Original Author: 1912212.eth, Foresight News

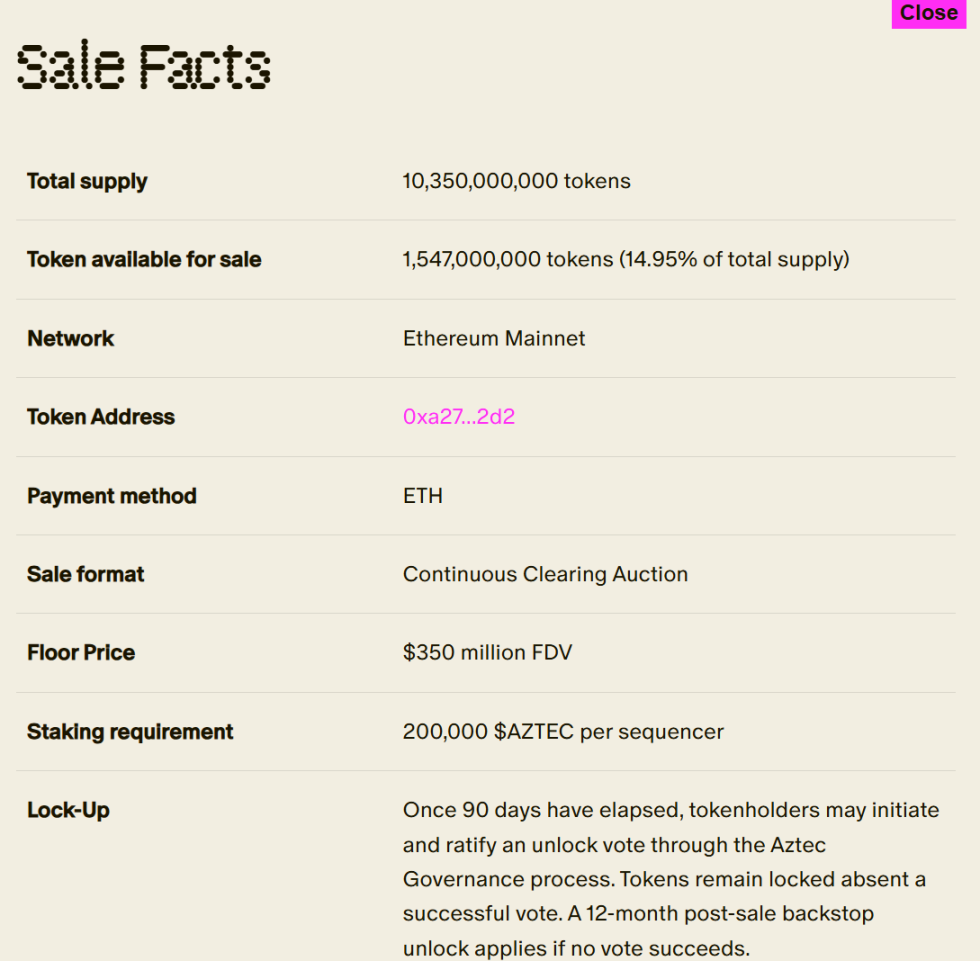

On November 13, the zero-knowledge privacy technology project Aztec announced the launch of the AZTEC token sale, with a total of 1.547 billion tokens available, accounting for 14.95% of the total supply, and the payment token being ETH. Regarding the sales mechanism, the project stated that it would prioritize real-time price discovery and fair participation opportunities. The starting price is set at a $350 million FDV, which is approximately 75% lower than the implied network valuation based on the latest equity financing. Participants can mint soul-bound NFTs to confirm their participation status.

