I. Introduction

Last week, the collapse of Stream Finance's xUSD acted as a trigger, leading to the decoupling of stablecoins such as deUSD and USDX. A crisis unfolded in the DeFi space, marked by a chain reaction of stablecoin decouplings and the impact on lending protocols. The Curator model played a significant role in this situation, sparking market controversy and reflection.

The Curator model (often translated as "Curator") has rapidly expanded over the past year, with managed funds exceeding $10 billion at one point. Curators are widely distributed across mainstream lending protocols, meaning that a single failure can transmit through the entire DeFi lending landscape. The recent stablecoin decoupling incident confirmed this: xUSD -> deUSD -> USDX resembled a domino effect, breaching multiple protocols' defenses. This chain reaction not only accelerated capital outflows but also shook investors' confidence in the Curator model, prompting the industry to reflect: Does the Curator model reduce risk, or does it concentrate and amplify risk?

This article will delve into the role and function of Curators in on-chain lending protocols, their profit models, and review leading Curators, including their backgrounds, styles, fund sizes, and performances during this incident. It will also expose the risks and challenges of the Curator model revealed by this stablecoin decoupling event and look ahead to the future evolution of the Curator model and the lending market, aiming to provide comprehensive insights for investors.

II. Role and Function of Curators

A Curator refers to an external fund pool manager present in DeFi lending protocols. They are responsible for designing, deploying, and operating specific strategic fund pools (Vaults), encapsulating complex DeFi yield strategies into products that ordinary users can deposit with a single click. For example, in emerging lending protocols like Morpho and Euler, users can choose different Vaults provided by Curators, and after depositing funds, the Curator decides on the investment strategy in the backend, including asset allocation weights, risk management, rebalancing cycles, and withdrawal rules. Unlike traditional centralized wealth management, Curators cannot directly misappropriate user funds; their authority is limited to executing strategies through smart contract interfaces, and all operations are subject to contract security constraints.

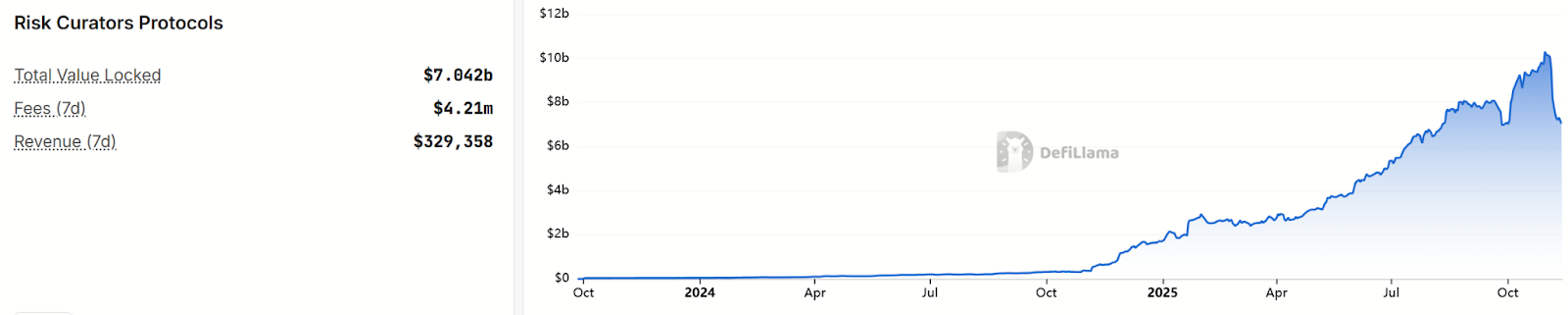

The original intention of introducing the Curator model was to leverage the strategic management and risk control capabilities of these professional teams to bridge the supply-demand mismatch in the lending market. On one hand, it helps ordinary users achieve higher yields in an increasingly complex DeFi world; on the other hand, it assists lending protocols in increasing Total Value Locked (TVL) and reducing the probability of systemic risk events. Since the Vaults managed by Curators often provide higher yields than traditional lending pools (such as Aave), they can attract significant capital. According to DefiLlama data, the scale of Curator model fund pools has rapidly grown, surpassing $10 billion in early November 2025. Currently, due to panic, it has dropped to about $7 billion, indicating that some funds are withdrawing from this model.

