Economic resilience exceeds expectations, inflation remains stubborn, and an intense debate over the interest rate path is unfolding within the Federal Reserve. "A lot of field research evidence and data show me that the inherent resilience of economic activity has exceeded my expectations," said Minneapolis Fed President Neel Kashkari in an interview on November 13.

This Fed official, who previously predicted two rate cuts in 2025, now admits he has "not yet made up his mind" about the best course of action for the December policy meeting.

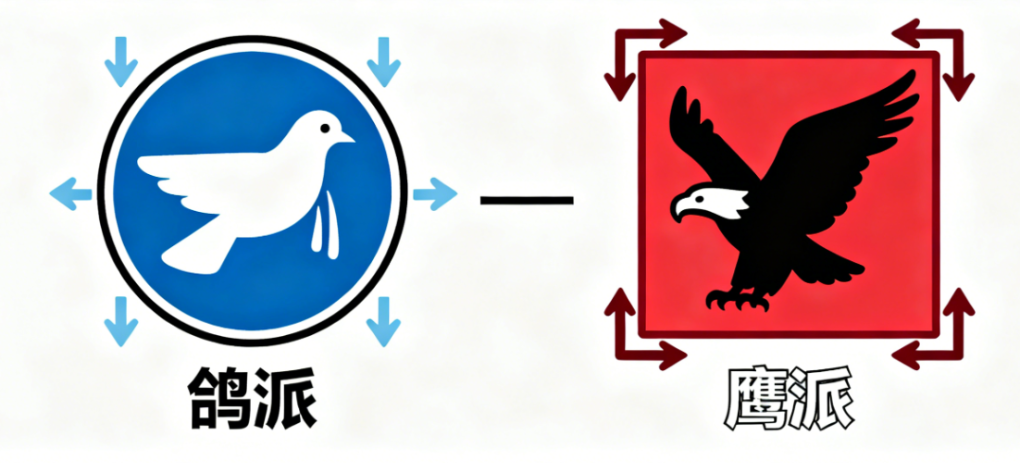

Kashkari is not alone. As Cleveland Fed President Loretta Mester emphasizes that rates are "not restrictive enough," and Boston Fed President Susan Collins clearly opposes further rate cuts, the hawkish camp within the Fed is continuing to expand.

1. Intensifying Divisions within the FOMC

● The Federal Open Market Committee (FOMC) is facing the most significant divisions in years, a rift that was evident in the October rate decision. The October Fed meeting concluded with a 25 basis point rate cut, but there were two dissenting votes: one member advocated for a 50 basis point cut, while another opposed any cut.

● This "polarized opposition" is a first in this rate-cutting cycle, highlighting profound disagreements among Fed leaders regarding the direction of monetary policy.

● Fed Chair Jerome Powell also had to acknowledge that there are clear divisions among committee members on how to act in December, and that another rate cut in December is "far from a done deal."

2. The Hawkish Camp Continues to Expand

Recently, several Fed officials have expressed clear reservations about further rate cuts, significantly amplifying the voice of the hawkish camp.

Kashkari: Economic Resilience Exceeds Expectations

● Kashkari stated that he does not support the Fed's last rate cut decision and is taking a wait-and-see approach for the December meeting. "Based on the data trends, I can make a case for a rate cut or a case for holding steady; it all remains to be seen." Kashkari said on November 13.

As an official without voting rights on interest rate decisions this year, Kashkari still participates in FOMC policy discussions, and his shift in stance has drawn widespread market attention.

Mester: Rates Not Restrictive Enough

● Cleveland Fed President Mester's position is more pronounced; she directly pointed out that current rates "are only somewhat restrictive, even if they are restrictive." "Overall, we need to maintain a certain level of restrictive policy to continue applying pressure to bring inflation back to target levels." Mester stated at an event in the Pittsburgh Economic Club.

She expects inflationary pressures to persist through the end of this year and into early next year, emphasizing that businesses are seeking ways to pass on rising costs to consumers.