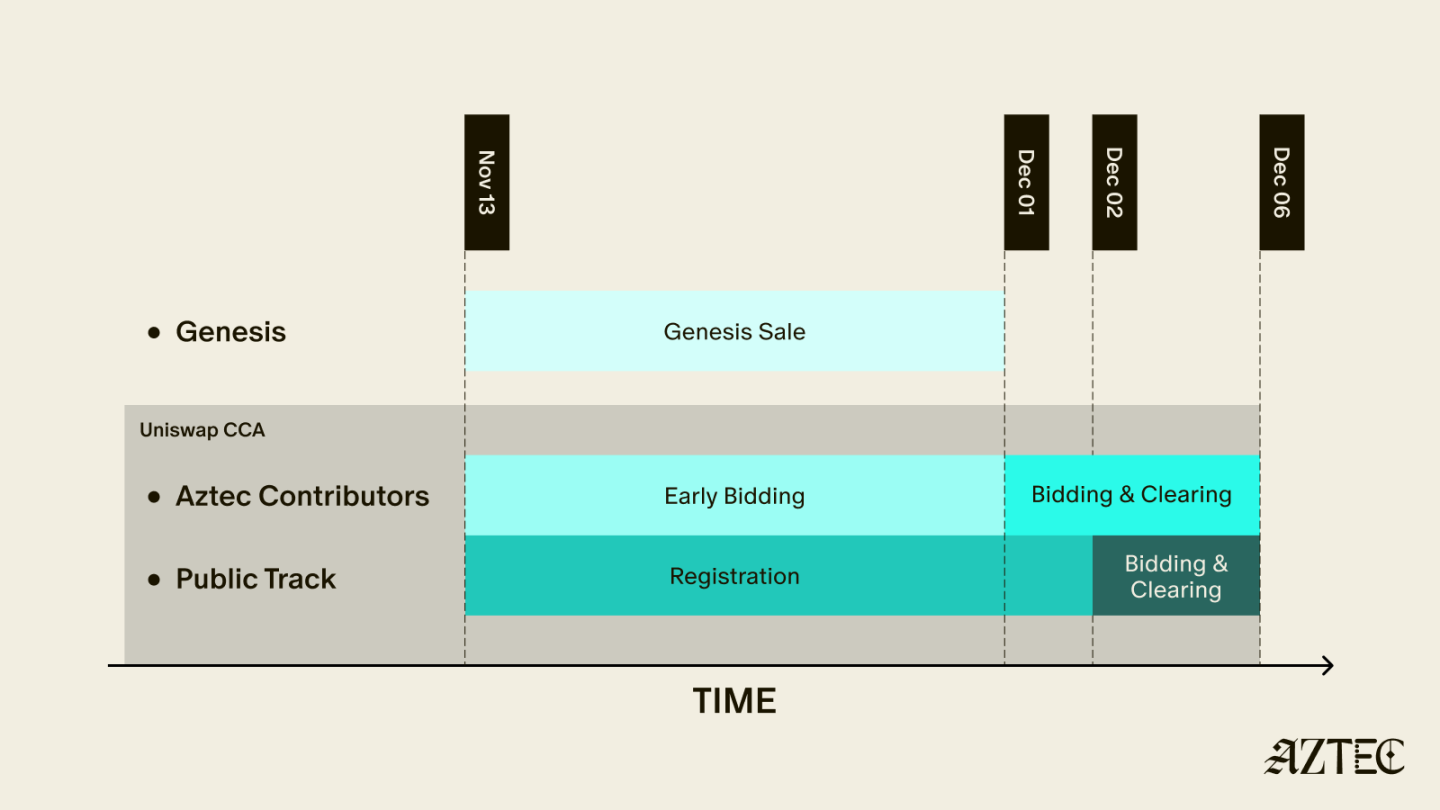

Registration and bidding for early participants will begin today (November 13) at 3 PM (CET), with early participants enjoying a one-day exclusive early access period before bidding opens to the public. On December 1, AZTEC will be distributed to contributors and genesis bidders, and on December 2, all NFT holders will be able to participate in the auction bidding.

The public auction will take place from December 2 to December 6, 2025, at which point the tokens can be withdrawn and staked.

This sale does not include an airdrop phase and does not set up a special allocation mechanism. Over 300,000 addresses have been whitelisted, and these addresses will qualify for bidding on the first day. The sale is open to global users, including U.S. citizens.

Contributor Qualification Certification Rules

Participants must have engaged in one or more of the following:

- Sorters and provers on the Aztec testnet

- ETH solo stakers, including selected StakeCat ETH operators, Obol Silver, Rocketpool, LidoCSM, and Stakers Union.