Source: https://defillama.com/protocols/risk-curators

In this "Curator" model, the lending protocol itself becomes a matching platform, outsourcing risk control and fund allocation functions to Curator teams, which is vividly likened to "fund managers in the DeFi world." This means that over $8 billion in funds are effectively managed by numerous Curators with diverse backgrounds. On the surface, it seems that professionals are doing professional work, making it easy for users to achieve high yields; however, at the same time, risk has shifted from code to human management, and human factors have once again become a significant source of risk.

III. Curator Profit Model

To understand the risks inherent in the Curator model, one must first grasp its profit logic. Typically, Curators' income sources include:

Performance Fee: After strategy profits, a certain percentage is extracted from net earnings, which is the primary form of income. For example, the USDT Vault managed by Gauntlet on Morpho charges a 5% profit share.

Management Fee: A management fee is charged based on a certain annualized percentage of the total assets in the fund pool (similar to traditional fund management fees).

Protocol Incentives: Lending protocol parties may offer token rewards to Curators to encourage them to create high-quality strategies, such as subsidies for early introduction of new strategies.

Brand Derivative Income: Once a Curator gains fame, they may also issue their own products or even tokens for profit.

In short, the larger the Vault size and the higher the strategy yield, the more profit Curators can obtain. In a fiercely competitive environment, no Curator dares to arbitrarily raise the commission rate to seize profits, as users are more concerned about the APY. Therefore, to attract funds, Curators often strive to increase the nominal yield of their strategies, leading to yield-driven competition.

This incentive mechanism contains significant moral hazard: Curators earn excess profits, but losses are borne by users. Driven by the internalization of profits and externalization of risks, Curators inevitably seek higher yields, which equate to higher risks, and safety can easily be overlooked. This tendency becomes even more dangerous when most deposit users only focus on yield numbers without understanding the details of the strategies.

IV. Review of Leading Curators

Currently, a number of leading professional Curators have emerged in the DeFi lending space, managing assets worth hundreds of millions. Below is a review of representative leading Curators, each with distinct team backgrounds, management scales, risk control styles, and profit methods:

