Written by: Glendon, Techub News

Today, the cryptocurrency market has once again encountered a widespread decline. Bitcoin has once again fallen below the critical psychological level of $100,000, dipping to a low of $96,712.12, marking a new low since May 7. Ethereum has dropped below $3,200, with a daily decline of nearly 9%; SOL has also fallen below $140, with a similar decline exceeding 9%.

According to Coinglass data, as of the time of writing, the total liquidation amount across the network in the past 12 hours has reached $660 million, with long positions liquidated amounting to approximately $591 million and short positions liquidated around $68.54 million. Bitcoin and Ethereum have become the "disaster zones" for liquidations, with the total amount of long position liquidations exceeding $420 million.

It is important to note that the downward trend in the cryptocurrency market is highly correlated with the U.S. stock market. At the close of today’s trading, all three major indices in the U.S. stock market fell collectively, with the Dow Jones down 1.65%, the S&P 500 down 1.66%, and the Nasdaq dropping over 2%, reflecting a weak performance in tech stocks. The core factor behind the decline in the U.S. stock market is the rising concern over the Federal Reserve's policies.

Although U.S. President Trump signed a temporary funding bill yesterday, officially ending the longest government "shutdown" in U.S. history, this "shutdown" has severely disrupted the release of key economic data, leading to a continued weak market sentiment. Meanwhile, several Federal Reserve officials have expressed a cautious attitude towards further interest rate cuts, which has also led to a rapid cooling of market expectations for loose monetary policy.

