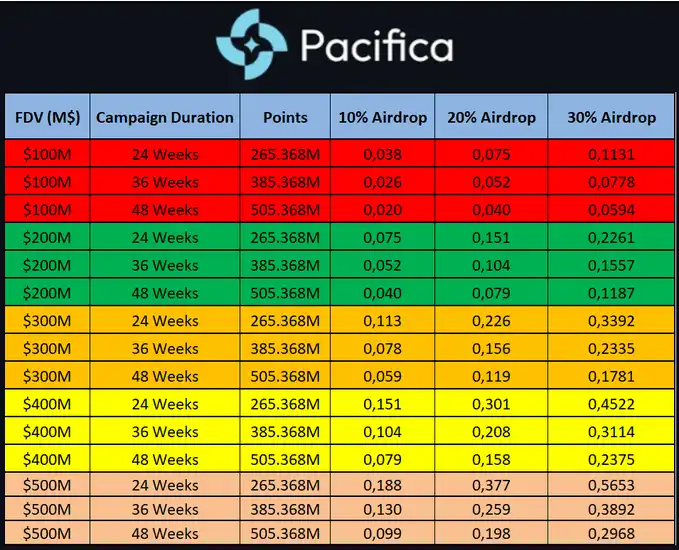

It is important to clarify that linking Pacifica points to token value is still based on community speculation grounded in industry experience, and the official has not provided clear rules. However, based on the conventional operations of projects in the past and community speculation, there is a general tendency to associate points with tokens. Under this assumption, the community has derived a widely circulated valuation logic, with the core formula being: Single point price = (Fully Diluted Valuation FDV × Token Airdrop Ratio) / Total Points Distribution Amount.

The application of this formula relies on several core variables: first, the estimation of the project's FDV; second, the assumption of the airdrop's proportion of total supply; and third, the most variable—predictions of the total duration of points distribution (usually assumed to be 24, 36, or 48 months). The table below will present different scenarios for estimating point prices based on these variables for reference:

Finally, a reminder to everyone: this tutorial aims to help you earn more points. Contracts can be overwhelming, so resist the urge to fomo and hold back.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。