1. Gauntlet

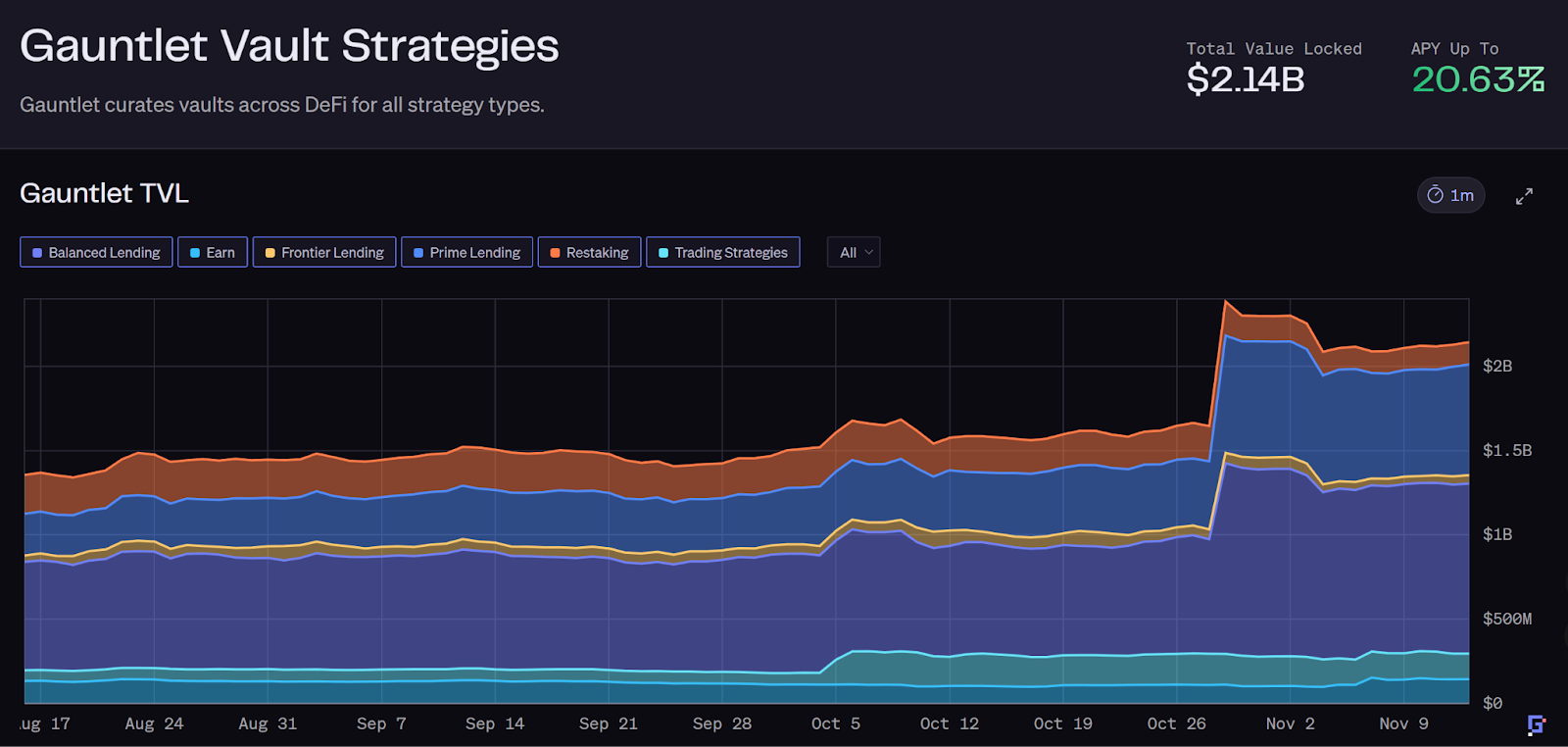

Source: https://app.gauntlet.xyz/

Founded in 2018 by Tarun Chitra and other quantitative finance experts, Gauntlet is one of the earliest teams focused on DeFi risk management. Gauntlet is known for its data-driven risk assessment and management, having provided parameter optimization services for Aave, Compound, and others. In the Curator model, Gauntlet emphasizes robust risk control, continuously calibrating strategy parameters and compliance audits through an automated quantitative platform. Its Vaults have a total locked value exceeding $2 billion, covering multiple chains such as Ethereum, Base, and Solana. Gauntlet's revenue primarily comes from management fees (charged annually), with annual management fee income estimated at around $7.2 million.

Gauntlet's model is closer to "risk control consultant + Curator." During the recent deUSD decoupling, Gauntlet assisted Compound in urgently freezing withdrawals to stop losses, acting three hours earlier than manual operations, reducing losses by approximately $120 million. This demonstrates its professional and rapid risk control response.

