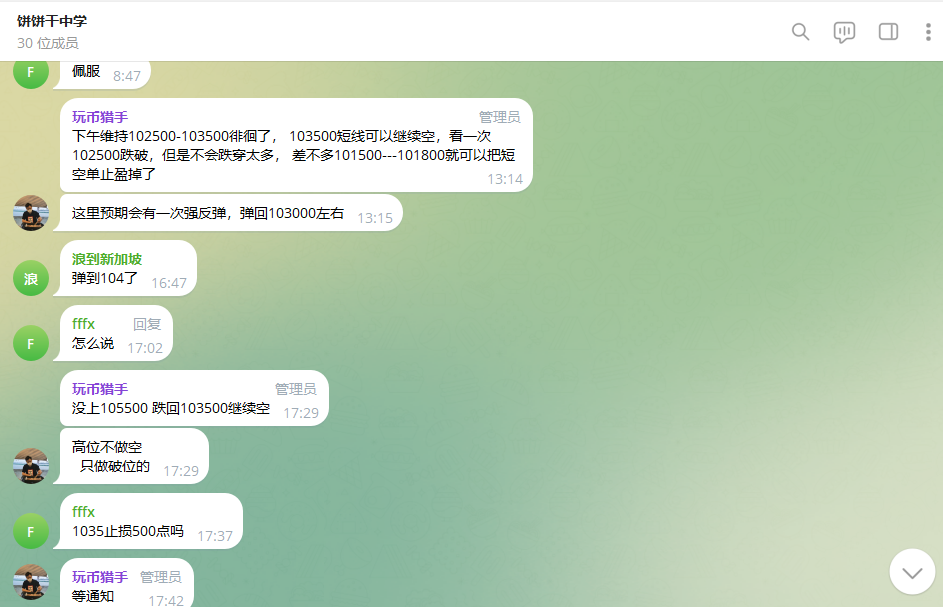

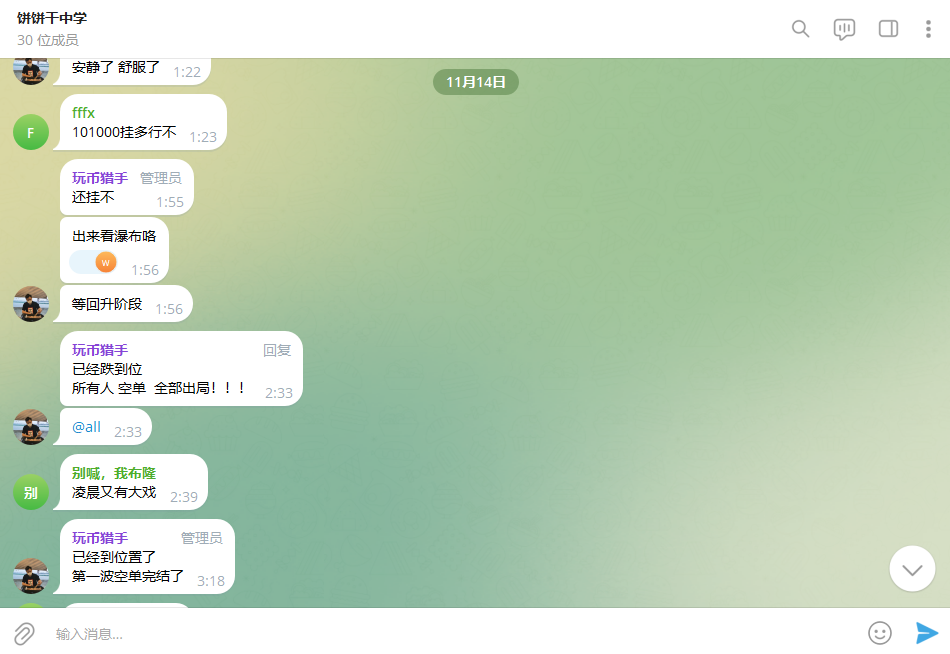

Don't worry about not having friends on the road ahead; there are like-minded people on the investment journey! Good afternoon, everyone! I am the King of Coins from the Coin Victory Group! Thank you, friends, for your attention. Every day, I bring fresh news from the crypto world and accurate market trends. Follow along, and you'll profit—this is no empty talk! Let's start with the results; let the performance speak for itself! Yesterday, the King provided a short entry at 103800, and as soon as it was given, it dropped straight down. In the live trading group, I notified to reduce positions at 101500, and we exited all at 98000. This wave of profit was a full score—how great is that? (Attached is a screenshot from the live trading group.) If you missed out, don't regret it; today's insights are even more solid. Take good notes, and you'll still benefit!

