The U.S. monetary policy, regulatory enforcement, and stablecoin legislation are forming a triple force that redefines the risks and opportunities of crypto assets. The Federal Reserve's interest rate decisions, regulatory actions by agencies, and the legislative process surrounding stablecoins have become the core forces shaping the direction of the crypto market.

Recently, the Federal Reserve's decision to cut interest rates, combined with concerns in the traditional banking sector, has highlighted the profound impact of stablecoins on the traditional financial system. At the same time, the GENIUS Act's specific rule-making has become a regulatory battleground involving the allocation of hundreds of billions of dollars.

1. Three Main Lines: How Policy Transmits to the Market

U.S. economic policy is directly influencing the risks and opportunities in the crypto market through three core channels.

Monetary Policy: The Total Gate of Liquidity

● The Federal Reserve's interest rate policy and balance sheet management directly determine the liquidity environment of the crypto market. On October 30, 2025, the Federal Reserve implemented its second interest rate cut of the year, lowering the target range for the federal funds rate to 3.75%-4.00%.

● At the same time, the Federal Reserve clearly stated that it would stop reducing the balance sheet starting December 1, ending the quantitative tightening policy.

● Interest rate cuts should boost risk assets, but the cryptocurrency market experienced a massive sell-off in October, with a total market value dropping more than 9% in a single day, evaporating about $400 billion at one point.

This unusual phenomenon reveals the characteristic of the crypto market as a "marginal risk asset": when interest rate cuts stem from economic concerns rather than healthy growth, market skepticism about easing policies can suppress their positive effects.

Regulatory Enforcement: Restructuring Compliance Boundaries

● Changes in regulatory direction have an immediate effect on industry confidence and compliance costs. In 2025, the U.S. Securities and Exchange Commission (SEC) underwent a significant shift in its approach to regulating cryptocurrencies.

● The SEC not only approved the physical purchase and redemption of crypto assets but also withdrew several past enforcement actions against cryptocurrency exchanges. Regulatory events continue to be important catalysts for market price fluctuations.

For example, a sudden tightening of regulations in October 2025 caused LINK to plummet from $22.66 to $7.63 within 24 hours, a nearly 66% drop in a single day.

Stablecoin Governance: The Core Battleground of the Game

● Stablecoin governance has become the center of policy discussions, with relevant legislation from Congress and the Treasury aimed at bringing stablecoins under stricter anti-money laundering and payment regulatory frameworks.

● The GENIUS Act was signed into law on July 18, 2025, establishing a system for "licensed payment stablecoin issuers" and setting a three-year phased implementation timeline. This act will determine whether the current $250 billion in stablecoin funds flows into bank-wrapped structures or splits into offshore islands.

2. GENIUS Act: The Battle for Stablecoin Rule-Making

Although the GENIUS Act has been signed into law, the real battle has just begun—this is a competition over the formulation of specific rules.

Key Controversy: The Dispute Over Interest Payment Rights

Currently, the Treasury and the industry are at odds over key provisions.

● The GENIUS Act prohibits stablecoin issuers from directly paying interest, but does not explicitly regulate interest payments by non-issuers (such as cryptocurrency exchanges).

Coinbase emphasized in a letter to the Treasury that "Congress refused to include non-issuer third parties in this ban," pointing out that the Treasury has no authority to question Congress's work.

● Meanwhile, the banking group, led by the Bank Policy Institute, urges the Treasury to expand the ban to non-issuers, advocating for a complete prohibition on stablecoin interest payments.

The banking alliance believes that stablecoin interest payments could trigger a $6.6 trillion outflow of deposits from the traditional banking system.

This controversy will determine whether stablecoins become neutered banking products or can compete with banks on interest rates.

Implementation Timeline: The Countdown Has Started

The GENIUS Act sets a clear timeline, requiring industry participants to complete compliance adjustments before the deadline.

The table below outlines key milestones:

● The three-year grace period will end on July 18, 2028, after which U.S. exchanges, custodians, and most DeFi frontends will not be allowed to offer "payment stablecoins" unless issued by licensed payment stablecoin issuers.

This means that by mid-2028, all institutions dealing with U.S. customers must either comply or exit the market.

Winners and Losers: Market Restructuring Imminent

The implementation of the GENIUS Act will reshape the stablecoin market landscape, creating clear winners and losers.

● Large U.S. banks and quasi-bank stablecoin issuers emerge as clear winners. The GENIUS Act provides the first clear federal path for regulated entities to issue dollar tokens.

● Circle, Paxos, and PayPal are accelerating their efforts to obtain licensed issuer status, and major banks are expected to launch tokenized deposits.

● On the other hand, offshore issuers will lose their U.S. distribution channels. After mid-2028, U.S. platforms will not be able to offer any "payment stablecoins" issued by non-licensed issuers.

● Tether and similar entities can serve non-U.S. customers but will lose seamless integration with major U.S. platforms like Coinbase and Kraken.

3. Market Impact: Liquidity, Sentiment, and Structural Changes

Policy changes have triggered a chain reaction in the market, affecting liquidity patterns, investor sentiment, and capital flows.