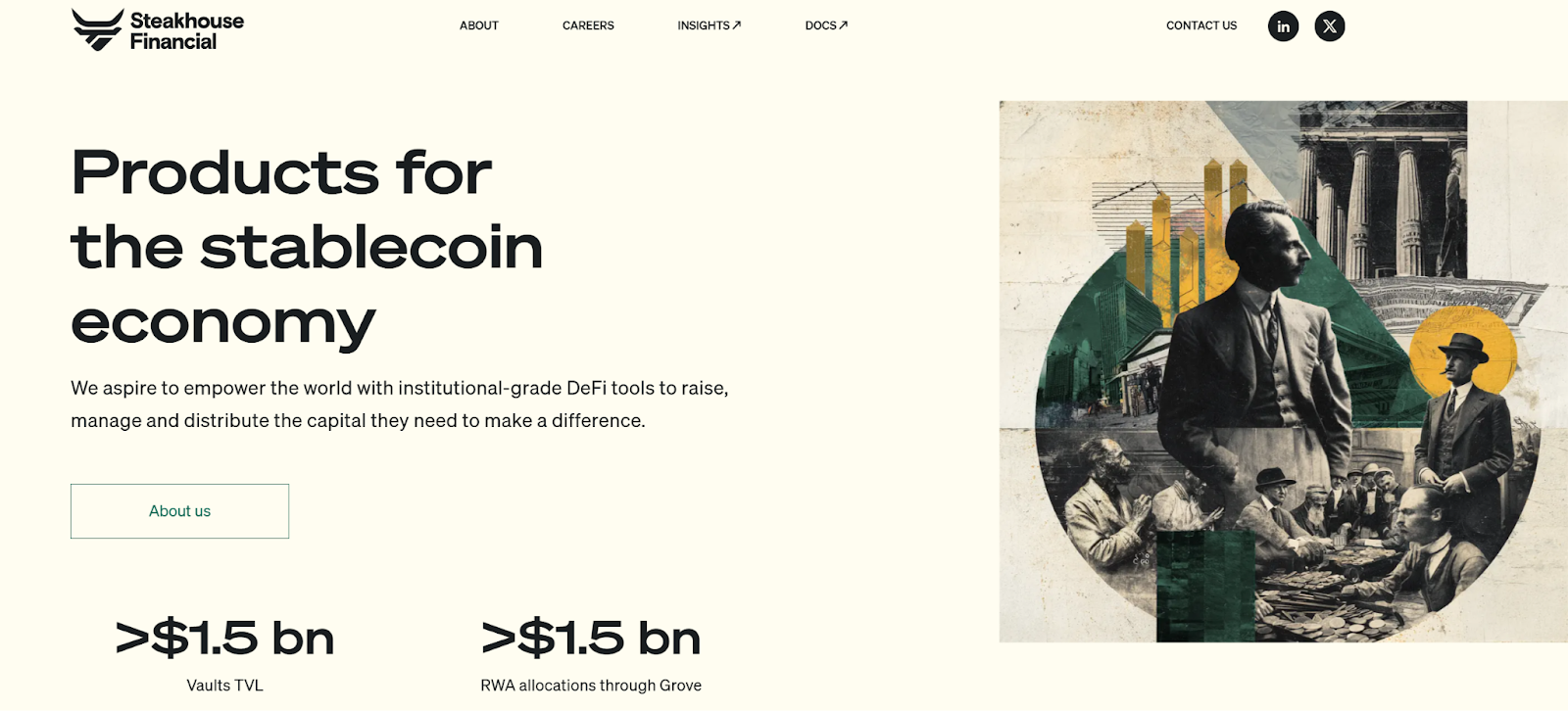

2. Steakhouse Financial

Source: https://www.steakhouse.financial/

Founded in 2020, Steakhouse previously promoted MakerDAO to bring U.S. Treasury bonds and private credit on-chain, aiding the development of RWA tokenization. It utilizes Morpho's infrastructure to dynamically allocate and rebalance funds across various lending pools based on different market yield conditions, thereby creating institution-level robust yield strategies. Steakhouse excels in detailed interest rate risk analysis and portfolio optimization, focusing on stablecoin yield spreads and staking returns. Currently, Steakhouse manages 48 Vaults across chains such as Ethereum, Base, and Polygon, with a fund management scale of approximately $1.5 billion. Its clients include institutions like Coinbase, Lido, and Ethena, helping them design stablecoin yield products.

In the xUSD incident, Steakhouse completely avoided this risk exposure and did not invest user funds in high-risk projects like Stream xUSD, reflecting its cautious style. Overall, Steakhouse is known for its stability, striving for solid returns while ensuring safety.