Everyone, did you wake up confused by Bitcoin? It was directly pressed below 100K, scraping down to 98K at four in the morning, like being slapped awake in the middle of the night. What's even more frustrating is—this isn't the bottom yet! Last night, the three major U.S. stock indices collectively plunged, with the Nasdaq dropping 2.29%, and tech stocks were pressed down! Do you think this is the end? Don't be foolish; the decline in U.S. stocks is just warming up! As long as U.S. stocks are on a downward trend, high-risk assets like Bitcoin will undoubtedly be among the first to be thrown out! Those Wall Street folks run the fastest; in the past month or two, ETF funds have been flowing out like a broken faucet—doesn't that seem obvious enough?

The lack of macro data has given the hawks a chance to jump, with the probability of a rate cut in December torn from 90% down to 50%, and market sentiment has been directly crushed! U.S. stocks have risen too much and need to correct, dragging the crypto market down instead of up—this correlation is too intense! Pessimistic sentiment is the most disgusting; the more it falls, the more afraid people get, and the more fear leads to further declines, forming a closed-loop panic chain! Without new funds to support it, the crypto market can't turn around on its own! I mentioned a couple of days ago, don't dream that the U.S. government stopping its operations will save the market; that's just stepping on the brakes on the way down, nothing more, the direction is still downward!

Back to the market, last night Bitcoin briefly broke below 98K, with the maximum pressure above stuck at 102K-102.4K, unable to push higher. The 98K-88.2K range has already opened half a door waiting for you! In this range, the only position that can be called a bottom is 94.2K, which is the golden ratio from the big wave from 74.4K on April 7 to 126.2K in October. Don't think about being a hero at other small points! If we break below 94.2K, only the major support at 88.2K remains. Now, shorting at highs is the long-term main strategy!

Ethereum isn't doing much better, dropping from 3500 all the way down to around 3230, just hanging on. The trend is clearly downward! Recently, the daily charts have been all bearish candles, and the slight rebound in the last few hours has a pitifully short upper shadow—this indicates that the bears are just catching their breath, not disappearing! Today's maximum pressure is at 3330-3380; if it can't go above 3440, the 800-point drop range from 3300-2520 could open up at any time! Within that range, 2880 is a hard point; once it breaks, if it goes below 2800, it will likely head straight for 2112!

The Coin Victory Group has solidified the trend and points, so remember not to guess randomly:

Resistance levels: Second resistance at 103700, first resistance at 100700;

Support levels: First support at 96500, second support at 93500.

The 98K lower shadow area is a key short-term support; if it breaks down further, the space below will continue to open up, so be careful of further declines! This is the upper edge of the range from February 7 to February 21; although it is a temporary low, it is by no means the bottom! If it fails, look down to 95.6K (the lower edge of the same range), and below that is the CME gap at 92K!

Above, 100K-100.7K is strong resistance, with 100.7K being the low point from June 22, and 103.7K being the upper edge of the range from November 7! The psychological barrier of 100K has been lost; for the bulls to come back, the first step is to reclaim 100K!

The daily RSI shows a bullish divergence; if it hasn't been smashed through, there could be a slight rebound, but the selling pressure isn't clean, and the risk of bears cannot be ignored! Before the market stabilizes, don't catch falling knives recklessly! 100K itself is pressure; a rebound to this level can easily lead to an N-shaped drop, and the fact is that the bear advantage is increasing!

While it is possible to aim for a very short-term rebound, don't fantasize about a trend reversal! Maintain a bearish operation; shorting on rebounds is the prudent approach!

11.14 Swing Strategy:

Long: Not recommended for now; don't rush in blindly like a novice;

Short: For the aggressive, short directly at 98500, targeting 95800;

For those seeking stability, wait for the 100700-101500 range to enter, targeting above 98000.

Finally, a heartfelt note: If you want to learn real things in the crypto world, you need to follow the right people for the long term; don't just look at the market a couple of times and make random judgments! The market is full of performers, showing off screenshots and pretending to be experts, all just hindsight! The truly reliable ones have consistent logic that can withstand scrutiny, not just jumping in when the market moves!

Our Coin Victory Group has all exclusive insights; search for "Coin Victory Group" on WeChat to find us! We have real-time strategies, techniques for breaking even, and contract trading methods, along with free experience groups and live broadcasts! If you find it useful, give a thumbs up and follow along; with the King of Coins, you can still profit in a bear market!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。