If we can't meet at the peak, let's reunite in the valley. Last night, the US stock market plummeted, and Bitcoin also faced a severe setback. The resistance at 98,000 was very strong, but it still couldn't hold, and this morning it was directly breached. Currently, Bitcoin is hovering around the 96,000 mark.

In fact, this time the 98,000 level was broken, and the level of panic far exceeded the spike on October 11. The last time was about clearing leverage, but this time it has made the market seriously examine whether the crypto market has entered a bear market.

Let me share my own thoughts. After Bitcoin first fell below 106,000, it had already entered a bear market cycle. The rebound to 107,500 at the beginning of this week was merely a rebound adjustment after breaking the weekly bull-bear line, perfectly pressured downwards, further confirming the bear market structure. Therefore, today's market breaking below 98,000 is a natural occurrence. I want to tell everyone that the so-called news, the so-called collective hawkish turn of the Federal Reserve last night, is just a scapegoat that the market needs afterward.

For all those who are looking to buy the dip, the unexpected drop in the market has caused a drastic change in mindset, leading to confusion and panic. At this moment, psychological comfort is urgently needed. For KOLs, the statements about buying the dip have collapsed, and they urgently need to reshuffle themselves, shifting the blame away, claiming they are not at fault, but that the market is the problem, in order to maintain their persona as analysts. At this time, the Federal Reserve becomes the best scapegoat; no one can question it, and anyone who does will be decisively taken down. This is the reason everyone in the market currently needs; otherwise, it would mean admitting they are foolish.

Objectively speaking, the collective hawkish turn of the Federal Reserve will indeed impact the crypto market, but it is definitely not the core factor. The news is merely a catalyst for Bitcoin, accelerating the original pace. What might have taken a week to break below 98,000 has now been compressed to a day due to the impact of the news. However, does it affect your losses? Whether it takes a day or a week, the result remains unchanged. As long as you still have the thought of buying the dip, you cannot escape this round of explosion. Believe me, as long as you still want to buy the dip, there will be more hard days ahead; this is just the beginning.

Now, back to the main topic, let me share my current thoughts with all the experts.

First, the bear market mindset remains unchanged; this is the core idea. Great people teach us that when thoughts go wrong, reading more books only leads to more reactionary ideas. The same goes for the crypto market; if you can't figure out the direction, the harder you work, the more you lose.

In the short term, combining what I just said, today's drop is a catalytic effect brought about by the Federal Reserve's hawkish turn, which has accelerated the breach of 98,000 to be completed in the short term. Therefore, the first phase of the bearish market has already ended, but this does not mean that the market is about to warm up; you can think of it as a halftime break.

The lowest point today is 95,800, forming a single needle low. The current rebound is weak, and it seems that after consolidating tonight, there will be a second drop. However, just the opposite, tonight will not only not drop but will instead welcome a strong recovery. As I said, the first phase of the bearish market has completed its historical task, and we are now entering a window period before the second phase starts.