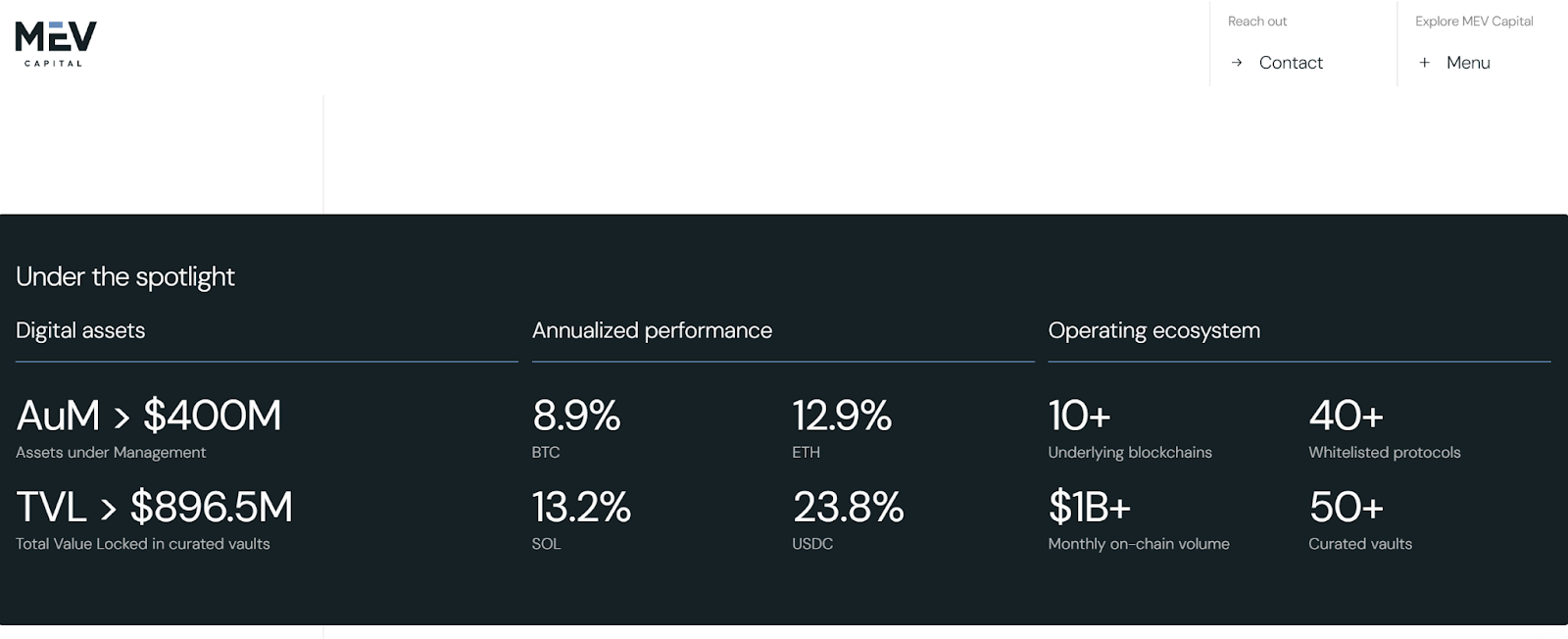

3. MEV Capital

Source: https://www.mevcapital.com/

A Curator known for its DeFi quantitative hedging strategies, MEV Capital managed assets peaking at nearly $1 billion, which has now decreased to $400 million. The team consists of traditional hedge fund and on-chain arbitrage experts, skilled in enhancing yields using methods like MEV. MEV Capital specializes in using over-the-counter options hedging strategies combined with cyclical lending to improve capital utilization. In extreme market conditions, this high-leverage design accelerated the risk of failures.

MEV Capital became the focus during the Stream incident: as a core cooperative Curator introduced by the Stream protocol, its business was deeply involved in the xUSD strategy. The two parties were closely bound by an agreement of "strategy licensing - fund custody - profit sharing." Currently, MEV Capital's TVL on Morpho has rapidly declined, with some pools' TVL being only one-tenth of their peak. Recently, MEV Capital began "bad debt liquidation" for some stablecoins, handling it in a way that spreads the losses among depositors.