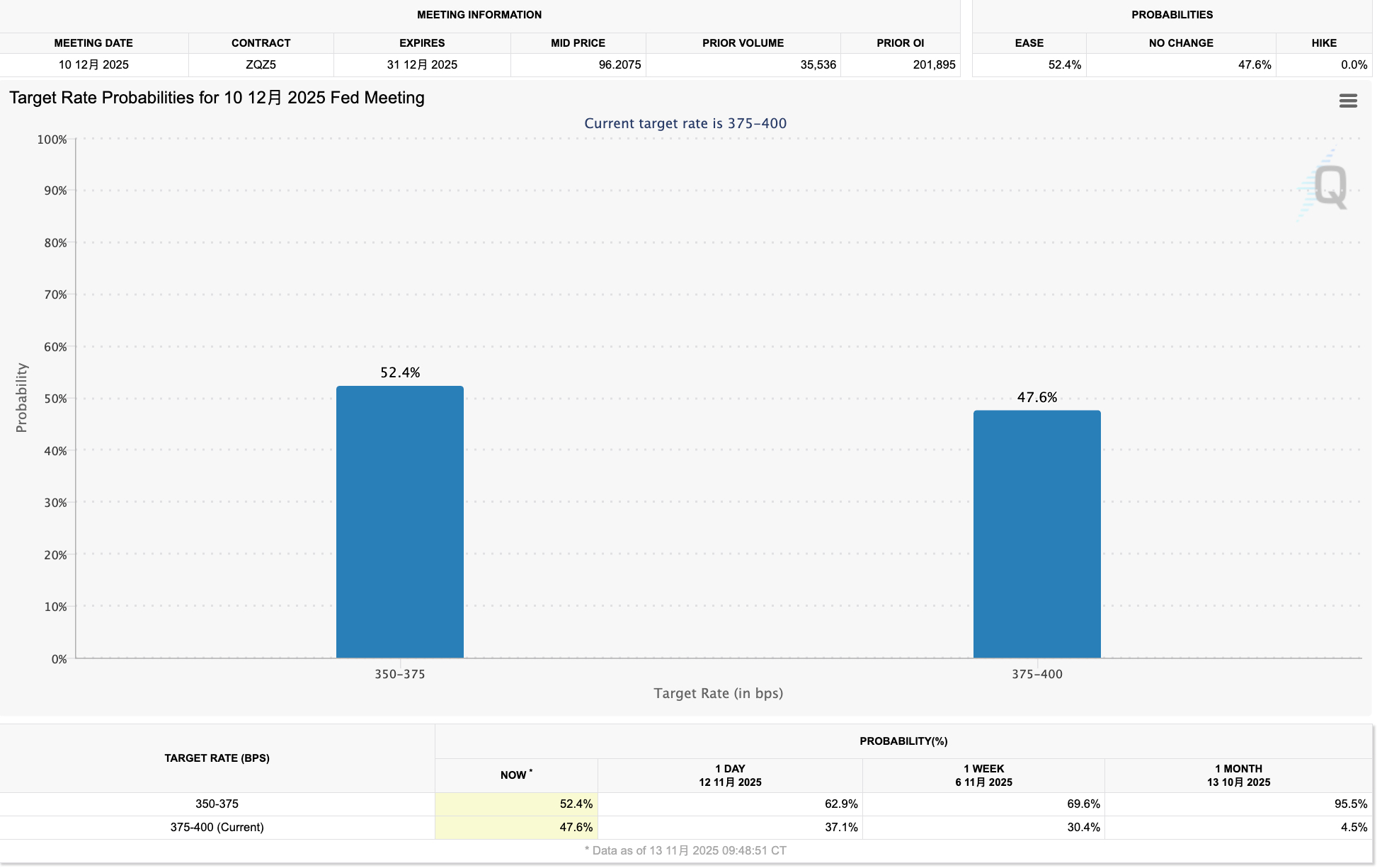

From the changes in CME's "FedWatch" data, it is clear to see the market's shift in expectations regarding interest rate cuts by the Federal Reserve. Currently, the probability of a 25 basis point rate cut in December is only 52.4%, down from nearly 70% a week ago and as high as 95.5% a month ago. Nomura Securities even asserts that the Federal Reserve will pause rate cuts in December.

In the current context where the cryptocurrency market is deeply tied to macro factors, the liquidity in the U.S. Treasury is tending towards "drying up," increasing the likelihood that expectations for rate cuts will not materialize, making market fluctuations inevitable.

Structural Pressure Under Macroeconomic Clouds

More critically, since the "10.11" flash crash event, the cryptocurrency market has shown a trend of oscillating declines. Moreover, various data and indicators suggest that the cryptocurrency market is under significant structural pressure.

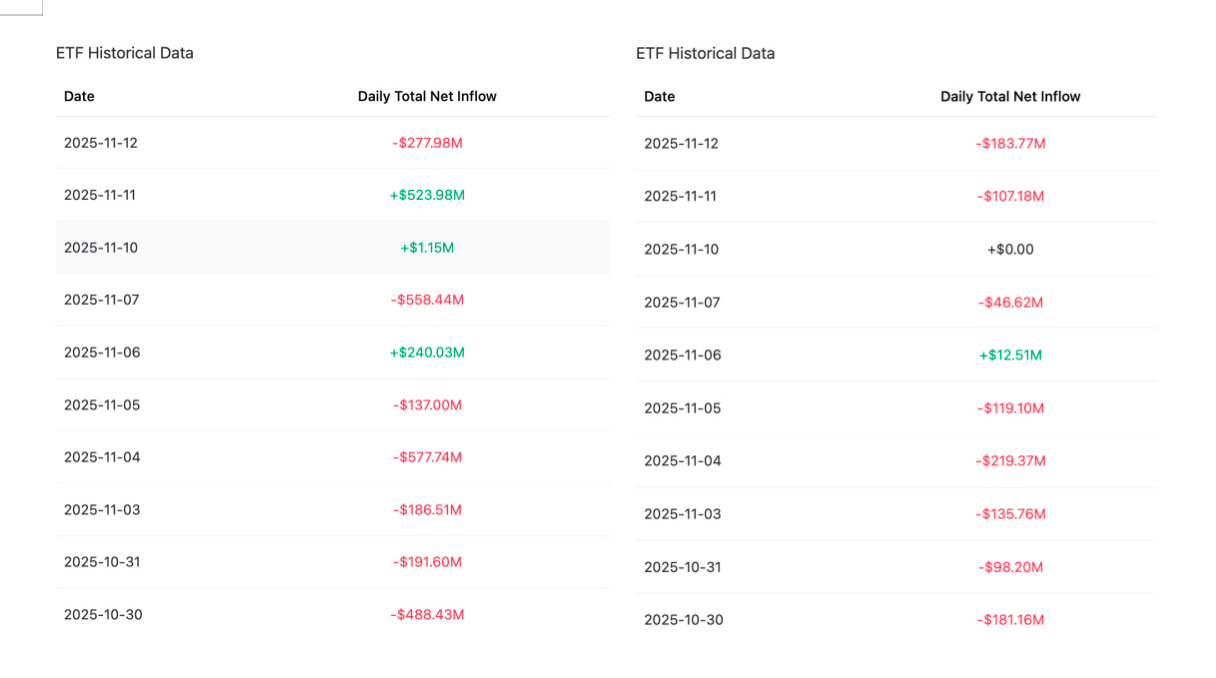

The most direct data is the ETF fund flows, with severe outflows from Bitcoin and Ethereum. According to ichaingo data, last week, the U.S. Bitcoin spot ETF saw a cumulative net outflow of approximately $1.22 billion, marking two consecutive weeks of net outflows, while the Ethereum spot ETF also experienced a net outflow of as much as $508 million. Yesterday, the net outflow from the Bitcoin spot ETF reached a staggering $870 million, setting a record for the second-highest outflow in history. From the chart below, it is evident that since the beginning of this month, Bitcoin and Ethereum ETFs have shown a very clear trend of "more out than in."