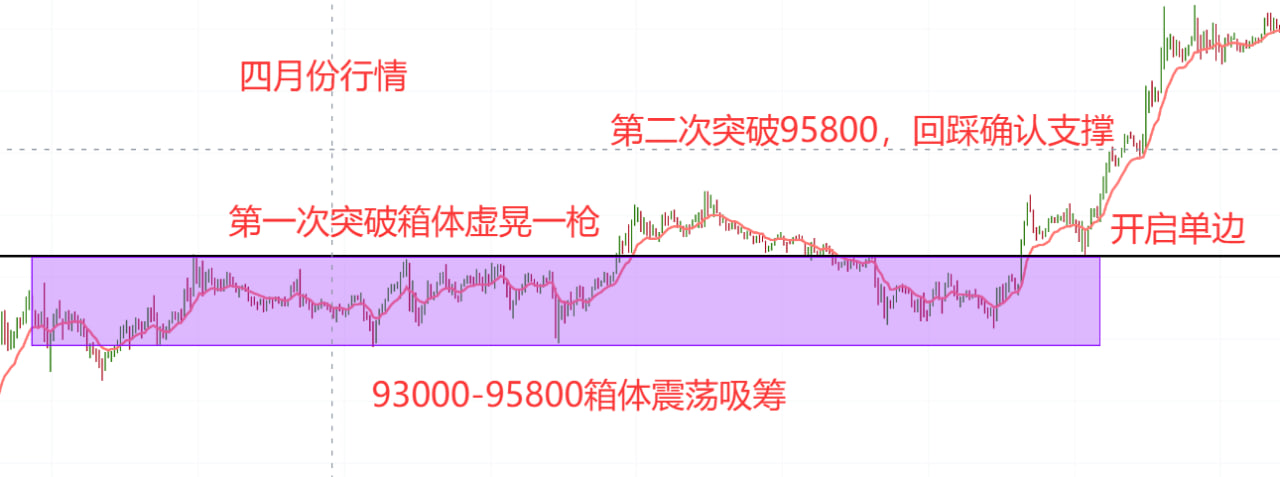

What is this time for? To create an escape time for the profit-taking positions in April. When mentioning 95,800, we must push the timeline to April, as one chart clearly shows.

Do you see it clearly? In April, Bitcoin formed a large cyclical box oscillation between 93,000 and 95,800, then broke the head and shoulders top pattern, completing the second round of accelerated rise and continuously hitting new historical highs. During this startup phase, the market maintained a downward pressure at 95,800, then broke through and confirmed support during the pullback phase. It can be confirmed that this area is the profit-taking position of this round of bull market. Now that the market has returned to 95,800, profit-taking positions will definitely be continuously offloading, but the bottom positions still exist. This is a dense area for the exchange of chips between bulls and bears. Regardless of future rises or falls, 95,800 must give the market ample reaction time to readjust and complete a new round of chip exchange.

OK, now back to the key issue. Identify the market motivation.

Known conditions: 98,000 buy-the-dip long positions are trapped

Current market panic

No short-term long entry opportunities

95,800 profit-taking positions need time to escape

Summarizing these four conditions, if the subsequent market continues to decline into a bear market, will it be necessary to trap the 98,000 buy-the-dip long positions? If the market continues to decline unilaterally in a short time and falls below 93,000, it will trigger a forced liquidation of long positions, ultimately causing a complete market collapse, and the 95,800 profit-taking positions will not have time to escape. Can this consequence be borne?

The way I can think of is for tonight's market to rely on 95,800 to recover and rise, and return above 98,000, extending the recovery period. The benefit of doing this is that although the market returns above 98,000, the buy-the-dip long positions will not exit due to being untrapped; instead, after the recovery at 98,000, it will rise slowly and oscillate, allowing the bulls to see the dawn of successful buying the dip, making them firmly believe that 98,000 was a false break and that the bull market still exists. Then, if it falls below 98,000 again, the buy-the-dip long positions will not panic and may even add positions at 93,000, perfectly achieving the goal of trapping longs. At the same time, a long period of stabilization will create escape conditions for the 95,800 profit-taking positions, while extending the time cycle facilitates the completion of a new round of chip exchange, with long positions handed over to the buy-the-dippers, allowing oneself to establish new short positions.

I've said my piece; who agrees and who disagrees!

Tonight's operations, including next week, will be extremely simple.

In the short term, rely on 95,800 to go long, with a stop loss of 500 points. If stopped out, return to 95,800 for a second long position.

This long position does not have a specific take-profit target; you need to pay attention to two levels: 98,000 and 100,500. It can be confirmed that 98,000 will definitely recover, but it is uncertain whether 100,500 will recover in the short term. Therefore, take profit needs to be adjusted. When the market returns to 98,500, move your stop loss to 98,000. Whenever the market falls below 98,000, that’s when the long position takes profit. If it further recovers and returns to 100,500, repeat the previous operation, and continue to move the stop loss to the 100,000 integer level.

In the long term, do not attempt to catch the top with the second round of cycle short positions. The market needs to recover back to either 98,000 or 100,500. After recovering, wait for a second breach; the phase of the second breach is the signal for entering long-term short positions, with a target of 89,000-88,000, and the ultimate target for the second phase is 74,000.

Follow me to avoid getting lost; I will take you on the fast track. Here, there are no flashy theories, only a soul-searching inquiry into human nature, exploring the market's bull-bear game, and seeking the most authentic market language.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。