- zk.money users

- Active community members

- Uniswap traders (3000 randomly selected from active traders in the past 30 days).

- Nansen's Ice, North, and Star tiers.

Additionally, the top 200 high-quality node operators who performed well on the Aztec testnet are also eligible to participate as genesis sorter nodes.

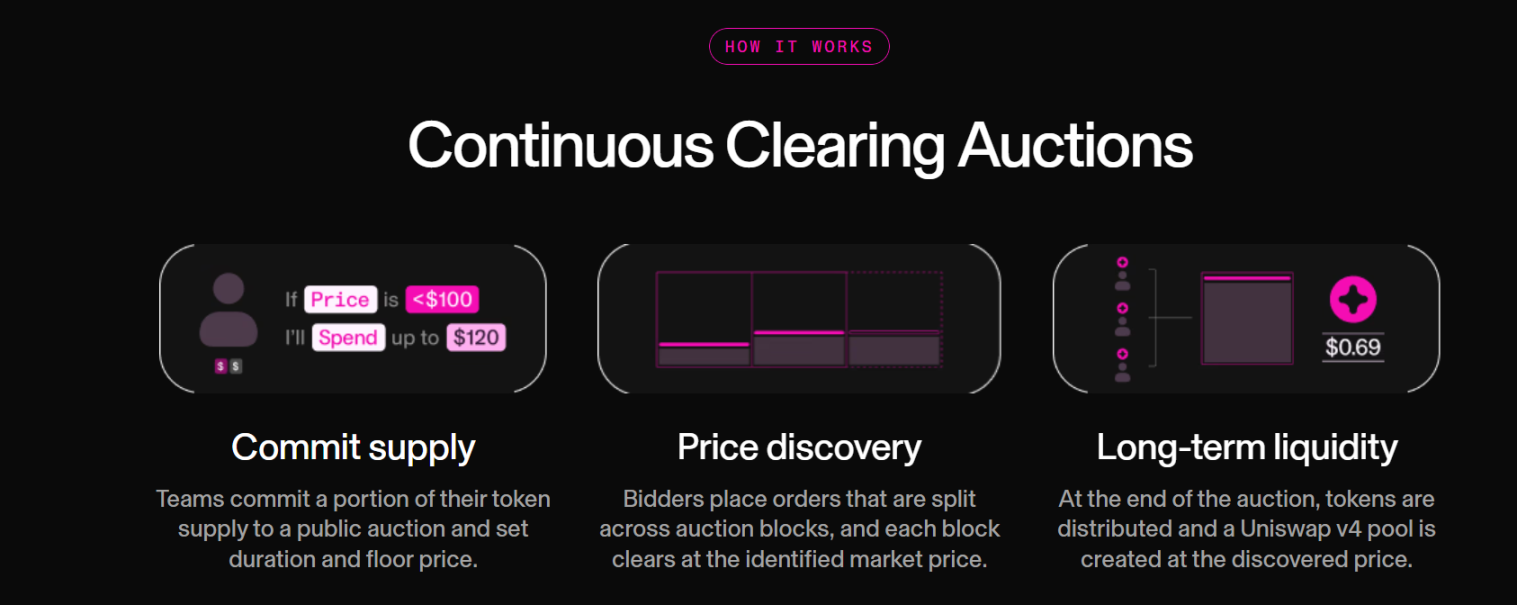

Auction Method: Continuous Clearing Auction Protocol

Uniswap has announced the launch of the "Continuous Clearing Auction Protocol (CCA)," a customizable protocol for launching liquidity and issuing tokens on Uniswap v4. This protocol was designed in collaboration with Aztec, which provides a ZK Passport module for private and verifiable participation.

The team has committed a portion of the token supply to the public auction and has set a duration and reserve price. Price discovery bidders place orders, which are split in the auction block, with each split order settled at the determined market price.

At the end of the long-term liquidity auction, the tokens will be distributed, and a Uniswap V4 liquidity pool will be created at the discovered price.