Liquidity Contraction and Market Response

● The U.S. government shutdown led to an unexpected contraction in liquidity. The U.S. Treasury General Account (TGA) faced a "cash in, no cash out" situation due to the government shutdown, with its balance swelling from about $800 billion to over $1 trillion, equivalent to pulling about $200 billion in liquidity from the market, exacerbating funding pressures in the banking system.

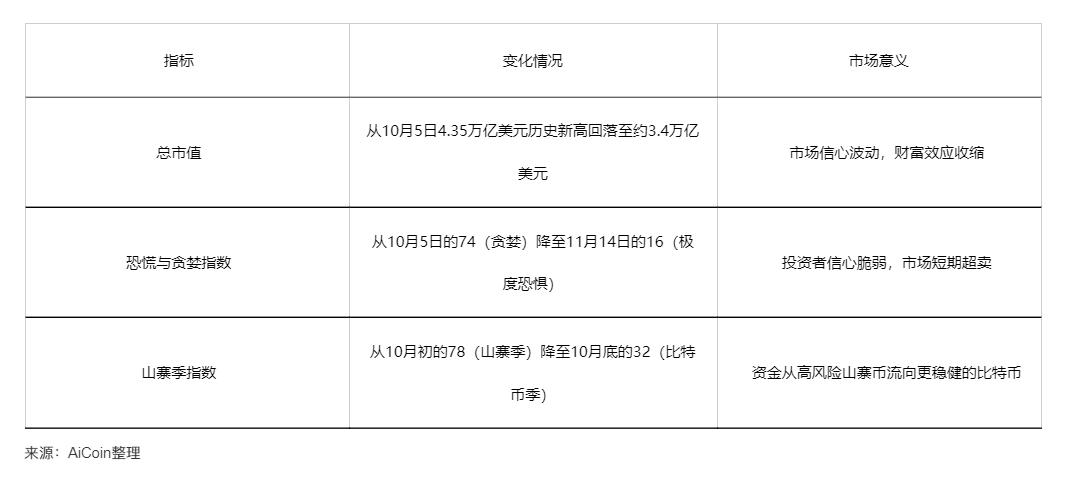

This change is clearly reflected in the sentiment indicators of the crypto market:

Federal Reserve's View: Stablecoin Use and Interest Rate Policy

● Federal Reserve Governor Stephen Milan, in his first speech on stablecoins and cryptocurrencies, stated that the increased use of stablecoins in the economy will lead to lower interest rates.

● This statement directly acknowledges the inherent connection between stablecoin use and monetary policy, providing a new perspective for future policy-making.

4. Industry Outlook: Short-Term Volatility and Long-Term Restructuring

The crypto market, driven by policy, is undergoing a dual process of short-term turbulence and long-term restructuring.

Short-Term Volatility Remains Inevitable

● In the short term, regulatory uncertainty and the pace of enforcement will continue to be catalysts for price volatility.

● The market is highly sensitive to regulatory news, and any sudden regulatory announcements could trigger significant market fluctuations, as demonstrated by LINK's nearly 66% drop in a single day in October 2025.

Medium to Long-Term Restructuring

● In the medium term, the clarification of stablecoin rules and compliance frameworks will attract more institutional capital, but it will also eliminate some business models that cannot comply. In the long term, if the U.S. establishes a relatively stable and predictable framework for regulation and monetary policy, the maturity of the crypto market and its interoperability with traditional finance will significantly improve.

● The implementation of the GENIUS Act will encourage more "crypto dollars" to achieve full reserves, be regulated, undergo KYC, and be held on and off bank balance sheets. On-chain settlement will no longer resemble a pirate market but will look more like a Fedwire with APIs.

Three Stages of Capital Flow Restructuring

The reshaping of capital flows will go through three distinct stages:

● Layout Period (Now to Mid-2026): Issuers and banks will lobby on qualified reserves, foreign equivalence, affiliate income, and definitions.

● Regulatory Screening Period (2026 to 2027): Final rules will be published, compliant large institutions will receive early approvals, and U.S. platforms will shift trading volume to "soon-to-be-licensed" tokens.

● Path Solidification Period (2027 to 2028): U.S.-facing exchanges, brokers, and most DeFi frontends will primarily list licensed stablecoins.

5. Investment and Practical Recommendations

In a policy-driven market environment, investors and practitioners need to adjust their strategies to cope with the new landscape.

● Closely monitor macro monetary policy signals and the regulatory legislative process as a top priority. The Federal Reserve's interest rate decision path and the Treasury's rule-making should be included in daily monitoring frameworks.

● Assess the transparency of projects or exchanges regarding compliance and asset-liability management. After the implementation of the GENIUS Act, compliance capability will become a key threshold for project survival.

● Incorporate stablecoin risks into daily due diligence, including reserve asset composition, redemption mechanisms, compliance processes, and other factors.

● In the face of policy changes, information advantage and compliance capability often determine long-term success more than short-term speculation.

The outcome of the stablecoin regulatory game will determine whether the future crypto market follows a bank-dominated traditional path or retains its existing innovative and open characteristics.

Regulatory agencies can execute the GENIUS Act as written or distort it into bank protectionism, stifling all unlicensed federal businesses.

For investors and practitioners, embracing innovation while prioritizing compliance governance and macro risk management is essential to maintain resilience and growth amid policy changes.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。