Master Discusses Hot Topics:

Speaking of the slight drop over the weekend and this morning, it can't be said to be earth-shattering, but Bitcoin has stubbornly smashed through 93K, casting a shadow over Monday's opening. The entire market's fear index is absurdly high; quickly tell me, are you all running away and not playing anymore?

This morning, I also looked through GlassNode's data, and the fear level has hit the lowest point for the entire year of 2025. The last time it was this low was in April this year when the price was only 74K. Now, the fear is stronger, yet the price is still holding around 94K. This directly indicates that the market is in a complete psychological collapse, but the underlying buying pressure is still there.

Now, let's talk about this Thursday's non-farm payrolls for September. The delay has dragged on until now, and its actual significance has been killed by time, but the main players will definitely use it to stir things up, as the narrative around the fundamentals is becoming increasingly scarce.

Back to the market, Bitcoin's weekly MACD has brought the fast line down to near zero, which is a blatant structural change. Comparing it to the drop to 74.4K on April 7, the weekly MACD was still in the air back then. Now it's sliding directly to the ground, indicating that the level of correction has upgraded.

The bull market's residual bloodline has hit zero, and the impressive trend that started at the end of 2022 has basically declared death. What follows is a deep bear echo chamber, rather than the previous kind of corrective market that offered some sweet rewards.

Coinbase had some funds sweep in at 93K, so the short-term decline didn't continue, but that doesn't mean the correction is over. Bitcoin's last three rebounds all died before the 1-hour MACD could climb above the zero axis. Today is even more amusing; it didn't even have the qualification to climb, and it couldn't even pretend to.

When I was elected last November, Bitcoin had stubbornly broken through 73.3K, then surged past 80K and 90K, directly tearing open the door to 100K. Since it surged up like that, I won't expect any buying support around 90K after the drop from 100K; the only decent support layer is the thin paper between 93.3K and 92K. If it breaks through, be prepared to welcome 88K.

Additionally, I have some thoughts; let's act like bulls today. I'm not pretending to be high-minded anymore; this week is about preparing a plan to buy the dip. The first phase low after losing 100K is coming. If 90K is broken, then a rebound could at least bounce back 5000 to 7000 points, which wouldn't be hard to slap the bears.

But please listen carefully; this is just a phase rebound. If it breaks 92K again, then 90K will be completely dead, with the target directly heading towards 78 to 74.6K, which is the second phase deep pit.

For spot traders, this position can consider layout probabilities; don't fantasize about picking the bottom every day. The key is to manage your position and average price without killing yourself. Don't go all in at once; going all in isn't bravery, it's foolishness. Split your chips, place them densely in a small range; cost is king.

As for Ethereum, the rebound pressure has dropped to 3150. The rebound is as weak as an electric vehicle running out of power, unable to sustain the sentiment. If it doesn't break above 3250, that's the ceiling. The lower threshold of 3000 has already become a threshold, and the main support below is only 2880 to 2800.

Master Looks at Trends:

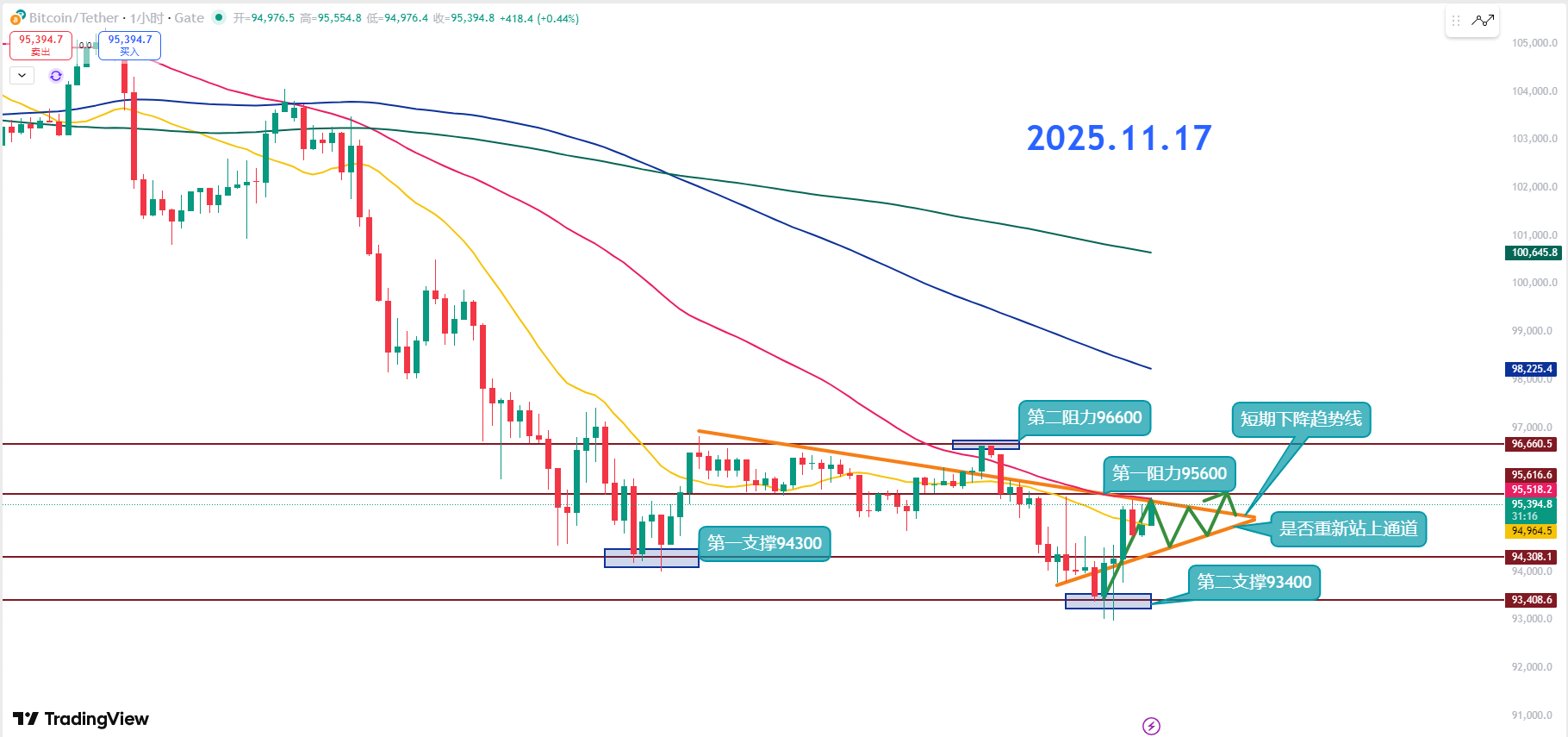

Resistance Level Reference:

Second Resistance Level: 96600

First Resistance Level: 95600

Support Level Reference:

First Support Level: 94300

Second Support Level: 93400

Currently, Bitcoin must break through the short-term downtrend line shown in the chart to continue strengthening on the hourly level. It is currently in a weak rebound zone after a decline. If it can form a structure of gradually higher lows, then the bulls will have the qualification to continue rising.

The short-term support level is around 94K to 94.3K. If 94K cannot be broken again, the hope for a rebound will be directly cut off. If it breaks below 94K, it will accelerate the decline, targeting the range of 91K to 92K, and the downward space will be opened again.

The first support around 94.3K is the starting point for the previous low rebound; it must be held to continue playing the rebound. As long as it is not broken through, the bulls can still breathe. The second support is 93.4K; once it breaks below 94K, we will see if it can hold here. Also, pay attention to whether the lower shadow line raises the low point; otherwise, continue to look bearish.

The first resistance of 95.6K must be broken before we can talk about trend reversal and retest confirmation. The second resistance of 96.6K is the upper edge of the short-term range; breaking through it would be considered strong; not breaking through is just struggling.

Intra-day, pay attention to the short-term downtrend line and treat it as a watershed. If it doesn't break through, any rise is just a flash in the pan. If it approaches the upper resistance area and the RSI enters the overbought zone, be careful of being hit in the face. If you need to hedge, then hedge; short-term relies on controlling points and executing plans.

11.17 Master’s Wave Strategy:

Long Entry Reference: Not currently referenced

Short Entry Reference: Directly short in the range of 95600-96000, defend at 96600, target: 94300-93400

If you truly want to learn something from a blogger, you need to keep following them, rather than making rash conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "catch the top and pick the bottom every time," but in reality, it's all hindsight. A truly worthy blogger will have trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don't be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you want to learn more about real-time investment strategies, unlocking positions, spot trading, short, medium, and long-term contract trading techniques, and knowledge about candlesticks, you can add Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。