Collins: Raising the Bar for Rate Cuts

● Boston Fed President Collins explicitly stated on Wednesday that rates should be maintained at current levels for "some time." She noted that the "bar for further easing is relatively high," and unless there is evidence of significant deterioration in the labor market, she would be hesitant to support further easing.

3. Historical Decisions on Rate Cuts and Balance Sheet Reduction

Looking back at the Fed's recent monetary policy trajectory, it is clear that current divisions have long been in the making:

● In October, the Fed announced it would end balance sheet reduction on December 1, marking the conclusion of a three-and-a-half-year process of quantitative tightening. According to the decision, starting in December, the Fed will reinvest the proceeds from maturing agency mortgage-backed securities (MBS) into short-term U.S. Treasury securities.

● Powell explained that the current level of reserves is slightly above the "ample reserves" standard, and the recent upward pressure on rates in the money market further supports this decision.

4. Two Scenarios for the December Meeting

In light of the increasingly apparent internal divisions, what scenarios might unfold at the December FOMC meeting?

● The outcome of the December meeting seems to be leaning towards "two options": either maintain rates as they are or, while cutting rates, set a higher bar for future easing through policy guidance. Regardless of the final decision, Powell may face more dissenting votes than in the October meeting.

● Evercore ISI Vice Chairman Krishna Guha noted in an analysis that if the Fed decides to cut rates, Kansas City Fed President Esther George may receive support from Collins and Mester.

● If the Fed decides to hold steady, then the previously more aggressive rate cutter, Governor Michelle Bowman, may join fellow dovish Governor Christopher Waller in casting dissenting votes.

5. Deep-Seated Reasons for Policy Disagreements

Why is there such a pronounced division within the Fed at this time? The root lies in differing judgments among officials on three key issues:

Concerns About Inflation Persistence

● Hawkish officials worry that businesses will pass on more tariff-related costs to consumers next year, keeping price pressures persistent.

● Dovish officials believe that businesses have been unwilling to pass on tariff costs, indicating that demand is too weak to support sustained inflation.

Different Interpretations of the Labor Market

Regarding the slowdown in monthly wage growth, hawks believe the primary reason is a reduction in supply due to decreased immigration, while doves argue it is due to weakened demand for workers by businesses.

If the former is true, maintaining high rates could pose recession risks; if the latter is true, cutting rates could overly stimulate demand.

Assessments of Rate Restrictiveness

● Hawks believe that after a 50 basis point cut this year, rates are close to a "neutral level" that neither stimulates nor suppresses growth, and further cuts pose risks.

● Doves, however, believe rates are still restrictive, giving the Fed room to support the labor market without reigniting inflation.

6. Market Impact and Outlook

The internal policy divisions within the Fed have already had a significant impact on the market.

Dramatic Fluctuations in Rate Cut Probabilities

● According to federal funds futures contracts, investors have reduced the probability of a December rate cut to about 47%, down from nearly 100% before the October Fed meeting. This sharp change reflects a repricing of market expectations regarding the Fed's policy path and highlights the uncertainty surrounding monetary policy direction.

Cryptocurrency and U.S. Stocks Hit Hard

● As market expectations for a Fed rate cut have diminished, the cryptocurrency market has been severely impacted. On November 14, Bitcoin briefly fell to $98,000, while Ethereum dropped below $3,200. U.S. stock market shares related to cryptocurrencies all fell, with MARA Holdings down 11.31% and Riot Platforms down 10.22%.

● The three major U.S. stock indices also closed lower, with the Nasdaq index plummeting 2.3%, and both the Dow Jones and S&P 500 indices falling 1.6%.

The December Fed meeting is evolving into a critical battle concerning the direction of global asset prices in 2025. As the hawkish camp continues to expand, how Powell balances internal and external divisions has become a focal point for the market.

Boston Fed President Collins' clear opposition to a December rate cut has intensified concerns about Powell's ability to manage divisions within the FOMC.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。