It is evident that MEV Capital has an aggressive style, willing to introduce complex derivatives and high leverage in pursuit of high yields, with a high risk tolerance. Additionally, its profit-sharing arrangement with Stream has sparked controversy among users.

4. K3 Capital

Source: https://www.k3.capital/

K3 Capital is a Curator positioned for institutional-level compliance, emphasizing safe and transparent on-chain asset allocation services for institutions and high-net-worth individuals. K3 manages approximately $570 million in funds. K3 has a close partnership with the Gearbox protocol and previously launched a customized USDT credit market using Gearbox's "pool-to-account" model, allowing users to borrow up to 10 times leverage against USDT collateral to invest in DeFi strategies like Ethena, Sky, and Pendle. Through this approach, some of K3's Vaults provide users with stable annual returns of 8%-12%. In terms of risk control, K3 prefers basis arbitrage while avoiding excessive nested risks.

In this incident, K3 was also unable to escape: it invested part of its Vault managed on the Euler platform in the stablecoin deUSD issued by the Elixir protocol. After the Stream incident on November 3, K3 negotiated with the Elixir founder to redeem deUSD at a 1:1 ratio but was met with avoidance. Left with no choice, K3 sold off deUSD for liquidation on November 4, but still had $2 million that could not be redeemed, resulting in a loss. Subsequently, Elixir officially announced bankruptcy, promising that retail investors and liquidity pool holders of deUSD could be compensated 1:1 in USDC, but the deUSD held by Curator Vaults would not be honored, requiring separate negotiations. K3 has hired top lawyers in the U.S. and plans to sue Elixir and its founder Philip Forte for breach of contract and false statements, seeking compensation for reputational damage and forced redemption of deUSD.