CoinShares' latest weekly report data also corroborates this point. Last week, digital asset investment products saw a net outflow of $1.17 billion, marking the second consecutive week of capital outflow. Among them, Bitcoin investment products had a net outflow of $932 million, while Ethereum investment products saw a net outflow of $438 million. Notably, as the "eye of the storm" in this capital outflow, the U.S. market experienced a net outflow of $1.22 billion.

In addition to ETF fund outflows, long-term Bitcoin holders are cashing out. CryptoQuant tweeted that long-term Bitcoin holders are selling off in large quantities. In the past 30 days, approximately 815,000 Bitcoins have been sold, the highest level since January 2024.

Glassnode also analyzed that by observing the monthly average spending of long-term holders, a clear trend can be seen: the outflow amount has risen from about 125,000 Bitcoins per day in early July to the current 265,000 Bitcoins per day (30-day average). This steadily increasing trend reflects that the selling pressure from long-term investors is continuously rising.

Although this phenomenon has not yet evolved into panic selling, it undoubtedly further exacerbates the downward pressure on the market.

Meanwhile, other sectors of the cryptocurrency market (such as DeFi, NFT, and RWA) are also unable to remain unscathed. The total value locked (TVL) in DeFi has dropped from a recent peak of $172.116 billion to $129.275 billion. In the past 30 days, none of the top ten DeFi protocols have escaped the decline, with Ethena experiencing a drop of over 30%.

The NFT market is also deeply mired in a general downturn. CryptoSlam data shows that NFT sales amount to approximately $399 million, with a decline of over 60%; the number of NFT transactions is about 6.19 million, with a decline of 55%. Additionally, Glassnode pointed out that the current funding rates in the futures market are sluggish, and the open interest is at a low level, indicating that speculative activities in Bitcoin and altcoins are relatively weak, and the market lacks sufficient vitality and enthusiasm.

So, does this mean that the cryptocurrency market has officially entered a bear market?

It is too early to declare a "bear market"

Analyzing various data indicators and multiple factors, the cryptocurrency market indeed shows characteristics of a bear market. The market trend continues to decline, with Bitcoin's key support level (around $100,000) having been breached multiple times, key indicators deteriorating, short-term moving averages trending downward, and technical patterns entering the "confirm bear market" stage. Moreover, with the 50-week moving average trend officially breaking down, $100,000 may turn into a new resistance level for upward movement.

Furthermore, the trend of institutional capital withdrawing in the short term is evident, further intensifying market panic. Today, the cryptocurrency fear and greed index stands at 16, indicating an "extreme fear" state. Since the beginning of this month, market sentiment has consistently remained in a "panic" state, with most of the time spent in the "extreme fear" range.

However, while the market is likely to enter a state of deep consolidation in the short term, it cannot be completely confirmed that the bull market has completely reversed.

Moreover, the market is not entirely pessimistic; there are still many optimistic voices. Analyst Ignas believes that Bitcoin is transitioning from a small number of ultra-low-cost holders to a more diversified group of holders with higher cost bases, which is actually a positive bullish signal in the long run.