Token Economics

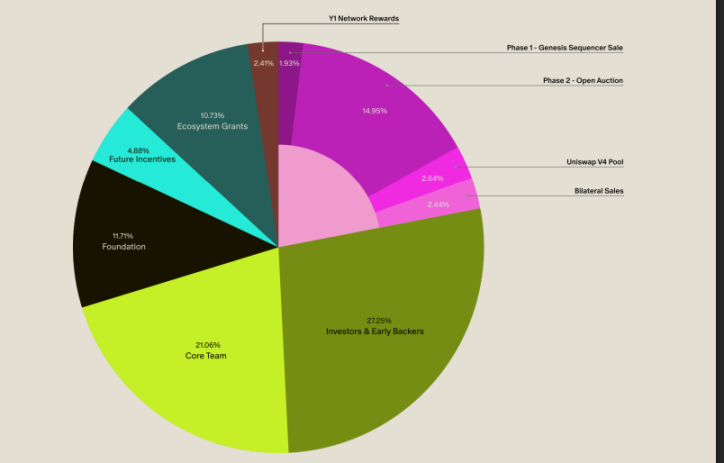

The Aztec white paper shows that the total genesis supply of AZTEC is 10,350,000,000 tokens, allocated as follows: 27.26% to investors and early supporters, 21.06% to the core team, 11.71% to the foundation, 10.73% to ecosystem grants, 14.95% to Phase 2 public auction, 1.93% to Phase 1 genesis sorter sale, 2.44% to bilateral sales, 2.64% to Uniswap V4 liquidity pool, 4.89% to future incentives, and 2.41% to Y1 Network Rewards.

The total token sale accounts for 21.96%, corresponding to 2,272,500,000 tokens. This portion of tokens will be owned by token holders and the foundation at launch.

Token functions include:

- Sorter staking: Tokens will be used to secure the network through staking by Aztec validators (i.e., "sorters"), who are responsible for generating blocks on the Aztec network. Token holders who do not operate sorters can choose to delegate their tokens to sorters.

- Governance: Token holders can participate in the governance of the Aztec network ("Aztec Governance").

- Execution environment: If the network is upgraded in the future through Aztec governance to support a smart contract execution environment, tokens will be used to pay transaction fees on the Aztec network.

Twelve months after the start date of the token sale (November 13, 2025):

- Aztec governance can adjust the total token supply, including annual issuance up to a capped percentage;

- If the execution environment is enabled, transaction fees may be adjusted through a self-regulating mechanism similar to Ethereum's EIP-1559.

After the token sale is completed, the Uniswap v4 liquidity pool may provide secondary market liquidity, and the foundation plans to inject 273 million tokens into this pool. The token sale contract will automatically inject corresponding tokens into the liquidity pool based on the proportion of ETH paid by the purchasers. The liquidity pool will be controlled by Aztec governance and will be locked in an immutable smart contract for at least 90 days after launch, after which restrictions can be lifted through governance voting. Additionally, tokens may be listed for trading on other decentralized trading protocols or centralized exchanges.

Seven Years of Waiting

Aztec completed a $2.1 million seed round of financing at the end of 2018, followed by another round of financing in September 2019, and then launched the mainnet of the Aztec Network in January 2020. Amid the boom of ZK zero-knowledge and L2, in December 2021, it completed a $17 million Series A financing led by Paradigm, with participation from prominent figures and institutions including Vitalik, and then in December 2022, it completed a $100 million Series B financing led by a16z.

However, the luxurious venture capital lineup did not bring growth to the protocol.

In March 2023, Aztec Network announced the gradual shutdown of the DeFi privacy bridge project Aztec Connect, which will disable the ability to deposit funds into the Aztec Connect contract from zk.money and other front ends (such as zkpay.finance), and completely abandon the Aztec Connect contract one year later, with all Rollup functions ceasing. The person in charge responded that this decision was mainly based on business considerations.

In May 2025, it launched a public testnet, which once attracted many airdrop players, but the announced token economics show that Aztec has no airdrop allocation.

BTC has fallen below $100,000, and the market shows signs of turning bearish. It remains uncertain how many players will be willing to pay for it; perhaps the true test for Aztec is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。