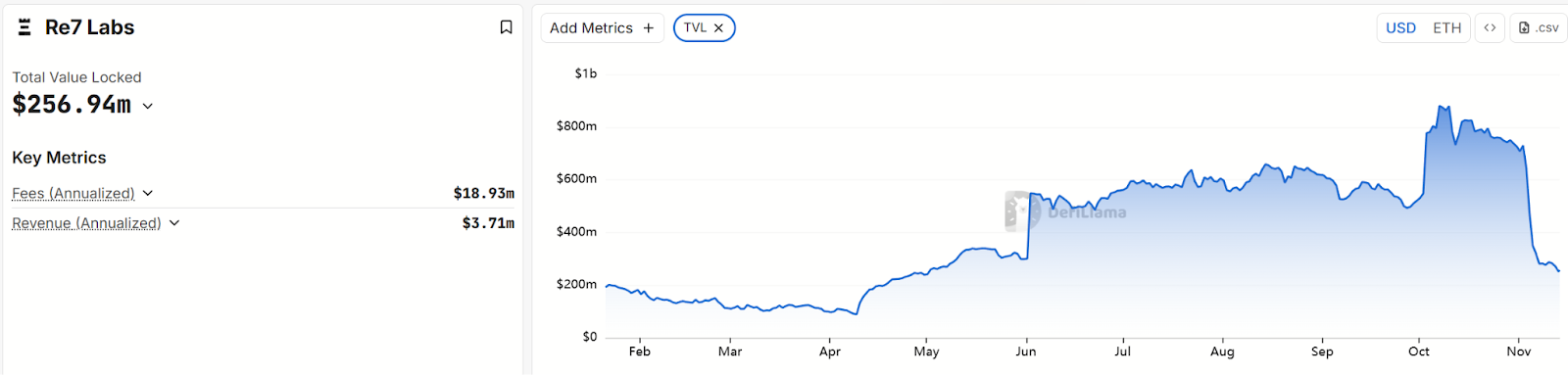

5. Re7 Labs7 Labs

Source: https://defillama.com/protocol/re7-labs?events=false

Re7 Labs is an emerging Curator that has also found itself in the spotlight alongside MEV Capital during this incident. At one point, Re7 managed approximately $900 million, which has now decreased to $250 million. As one of the top Curator partners on the Stream platform, Re7 once controlled over 25% of Stream's total locked value (about $125 million). However, its investment allocation was aggressive: it was disclosed that Re7 invested $65 million in Balancer's non-insurance pool for liquidity mining, $40 million in emerging public chain mining, and $20 million in off-chain perpetual contracts, leveraging up to 10 times for speculation. All three directions belong to high-risk, high-reward areas.

After Balancer encountered a security incident that indirectly triggered the xUSD collapse in early November, issues arose in the Vaults operated by Re7 and MEV in other protocols: the lending vaults operated by both on the Lista DAO platform were drained by loans collateralized with sUSDX/USDX, leading to a utilization rate of 99% and borrowing rates soaring to over 800%, triggering forced liquidation mechanisms. It can be said that Re7 Labs' operations reflect the most aggressive side of the Curator model: highly concentrated risk exposure compounded by multiple layers of high leverage. Re7 is now also mired in losses and a reputational crisis, with its published decoupling impact report indicating that affected funds exceed $13 million.

It is clear that during this stablecoin decoupling crisis, different Curators exhibited vastly different styles and outcomes: some Curators heavily invested in high-risk assets, ultimately leading to disaster, while others maintained risk control standards and successfully avoided catastrophe. This proves that professional Curators are not incapable of identifying and avoiding risks; the key lies in self-discipline and restraint.

V. Risks and Challenges of the Curator Model

In summary, the Curator model has exposed multiple inherent challenges during this incident:

Incentive Misalignment and Excessive Profit-Seeking: The performance-based profit model drives Curators to pursue high-yield strategies, leading to increased risk appetite. When profits come from high-risk investments while losses are borne by users, Curators lack sufficient motivation to prioritize safety, easily giving rise to moral hazard. Curators may take reckless risks for profit, ignoring the possibility of black swan events.

Lack of Transparency: Many Curator strategies operate as black boxes, with serious disclosure deficiencies. Users often only see vague strategy descriptions and historical return curves, while being completely unaware of core risk information such as underlying holdings, leverage ratios, and liquidation mechanisms. For example, after the Stream incident, users discovered that MEV Capital had an actual leverage of up to 5 times, with xUSD having only $170 million in assets but borrowing $530 million. Overall, the lack of transparency is one of the biggest hidden dangers of the current Curator model.

Risk Concentration and Domino Effect: Under the Curator model, a few Curators often control the majority of funds. If these Curators simultaneously fall into the same pit, the consequences can be dire. For instance, before the Stream collapse, MEV and Re7 managed 85% of its funds and heavily invested in the same protocol, leading to simultaneous bad debts due to mass failures among Curators. Additionally, cross-protocol activities by Curators themselves become conduits for risk transmission: Vaults are interconnected through shared assets and leverage chains, creating a domino effect. Furthermore, some Curators have highly similar strategies, exacerbating the impact of single-point failures. Therefore, the lack of independent strategies and highly overlapping positions is a problem that needs to be addressed in the Curator field.

User Awareness and Responsibility Definition: Many deposit users do not truly understand the existence and role of Curators, mistakenly equating Vault risks with protocol risks. If a Curator encounters issues, the protocol party is forced to "take the blame," facing pressure from rights protection and public opinion. This time, Euler faced massive bad debts caused by Curators, leading users to question Euler's safety; the suspension of withdrawals from Morpho Vault also impacted its reputation. This ambiguity of responsibility further leads some Curators to act recklessly in pursuit of profit.

Technical and Liquidation Mechanisms: Curator strategies are often complex and cross-protocol, sometimes challenging the timeliness and effectiveness of existing liquidation mechanisms. For example, Morpho experienced a 100% utilization rate in its Vault, unable to liquidate in time, resulting in $700,000 in bad debts, forcing it to suspend some on-chain operations. Complex strategies lengthen the liquidation chain, and in extreme market conditions, technical execution may fail.