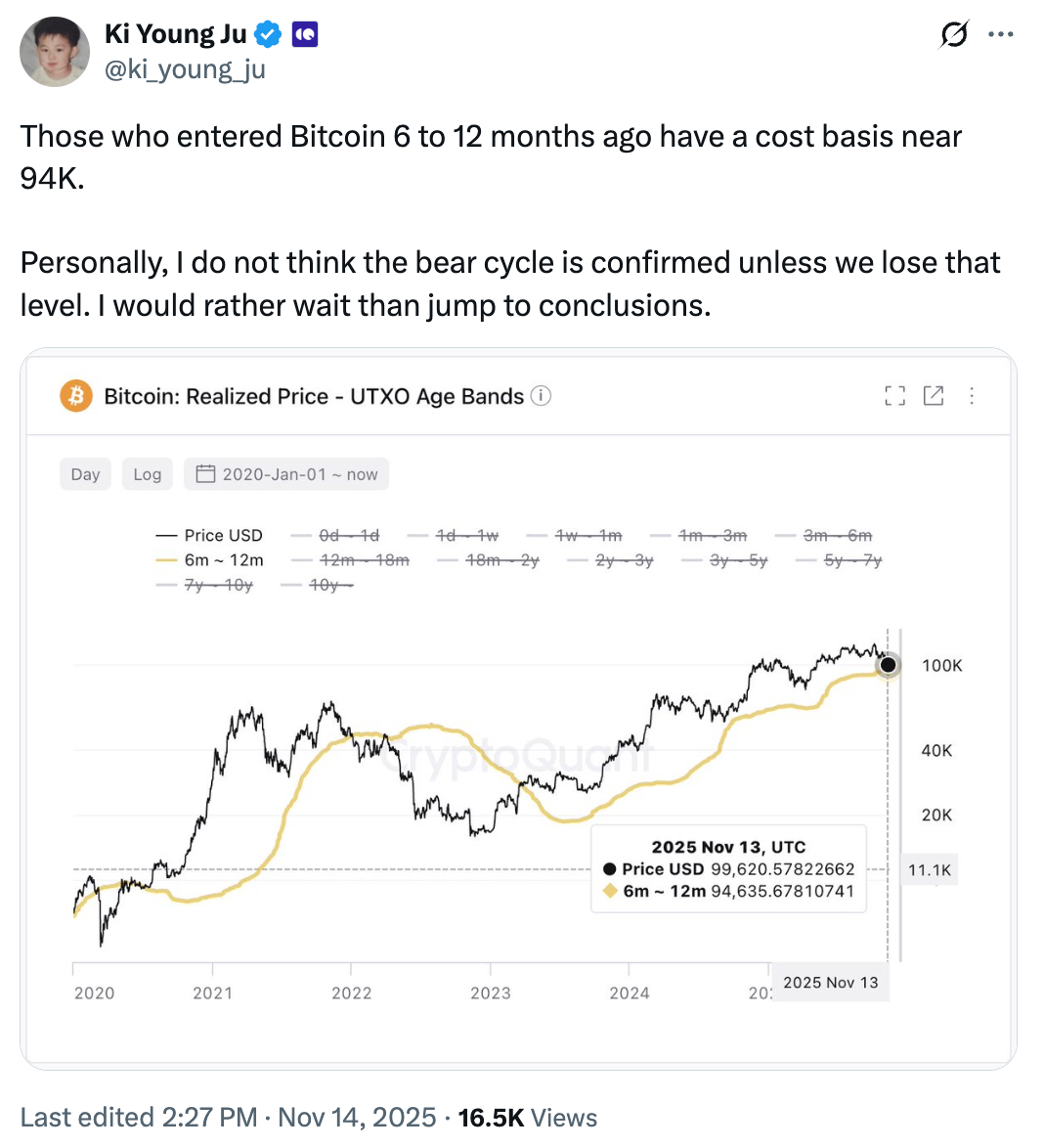

CryptoQuant founder and CEO Ki Young Ju tweeted that Bitcoin investors who entered the market in the past 6 to 12 months have an average cost of around $94,000. He pointed out that only when the price falls below this cost range can the bear market cycle be confirmed, and it is currently premature to draw conclusions.

From a macro perspective, the medium to long-term trend of the cryptocurrency market has solid support.

On one hand, the U.S. government has just ended the awkward situation of a government "shutdown," and a series of fiscal stimulus policies are likely to be introduced subsequently. Given the similarity in trends between the cryptocurrency market and the U.S. stock market, its future direction is expected to heavily depend on upcoming inflation data and signals from the Federal Reserve.

On the other hand, in terms of regulation in the cryptocurrency field, a clearer regulatory stance is emerging. SEC Chairman Paul Atkins has announced the "Token Classification Act" plan, further refining specific implementation rules and token classification frameworks based on an already friendly regulatory direction, providing clearer guidance for the regulated development of the cryptocurrency market.

Additionally, Coinbase CEO Brian Armstrong revealed in October that the cryptocurrency market structure bill is "90% finalized" and is expected to pass before the end of the year. Cryptocurrency journalist Eleanor Terrett also cited sources reporting that the U.S. Senate Agriculture Committee is about to release its bipartisan joint draft, which involves commodity-related content in the cryptocurrency market structure bill. These positive developments at the policy level undoubtedly inject strong momentum into the long-term development of the cryptocurrency market.

If relevant policies are successfully implemented, the liquidity situation of the U.S. dollar will improve, which will restore market confidence and attract institutional capital back into ETFs, DATs, and other related markets, bringing incremental funds to the market. Meanwhile, the market structure will gradually be repaired, and after the forced liquidation pressure in the current high-leverage environment eases, the selling pressure in the market will lighten, and prices are expected to stabilize and rebound as a result. If Bitcoin can form strong support in the $90,000 - $100,000 range, technical buying may further push prices up.

Overall, while the cryptocurrency market may continue to experience deep consolidation in the short term, from a medium to long-term perspective, the emergence of macro-level policy catalysts and improvements in liquidity will become key variables in reversing market trends, bringing new opportunities to the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。