In conclusion, the recent chain of stablecoin decoupling events has sounded the alarm, as the Curator model has reintroduced previously dispersed human risks into DeFi, concentrating and amplifying many issues from traditional finance: information asymmetry, moral hazard, concentration risk, and regulatory gaps.

VI. Improvements and Future Outlook for the Curator Model

In the face of these challenges, various industry stakeholders are exploring paths to improve the Curator model to rebuild trust and harness its positive value:

Self-Discipline and Capability Enhancement of Curators are Crucial: Excellent Curators should possess awareness of traditional financial compliance and comprehensive risk management capabilities, including portfolio risk assessment, understanding of oracles and contracts, market monitoring, and intelligent rebalancing. Curators should also abandon short-sighted gambling mindsets, focusing more on long-term stable returns and prioritizing user interests. Transparency is also a part of self-discipline: Curators have a responsibility to proactively disclose key information such as strategy structure, collateral composition, leverage ratios, and liquidation rules for external review and verification. This not only protects users but also shields Curators from false accusations. Future Curators must establish "high transparency standards" to expose hidden risks to the light of day.

Users Should Carefully Evaluate and Choose Curators: Before investing in a Vault, users should pay more attention to the Curator team's reputation, publicly available risk models or stress test reports, whether they have been audited, how they performed during past extreme market conditions, and whether the incentive mechanisms align with user interests. It is especially important to remember the ironclad rule that high yields correspond to high risks and to steer clear of gimmicks that claim "double-digit risk-free returns." Ordinary investors may not have the energy to delve into the details of every Vault, but they can at least use community discussions and third-party data to assist in their judgments.

Protocol Layers Need to Strengthen Regulation and Constraints on Curators: Lending protocols should not blindly allow Curators to attract TVL but should assume a basic "regulator" role. Specific measures include: requiring Curators to publicly release risk models and regular reports, allowing protocols to independently verify strategy data; introducing staking and forfeiture mechanisms to require Curators to lock a certain margin, which would be proportionally forfeited in the event of significant violations or losses; establishing a Curator admission and replacement system, regularly evaluating Curator performance, and replacing those who perform poorly or are overly aggressive, creating ongoing external supervision of Curators to avoid systemic resonance risks. It is expected that future protocols will impose stricter contractual restrictions and governance clauses when introducing Curators to prevent similar incidents from recurring.

Looking ahead, modular, composable but mutually isolated lending strategies may become a trend. The Curator model has indeed enhanced yields, enriched the variety of strategies, and attracted institutional participation in DeFi. However, to ensure that Curators become a positive force for the long-term prosperity of DeFi, it is essential to design mechanisms that leverage strengths while avoiding weaknesses, integrating the flexibility of Curators into a verified liquidation and governance framework, while maintaining the unity and security of the underlying capital pools. Perhaps in the near future, Curators will evolve into controlled modular plugins, allowing various service providers and integrators to build specific strategies within a mature protocol ecosystem. At that time, the Curator model will move beyond its phase of unrestrained growth into a regulated and secure new era.

Conclusion

After experiencing this chain reaction of stablecoin collapses, the Curator model in DeFi lending has reached a profound moment for reflection and adjustment. In just a few days, the TVL of Curator Vaults evaporated by approximately 25%. However, amidst the bursting of the bubble, more mature mechanisms and innovations are poised to emerge. The Curator model has the potential to undergo a phoenix-like rebirth—under transparency, accountability, and structural optimization, it can become a key component in the DeFi ecosystem that enhances yields while safeguarding security. We have already seen some positive signs: certain Curators are strengthening information disclosure, lending protocols are exploring the introduction of staking accountability mechanisms, and leading projects like Aave are providing new ideas for modular isolation. These efforts are expected to reshape user confidence, and through collaborative efforts, the Curator model could very well transform into one of the cornerstones of DeFi innovation.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。